Overview

This strategy is a sophisticated multi-indicator trading system that combines multiple technical indicators including RSI, MACD, and Moving Averages (SMA) to identify trading opportunities through price trend and momentum analysis. The strategy uses the 200-day moving average to determine long-term trends, the 50-day moving average as a medium-term reference, and utilizes Stochastic RSI and MACD crossover signals to confirm trading opportunities.

Strategy Principles

The core logic is built on three main pillars: 1. Trend Determination: Uses 200-day moving average to judge the main trend direction, with prices above the line indicating an uptrend and below indicating a downtrend. 2. Momentum Confirmation: Uses Stochastic RSI (SRSI) %K and %D line crossovers to confirm price momentum, with %K crossing above %D indicating strengthening upward momentum. 3. Trend Confirmation: Uses MACD indicator as a trend confirmation tool, with MACD line above signal line confirming uptrend.

Buy conditions must simultaneously satisfy: - Price above 200-day moving average - Stochastic RSI %K line crosses above %D line - MACD line is above signal line

Sell conditions must simultaneously satisfy: - Price below 200-day moving average - Stochastic RSI %K line crosses below %D line - MACD line is below signal line

Strategy Advantages

- Multiple Verification: Reduces false signal risk through the combined use of multiple technical indicators.

- Trend Following: Effectively captures major trends by combining long-term and medium-term moving averages.

- Momentum Identification: Uses Stochastic RSI to identify potential trend turning points earlier.

- Risk Control: Uses 50-day moving average as a stop-loss reference, providing clear exit mechanisms.

- Systematic Operation: Clear strategy logic, suitable for programmatic implementation and backtesting.

Strategy Risks

- Lag Risk: Moving averages are inherently lagging indicators, potentially causing delayed entry and exit timing.

- Oscillation Risk: Multiple indicators may produce confusing signals in sideways markets.

- False Breakout Risk: Price may quickly retreat after short-term breakouts above moving averages.

- Parameter Sensitivity: Multiple indicator parameters need optimization for different market environments.

- Signal Conflict: Different indicators may produce contradictory signals, increasing decision-making difficulty.

Strategy Optimization Directions

Indicator Parameter Optimization:

- Find optimal moving average periods through historical data backtesting

- Optimize Stochastic RSI parameters to adapt to different market volatilities

Signal Filtering:

- Add volume confirmation mechanism

- Introduce volatility indicators to adjust trading strategy during high volatility periods

Risk Management Improvements:

- Implement dynamic stop-loss mechanisms

- Adjust position sizes dynamically based on market volatility

Market Adaptability:

- Add market environment identification mechanisms

- Use different parameter settings under different market conditions

Summary

This is a systematic trend-following strategy that ensures trading reliability while providing clear risk control mechanisms through the combined use of multiple technical indicators. The strategy’s main advantage lies in its multi-layer verification mechanism, but attention must be paid to controlling the lag risks that multiple indicators may bring. Through continuous optimization and improvement, this strategy has the potential to maintain stable performance across different market environments.

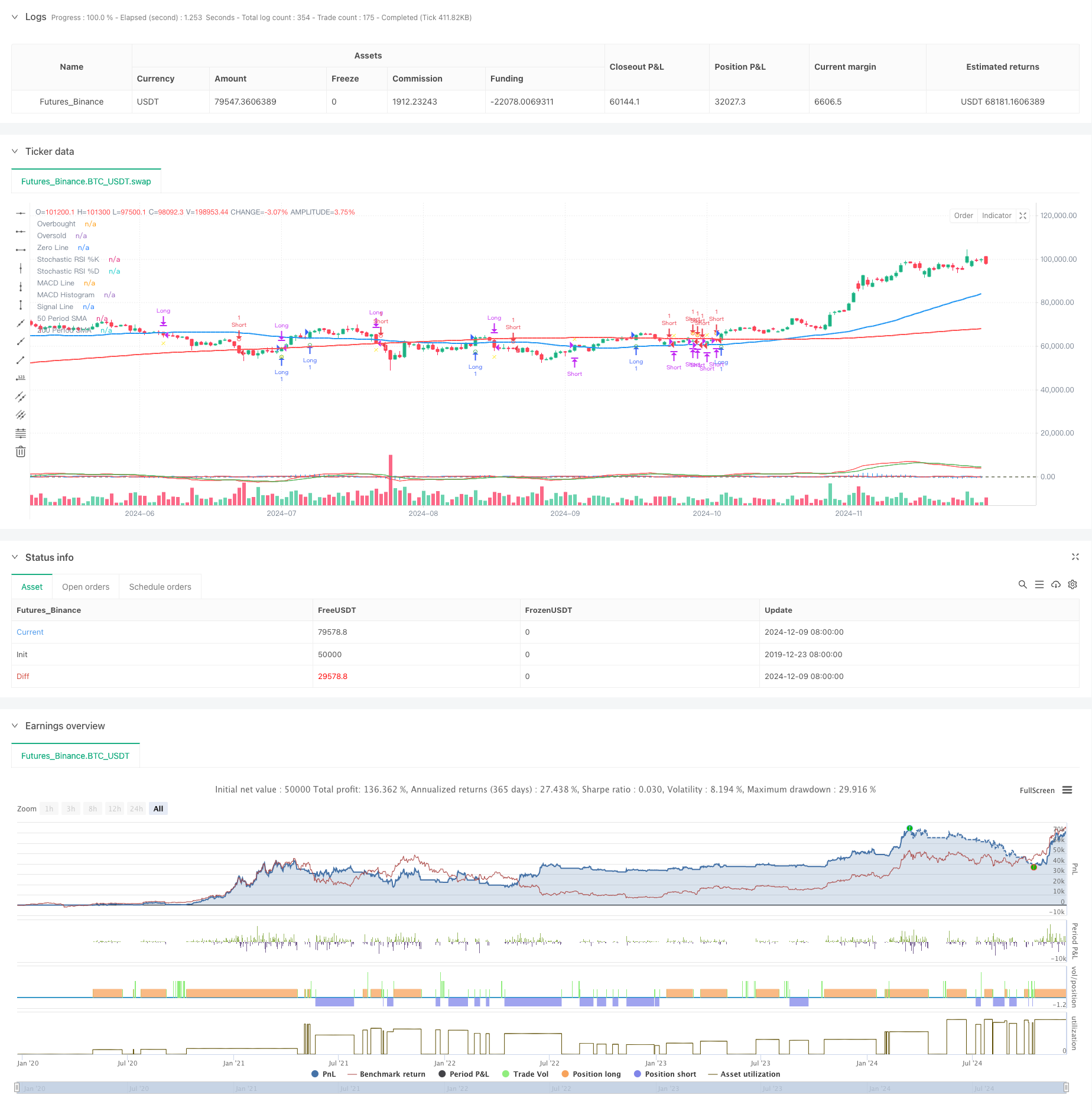

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI and MACD by Karthik", overlay=true)

// Define periods for SMAs

sma50Period = 50

sma200Period = 200

// Calculate SMAs

sma50 = ta.sma(close, sma50Period)

sma200 = ta.sma(close, sma200Period)

// Plot SMAs on the main chart

plot(sma50, color=color.blue, title="50 Period SMA", linewidth=2)

plot(sma200, color=color.red, title="200 Period SMA", linewidth=2)

// Define and calculate parameters for Stochastic RSI

stochRSIPeriod = 14

rsi = ta.rsi(close, stochRSIPeriod)

stochRSIK = ta.stoch(rsi, rsi, stochRSIPeriod, 3)

stochRSID = ta.sma(stochRSIK, 3)

// Define and calculate parameters for MACD

macdShort = 12

macdLong = 26

macdSignal = 9

[macdLine, signalLine, macdHist] = ta.macd(close, macdShort, macdLong, macdSignal)

// Plot Stochastic RSI in a separate pane

hline(80, "Overbought", color=color.red, linewidth=1)

hline(20, "Oversold", color=color.green, linewidth=1)

plot(stochRSIK, color=color.blue, title="Stochastic RSI %K")

plot(stochRSID, color=color.red, title="Stochastic RSI %D")

// Plot MACD in a separate pane

hline(0, "Zero Line", color=color.gray, linewidth=1)

plot(macdHist, color=color.blue, title="MACD Histogram", style=plot.style_histogram)

plot(macdLine, color=color.red, title="MACD Line")

plot(signalLine, color=color.green, title="Signal Line")

// Conditions for buy and sell signals

isAbove200SMA = close > sma200

isStochRSIKAbove = stochRSIK > stochRSID

macdLineAbove = macdLine > signalLine

buySignal = isAbove200SMA and isStochRSIKAbove and macdLineAbove

isBelow200SMA = close < sma200

isStochRSIKBelow = stochRSIK < stochRSID

macdLineBelow = macdLine < signalLine

sellSignal = isBelow200SMA and isStochRSIKBelow and macdLineBelow

// Track the last signal with explicit type declaration

var string lastSignal = na

// Create series for plotting conditions

var bool plotBuySignal = na

var bool plotSellSignal = na

var bool plotExitBuySignal = na

var bool plotExitSellSignal = na

// Update plotting conditions based on signal and last signal

if buySignal and (lastSignal != "buy")

plotBuySignal := true

lastSignal := "buy"

else

plotBuySignal := na

if sellSignal and (lastSignal != "sell")

plotSellSignal := true

lastSignal := "sell"

else

plotSellSignal := na

// Update exit conditions based on SMA50

if lastSignal == "buy" and close < sma50

plotExitBuySignal := true

lastSignal := na // Clear lastSignal after exit

else

plotExitBuySignal := na

if lastSignal == "sell" and close > sma50

plotExitSellSignal := true

lastSignal := na // Clear lastSignal after exit

else

plotExitSellSignal := na

// Plot buy and sell signals on the main chart

plotshape(series=plotBuySignal, location=location.belowbar, color=color.green, style=shape.circle, size=size.small, title="Buy Signal")

plotshape(series=plotSellSignal, location=location.abovebar, color=color.red, style=shape.circle, size=size.small, title="Sell Signal")

// Plot exit signals for buy and sell

plotshape(series=plotExitBuySignal, location=location.belowbar, color=color.yellow, style=shape.xcross, size=size.small, title="Exit Buy Signal")

plotshape(series=plotExitSellSignal, location=location.abovebar, color=color.yellow, style=shape.xcross, size=size.small, title="Exit Sell Signal")

// Strategy to Backtest

long = buySignal

short = sellSignal

// Exit Conditions

exitBuy = close < sma50

exitSell = close > sma50

if (buySignal)

strategy.entry("Long", strategy.long, 1.0)

if (sellSignal)

strategy.entry("Short", strategy.short, 1.0)

strategy.close("Long", when=exitBuy)

strategy.close("Short", when=exitSell)