Dual Chain Hybrid Momentum EMA Tracking Trading System

Author: ChaoZhang, Date: 2024-11-29 17:04:57Tags: EMAMA

Overview

This strategy is an innovative trading system based on Exponential Moving Averages (EMA), capturing market opportunities through two independent trading chains set across different timeframes. The strategy integrates the advantages of long-term trend following and short-term momentum trading, generating trading signals through EMA crossovers across weekly, daily, 12-hour, and 9-hour timeframes for multi-dimensional market analysis.

Strategy Principles

The strategy employs a dual-chain design, with each chain having its unique entry and exit logic:

Chain 1 (Long-term Trend) uses weekly and daily timeframes:

- Entry signal: Generated when closing price crosses above EMA on weekly timeframe

- Exit signal: Generated when closing price crosses below EMA on daily timeframe

- Default EMA period is 10, adjustable as needed

Chain 2 (Short-term Momentum) uses 12-hour and 9-hour timeframes:

- Entry signal: Generated when closing price crosses above EMA on 12-hour timeframe

- Exit signal: Generated when closing price crosses below EMA on 9-hour timeframe

- Default EMA period is 9, adjustable as needed

Strategy Advantages

- Multi-dimensional market analysis: Comprehensive market trend capture through timeframe combination

- High flexibility: Two chains can be enabled or disabled independently

- Robust risk control: Multiple timeframe confirmation reduces false signals

- Strong parameter adaptability: EMA periods and timeframes are adjustable

- Complete backtesting functionality: Built-in testing period settings for strategy verification

Strategy Risks

- Trend reversal risk: May show lag in volatile markets

- Timeframe configuration risk: Different markets may require different timeframe combinations

- Parameter optimization risk: Over-optimization may lead to overfitting

- Signal overlap risk: Simultaneous triggers from both chains may increase position risk

Risk control suggestions:

- Set reasonable stop-loss levels

- Adjust parameters based on market characteristics

- Conduct thorough backtesting before live trading

- Control position sizing per trade

Strategy Optimization Directions

- Signal Filtering Optimization:

- Add volume confirmation mechanism

- Incorporate volatility indicators

- Include trend strength confirmation

- Risk Control Optimization:

- Develop dynamic stop-loss mechanism

- Design position management system

- Add drawdown control functionality

- Timeframe Optimization:

- Research optimal timeframe combinations

- Develop adaptive timeframe mechanisms

- Add market state recognition functionality

Summary

The Dual Chain Hybrid Momentum EMA Tracking Trading System achieves multi-dimensional market analysis through innovative combination of long and short-term moving average strategies. The system design is flexible and can be adjusted according to different market conditions and trader styles, showing strong practicality. Through proper risk control and continuous optimization, this strategy has the potential to achieve stable returns in actual trading. Traders are advised to conduct thorough backtesting and parameter optimization before live implementation to achieve optimal trading results.

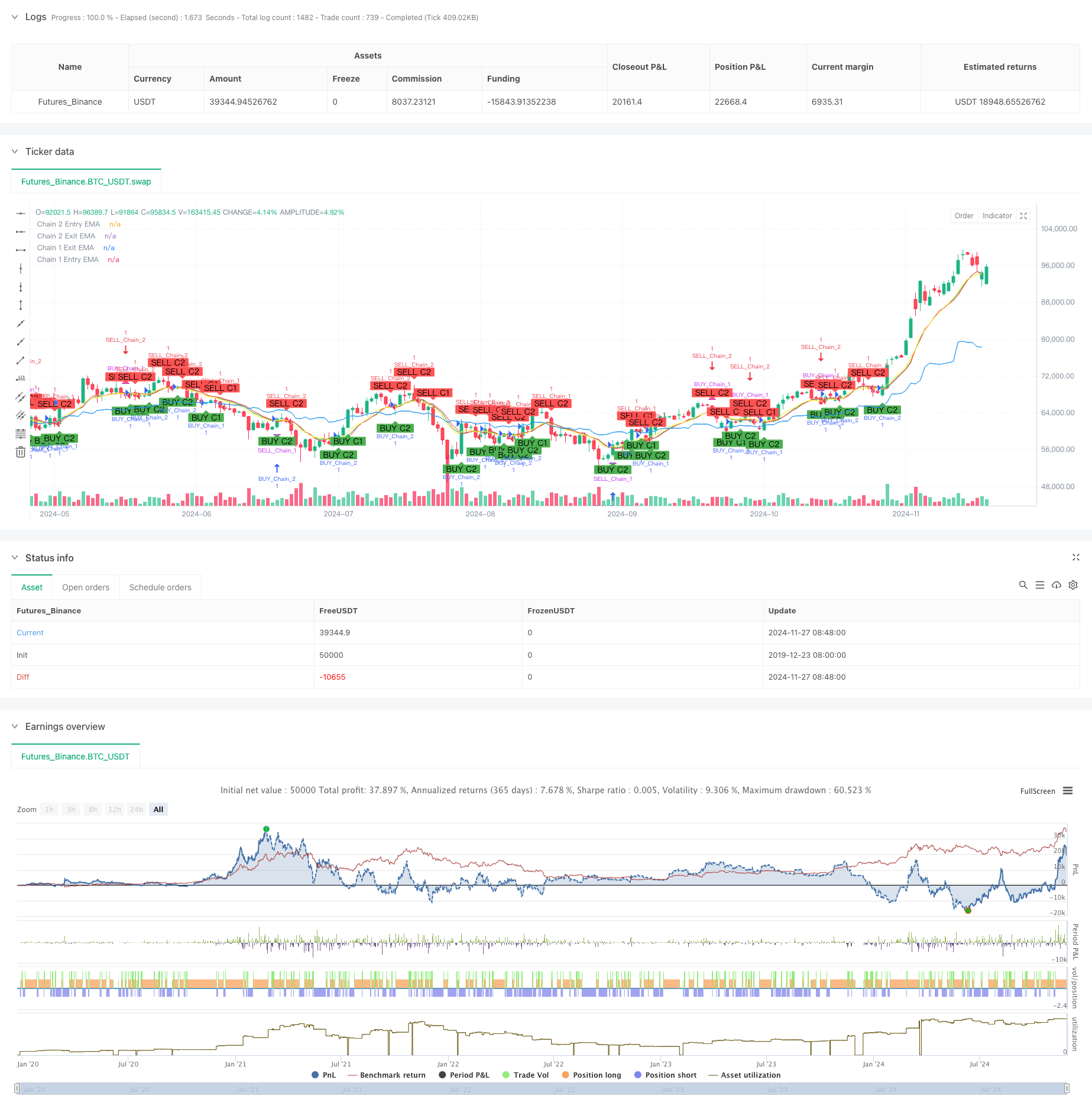

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Dual Chain Strategy', shorttitle='DualChain', overlay=true)

// User inputs for enabling/disabling chains

enableChain1 = input.bool(true, title='Enable Chain 1')

enableChain2 = input.bool(true, title='Enable Chain 2')

// User inputs for the first chain

len1 = input.int(10, minval=1, title='Length Chain 1 EMA', group="Chain 1")

src1 = input(close, title='Source Chain 1', group="Chain 1")

tf1_entry = input.timeframe("W", title='Chain 1 Entry Timeframe', group="Chain 1")

tf1_exit = input.timeframe("D", title='Chain 1 Exit Timeframe', group="Chain 1")

// Weekly timeframe EMA for Chain 1

entryEMA1 = request.security(syminfo.tickerid, tf1_entry, ta.ema(src1, len1))

// Daily timeframe EMA for Chain 1

exitEMA1 = request.security(syminfo.tickerid, tf1_exit, ta.ema(src1, len1))

// User inputs for the second chain

len2 = input.int(9, minval=1, title='Length Chain 2 EMA', group="Chain 2")

src2 = input(close, title='Source Chain 2', group="Chain 2")

tf2_entry = input.timeframe("720", title='Chain 2 Entry Timeframe (12H)', group="Chain 2") // 12 hours

tf2_exit = input.timeframe("540", title='Chain 2 Exit Timeframe (9H)', group="Chain 2") // 9 hours

// Entry timeframe EMA for Chain 2

entryEMA2 = request.security(syminfo.tickerid, tf2_entry, ta.ema(src2, len2))

// Exit timeframe EMA for Chain 2

exitEMA2 = request.security(syminfo.tickerid, tf2_exit, ta.ema(src2, len2))

// Plotting Chain 1 EMAs

plot(enableChain1 ? entryEMA1 : na, title='Chain 1 Entry EMA', color=color.new(color.blue, 0))

plot(enableChain1 ? exitEMA1 : na, title='Chain 1 Exit EMA', color=color.new(color.yellow, 0))

// Plotting Chain 2 EMAs

plot(enableChain2 ? entryEMA2 : na, title='Chain 2 Entry EMA', color=color.new(color.green, 0))

plot(enableChain2 ? exitEMA2 : na, title='Chain 2 Exit EMA', color=color.new(color.red, 0))

// Backtesting period

startDate = input(timestamp('2015-07-27'), title="StartDate")

finishDate = input(timestamp('2026-01-01'), title="FinishDate")

time_cond = true

// Entry Condition (Chain 1)

bullishChain1 = enableChain1 and ta.crossover(src1, entryEMA1)

bearishChain1 = enableChain1 and ta.crossunder(src1, entryEMA1)

// Exit Condition (Chain 1)

exitLongChain1 = enableChain1 and ta.crossunder(src1, exitEMA1)

exitShortChain1 = enableChain1 and ta.crossover(src1, exitEMA1)

// Entry Condition (Chain 2)

bullishChain2 = enableChain2 and ta.crossover(src2, entryEMA2)

bearishChain2 = enableChain2 and ta.crossunder(src2, entryEMA2)

// Exit Condition (Chain 2)

exitLongChain2 = enableChain2 and ta.crossunder(src2, exitEMA2)

exitShortChain2 = enableChain2 and ta.crossover(src2, exitEMA2)

// Debugging: Plot entry signals for Chain 1

plotshape(bullishChain1, color=color.new(color.green, 0), style=shape.labelup, text='BUY C1', location=location.belowbar)

plotshape(bearishChain1, color=color.new(color.red, 0), style=shape.labeldown, text='SELL C1', location=location.abovebar)

// Debugging: Plot entry signals for Chain 2

plotshape(bullishChain2, color=color.new(color.green, 0), style=shape.labelup, text='BUY C2', location=location.belowbar)

plotshape(bearishChain2, color=color.new(color.red, 0), style=shape.labeldown, text='SELL C2', location=location.abovebar)

// Trade Execution for Chain 1

if bullishChain1 and time_cond

strategy.entry('BUY_Chain_1', strategy.long)

if bearishChain1 and time_cond

strategy.entry('SELL_Chain_1', strategy.short)

// Exit trades based on daily conditions for Chain 1

if exitLongChain1 and strategy.opentrades > 0

strategy.close(id='BUY_Chain_1', when=exitLongChain1)

if exitShortChain1 and strategy.opentrades > 0

strategy.close(id='SELL_Chain_1', when=exitShortChain1)

// Trade Execution for Chain 2

if bullishChain2 and time_cond

strategy.entry('BUY_Chain_2', strategy.long)

if bearishChain2 and time_cond

strategy.entry('SELL_Chain_2', strategy.short)

// Exit trades based on daily conditions for Chain 2

if exitLongChain2 and strategy.opentrades > 0

strategy.close(id='BUY_Chain_2', when=exitLongChain2)

if exitShortChain2 and strategy.opentrades > 0

strategy.close(id='SELL_Chain_2', when=exitShortChain2)

// Close all positions outside the backtesting period

if not time_cond

strategy.close_all()

- Cross-Market Overnight Position Strategy with EMA Filter

- MACD Crossover Strategy

- G-Channel and EMA Trend Filter Trading System

- Multi-EMA Crossover Trend Following Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Triple EMA Crossover Trading Strategy with Dynamic Stop-Loss and Take-Profit

- Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- EMA Momentum Trading Strategy

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-EMA Automated Trading System with Trailing Profit Lock

- High-Frequency Hybrid Technical Analysis Quantitative Strategy

- Dual EMA and Relative Strength Adaptive Trading Strategy

- Dynamic Support Resistance Price Action Trading System

- Bollinger Bands High-Frequency Quantitative Strategy Combined with High-Low Breakout System

- MACD-RSI Dynamic Crossover Quantitative Trading System

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy

- Statistical Deviation-Based Market Extreme Drawdown Strategy

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy