RSI トレンド戦略

作者: リン・ハーンチャオチャン,日付: 2024-06-14 15:28:38タグ:RSISMAエイマ

概要

この戦略は,相対強度指数 (RSI) 指標に基づいています.この戦略は,RSI値が事前に設定された上位および下位

戦略原則

- RSIの値を計算する.

- RSI値が既定の買い値を下回ると,買い信号を生成し,RSI値が既定の売り値を超えると,売り信号を生成する.

- 購入信号に基づいて,現在の閉店価格で購入量を計算し,購入注文をします.

- ストップ・ロスの割合が設定されている場合,ストップ・ロスの価格を計算し,ストップ・ロスの注文をします.

- 売り信号やストップ・ロスの条件に基づいてすべてのポジションを閉じる.

- ポジションの最長期間が設定されている場合,利益または損失に関係なく,ポジションの最長期間が最大期間を超えるとすべてのポジションを閉じる.

戦略 の 利点

- RSIインジケーターは,市場における過剰購入と過剰売却の信号を効果的に把握できる,広く使用される技術分析インジケーターです.

- ストップ・ロストとポジション期間制限を組み込み,リスクをコントロールする.

- 戦略の論理は明確で 分かりやすく 実行できます

- RSIのパラメータと

値を調整することで,戦略は異なる市場環境に適応できます.

戦略リスク

- RSIインジケーターが誤った信号を生成し,戦略の損失につながる場合もあります.

- この戦略は,取引手段の基本的要因を考慮せず,技術指標のみを基にしており,予期せぬ市場動向によるリスクに直面する可能性があります.

- 固定ストップ・ロスの割合は,市場の変動に適応しない可能性があります.

- 戦略のパフォーマンスにはパラメータ設定が影響し,適切なパラメーターが戦略のパフォーマンスが低下する可能性があります.

戦略の最適化方向

- 戦略の信頼性を高めるため,移動平均などの他の技術指標を導入する.

- ストップ・ロスの戦略を最適化します.例えば,波動性に基づくトラッキング・ストップ・ロスやダイナミック・ストップ・ロスを使用します.

- RSIのパラメータと

値を市場の状況に応じて動的に調整する. - 戦略のリスク管理能力を向上させるために,取引手段の基本面の分析を組み合わせる.

- バックテストとパラメータ最適化を実行し,最適なパラメータの組み合わせを見つけます.

概要

この戦略は,市場における過剰購入および過剰売却のシグナルを捕捉するために,RSI指標を利用し,リスク管理のためにストップ・ロストとポジション期間制限を導入する.戦略論理はシンプルで直接的で,実装し最適化することは簡単です.しかし,戦略のパフォーマンスには市場の変動とパラメータ設定の影響があります.したがって,戦略の安定性と収益性を向上させるために,他の分析方法とリスク管理措置を組み合わせることが必要です.

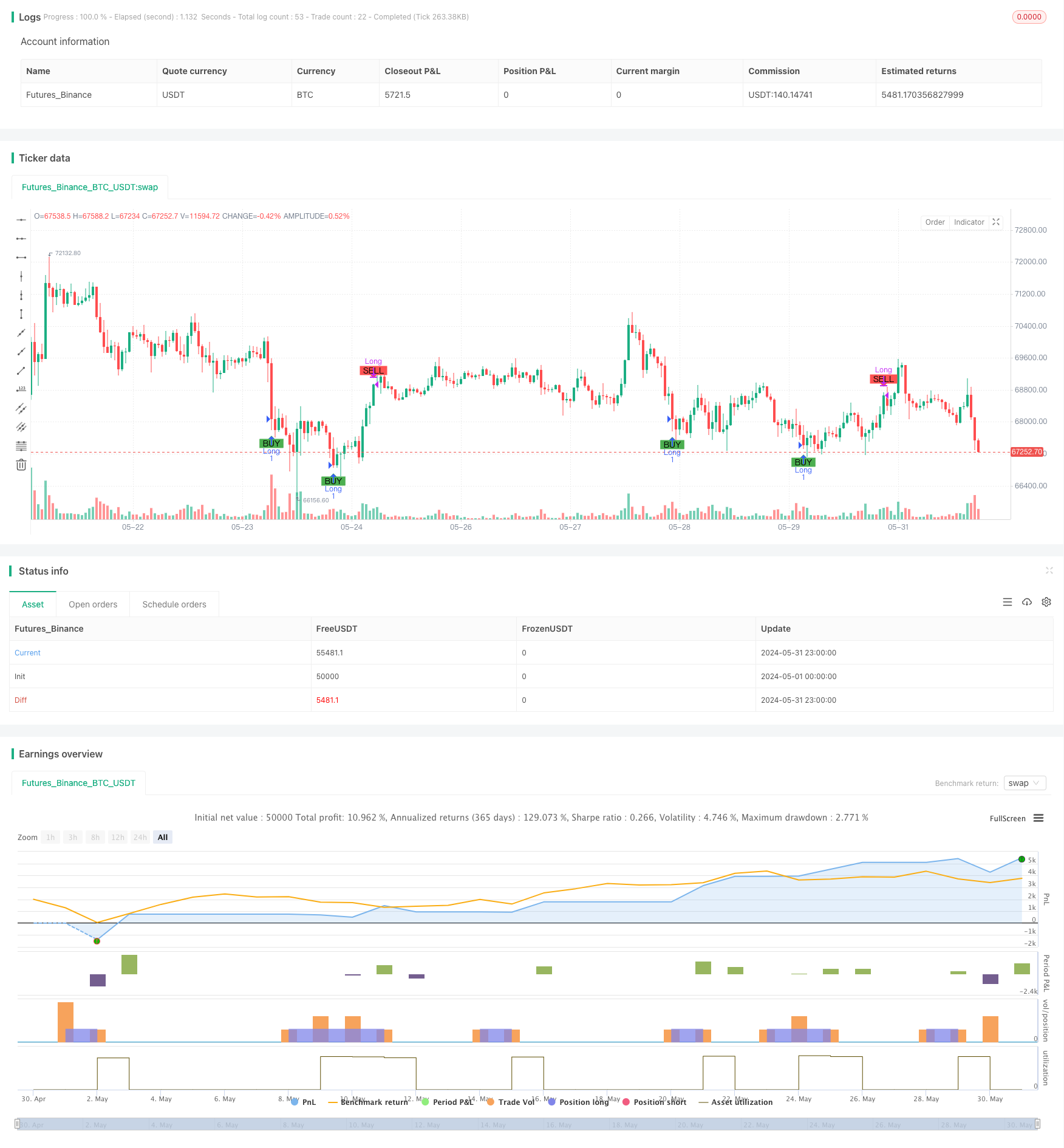

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple RSI Strategy", overlay=true, initial_capital=20, commission_value=0.1, commission_type=strategy.commission.percent)

// Define the hardcoded date (Year, Month, Day, Hour, Minute)

var hardcodedYear = 2024

var hardcodedMonth = 6

var hardcodedDay = 10

// Convert the hardcoded date to a timestamp

var start_date = timestamp(hardcodedYear, hardcodedMonth, hardcodedDay)

// settings

order_size_usdt = input.float(20, title="Order Size (USDT)")

rsiLength = input.int(9, title="RSI Length")

rsiBuyThreshold = input.int(30, title="RSI Buy Threshold")

rsiSellThreshold = input.int(70, title="RSI Sell Threshold")

rsibuystrat = input.int(1, title="buy strat 1=achieved,2=recross")

rsisellstrat = input.int(1, title="sell strat 1=achieved,2=recross")

stoploss = input.int(1, title="Stop loss percent")

max_duration = input(24, title="Max Position Duration (hours)")*60

// emaPeriod = input.int(50, title="EMA Period")

// smaPeriod = input.int(200, title="SMA Period")

rsi = ta.rsi(close, rsiLength)

// ma_rsi = ta.sma(rsi, rsiLength)

// ema = ta.ema(close,emaPeriod)

// sma = ta.sma(close,smaPeriod)

// plot(sma, color=color.red, title="exp Moving Average")

// plot(smal, color=color.blue, title="Simple Moving Average")

longCondition = ((ta.crossunder(rsi, rsiBuyThreshold) and rsibuystrat==1) or (ta.crossover(rsi, rsiBuyThreshold) and rsibuystrat==2) ) and strategy.position_size == 0

shortCondition = ( (ta.crossover(rsi, rsiSellThreshold) and rsisellstrat==1) or (ta.crossunder(rsi, rsiSellThreshold) and rsisellstrat==2) ) and strategy.position_size > 0

// Execute Buy and Sell orders

if (longCondition)

positionSize = order_size_usdt / close

strategy.entry("Long", strategy.long,qty=positionSize)

if (stoploss>0)

stopLossPrice = close * (1 - stoploss/100 )

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossPrice)

if (shortCondition )//or stopCondition)

strategy.close("Long")

//add condition open time

if (strategy.position_size > 0 and max_duration >0)

var float entry_time = na

if (strategy.opentrades > 0)

entry_time := nz(strategy.opentrades.entry_time(0), na)

else

entry_time := na

current_time = time

var float duration_minutes = -1

if (not na(entry_time))

duration_minutes := (current_time - entry_time) / 60000

// Close positions after a certain duration (e.g., 60 minutes)

// if ( duration_minutes > max_duration and close>=strategy.opentrades.entry_price(0))

if ( duration_minutes > max_duration )

label.new(bar_index, high, text="Duration: " + str.tostring(duration_minutes/60) + " hrs", color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.small)

strategy.close("Long")

// Plot Buy and Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

//plotshape(series=stopCondition, title="stop Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot RSI

// hline(rsiBuyThreshold, "RSI Buy Threshold", color=color.green)

// hline(rsiSellThreshold, "RSI Sell Threshold", color=color.red)

関連性

- QQEMOD + SSLハイブリッド + ワダアター爆発

- RSI 双面取引戦略

- スウィング・トレード・シグナル

- 44 SMAと9 EMAのクロスオーバー戦略 RSIフィルターとTP/SL

- 二重動的指標の最適化戦略

- マルチテクニカルインジケーター トレンド イチモク・クラウド・ブレイクとストップ・ロスのシステムによる戦略

- 複数の指標による変動取引のRSI-EMA-ATR戦略

- ATR波動性戦略を用いた多指標動的適応位置サイズ化

- 多指標トレンド・モメント・クロスオーバー量的な戦略

- 多指標量的な取引戦略 - スーパー指標7対1戦略

もっと

- EMA100とNUPL 相対的未実現利益量的な取引戦略

- ストカスティックオシレーターに基づく波動範囲取引戦略

- シンプルな組み合わせ戦略:ピボットポイント スーパートレンドとDEMA

- EMAのトレンドフィルター戦略

- 移動平均のクロスオーバー戦略

- 3分間のキャンドル・ハイ・ロー・ポイントに基づいた日中のブレイクアウト戦略

- 移動平均値,サポート/レジスタンス,およびボリュームに基づいたアドバンストエントリー戦略

- EMA RSI MACD ダイナミック・テイク・プロフィート・ストップ・ロスト・トレード・戦略

- G-Trend EMA ATR インテリジェント・トレーディング・ストラテジー

- トレンドフォロー戦略 200日移動平均値とストカスティックオシレーターに基づく

- EMAのクロスオーバー・モメンタム・スカルピング戦略

- BBの脱出戦略

- VWAP と RSI ダイナミック・ボリンガー・バンドは,利益とストップ・ロスの戦略をとる

- チェンデ・クロール ストップ ダイナミックATRトレンド 戦略をフォローする

- この戦略はチャイキンマネーフロー (CMF) をベースに取引信号を生成します

- トレンドフィルタピンのバー逆転戦略

- サポート・レジスタンスレベルでの逆転パターンに基づく定量的な取引戦略

- MA,SMA,MA傾斜,ストップ損失を後押しし,再入力

- クロスオーバー TSI戦略

- EMAの二重移動平均のクロスオーバー戦略