Stratégie dynamique de négociation long/courte avec système de signaux croisés de moyenne mobile

Auteur:ChaoZhang est là., Date: 2024-12-12 11:11:15 Je vous en prie.Les étiquettes:Le taux d'intérêtSMAIndice de résistanceATRTPSL

Résumé

Cette stratégie est un système de swing trading basé sur des indicateurs techniques qui combine plusieurs signaux, y compris les croisements moyens mobiles, les conditions de surachat / survente du RSI et les niveaux de stop-loss / take-profit basés sur l'ATR. Le mécanisme de base repose sur la capture des tendances du marché via des croisements EMA à court terme et SMA à long terme, confirmés par des signaux RSI, avec des niveaux de stop-loss et de take-profit dynamiques définis à l'aide de l'ATR. La stratégie prend en charge les directions de trading longues et courtes et permet une activation / désactivation flexible de l'une ou l'autre direction.

Principes de stratégie

La stratégie utilise une approche à plusieurs niveaux en termes d'indicateurs techniques:

- Couche de détermination de la tendance: utilise des croisements EMA de 20 périodes et SMA de 50 périodes pour déterminer la direction de la tendance, avec EMA traversant au-dessus de la SMA comme signal long et en dessous comme signal court.

- Couche de confirmation de l'élan: utilise l'indicateur RSI pour la confirmation de surachat/survente, permettant des longs inférieurs à RSI 70 et des shorts supérieurs à RSI 30.

- Couche de calcul de la volatilité: utilise l'ATR à 14 périodes pour calculer les niveaux de stop-loss et de take-profit, en fixant l'stop-loss à 1,5x ATR et le take-profit à 3x ATR.

- Couche de gestion des positions: calcule dynamiquement la taille de la position en fonction du capital initial et du pourcentage de risque par transaction (par défaut 1%).

Les avantages de la stratégie

- Confirmation de signaux multiples: réduit les faux signaux grâce à la combinaison d'indicateurs croisés de moyenne mobile, RSI et ATR.

- L'établissement de crédit est un établissement financier dont la valeur de ses actifs est supérieure ou égale à la valeur de ses actifs.

- Direction de négociation flexible: permet de réaliser indépendamment des transactions longues ou courtes en fonction des conditions du marché.

- Contrôle strict des risques: contrôle efficace de l'exposition aux risques par le biais d'un contrôle des risques basé sur le pourcentage et d'une dimensionnement dynamique des positions.

- Prise en charge de la visualisation: offre une visualisation complète des graphiques, y compris les marqueurs de signaux et les affichages d'indicateurs.

Risques stratégiques

- Risque de marché latéral: les croisements de moyennes mobiles peuvent générer des faux signaux excessifs sur des marchés variables.

- Risque de glissement: les prix d'exécution réels peuvent s'écarter sensiblement des prix de signaux pendant les périodes de volatilité.

- Risque de gestion des capitaux: des paramètres de pourcentage de risque excessifs peuvent entraîner des pertes importantes pour une seule transaction.

- Sensibilité aux paramètres: la performance de la stratégie est sensible aux paramètres, ce qui nécessite une optimisation minutieuse.

Directions d'optimisation de la stratégie

- Ajouter un filtre de force de tendance: mettre en œuvre l'indicateur ADX pour filtrer les transactions dans des environnements de tendance faible.

- Optimiser les périodes de moyenne mobile: ajuster dynamiquement les paramètres de moyenne mobile en fonction des caractéristiques du cycle du marché.

- Améliorer le mécanisme de stop-loss: ajouter une fonctionnalité de stop-loss pour mieux protéger les bénéfices.

- Ajouter la confirmation du volume: intégrer des indicateurs de volume comme confirmation supplémentaire pour améliorer la fiabilité du signal.

- Classification de l'environnement du marché: ajouter un module de reconnaissance de l'environnement du marché pour utiliser différents ensembles de paramètres dans différentes conditions de marché.

Résumé

La stratégie construit un système de trading relativement complet grâce à la combinaison de plusieurs indicateurs techniques. Ses atouts résident dans la fiabilité de la confirmation du signal et la gestion complète des risques, bien que l'impact de l'environnement du marché sur les performances de la stratégie nécessite une attention.

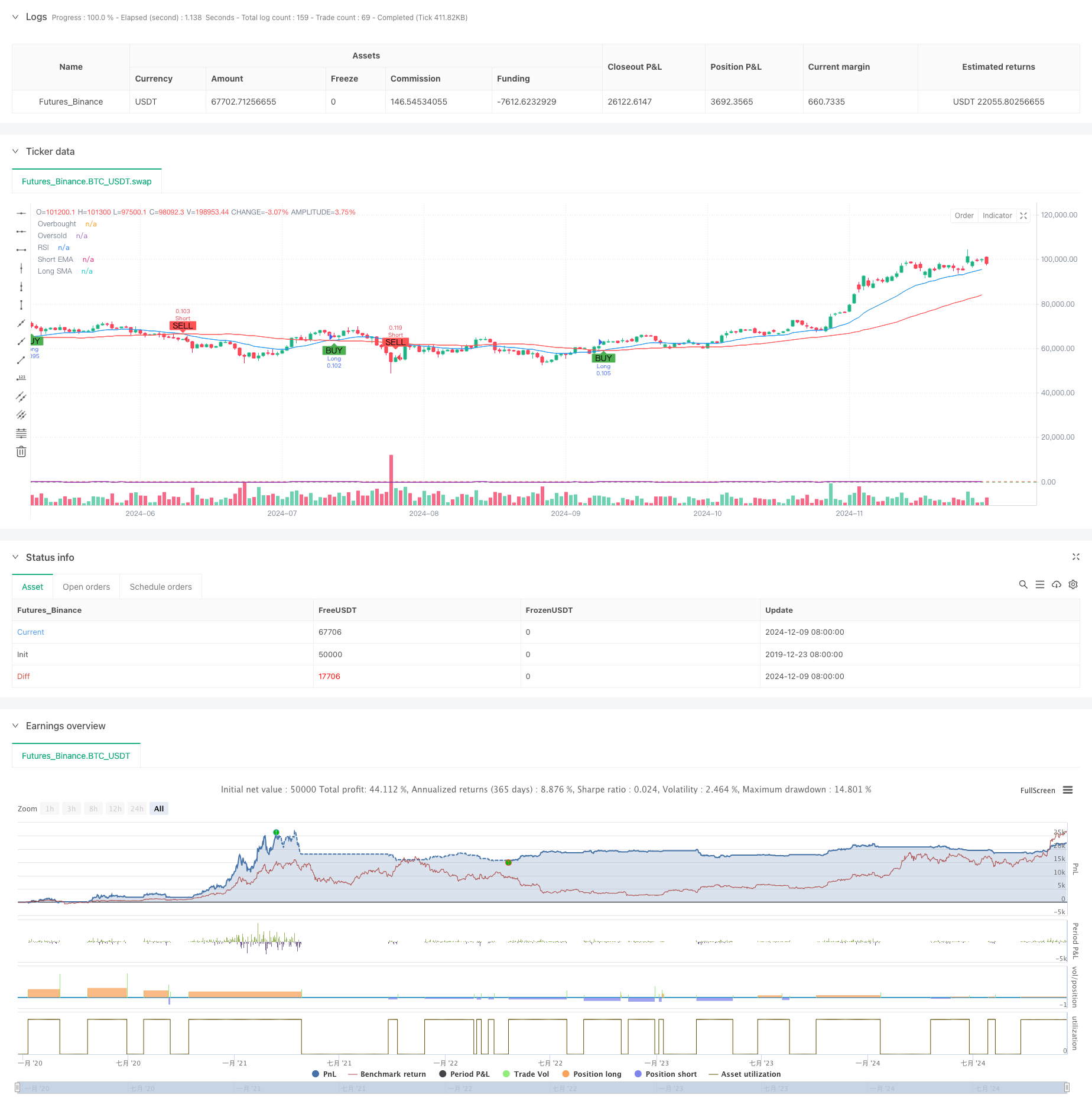

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CryptoRonin84

//@version=5

strategy("Swing Trading Strategy with On/Off Long and Short", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input for turning Long and Short trades ON/OFF

enable_long = input.bool(true, title="Enable Long Trades")

enable_short = input.bool(true, title="Enable Short Trades")

// Input parameters for strategy

sma_short_length = input.int(20, title="Short EMA Length", minval=1)

sma_long_length = input.int(50, title="Long SMA Length", minval=1)

sl_percentage = input.float(1.5, title="Stop Loss (%)", step=0.1, minval=0.1)

tp_percentage = input.float(3, title="Take Profit (%)", step=0.1, minval=0.1)

risk_per_trade = input.float(1, title="Risk Per Trade (%)", step=0.1, minval=0.1)

capital = input.float(10000, title="Initial Capital", step=100)

// Input for date range for backtesting

start_date = input(timestamp("2020-01-01 00:00"), title="Backtest Start Date")

end_date = input(timestamp("2024-12-31 23:59"), title="Backtest End Date")

inDateRange = true

// Moving averages

sma_short = ta.ema(close, sma_short_length)

sma_long = ta.sma(close, sma_long_length)

// RSI setup

rsi = ta.rsi(close, 14)

rsi_overbought = 70

rsi_oversold = 30

// ATR for volatility-based stop-loss calculation

atr = ta.atr(14)

stop_loss_level_long = strategy.position_avg_price - (1.5 * atr)

stop_loss_level_short = strategy.position_avg_price + (1.5 * atr)

take_profit_level_long = strategy.position_avg_price + (3 * atr)

take_profit_level_short = strategy.position_avg_price - (3 * atr)

// Position sizing based on risk per trade

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / (close * sl_percentage / 100)

// Long and Short conditions

long_condition = ta.crossover(sma_short, sma_long) and rsi < rsi_overbought

short_condition = ta.crossunder(sma_short, sma_long) and rsi > rsi_oversold

// Execute long trades

if (long_condition and inDateRange and enable_long)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Long", stop=stop_loss_level_long, limit=take_profit_level_long)

// Execute short trades

if (short_condition and inDateRange and enable_short)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Short", stop=stop_loss_level_short, limit=take_profit_level_short)

// Plot moving averages

plot(sma_short, title="Short EMA", color=color.blue)

plot(sma_long, title="Long SMA", color=color.red)

// Plot RSI on separate chart

hline(rsi_overbought, "Overbought", color=color.red)

hline(rsi_oversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

// Plot signals on chart

plotshape(series=long_condition and enable_long, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=short_condition and enable_short, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Background color for backtest range

bgcolor(inDateRange ? na : color.red, transp=90)

- Stratégie dynamique de DCA basée sur le volume

- La stratégie quantitative de rebond sur les ventes excédentaires de l'ATR

- Stratégie de négociation dynamique à indicateurs multiples

- La moyenne mobile adaptative est croisée avec une stratégie de stop-loss

- La stratégie suivie par l'EMA multipériodique avec dynamique RSI et ATR basée sur la tendance à la volatilité

- La tendance à un taux de gain élevé signifie une stratégie de négociation de renversement

- Stratégie d'optimisation dynamique à haute fréquence basée sur des indicateurs techniques multiples

- Système de négociation suivant la tendance à plusieurs délais avec intégration ATR et MACD

- Stratégie améliorée d'inversion moyenne avec mise en œuvre du MACD-ATR

- Système d'analyse stratégique de l'anomalie du vendredi d'or multidimensionnel

- Système de négociation de moyennes mobiles multiples avec confirmation de l'élan et du volume Stratégie de tendance quantitative

- Stratégie de négociation équilibrée avec prise de bénéfices et stop-loss

- Système amélioré de suivi des tendances: Identification dynamique des tendances basée sur ADX et SAR parabolique

- Stratégie de négociation à dynamique stochastique à deux délais

- Stratégie de gestion dynamique des positions de bandes de Bollinger adaptatives

- RSI dynamique et stratégie de négociation en swing

- Stratégie de négociation bidirectionnelle basée sur l'analyse du modèle d'absorption des bougies

- Bollinger Breakout avec inversion moyenne 4H Stratégie de négociation quantitative

- Tendance à suivre la stratégie de dimensionnement de la position dynamique de la grille

- Stratégie croisée à double BBI (indice taureaux et ours)

- Tendance de l'indicateur multi-technique à la suite d'une stratégie de négociation

- Stratégie de négociation avancée de réversion moyenne de la volatilité: Système de négociation quantitatif multidimensionnel basé sur le VIX et la moyenne mobile

- Stratégie d'inversion de la dynamique du canal de tendance de l'or

- Stratégie de négociation avancée de la tendance à la dynamique de l'EMA

- Stratégie de négociation d'intensité de tendance multi-MA - Système de négociation intelligent flexible basé sur l'écart MA

- Système de détection de double tendance pondéré par volume

- Stratégie de négociation multifactorielle contre tendance

- Stratégie de négociation quantitative d'oscillateur de dynamique amélioré et de divergence stochastique

- Rétracement de Fibonacci sur plusieurs délais avec stratégie de négociation de rupture de tendance

- Tendance multi-indicateur suivant une stratégie d'optimisation des bénéfices