Dual Moving Average Trend Capture Strategy with Dynamic Stop-Loss and Filter

Author: ChaoZhang, Date: 2024-07-31 11:46:38Tags: MAEMASMAWMATPSL

Overview

This is a trend-following strategy based on a dual moving average system, incorporating dynamic stop-loss and a moving average filter. The strategy uses two moving averages of different periods to capture market trends, while using a filter moving average to restrict trading direction and providing flexible stop-loss options. This approach aims to capture medium to long-term trends while protecting capital through dynamic risk management.

Strategy Principles

The core principles of this strategy include:

Dual Moving Average System: Uses two moving averages, one as the main signal line (shorter period) and another as a filter (longer period).

Trend Confirmation: Only considers opening positions when both price and the main moving average are on the same side of the filter moving average. This helps ensure that the trading direction aligns with the overall trend.

Entry Signals: Triggers entry signals when the price breaks through the main moving average and meets the filter conditions.

Dynamic Stop-Loss: Offers two stop-loss options - a percentage-based dynamic stop-loss or a fixed stop-loss based on the previous candle’s high/low.

Fixed Take-Profit: Uses a fixed take-profit level based on a percentage of the entry price.

Visualization: Plots moving averages, entry prices, stop-loss, and take-profit levels on the chart for intuitive analysis of trades.

Strategy Advantages

Trend Following: By using a dual moving average system, the strategy can effectively capture medium to long-term trends, increasing profit opportunities.

Risk Management: The dynamic stop-loss option allows the strategy to automatically adjust risk exposure based on market volatility, enhancing capital protection.

Flexibility: The strategy allows users to choose different types of moving averages (SMA, EMA, WMA) and customize various parameters, adapting to different trading styles and market environments.

Filtering Mechanism: Using a longer-period moving average as a filter helps reduce false breakouts and counter-trend trades, improving strategy stability.

Visual Effects: By plotting key price levels and moving averages on the chart, traders can intuitively understand strategy logic and current market conditions.

Automated Execution: The strategy can be executed automatically on trading platforms, reducing human intervention and emotional influence.

Strategy Risks

Lag: Moving averages are inherently lagging indicators, which may lead to late entries or exits during trend reversals.

Performance in Ranging Markets: In sideways or choppy markets, the strategy may generate frequent false signals, leading to consecutive losses.

Parameter Sensitivity: Strategy performance is highly dependent on chosen parameters; improper parameter settings may result in overtrading or missing important opportunities.

Fixed Take-Profit Limitations: Using a fixed percentage take-profit may prematurely end profitable trades during strong trends.

Changing Market Conditions: Strategy performance may vary significantly under different market environments, requiring regular evaluation and adjustment.

Slippage and Trading Costs: In actual trading, slippage and trading costs can significantly impact strategy profitability, especially in high-frequency trading scenarios.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Implement adaptive moving average periods and stop-loss percentages to suit different market volatilities and trend strengths.

Multi-Timeframe Analysis: Integrate trend information from longer timeframes to improve entry decision accuracy and reduce false signals.

Volatility Filtering: Introduce volatility indicators (such as ATR) to pause trading during low volatility periods, reducing losses in choppy markets.

Trend Strength Confirmation: Combine other technical indicators (like ADX) to assess trend strength and only open positions in strong trends.

Dynamic Take-Profit: Implement a dynamic take-profit mechanism based on market volatility or trend strength to maximize profit potential.

Position Sizing Optimization: Dynamically adjust position size based on account size and market volatility to optimize risk-reward ratio.

Machine Learning Integration: Utilize machine learning algorithms to optimize parameter selection and entry timing, improving strategy adaptability and performance.

Sentiment Analysis: Incorporate market sentiment indicators to adjust strategy behavior during extreme sentiment periods, avoiding overcrowded trades.

Conclusion

The Dual Moving Average Trend Capture Strategy with Dynamic Stop-Loss and Filter is a comprehensive trend-following system designed to capture medium to long-term market trends. By combining a main signal moving average with a filter moving average, the strategy can effectively identify trend direction and generate trading signals. The dynamic stop-loss option provides flexible risk management, while the visualization features enhance strategy interpretability.

While the strategy shows strong potential, it still has inherent risks such as lag and sensitivity to changing market conditions. To improve the strategy’s robustness and adaptability, further optimizations are recommended, such as implementing dynamic parameter adjustments, integrating multi-timeframe analysis, and introducing additional filtering mechanisms.

Overall, this strategy provides traders with a solid foundation that can be customized and improved based on individual needs and market characteristics. Through continuous monitoring, backtesting, and optimization, the strategy has the potential to become a reliable trading tool suitable for various market environments.

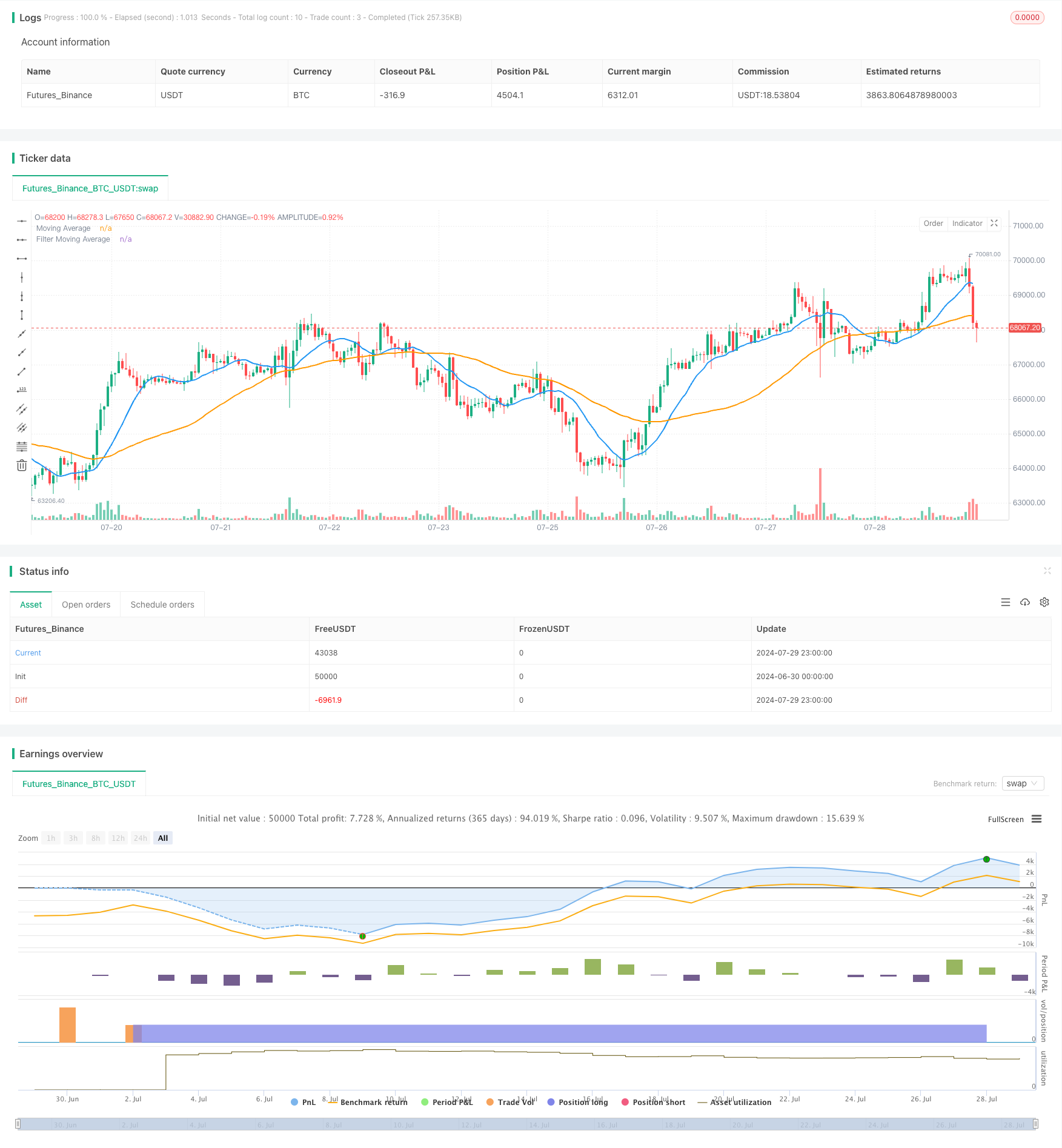

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Breakout with Filter and Dynamic Stop Loss", overlay=true)

// Параметры

maLength = input.int(14, "MA Length")

maType = input.string("SMA", "MA Type", options=["SMA", "EMA", "WMA"])

takeProfitPercent = input.float(1.0, "Take Profit (%)", step=0.1)

filterMaLength = input.int(50, "Filter MA Length")

filterMaType = input.string("SMA", "Filter MA Type", options=["SMA", "EMA", "WMA"])

useDynamicStopLoss = input.bool(false, "Use Dynamic Stop Loss")

dynamicStopLossPercent = input.float(1.0, "Dynamic Stop Loss (%)", step=0.1)

// Выбор типа основной скользящей средней

float ma = na

switch maType

"SMA" => ma := ta.sma(close, maLength)

"EMA" => ma := ta.ema(close, maLength)

"WMA" => ma := ta.wma(close, maLength)

// Выбор типа скользящей средней фильтра

float filterMa = na

switch filterMaType

"SMA" => filterMa := ta.sma(close, filterMaLength)

"EMA" => filterMa := ta.ema(close, filterMaLength)

"WMA" => filterMa := ta.wma(close, filterMaLength)

// Построение скользящих средних

plot(ma, color=color.blue, linewidth=2, title="Moving Average")

plot(filterMa, color=color.orange, linewidth=2, title="Filter Moving Average")

// Логика открытия позиций

longCondition = ta.crossover(close, ma) and close > filterMa

shortCondition = ta.crossunder(close, ma) and close < filterMa

var bool inPosition = false

var float entryPrice = na

var float takeProfitLevel = na

var float stopLossLevel = na

if (longCondition and not inPosition and strategy.position_size == 0)

entryPrice := close

takeProfitLevel := close * (1 + takeProfitPercent / 100)

if (useDynamicStopLoss)

stopLossLevel := close * (1 - dynamicStopLossPercent / 100)

else

stopLossLevel := low[1]

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", limit=takeProfitLevel, stop=stopLossLevel)

// line.new(bar_index, entryPrice, bar_index + 1, entryPrice, color=color.blue, width=2)

// line.new(bar_index, takeProfitLevel, bar_index + 1, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index, stopLossLevel, bar_index + 1, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

inPosition := true

if (shortCondition and not inPosition and strategy.position_size == 0)

entryPrice := close

takeProfitLevel := close * (1 - takeProfitPercent / 100)

if (useDynamicStopLoss)

stopLossLevel := close * (1 + dynamicStopLossPercent / 100)

else

stopLossLevel := high[1]

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", limit=takeProfitLevel, stop=stopLossLevel)

// line.new(bar_index, entryPrice, bar_index + 1, entryPrice, color=color.blue, width=2)

// line.new(bar_index, takeProfitLevel, bar_index + 1, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index, stopLossLevel, bar_index + 1, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

inPosition := true

// Проверка закрытия позиции по тейк-профиту или стоп-лоссу

if (strategy.position_size == 0)

inPosition := false

// Отображение текущих линий стоп-лосса и тейк-профита

// if (strategy.position_size > 0)

// line.new(bar_index[1], takeProfitLevel, bar_index, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index[1], stopLossLevel, bar_index, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

// line.new(bar_index[1], entryPrice, bar_index, entryPrice, color=color.blue, width=2)

// if (strategy.position_size < 0)

// line.new(bar_index[1], takeProfitLevel, bar_index, takeProfitLevel, color=color.green, width=2, style=line.style_dashed)

// line.new(bar_index[1], stopLossLevel, bar_index, stopLossLevel, color=color.red, width=2, style=line.style_dashed)

// line.new(bar_index[1], entryPrice, bar_index, entryPrice, color=color.blue, width=2)

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- Dual Moving Average and MACD Combined Trend Following Dynamic Take Profit Smart Trading System

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Intelligent Moving Average Crossover Strategy with Dynamic Profit/Loss Management System

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGY

- Adaptive Trend Following Strategy Based on Fibonacci Retracement

- Advanced Markov Model Technical Indicator Fusion Trading Strategy

- Multi-Layer Volatility Band Trading Strategy

- Multi-Period Moving Average Crossover Strategy with Dynamic Volatility Filter

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Triple EMA with Dynamic Support/Resistance Trading Strategy

- Dual RSI Strategy: Advanced Trend Capture System Combining Divergence and Crossover

- Lorenzian Classification Multi-Timeframe Target Strategy

- Multi-Indicator Trend Following with Volume Confirmation Strategy

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Elliott Wave and Tom DeMark Trend-Following Trading Strategy

- Multi-Timeframe Unified Strategy Based on Quantitative Momentum and Convergence-Divergence

- RSI Oversold Periodic Investment Strategy with Cooldown Optimization

- Optimized Multi-Timeframe HMA Quantitative Trading Strategy with Dynamic Stop-Loss

- Bollinger Band Crossover with Slippage and Price Impact Combined Strategy

- Trend Structure Break with Order Block and Fair Value Gap Strategy

- Adaptive Dynamic Stop-Loss and Take-Profit Strategy with SMA Crossover and Volume Filter

- Dual MACD Trend Confirmation Trading System