Triple Standard Deviation Bollinger Bands Breakout Strategy with 100-Day Moving Average Optimization

Author: ChaoZhang, Date: 2024-12-13 11:20:13Tags: MABBSMASD

Overview

This strategy is a quantitative trading system based on Bollinger Bands breakout, utilizing 3 standard deviations for the upper band and 1 standard deviation for the lower band, combined with a 100-day moving average as the middle band. The strategy primarily captures long-term trends by detecting price breakouts above the upper band and uses the lower band as a stop-loss signal. The core concept is to enter positions during strong breakouts and exit when prices fall below the lower band, achieving controlled risk trend following.

Strategy Principles

The core principle is based on the statistical properties of Bollinger Bands. The upper band uses 3 standard deviations, meaning under normal distribution assumptions, the probability of price breaking above this level is only 0.15%, suggesting significant trend formation when breakouts occur. The middle band uses a 100-day moving average, a period long enough to effectively filter short-term market noise. The lower band uses 1 standard deviation as a stop-loss line, a relatively conservative setting that helps with timely exit. The strategy generates long signals when price breaks above the upper band and exits when price falls below the lower band.

Strategy Advantages

- Strong trend capture capability: The 3 standard deviation setting effectively captures significant trend breakout opportunities.

- Reasonable risk control: Using 1 standard deviation as the stop-loss line provides conservative risk management.

- High parameter adaptability: The standard deviation multipliers and moving average period can be adjusted for different market characteristics.

- Systematic approach: Clear strategy logic with comprehensive backtesting capabilities for accurate performance tracking.

- Wide applicability: Can be applied to various markets including stocks and cryptocurrencies.

Strategy Risks

- False breakout risk: Markets may show short-term breakouts followed by quick reversals, leading to false signals.

- Significant drawdowns: Large drawdowns may occur in highly volatile markets.

- Lag risk: The 100-day moving average has inherent lag, potentially missing some rapid market moves.

- Market environment dependency: May generate excessive trades in ranging markets, leading to high transaction costs.

Strategy Optimization Directions

- Incorporate volume confirmation: Add volume breakout confirmation mechanism to improve signal reliability.

- Optimize stop-loss mechanism: Consider implementing trailing stops or ATR-based dynamic stops for more flexible exit management.

- Add trend filters: Incorporate long-term trend identification indicators to trade only in the primary trend direction.

- Improve position management: Dynamically adjust position sizes based on breakout strength.

- Add time filters: Avoid trading during specific market periods.

Summary

This is a well-designed trend following strategy with clear logic. Through the statistical properties of Bollinger Bands and the trend-following characteristics of moving averages, it effectively captures significant market breakout opportunities. While there are drawdown risks, the strategy maintains practical value through reasonable stop-loss settings and risk control. Further optimization potential lies in signal confirmation, stop-loss mechanisms, and position management aspects.

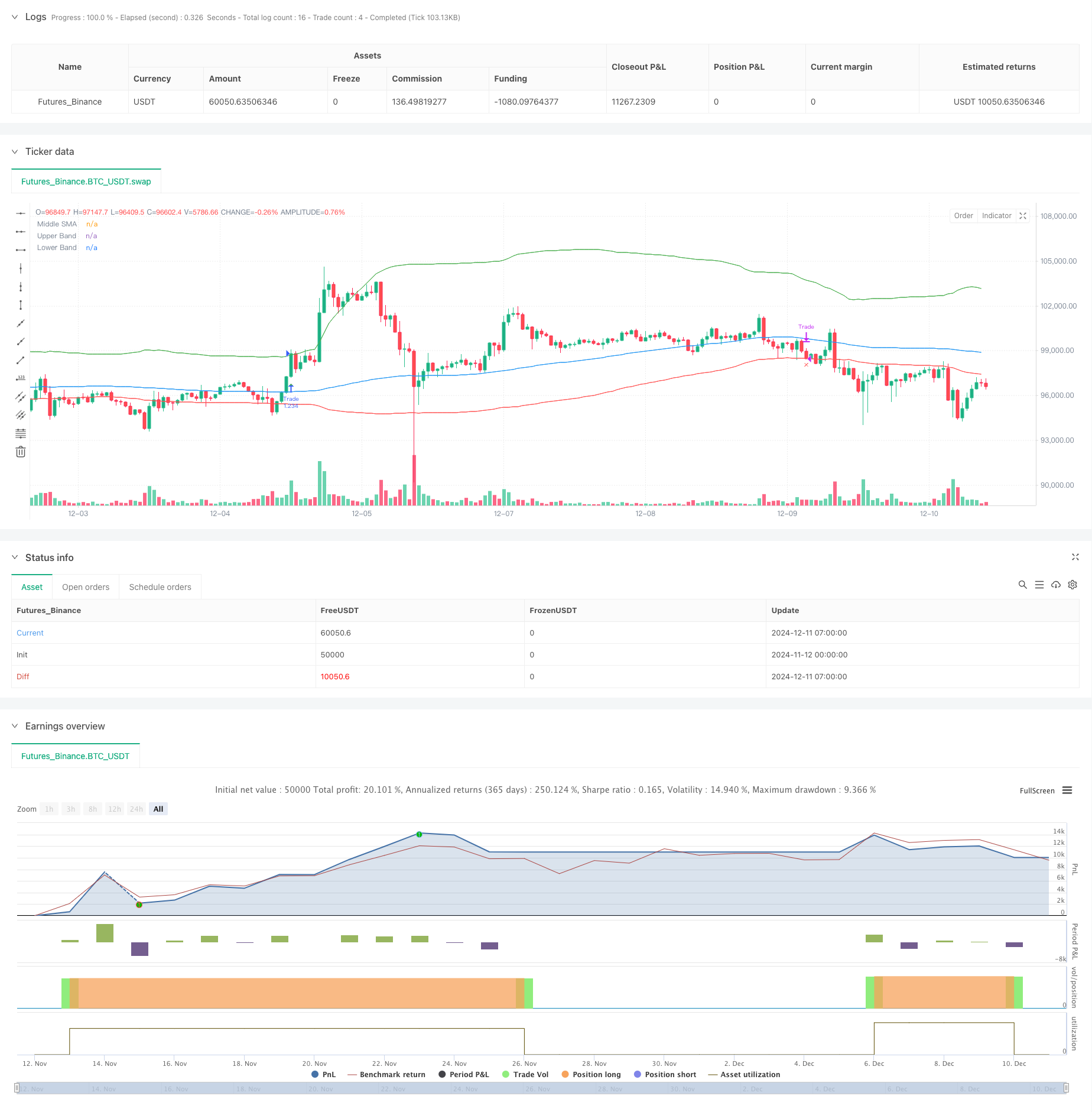

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MounirTrades007

// @version=6

strategy("Bollinger Bands", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Get user input

var g_bb = "Bollinger Band Settings"

upperBandSD = input.float(title="Upper Band Std Dev", defval=3.0, tooltip="Upper band's standard deviation multiplier", group=g_bb)

lowerBandSD = input.float(title="Lower Band Std Dev", defval=1.0, tooltip="Lower band's standard deviation multiplier", group=g_bb)

maPeriod = input.int(title="Middle Band MA Length", defval=100, tooltip="Middle band's SMA period length", group=g_bb)

var g_tester = "Backtester Settings"

drawTester = input.bool(title="Draw Backtester", defval=true, group=g_tester, tooltip="Turn on/off inbuilt backtester display")

// Get Bollinger Bands

[bbIgnore1, bbHigh, bbIgnore2] = ta.bb(close, maPeriod, upperBandSD)

[bbMid, bbIgnore3, bbLow] = ta.bb(close, maPeriod, lowerBandSD)

// Prepare trade persistent variables

drawEntry = false

drawExit = false

// Detect bollinger breakout

if close > bbHigh and barstate.isconfirmed and strategy.position_size == 0

drawEntry := true

strategy.entry(id="Trade", direction=strategy.long)

alert("Bollinger Breakout Detected for " + syminfo.ticker, alert.freq_once_per_bar_close)

// Detect bollinger sell signal

if close < bbLow and barstate.isconfirmed and strategy.position_size != 0

drawExit := true

strategy.close(id="Trade")

alert("Bollinger Exit detected for " + syminfo.ticker, alert.freq_once_per_bar_close)

// Draw bollinger bands

plot(bbMid, color=color.blue, title="Middle SMA")

plot(bbHigh, color=color.green, title="Upper Band")

plot(bbLow, color=color.red, title="Lower Band")

// Draw signals

plotshape(drawEntry, style=shape.triangleup, color=color.green, location=location.belowbar, size=size.normal, title="Buy Signal")

plotshape(drawExit, style=shape.xcross, color=color.red, location=location.belowbar, size=size.normal, title="Sell Signal")

// // =============================================================================

// // START BACKTEST CODE

// // =============================================================================

// // Prepare stats table

// var table testTable = table.new(position.top_right, 2, 2, border_width=1)

// f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

// _cellText = _title + "\n" + _value

// table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor)

// // Draw stats table

// var bgcolor = color.black

// if barstate.islastconfirmedhistory

// if drawTester

// dollarReturn = strategy.equity - strategy.initial_capital

// f_fillCell(testTable, 0, 0, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(testTable, 0, 1, "Win Rate:", str.tostring(strategy.wintrades / strategy.closedtrades * 100, "##.##") + "%", bgcolor, color.white)

// f_fillCell(testTable, 1, 0, "Equity:", "$" + str.tostring(strategy.equity, "###,###.##"), bgcolor, color.white)

// f_fillCell(testTable, 1, 1, "Return:", str.tostring((strategy.netprofit / strategy.initial_capital) * 100, "##.##") + "%", dollarReturn > 0 ? color.green : color.red, color.white)

// // =============================================================================

// // END BACKTEST CODE

// // =============================================================================

- Enhanced Dynamic Bollinger Bands Trading Strategy

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Dynamic Reversal Point Strategy Based on Bollinger Bands and Fractal Breakouts

- Cross-boundary Dynamic Range Quantitative Trading Strategy Based on Bollinger Bands

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

- Bollinger Bands Precise Crossover Quantitative Strategy

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Bollinger Bands Breakout Quantitative Trading Strategy

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- Adaptive Range Trading System Based on Dual RSI Indicators

- Dynamic Dual Supertrend Volume-Price Strategy

- Black Swan Volatility and Moving Average Crossover Momentum Tracking Strategy

- Intelligent Volatility Range Trading Strategy Combining Bollinger Bands and SuperTrend

- Multi-Indicator Synergistic Trend Following Strategy with Dynamic Stop-Loss System

- Bollinger Bands Momentum Breakout Adaptive Trend Following Strategy

- Enhanced Mean Reversion Strategy with MACD-ATR Implementation

- Quantitative Trading Signal Tracking and Multi-Exit Strategy Optimization System

- Dual Moving Average and MACD Combined Trend Following Dynamic Take Profit Smart Trading System

- Dynamic EMA Trend Crossover Entry Quantitative Strategy

- Multi-Wave Trend Crossing Risk Management Quantitative Strategy

- Dual EMA Stochastic Trend Following Trading Strategy

- Dynamic Trend Following Multi-Period Moving Average Crossover Strategy

- Dual Momentum Breakthrough Confirmation Quantitative Trading Strategy

- MACD-RSI Trend Momentum Cross Strategy with Risk Management Model

- Multi-Period EMA Crossover with RSI Momentum and ATR Volatility Based Trend Following Strategy

- Dual EMA Crossover Strategy with Smart Risk-Reward Control

- Multi-Moving Average Trend Following Strategy - Long-term Investment Signal System Based on EMA and SMA Indicators

- Historical High Breakthrough with Monthly Moving Average Filter Trend Following Strategy