MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization

Author: ChaoZhang, Date: 2024-07-29 13:35:02Tags: MACDEMATPSLATR

Overview

The MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization is a quantitative trading approach that combines the Moving Average Convergence Divergence (MACD) indicator with a flexible risk management mechanism. This strategy utilizes MACD crossover signals to identify potential trend changes while implementing dynamic take profit and stop loss points to optimize the risk-reward ratio of trades. The approach aims to capture market momentum while providing clear exit strategies for each trade.

Strategy Principles

The core principle of this strategy is based on MACD signal line crossovers:

MACD Calculation:

- Uses a 12-period fast Exponential Moving Average (EMA) and a 26-period slow EMA

- MACD Line = Fast EMA - Slow EMA

- Signal Line = 9-period EMA of the MACD Line

Entry Signals:

- Long Entry: MACD Line crosses above the Signal Line

- Short Entry: MACD Line crosses below the Signal Line

Exit Strategy:

- Sets fixed point take profit and stop loss levels

- For Long Trades: Take Profit = Entry Price + 100 points; Stop Loss = Entry Price - 50 points

- For Short Trades: Take Profit = Entry Price - 100 points; Stop Loss = Entry Price + 50 points

The strategy uses the ta.macd() function to calculate the MACD indicator, and ta.crossover() and ta.crossunder() functions to detect crossover signals. Trade execution is handled through strategy.entry() and strategy.exit() functions.

Strategy Advantages

Trend Following: The MACD indicator helps identify and follow market trends, increasing the probability of capturing major moves.

Momentum Capture: Through MACD crossover signals, the strategy can promptly enter emerging market momentum.

Risk Management: Preset take profit and stop loss points provide clear risk control for each trade.

Flexibility: Strategy parameters can be adjusted for different markets and timeframes.

Automation: The strategy can be executed automatically on trading platforms, reducing emotional interference.

Objectivity: Signal generation based on technical indicators eliminates subjective judgment, improving trading consistency.

Strategy Risks

False Breakouts: In ranging markets, MACD may produce frequent false breakout signals, leading to overtrading.

Lag: As a lagging indicator, MACD may react too slowly in fast-reversing markets.

Fixed Stop Loss: Using fixed point values for stop losses may not be suitable for all market conditions, especially when volatility changes.

Parameter Sensitivity: Strategy performance is highly dependent on the chosen EMA and signal line parameters.

Market Adaptability: The strategy may perform well in certain market environments but poorly in others.

Over-optimization: There’s a risk of overfitting to historical data during backtesting.

Strategy Optimization Directions

Dynamic Stop Loss: Implement ATR (Average True Range) to adjust stop loss points, adapting to current market volatility.

Multi-Timeframe Analysis: Incorporate longer-term trend analysis to improve the reliability of entry signals.

Filters: Add additional technical indicators or price action patterns as filters to reduce false signals.

Position Sizing: Implement dynamic position sizing, adjusting trade size based on market volatility and account risk.

Market State Recognition: Develop algorithms to identify trending/ranging markets and adjust strategy parameters accordingly.

Machine Learning Optimization: Use machine learning algorithms to dynamically optimize MACD parameters, improving strategy adaptability.

Conclusion

The MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization is a quantitative trading approach that combines technical analysis with risk management. By leveraging the trend-following and momentum-capturing capabilities of the MACD indicator while implementing clear take profit and stop loss rules, the strategy aims to capture market opportunities while controlling risk. However, like all trading strategies, it is not without flaws. Traders need to be aware of potential risks such as false breakouts, lag, and market adaptability. By introducing optimizations like dynamic stop losses, multi-timeframe analysis, and market state recognition, the strategy’s robustness and adaptability can be further enhanced. Overall, this strategy framework provides a solid starting point for quantitative traders, worthy of in-depth research and continuous optimization.

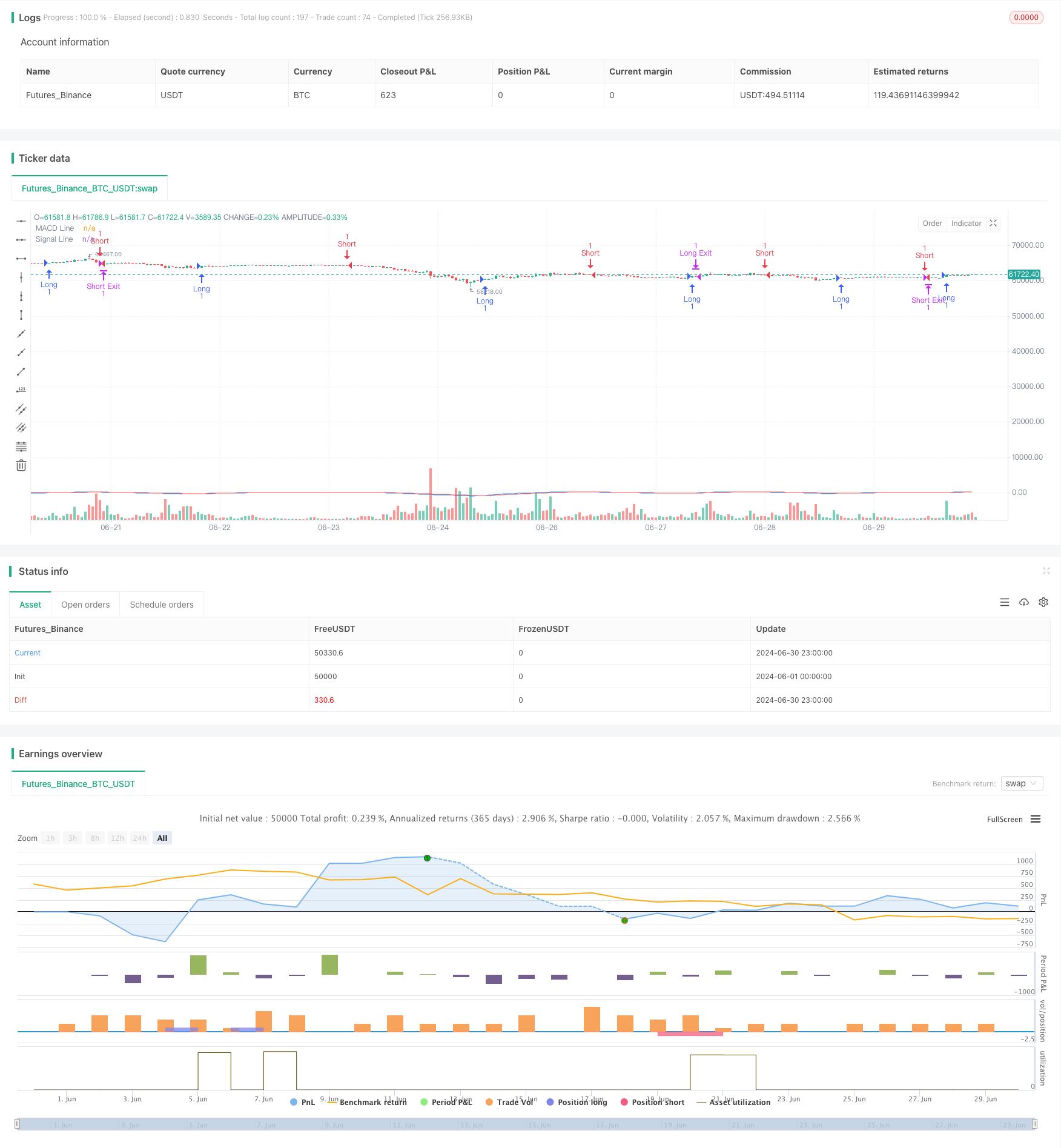

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD Strategy", overlay=true)

// Input parameters

fast_length = input.int(12, title="Fast EMA Length")

slow_length = input.int(26, title="Slow EMA Length")

signal_length = input.int(9, title="Signal Line Length")

target_points = input.int(100, title="Target Points")

stop_loss_points = input.int(50, title="Stop Loss Points")

// Calculate MACD

[macd_line, signal_line, _] = ta.macd(close, fast_length, slow_length, signal_length)

// Strategy logic

long_condition = ta.crossover(macd_line, signal_line)

short_condition = ta.crossunder(macd_line, signal_line)

// Plot MACD

plot(macd_line, color=color.blue, title="MACD Line")

plot(signal_line, color=color.red, title="Signal Line")

// Strategy entry and exit

if long_condition

strategy.entry("Long", strategy.long)

if short_condition

strategy.entry("Short", strategy.short)

// Calculate target and stop loss levels

long_target = strategy.position_avg_price + target_points

long_stop_loss = strategy.position_avg_price - stop_loss_points

short_target = strategy.position_avg_price - target_points

short_stop_loss = strategy.position_avg_price + stop_loss_points

// Strategy exit

strategy.exit("Long Exit", "Long", limit=long_target, stop=long_stop_loss)

strategy.exit("Short Exit", "Short", limit=short_target, stop=short_stop_loss)

- Multi-Timeframe Trend Following Trading System with ATR and MACD Integration

- Enhanced Mean Reversion Strategy with MACD-ATR Implementation

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Volume-based Dynamic DCA Strategy

- Multi-Level Multi-Period EMA Crossover Dynamic Take-Profit Optimization Strategy

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Dual EMA Pullback Trading System with ATR-Based Dynamic Stop-Loss Optimization

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- Darvas Box Breakout and Risk Management Strategy

- Multi-Timeframe Exponential Moving Average Crossover Strategy with Risk-Reward Optimization

- SMA Crossover Long-Short Strategy with Peak Drawdown Control and Auto-Termination

- High-Frequency Flip Percentage Tracking Momentum Strategy

- SMI and Pivot Point Momentum Crossover Strategy

- Support and Resistance Strategy with Dynamic Risk Management System

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- Multi-Timeframe Trend Following and Order Block Quantitative Trading Strategy

- Technical Support and Resistance Indicator Precision Trading Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- Big Red Candle Breakout Buy Strategy

- Adaptive Multi-Moving Average Crossover Dynamic Trading Strategy

- Dynamic Low-Price Entry and Stop-Loss Strategy Based on RSI

- Cloud Momentum Crossover Strategy with Moving Averages and Volume Confirmation

- ATR-RSI Enhanced Trend Following Trading System

- Multi-Indicator Trend Following Strategy: Integrating SuperTrend, EMA, and Risk Management

- Multi-EMA Crossover Trend Following Strategy

- Enhanced Multi-Indicator Momentum Trading Strategy

- Bollinger Bands and RSI Crossover Trading Strategy

- Confirmed SMA Crossover Momentum Strategy