Strategi perdagangan swing panjang/pendek yang dinamis dengan sistem sinyal crossover rata-rata bergerak

Penulis:ChaoZhang, Tanggal: 2024-12-12 11:11:15Tag:EMASMARSIATRTPSL

Gambaran umum

Strategi ini adalah sistem perdagangan swing berbasis indikator teknis yang menggabungkan beberapa sinyal termasuk crossover rata-rata bergerak, kondisi overbought / oversold RSI, dan level stop-loss / take-profit berbasis ATR. Mekanisme inti bergantung pada penangkapan tren pasar melalui EMA jangka pendek dan crossover SMA jangka panjang, yang dikonfirmasi oleh sinyal RSI, dengan stop-loss dan take-profit tingkat dinamis yang ditetapkan menggunakan ATR. Strategi ini mendukung arah perdagangan panjang dan pendek dan memungkinkan memungkinkan / menonaktifkan fleksibel dari kedua arah.

Prinsip Strategi

Strategi ini menggunakan pendekatan indikator teknis multi-lapisan:

- Trend Determination Layer: Menggunakan EMA 20-periode dan SMA 50-periode crossover untuk menentukan arah tren, dengan EMA melintasi di atas SMA sebagai sinyal panjang dan di bawah sebagai sinyal pendek.

- Layer Konfirmasi Momentum: Menggunakan indikator RSI untuk konfirmasi overbought/oversold, memungkinkan long di bawah RSI 70 dan short di atas RSI 30.

- Lapisan Perhitungan Volatilitas: Menggunakan ATR 14 periode untuk menghitung tingkat stop loss dan take profit, menetapkan stop loss pada 1,5x ATR dan take profit pada 3x ATR.

- Layer Manajemen Posisi: Menghitung ukuran posisi secara dinamis berdasarkan modal awal dan persentase risiko per perdagangan (default 1%).

Keuntungan Strategi

- Konfirmasi Multiple Signal: Mengurangi sinyal palsu melalui kombinasi crossover rata-rata bergerak, RSI, dan indikator ATR.

- Dinamis Stop-Loss/Take-Profit: Beradaptasi dengan perubahan volatilitas pasar melalui manajemen posisi berbasis ATR.

- Arah Perdagangan Fleksibel: Memungkinkan memungkinkan perdagangan panjang atau pendek secara independen berdasarkan kondisi pasar.

- Pengendalian Risiko yang ketat: Mengontrol eksposur risiko secara efektif melalui pengendalian risiko berbasis persentase dan ukuran posisi dinamis.

- Dukungan Visualisasi: Menyediakan visualisasi grafik yang komprehensif termasuk penanda sinyal dan tampilan indikator.

Risiko Strategi

- Risiko pasar sampingan: Crossover rata-rata bergerak dapat menghasilkan sinyal palsu yang berlebihan di pasar yang bervariasi.

- Risiko tergelincir: Harga eksekusi yang sebenarnya dapat menyimpang secara signifikan dari harga sinyal selama periode volatilitas.

- Risiko Manajemen Modal: Pengaturan persentase risiko yang berlebihan dapat menyebabkan kerugian tunggal yang besar.

- Sensitivitas Parameter: Kinerja strategi sensitif terhadap pengaturan parameter, yang membutuhkan optimasi yang cermat.

Arah Optimasi Strategi

- Tambahkan Filter Kekuatan Tren: Terapkan indikator ADX untuk menyaring perdagangan di lingkungan tren yang lemah.

- Mengoptimalkan Periode Rata-rata Bergerak: Sesuaikan secara dinamis parameter rata-rata bergerak berdasarkan karakteristik siklus pasar.

- Meningkatkan Mekanisme Stop-Loss: Tambahkan fungsi stop-loss trailing untuk lebih melindungi keuntungan.

- Tambahkan Konfirmasi Volume: Masukkan indikator volume sebagai konfirmasi tambahan untuk meningkatkan keandalan sinyal.

- Klasifikasi Lingkungan Pasar: Tambahkan modul pengenalan lingkungan pasar untuk menggunakan set parameter yang berbeda dalam kondisi pasar yang berbeda.

Ringkasan

Strategi ini membangun sistem perdagangan yang relatif lengkap melalui kombinasi beberapa indikator teknis. Kekuatannya terletak pada keandalan konfirmasi sinyal dan manajemen risiko yang komprehensif, meskipun dampak lingkungan pasar pada kinerja strategi perlu diperhatikan. Melalui arah optimasi yang disarankan, ada ruang yang signifikan untuk perbaikan.

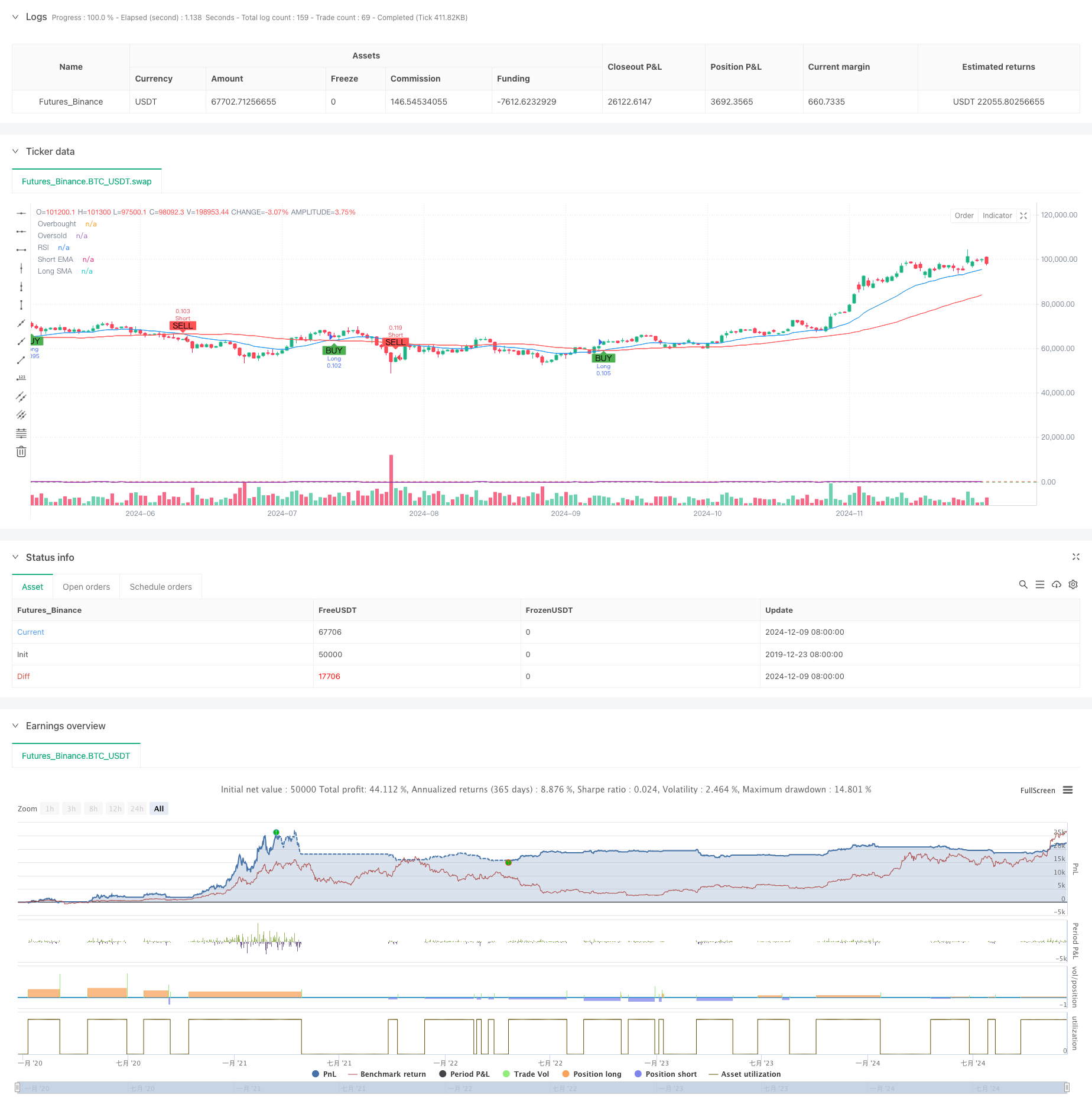

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © CryptoRonin84

//@version=5

strategy("Swing Trading Strategy with On/Off Long and Short", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input for turning Long and Short trades ON/OFF

enable_long = input.bool(true, title="Enable Long Trades")

enable_short = input.bool(true, title="Enable Short Trades")

// Input parameters for strategy

sma_short_length = input.int(20, title="Short EMA Length", minval=1)

sma_long_length = input.int(50, title="Long SMA Length", minval=1)

sl_percentage = input.float(1.5, title="Stop Loss (%)", step=0.1, minval=0.1)

tp_percentage = input.float(3, title="Take Profit (%)", step=0.1, minval=0.1)

risk_per_trade = input.float(1, title="Risk Per Trade (%)", step=0.1, minval=0.1)

capital = input.float(10000, title="Initial Capital", step=100)

// Input for date range for backtesting

start_date = input(timestamp("2020-01-01 00:00"), title="Backtest Start Date")

end_date = input(timestamp("2024-12-31 23:59"), title="Backtest End Date")

inDateRange = true

// Moving averages

sma_short = ta.ema(close, sma_short_length)

sma_long = ta.sma(close, sma_long_length)

// RSI setup

rsi = ta.rsi(close, 14)

rsi_overbought = 70

rsi_oversold = 30

// ATR for volatility-based stop-loss calculation

atr = ta.atr(14)

stop_loss_level_long = strategy.position_avg_price - (1.5 * atr)

stop_loss_level_short = strategy.position_avg_price + (1.5 * atr)

take_profit_level_long = strategy.position_avg_price + (3 * atr)

take_profit_level_short = strategy.position_avg_price - (3 * atr)

// Position sizing based on risk per trade

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / (close * sl_percentage / 100)

// Long and Short conditions

long_condition = ta.crossover(sma_short, sma_long) and rsi < rsi_overbought

short_condition = ta.crossunder(sma_short, sma_long) and rsi > rsi_oversold

// Execute long trades

if (long_condition and inDateRange and enable_long)

strategy.entry("Long", strategy.long, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Long", stop=stop_loss_level_long, limit=take_profit_level_long)

// Execute short trades

if (short_condition and inDateRange and enable_short)

strategy.entry("Short", strategy.short, qty=position_size)

strategy.exit("Take Profit/Stop Loss", "Short", stop=stop_loss_level_short, limit=take_profit_level_short)

// Plot moving averages

plot(sma_short, title="Short EMA", color=color.blue)

plot(sma_long, title="Long SMA", color=color.red)

// Plot RSI on separate chart

hline(rsi_overbought, "Overbought", color=color.red)

hline(rsi_oversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.purple)

// Plot signals on chart

plotshape(series=long_condition and enable_long, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=short_condition and enable_short, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Background color for backtest range

bgcolor(inDateRange ? na : color.red, transp=90)

- Strategi DCA dinamis berbasis volume

- Strategi Perdagangan Dinamis Multi-Indikator

- Strategi kuantitatif rebound over-sold RSI stop-loss ATR dinamis

- Adaptive Moving Average Crossover dengan Trailing Stop-Loss Strategy

- Multi-Periode EMA Crossover dengan RSI Momentum dan ATR Volatility Based Trend Mengikuti Strategi

- Tren Tingkat Menang Tinggi Artinya Strategi Perdagangan Reversi

- Strategi Optimisasi Dinamis Frekuensi Tinggi Berbasis Indikator Multi-Teknis

- Tren Multi-Timeframe Mengikuti Sistem Trading dengan Integrasi ATR dan MACD

- Strategi pembalikan rata-rata yang ditingkatkan dengan pelaksanaan MACD-ATR

- Strategi Optimisasi Keuntungan Dinamis EMA Crossover Multi-Level Multi-Periode

- Sistem perdagangan multi moving average dengan momentum dan konfirmasi volume Strategi tren kuantitatif

- Adaptive Trailing Drawdown Balanced Trading Strategy dengan Take Profit dan Stop Loss

- Sistem Pengamatan Tren yang Ditingkatkan: Identifikasi Tren Dinamis Berdasarkan ADX dan SAR Parabolik

- Strategi Trading Momentum Stochastic Dual Timeframe

- Adaptive Bollinger Bands Strategi Manajemen Posisi Dinamis

- RSI Dinamis Smart Timing Swing Trading Strategi

- Strategi perdagangan dua arah berdasarkan analisis pola penyerapan candlestick

- Bollinger Breakout dengan Reversi Rata-rata 4H Strategi Perdagangan Kuantitatif

- Tren Mengikuti Strategi Pengukuran Posisi Garis Dinamis

- Dual BBI (Bulls and Bears Index) Strategi Crossover

- Trend Indikator Multi-Teknis Mengikuti Strategi Perdagangan

- Strategi Trading Revolusi Volatilitas Mean Advanced: Sistem Trading Kuantitatif Multidimensional Berdasarkan VIX dan Moving Average

- Strategi Momentum Pembalikan Saluran Tren Emas

- Strategi Perdagangan Tren Momentum EMA Lanjutan

- Strategi Trading Intensitas Tren Multi-MA - Sistem Trading Pintar Fleksibel Berdasarkan Penyimpangan MA

- Sistem Deteksi Tren Dual Volume-Weighted

- Strategi perdagangan kontra-tren multi-faktor

- Strategi Perdagangan Kuantitatif Osilator Momentum dan Divergensi Stochastic yang Ditingkatkan

- Retracement Fibonacci Multi-Timeframe dengan Strategi Trading Trend Breakout

- Tren Multi-Indikator Mengikuti Strategi dengan Optimasi Keuntungan