Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

Author: ChaoZhang, Date: 2025-01-17 14:57:26Tags: EMADMIDPORSIATRADX

Overview

This strategy is a trend following system based on multiple technical indicators, combining Moving Averages (EMA), Directional Movement Index (DMI), Detrended Price Oscillator (DPO), Relative Strength Index (RSI), and Average True Range (ATR). The core concept is to execute trades only after confirming multiple market characteristics including trend direction, momentum, and volatility to improve trading success rate.

Strategy Principles

The strategy employs a Triple Exponential Moving Average (EMA) system as its core trend identification mechanism, combined with other technical indicators for multiple signal confirmation: 1. Fast EMA (10-day) captures short-term price momentum 2. Medium EMA (25-day) serves as a medium-term trend filter 3. Slow EMA (50-day) defines the overall trend direction 4. DMI (14-day) confirms trend directional strength 5. DPO confirms price deviation from trend 6. RSI (14-day) measures momentum and overbought/oversold conditions 7. ATR (14-day) sets stop-loss and profit targets

Trade Signal Conditions: - Long: Fast EMA crosses above Medium EMA with both above Slow EMA, ADX>25, RSI>50, DPO>0 - Short: Fast EMA crosses below Medium EMA with both below Slow EMA, ADX>25, RSI<50, DPO<0

Strategy Advantages

- Multiple signal confirmation improves reliability and reduces false signals

- Combines trend following and momentum characteristics for effective trend capture

- Dynamic adjustment of stops and targets through ATR adapts to market volatility

- Systematic risk management limits each trade risk to 2% of account

- Clear strategy logic with well-defined component functions facilitates debugging and optimization

Strategy Risks

- May generate frequent false breakout signals in ranging markets

- Multiple indicator confirmation can lead to delayed entries

- Fixed ADX threshold may perform inconsistently across different market conditions

- Potentially significant drawdowns during quick market reversals

- Parameter optimization risks overfitting to historical data

Risk Control Measures: - Dynamic ATR-based stops adapt to market volatility - Fixed proportion risk management - Multiple indicator cross-confirmation reduces false signals

Strategy Optimization Directions

- Introduce adaptive parameter mechanisms to dynamically adjust indicator parameters based on market conditions

- Add market environment recognition module to apply different trading rules in different market conditions

- Optimize exit mechanism by incorporating trend reversal signals and partial profit-taking

- Incorporate volume analysis to improve signal reliability

- Develop drawdown control mechanism to reduce position size or pause trading during consecutive losses

Summary

This strategy constructs a complete trend following trading system through the combination of multiple technical indicators. Its main features are strict signal confirmation and reasonable risk control, suitable for tracking medium to long-term trends on daily timeframes. While there is some lag in signals, the strategy demonstrates robust overall performance through strict risk control and multiple signal confirmation. When applying to live trading, careful consideration should be given to market environment selection and parameter optimization for specific instruments.

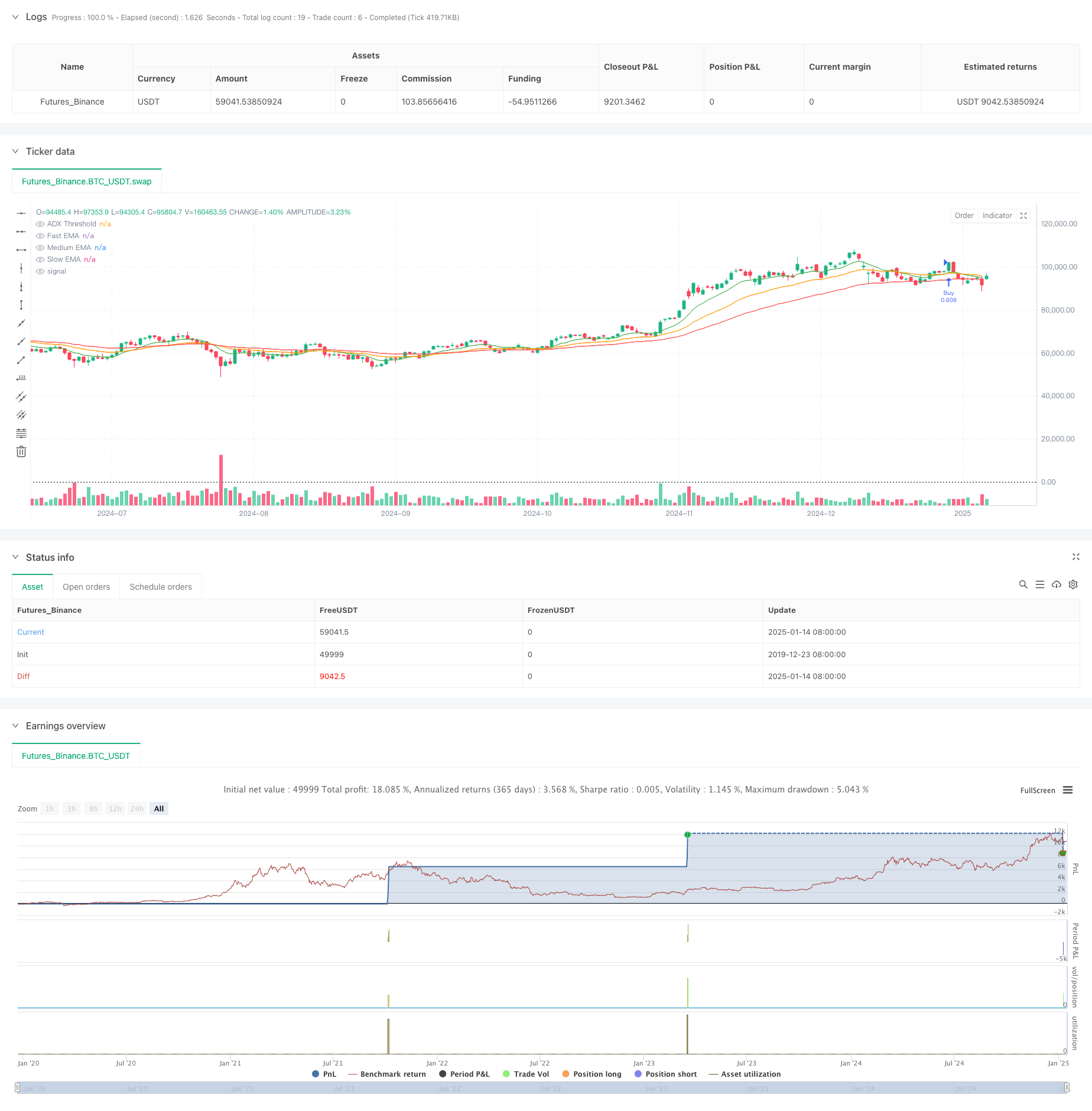

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Daily Strategy with Triple EMA, DMI, DPO, RSI, and ATR", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input parameters

fastEmaLength = input.int(10, title="Fast EMA Length")

mediumEmaLength = input.int(25, title="Medium EMA Length")

slowEmaLength = input.int(50, title="Slow EMA Length")

dmiLength = input.int(14, title="DMI Length")

adxSmoothing = input.int(14, title="ADX Smoothing")

dpoLength = input.int(14, title="DPO Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

riskPercentage = input.float(2.0, title="Risk Percentage", step=0.1)

atrMultiplier = input.float(1.5, title="ATR Multiplier for Stop Loss", step=0.1)

tpMultiplier = input.float(2.0, title="ATR Multiplier for Take Profit", step=0.1)

// Calculate EMAs

fastEma = ta.ema(close, fastEmaLength)

mediumEma = ta.ema(close, mediumEmaLength)

slowEma = ta.ema(close, slowEmaLength)

// Calculate other indicators

[adx, diPlus, diMinus] = ta.dmi(dmiLength, adxSmoothing)

dpo = close - ta.sma(close, dpoLength)

rsi = ta.rsi(close, rsiLength)

atr = ta.atr(atrLength)

// Trading logic

longCondition = ta.crossover(fastEma, mediumEma) and fastEma > slowEma and mediumEma > slowEma and adx > 25 and rsi > 50 and dpo > 0

shortCondition = ta.crossunder(fastEma, mediumEma) and fastEma < slowEma and mediumEma < slowEma and adx > 25 and rsi < 50 and dpo < 0

// Risk management

riskAmount = (strategy.equity * riskPercentage) / 100

stopLoss = atr * atrMultiplier

takeProfit = atr * tpMultiplier

// Entry and exit logic

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Long", "Buy", stop=close - stopLoss, limit=close + takeProfit)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Short", "Sell", stop=close + stopLoss, limit=close - takeProfit)

// Plot indicators

plot(fastEma, color=color.green, title="Fast EMA")

plot(mediumEma, color=color.orange, title="Medium EMA")

plot(slowEma, color=color.red, title="Slow EMA")

hline(25, "ADX Threshold", color=color.gray, linestyle=hline.style_dotted)

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Gaussian Cross EMA Trend Retracement Strategy

- Trend-Following Variable Position Grid Strategy

- Multi-Technical Indicator Based High-Frequency Dynamic Optimization Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Multi-Indicator Dynamic Trend Detection and Risk Management Trading Strategy

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Advanced Dynamic Stop-Loss Strategy Based on Large Candles and RSI Divergence

- Liquidity-Weighted Moving Average Momentum Crossover Strategy

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Multi-Channel Dynamic Support Resistance Keltner Channel Strategy

- Machine Learning Adaptive SuperTrend Quantitative Trading Strategy

- Dynamic WaveTrend and Fibonacci Integrated Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic Volatility Filter

- Year-end Trend Following Momentum Trading Strategy(60-day MA Breakout)

- Multi-Indicator Trend Following with RSI Overbought/Oversold Quantitative Trading Strategy

- Efficient Price Channel Trading Strategy Based on 15-Minute Breakout

- Multi-timeframe Fair Value Gap Breakout Strategy with Historical Backtest

- Dynamic QQE Trend Following with Risk Management Quantitative Trading Strategy

- Dual Trend Confirmation Trading Strategy Based on Moving Averages and Outside Bar Pattern

- Dynamic Trend Following SuperTrend Triple Enhancement Strategy

- RSI Dynamic Breakout Retracement Trading Strategy

- Optimized Dual T3 Trend Tracking Strategy

- Multi-Condition Donchian Channel Momentum Breakout Strategy