Bollinger Bands Momentum Crossover Strategy

Author: ChaoZhang, Date: 2024-06-21 14:12:29Tags: BBSMASTD

Overview

The Bollinger Bands Momentum Crossover Strategy is a technical analysis-based trading method that combines the Bollinger Bands indicator with price momentum concepts. This strategy primarily uses the crossover of price with the upper and lower Bollinger Bands to generate buy and sell signals, aiming to capture overbought and oversold market opportunities. By observing whether the price breaks through the upper or lower bands of the Bollinger Bands, traders can identify potential reversal points and profit from market fluctuations.

Strategy Principles

The core principle of this strategy is to use Bollinger Bands to measure market volatility and price deviation. Bollinger Bands consist of three lines: the middle band (simple moving average), the upper band (middle band plus a multiple of standard deviation), and the lower band (middle band minus a multiple of standard deviation). The specific logic of the strategy is as follows:

- Calculate Bollinger Bands: Use a 20-period simple moving average as the middle band, with upper and lower bands 2 standard deviations away from the middle band.

- Buy signal: When the closing price is below the lower band, the market is considered potentially oversold, triggering a buy signal.

- Sell signal: When the closing price is above the upper band, the market is considered potentially overbought, triggering a sell signal.

- Position closing logic: When holding a long position, if a sell signal appears, close the long position; when holding a short position, if a buy signal appears, close the short position.

The strategy uses variables in_long and in_short to track the current position status, ensuring that positions are not repeatedly opened and are closed at appropriate times.

Strategy Advantages

Combination of trend following and reversal: This strategy can capture both trend continuation (when price moves near the upper or lower bands) and potential reversals (when price breaks through the Bollinger Bands).

Strong adaptability: Bollinger Bands automatically adjust their width according to market volatility, allowing the strategy to adapt to different market environments.

Risk control: By opening positions when the price breaks through the Bollinger Bands, the strategy controls entry risk to some extent.

Clear entry and exit signals: The strategy provides clear buy and sell signals, reducing the impact of subjective judgment.

Visualization support: The strategy plots Bollinger Bands on the chart, allowing traders to visually analyze market conditions.

Strategy Risks

False breakout risk: Prices may briefly break through the Bollinger Bands and then return, leading to false signals.

Poor performance in trending markets: In strongly trending markets, prices may run outside the Bollinger Bands for extended periods, resulting in frequent trading and potential losses.

Lag: Due to the use of moving averages, the strategy may react slowly to rapid market changes.

Parameter sensitivity: The period and standard deviation multiplier of the Bollinger Bands significantly impact strategy performance and require careful optimization.

Lack of stop-loss mechanism: The current strategy does not have explicit stop-loss settings, which may lead to significant losses during extreme market volatility.

Strategy Optimization Directions

Introduce additional confirmation indicators: Combine other technical indicators (such as RSI or MACD) to filter trading signals and improve accuracy.

Dynamic parameter adjustment: Automatically adjust the Bollinger Bands period and standard deviation multiplier based on market volatility to adapt to different market environments.

Add stop-loss and take-profit mechanisms: Set stop-loss and take-profit levels based on ATR or fixed points to control risk and lock in profits.

Optimize entry timing: Consider entering positions when the price retests the Bollinger Bands instead of entering directly on breakouts to reduce false breakout risk.

Incorporate volume analysis: Combine volume indicators to help confirm the validity of breakouts and improve trade success rates.

Time filtering: Add time filtering conditions to avoid trading during highly volatile or low liquidity periods.

Consider market conditions: Use Bollinger Band width or other indicators to determine whether the market is in a trending or ranging state, and adopt different trading strategies accordingly.

Conclusion

The Bollinger Bands Momentum Crossover Strategy is a trading method that combines mean reversion and trend-following concepts. By leveraging the relationship between price and Bollinger Bands, this strategy aims to capture market overbought and oversold opportunities and potential reversal points. While the strategy has advantages such as strong adaptability and clear signals, it also faces risks like false breakouts and poor performance in trending markets. To improve the strategy’s robustness and profitability, consider introducing additional confirmation indicators, optimizing parameter settings, and adding risk management mechanisms. In practical application, traders need to continuously optimize and backtest the strategy based on specific market environments and individual risk preferences to achieve the best trading results.

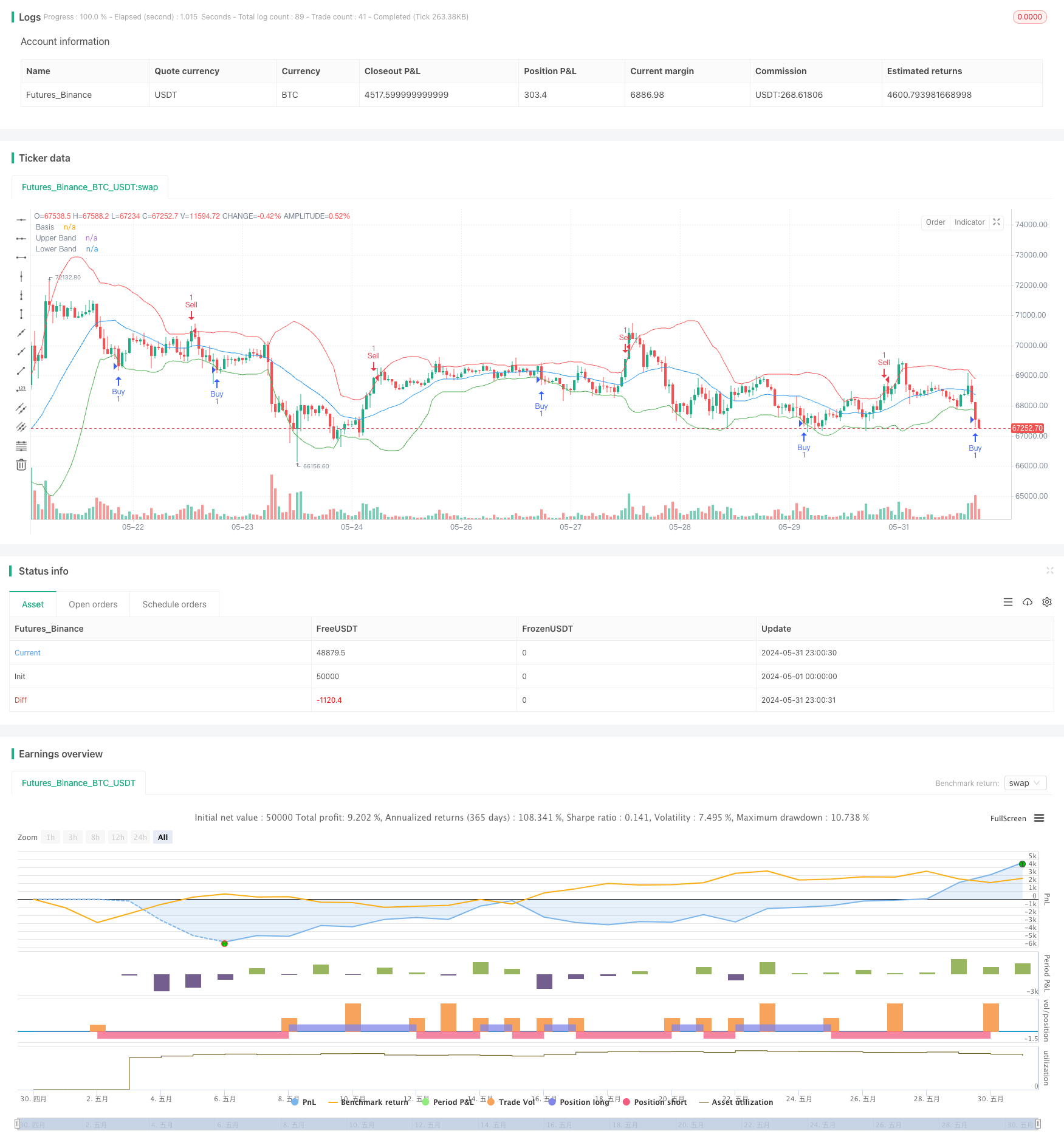

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Strategy", overlay=true)

// Input parameters

length = input.int(20, title="BB Length")

src = input(close, title="Source")

mult = input.float(2.0, title="BB Mult")

// Calculate Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper_band = basis + dev

lower_band = basis - dev

// Plotting Bollinger Bands

plot(basis, title="Basis", color=color.blue)

plot(upper_band, title="Upper Band", color=color.red)

plot(lower_band, title="Lower Band", color=color.green)

// Buy and Sell conditions

buy_condition = close < lower_band

sell_condition = close > upper_band

// Strategy logic

var in_long = false

var in_short = false

if buy_condition and not in_long

strategy.entry("Buy", strategy.long)

in_long := true

if sell_condition and not in_short

strategy.entry("Sell", strategy.short)

in_short := true

if in_long and sell_condition

strategy.close("Buy")

in_long := false

if in_short and buy_condition

strategy.close("Sell")

in_short := false

- Technical Support and Resistance Indicator Precision Trading Strategy

- Bollinger Bands Dynamic Breakout Strategy

- Bollinger Band Overbought/Oversold Strategy

- Hybrid Binomial Z-Score Quantitative Strategy

- Bollinger Bands Breakout Strategy

- Bollinger Bands Precise Crossover Quantitative Strategy

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- VAWSI and Trend Persistence Reversal Strategy with Dynamic Length Calculation Multi-Indicator Analysis System

- Dynamic Channel Percentage Envelope Strategy

- SuperTrend Strategy Optimization: Dynamic Volatility Tracking and Enhanced Trading Signal System

- Machine Learning Inspired Dual Moving Average RSI Trading Strategy

- Multi-Indicator High-Frequency Trading Strategy: Short-Term Trading System Combining Exponential Moving Averages and Momentum Indicators

- Triple Standard Deviation Momentum Reversal Trading Strategy

- Multi-Period Exponential Moving Average Crossover Strategy with Options Trading Suggestion System

- Double Supertrend Multi-Step Trailing Take-Profit Strategy

- Custom Signal Oscillator Strategy (CSO)

- Multi-Level RSI Mean Reversion Strategy with Dynamic Volatility Adjustment

- Super Triple Indicator RSI-MACD-BB Momentum Reversal Strategy

- CCI Momentum Divergence Trend Trading Strategy

- Hilo Activator MACD Dynamic Stop-Loss Take-Profit Trading Strategy

- Dynamic Take-Profit and Stop-Loss Dual Moving Average Crossover Trading Strategy

- RSI Dual-Period Moving Average Reversal Strategy with Dynamic Risk Management System

- Markov Chain Probability Transition State Quantitative Trading Strategy

- SMA Crossover Strategy with RSI Filter and Alerts

- Dynamic Donchian Channel and Simple Moving Average Combination Quantitative Strategy

- Dynamic Fibonacci Retracement Trading Strategy

- Bollinger Bands and Exponential Moving Average Crossover Trading Strategy