Detención de seguimiento dinámico avanzado con estrategia de orientación riesgo-recompensa

El autor:¿ Qué pasa?, fecha: 2024-12-11 14:57:09Las etiquetas:Indicador de riesgoEl ATRLa SMA

Resumen general

Esta estrategia es un sistema de negociación avanzado que combina paradas dinámicas, ratios de riesgo-recompensa y salidas extremas de RSI. Identifica patrones específicos (patrones de barra paralela y patrones de barra de pin) para la entrada en el comercio, mientras utiliza ATR y mínimos recientes para la colocación dinámica de stop loss, y determina objetivos de ganancia basados en ratios de riesgo-recompensa preseleccionados. El sistema también incorpora un mecanismo de salida de mercado sobrecomprado / sobrevendido basado en RSI.

Principios de estrategia

La lógica central incluye varios componentes clave: Las señales de entrada se basan en dos patrones: patrón de barras paralelas (barra alcista grande que sigue una barra bajista grande) y patrón de barras de doble pin. 2. Paradas dinámicas de seguimiento utilizando el multiplicador ATR ajustado a mínimos recientes de N-bar, asegurando que los niveles de parada de pérdida se adapten a la volatilidad del mercado. 3. Objetivos de ganancia establecidos sobre la base de ratios fijos de riesgo-recompensación, calculados utilizando el valor de riesgo ® para cada operación. 4. Tamaño de la posición calculado dinámicamente en función del importe del riesgo fijo y del valor del riesgo por operación. 5. El mecanismo de salida extrema del RSI desencadena el cierre de la posición en los extremos del mercado.

Ventajas estratégicas

- Gestión dinámica del riesgo: los niveles de suspensión de pérdidas se ajustan dinámicamente a la volatilidad del mercado mediante una combinación de ATR y mínimos recientes.

- Control preciso de las posiciones: el tamaño de las posiciones basado en el importe del riesgo fijo garantiza un riesgo constante por operación.

- Mecanismo de salida multidimensional: Combina paradas finales, objetivos de ganancias fijos y extremos del RSI.

- En el caso de los instrumentos financieros, el valor de los activos financieros de la entidad es el valor de los activos financieros de la entidad.

- Configuración clara de riesgo-recompensación: Las relaciones riesgo-recompensación predeterminadas definen objetivos de ganancia claros para cada operación.

Riesgos estratégicos

- Riesgo de exactitud del reconocimiento de patrones: posible identificación falsa de barras paralelas y barras de pines.

- El riesgo de deslizamiento en el punto de pérdida: puede sufrir un deslizamiento significativo en mercados volátiles.

- Salida prematura del RSI: podría conducir a salidas tempranas en mercados de fuerte tendencia.

- Limitaciones fijas de la relación riesgo-beneficio: las relaciones riesgo-beneficio óptimas pueden variar según las condiciones del mercado.

- Optimización de parámetros Riesgo de sobreajuste: las combinaciones de múltiples parámetros pueden conducir a una sobreoptimización.

Direcciones para la optimización de la estrategia

- Mejora de la señal de entrada: agregue más indicadores de confirmación de patrones como indicadores de volumen y tendencia.

- Relación dinámica riesgo-recompensa: ajustar las relaciones riesgo-recompensa basadas en la volatilidad del mercado.

- Adaptación inteligente de parámetros: introducir algoritmos de aprendizaje automático para la optimización de parámetros dinámicos.

- Confirmación de marcos de tiempo múltiples: agregar mecanismos de confirmación de señal en múltiples marcos de tiempo.

- Clasificación del entorno del mercado: aplicar diferentes conjuntos de parámetros para diferentes condiciones del mercado.

Resumen de las actividades

Esta es una estrategia de trading bien diseñada que combina múltiples conceptos de análisis técnico maduros para construir un sistema de trading completo. Las fortalezas de la estrategia se encuentran en su sistema integral de gestión de riesgos y reglas de trading flexibles, mientras que se necesita prestar atención a la optimización de parámetros y adaptabilidad del mercado. A través de las direcciones de optimización sugeridas, hay espacio para una mayor mejora de la estrategia.

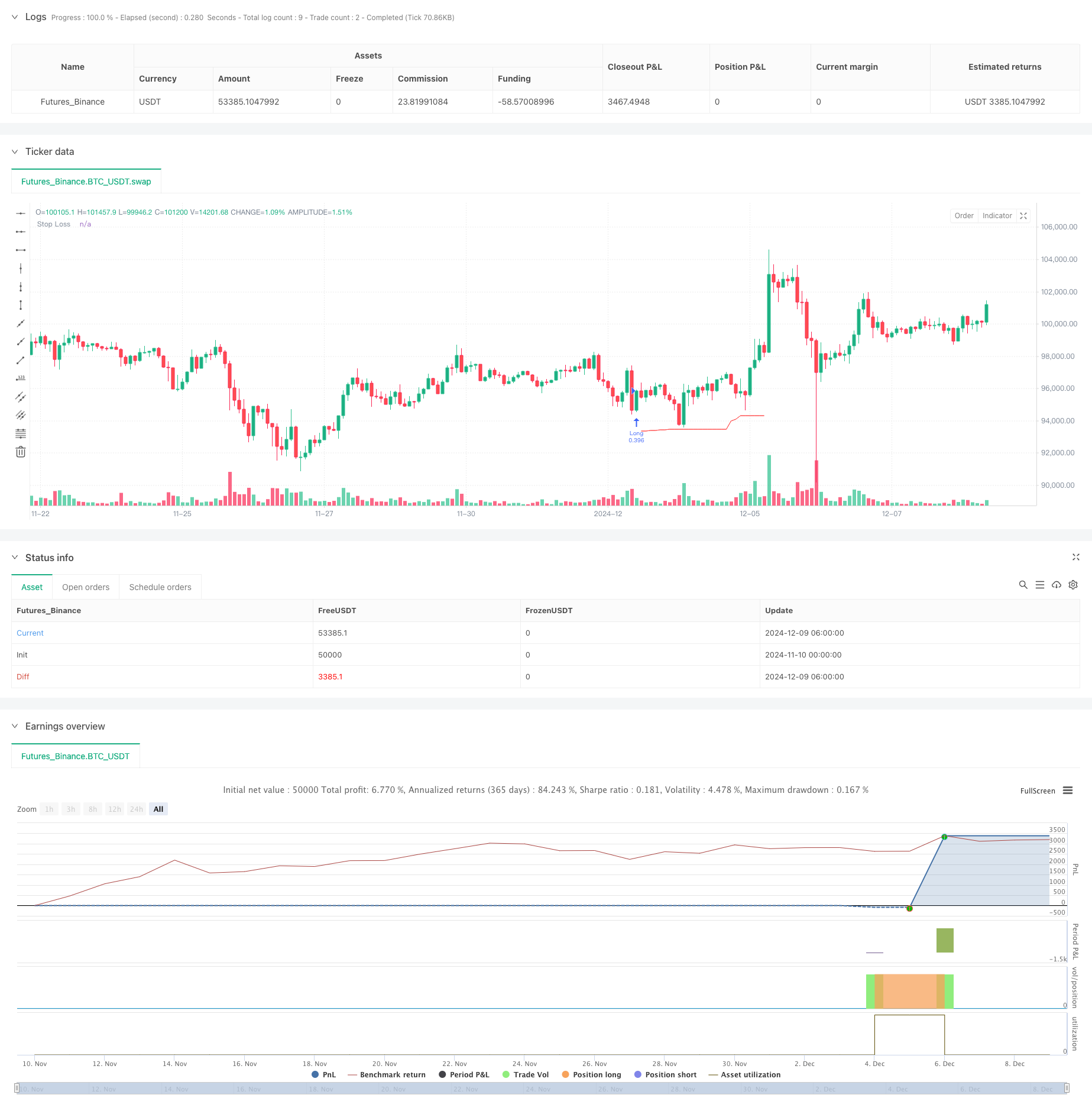

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)

- Estrategia de ruptura de la inversión media del RSI

- Estrategia de negociación dinámica basada en Z-Score y Supertrend: sistema de conmutación larga-corta

- RSI Dinámica Estrategia de negociación inteligente de stop-loss

- La media móvil cruzada con la estrategia de pérdida de parada de seguimiento

- Estrategia de negociación cuantitativa a corto plazo basada en el cruce de dos medias móviles, el RSI y los indicadores estocásticos

- Tendencia dinámica siguiendo una estrategia con aprendizaje automático y gestión de riesgos mejorada

- Estrategia de pirámide inteligente de múltiples indicadores

- Estrategia de ruptura de RSI y bandas de Bollinger de alta precisión con relación riesgo-rendimiento optimizada

- Estrategia de impulso del RSI con doble media móvil cruzada con sistema de optimización de riesgo-recompensa

- El valor de las posiciones de los instrumentos de inversión se calculará en función de la posición de los activos de inversión.

- MACD y estrategia de negociación inteligente de doble señal de regresión lineal

- Tendencia multi-EMA después de la estrategia de negociación

- Tendencia de Heikin Ashi suavizada de varios plazos siguiendo el sistema de negociación cuantitativa

- Indicador de inclinación polinomial del oscilador dinámico del RSI Tendencia Estrategia de negociación cuantitativa

- Estrategia de negociación en un solo sentido de ruptura diaria del rango

- Las operaciones de negociación de órdenes de límite dinámicas con múltiples indicadores de SMA-RSI-MACD

- EMA/SMA sigue la tendencia con la estrategia de negociación oscilante combinada con el filtro de volumen y el sistema de toma de ganancias/detención de pérdidas por porcentaje

- Estrategia de negociación de reversión de la media de desviación estándar de VWAP

- Estrategia de negociación de ruptura de la zona de precios dinámica basada en el sistema cuantitativo de soporte y resistencia

- Estrategia cuantitativa cruzada de tendencia de impulso de múltiples indicadores

- Estrategia avanzada de ruptura de la línea de tendencia dinámica de longitud única

- Las entidades que no cumplen los requisitos establecidos en el artículo 4, apartado 1, letra b), del Reglamento (UE) no 575/2013 deberán tener en cuenta los siguientes elementos:

- Las operaciones de inversión en el mercado de divisas se clasifican en el grupo de operaciones de inversión.

- Las bandas de Bollinger y la estrategia de negociación dinámica combinada del RSI

- Estrategia de negociación combinada de volatilidad de impulso RSI-ATR

- Estrategia de doble seguimiento de tendencias de la EMA con entrada de compra limitada

- Sistema de negociación de análisis técnico multiestratégico

- Estrategia de negociación combinada de reconocimiento de patrones de velas de varios plazos

- Las bandas de triple Bollinger tocan la tendencia siguiendo una estrategia de negociación cuantitativa

- Sistema de negociación de ruptura dinámica multidimensional basado en bandas de Bollinger y RSI