G-Trend EMA ATR Strategi Perdagangan Cerdas

Penulis:ChaoZhang, Tanggal: 2024-06-14 15:35:15Tag:EMAATR

Gambaran umum

Strategi ini menggunakan indikator G-Channel untuk mengidentifikasi arah tren pasar, sementara menggabungkan indikator EMA dan ATR untuk mengoptimalkan titik masuk dan keluar. Ide utamanya adalah: pergi panjang ketika harga melanggar band atas G-Channel dan berada di bawah EMA; pergi pendek ketika harga melanggar band bawah dan berada di atas EMA. Sementara itu, ATR digunakan untuk menetapkan stop-loss dan take-profit tingkat dinamis, dengan stop-loss 2 kali ATR dan take-profit 4 kali ATR. Pendekatan ini dapat menangkap lebih banyak keuntungan di pasar tren sambil mengontrol risiko secara ketat.

Prinsip Strategi

- Menghitung band atas dan bawah G-Channel: gunakan harga penutupan saat ini dan harga tinggi dan rendah sebelumnya untuk menghitung band atas dan bawah G-Channel.

- Menentukan arah tren: amati hubungan antara harga dan pita G-Channel untuk menentukan tren bullish atau bearish.

- Menghitung EMA: menghitung nilai EMA untuk periode yang ditentukan.

- Menghitung ATR: menghitung nilai ATR untuk periode yang ditentukan.

- Menentukan kondisi pembelian/penjualan: memicu posisi panjang ketika harga melanggar band atas dan berada di bawah EMA; memicu posisi pendek ketika harga melanggar band bawah dan berada di atas EMA.

- Set stop-loss dan take-profit: stop-loss adalah harga masuk - 2ATR, mengambil keuntungan adalah harga masuk + 4ATR (long); stop-loss adalah harga masuk + 2ATR, mengambil keuntungan adalah harga masuk - 4ATR (pendek).

- Eksekusi strategi: ketika kondisi beli/jual terpenuhi, eksekusi operasi masuk yang sesuai dan atur stop loss dan take profit sesuai.

Keuntungan Strategi

- Trend Following: strategi secara efektif menangkap tren pasar menggunakan G-Channel, yang cocok untuk tren pasar.

- Stop-loss dan take-profit dinamis: ATR digunakan untuk menyesuaikan secara dinamis tingkat stop-loss dan take-profit, lebih beradaptasi dengan volatilitas pasar.

- Pengendalian risiko: stop-loss ditetapkan pada 2 kali ATR, mengontrol risiko setiap perdagangan secara ketat.

- Sederhana dan mudah digunakan: logika strategi jelas dan langsung, cocok untuk sebagian besar investor.

Risiko Strategi

- Pasar yang bervariasi: di pasar yang bervariasi, sinyal perdagangan yang sering dapat menyebabkan peningkatan kerugian.

- Optimasi parameter: instrumen perdagangan dan kerangka waktu yang berbeda mungkin memerlukan parameter yang berbeda; menerapkan secara membabi buta dapat membawa risiko.

- Black swan events: dalam kondisi pasar yang ekstrim dengan fluktuasi harga yang drastis, stop-loss mungkin gagal untuk dieksekusi secara efektif.

Arah Optimasi Strategi

- Penyaringan tren: tambahkan kondisi penyaringan tren seperti penyeberangan MA, DMI, dll, untuk mengurangi perdagangan di pasar yang bervariasi.

- Optimasi parameter: mengoptimalkan parameter untuk instrumen dan kerangka waktu yang berbeda untuk menemukan kombinasi parameter terbaik.

- Manajemen posisi: menyesuaikan posisi secara dinamis berdasarkan volatilitas pasar untuk meningkatkan pemanfaatan modal.

- Kombinasi strategi: menggabungkan strategi ini dengan strategi efektif lainnya untuk meningkatkan stabilitas.

Ringkasan

Strategi ini membangun sistem perdagangan yang sederhana dan efektif mengikuti tren menggunakan indikator seperti G-Channel, EMA, dan ATR. Ini dapat mencapai hasil yang baik di pasar yang sedang tren, tetapi berkinerja rata-rata di pasar yang berkisar.

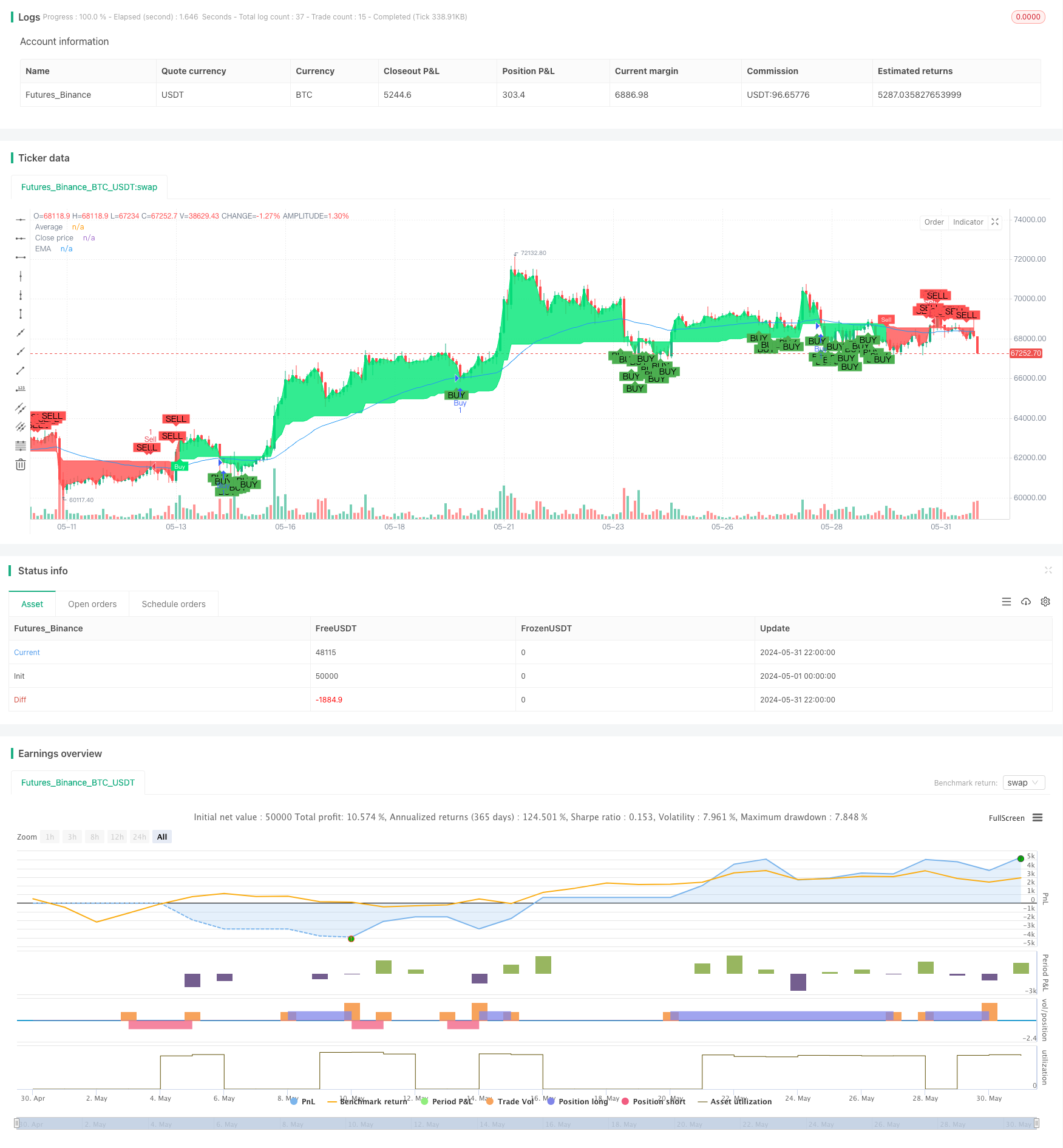

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Full credit to AlexGrover: https://www.tradingview.com/script/fIvlS64B-G-Channels-Efficient-Calculation-Of-Upper-Lower-Extremities/

strategy ("G-Channel Trend Detection with EMA Strategy and ATR", shorttitle="G-Trend EMA ATR Strategy", overlay=true)

// Inputs for G-Channel

length = input(100, title="G-Channel Length")

src = input(close, title="Source")

// G-Channel Calculation

var float a = na

var float b = na

a := max(src, nz(a[1])) - (nz(a[1] - b[1]) / length)

b := min(src, nz(b[1])) + (nz(a[1] - b[1]) / length)

avg = (a + b) / 2

// G-Channel Signals

crossup = b[1] < close[1] and b > close

crossdn = a[1] < close[1] and a > close

bullish = barssince(crossdn) <= barssince(crossup)

c = bullish ? color.lime : color.red

// Plot G-Channel Average

p1 = plot(avg, "Average", color=c, linewidth=1, transp=90)

p2 = plot(close, "Close price", color=c, linewidth=1, transp=100)

fill(p1, p2, color=c, transp=90)

// Show Buy/Sell Labels

showcross = input(true, title="Show Buy/Sell Labels")

plotshape(showcross and not bullish and bullish[1] ? avg : na, location=location.absolute, style=shape.labeldown, color=color.red, size=size.tiny, text="Sell", textcolor=color.white, transp=0, offset=-1)

plotshape(showcross and bullish and not bullish[1] ? avg : na, location=location.absolute, style=shape.labelup, color=color.lime, size=size.tiny, text="Buy", textcolor=color.white, transp=0, offset=-1)

// Inputs for EMA

emaLength = input(50, title="EMA Length")

emaValue = ema(close, emaLength)

// Plot EMA

plot(emaValue, title="EMA", color=color.blue, linewidth=1)

// ATR Calculation

atrLength = input(14, title="ATR Length")

atrValue = atr(atrLength)

// Strategy Conditions

buyCondition = bullish and close < emaValue

sellCondition = not bullish and close > emaValue

// Stop Loss and Take Profit Levels

longStopLoss = close - 2 * atrValue

longTakeProfit = close + 4 * atrValue

shortStopLoss = close + 2 * atrValue

shortTakeProfit = close - 4 * atrValue

// Execute Strategy with ATR-based stop loss and take profit

if (buyCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=longStopLoss, limit=longTakeProfit)

if (sellCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=shortStopLoss, limit=shortTakeProfit)

// Plot Buy/Sell Signals on the chart

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", offset=-1)

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", offset=-1)

- Strategi Perdagangan Momentum Multi-Indikator yang Ditingkatkan

- Trend Multi-Timeframe Mengikuti Strategi dengan Take Profit dan Stop Loss berbasis ATR

- K Lilin Berturut-turut Bull Bear Strategi

- Keltner Channels EMA Strategi ATR

- Strategi Kombinasi Supertrend dan EMA

- Tren Multi-Indikator Mengikuti Strategi dengan Saluran Dinamis dan Sistem Perdagangan Rata-rata Bergerak

- Strategi Adaptif Take Profit dan Stop Loss Dinamis berbasis ATR dan EMA

- Strategi Optimisasi Rezim Pasar Jangka Pendek Berbasis Volatilitas dan Regresi Linear

- Tren Dinamis EMA Mengikuti Strategi Perdagangan

- Triple EMA Crossover Strategi

- Strategi Crossover Rata-rata Gerak Multi-Eksponensial dengan Optimasi Stop-Loss Dinamis ATR Berbasis Volume

- Fisher Transform Dynamic Threshold Trend Mengikuti Strategi

- Strategi pengembalian rata-rata

- EMA100 dan NUPL Relative Unrealized Profit Quantitative Trading Strategy

- Strategi perdagangan rentang volatilitas berdasarkan osilator stokastik

- Strategi gabungan sederhana: Titik Pivot SuperTrend dan DEMA

- EMA Trend Filter Strategi

- Strategi Crossover Rata-rata Bergerak

- Strategi Breakout intraday Berdasarkan titik rendah 3 menit

- Strategi Entry Advanced berdasarkan Moving Average, Support/Resistance, dan Volume

- EMA RSI MACD Strategi Perdagangan Take Profit dan Stop Loss Dinamis

- Tren Mengikuti Strategi Berdasarkan Rata-rata Bergerak 200 Hari dan Osilator Stokastik

- Strategi Tren RSI

- EMA Crossover Momentum Scalping Strategi

- BB Breakout Strategi

- VWAP dan RSI Dynamic Bollinger Bands Take Profit dan Stop Loss Strategi

- Chande-Kroll Stop Tren ATR Dinamis Mengikuti Strategi

- Strategi ini menghasilkan sinyal perdagangan berdasarkan aliran uang Chaikin (CMF)

- Strategi Pembalikan Bar Pin yang Difilter Tren

- Strategi perdagangan kuantitatif berdasarkan pola pembalikan pada level support dan resistance

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry