Dual Coral Trend Crossover Strategy

Author: ChaoZhang, Date: 2024-09-26 16:00:59Tags: EMA

Overview

This strategy is a medium to long-term trading approach based on the crossover of Coral Trend indicators. It utilizes two Coral Trend lines with different parameters to identify potential buying opportunities. The strategy is primarily designed for longer timeframes, such as 1-month or 3-month charts, aiming to capture favorable entry points within larger trends.

Strategy Principle

The core of the strategy lies in using two Coral Trend lines, referred to as Coral Trend 1 and Coral Trend 2. Each trend line is calculated based on Exponential Moving Averages (EMAs) with additional smoothing applied. A buy signal is generated when Coral Trend 1 crosses above Coral Trend 2, which is considered the beginning of a potential uptrend.

Key parameters of the strategy include: 1. Smoothing periods for both Coral Trend lines 2. Constant D values, used to adjust the sensitivity of the trend lines

By adjusting these parameters, traders can optimize the strategy’s performance according to different market conditions and personal preferences.

Strategy Advantages

- Trend Following: The strategy effectively captures medium to long-term trends, reducing the impact of short-term market noise.

- Adaptability: The Coral Trend indicator demonstrates good adaptability, maintaining stability across various market environments.

- Visualization: The strategy clearly marks buy signals on the chart, allowing traders to quickly identify trading opportunities.

- Flexible Parameters: Traders can adjust parameters to suit different trading styles and market conditions.

- Wave Pattern Recognition: By observing the wave patterns of trend lines, traders can choose optimal entry points.

Strategy Risks

- Lag: As a trend-following strategy, it may experience lag during trend reversals.

- False Breakouts: In ranging markets, frequent false breakout signals may occur.

- Parameter Sensitivity: Strategy performance is sensitive to parameter settings; inappropriate parameters may lead to overtrading or missed opportunities.

- Market Environment Dependency: The strategy may underperform in highly volatile or rapidly reversing markets.

Strategy Optimization Directions

- Add Filters: Introduce additional technical or sentiment indicators to reduce false signals.

- Dynamic Parameter Adjustment: Develop adaptive mechanisms to automatically adjust parameters based on market volatility.

- Multi-Timeframe Analysis: Incorporate signals from shorter and longer timeframes to improve entry accuracy.

- Implement Stop-Loss and Take-Profit: Design reasonable risk management mechanisms to protect profits and limit losses.

- Backtesting Optimization: Conduct comprehensive backtests across different markets and periods to find optimal parameter combinations.

Summary

The Dual Coral Trend Crossover Strategy is an effective tool for capturing medium to long-term market trends. By leveraging the crossover of two Coral Trend lines with different parameters, the strategy can adapt to various market environments while maintaining stability. Although there are inherent risks such as lag and false breakouts, traders can significantly improve the strategy’s reliability and profitability through careful parameter optimization and additional risk management measures. Future optimization should focus on enhancing signal quality, improving adaptability, and refining risk control to create a more comprehensive and robust trading system.

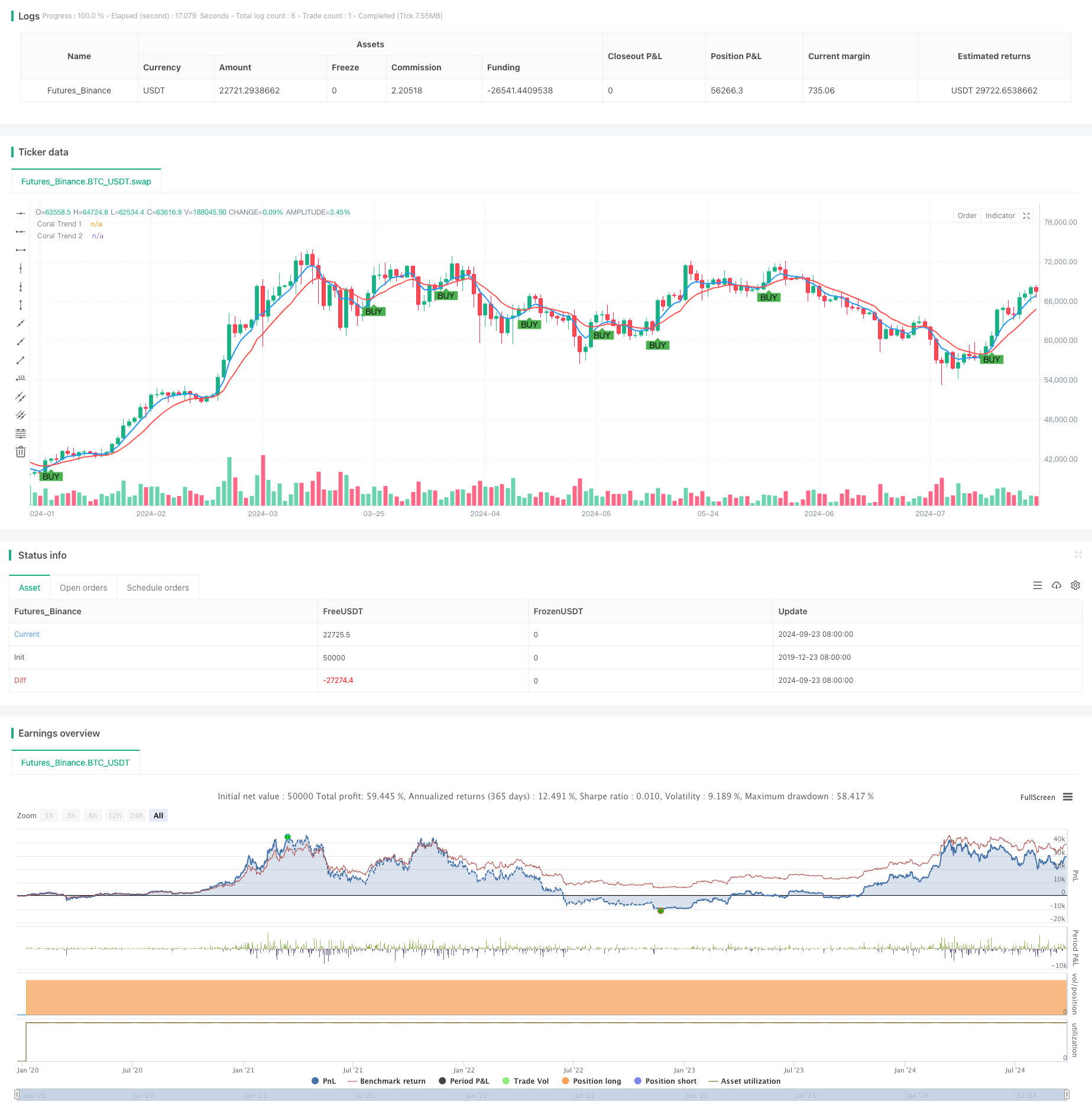

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("D-Stryker LT", overlay=true)

// Input settings for Coral Trend 1

smoothingPeriod1 = input.int(3, title="Coral Trend 1 Smoothing Period")

constantD1 = input.float(0.2, title="Coral Trend 1 Constant D")

// Input settings for Coral Trend 2

smoothingPeriod2 = input.int(6, title="Coral Trend 2 Smoothing Period")

constantD2 = input.float(0.2, title="Coral Trend 2 Constant D")

// Function to calculate Coral Trend

coralTrend(source, smoothingPeriod, constantD) =>

emaValue = ta.ema(source, smoothingPeriod)

smoothEma = ta.ema(emaValue, smoothingPeriod)

trendLine = smoothEma + constantD * (emaValue - smoothEma)

trendLine

// Calculate Coral Trends

coralTrend1 = coralTrend(close, smoothingPeriod1, constantD1)

coralTrend2 = coralTrend(close, smoothingPeriod2, constantD2)

// Plot Coral Trends

plot(coralTrend1, title="Coral Trend 1", color=color.blue, linewidth=2)

plot(coralTrend2, title="Coral Trend 2", color=color.red, linewidth=2)

// Generate buy signal when Coral Trend 1 crosses above Coral Trend 2

buySignal = ta.crossover(coralTrend1, coralTrend2)

// Plot buy signals on the chart

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

// Optional: Add strategy entry and exit logic

if (buySignal)

strategy.entry("Buy", strategy.long)

- Multi-Dimensional Trend Analysis with ATR-Based Dynamic Stop Management Strategy

- Advanced Multi-Indicator Trend Confirmation Trading Strategy

- Adaptive Trend Following and Multi-Confirmation Trading Strategy

- Dynamic EMA System Combined with RSI Momentum Indicator for Optimized Intraday Trading Strategy

- Multi-Technical Indicator Crossover Momentum Trend Following Strategy

- EMA Trend with Round Number Breakout Trading Strategy

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Dynamic Trend RSI Indicator Crossing Strategy

- Dual Crossover Trend Following Strategy: EMA and MACD Synergistic Trading System

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Bollinger Band Overbought/Oversold Strategy

- Multi-Period EMA Crossover with VWAP High Win-Rate Intraday Trading Strategy

- Enhanced Breakout Strategy with Targets and Stop Loss Optimization

- Dual Moving Average Channel Trend Following Strategy

- Multi-Indicator Adaptive Momentum Trading Strategy

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Adaptive Risk Management Strategy Based on Dual Moving Average Golden Cross

- Dual Indicator Trading Strategy Combining Trend Following and Momentum

- Adaptive Price-Crossing Moving Average Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Trend Following Strategy

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategy with Trend Magic Indicator Auto-Trading System

- 52-Week High-Low/Average Volume/Volume Breakout Strategy

- Multi-EMA and CCI Crossover Trend Following Strategy

- Dynamic Trend-Following EMA Crossover Strategy

- Multi-Factor Dynamic Adaptive Trend Following Strategy

- Multi-Timeframe RSI Oversold Reversal Strategy

- Intelligent Institutional Trading Structure Momentum Strategy

- Gaussian Cross EMA Trend Retracement Strategy

- EMA MACD Momentum Tracking Strategy

- Dynamic Position Management RSI Overbought Reversal Strategy