多期EMAトレンド・モメンタム・トレード戦略

作者: リン・ハーンチャオチャン開催日:2024年11月12日 16時35分41秒タグ:エイマATRKCSMALR

概要

この戦略は,多期間のEMAトレンドをモメンタム分析と組み合わせる定量的な取引戦略である.この戦略は主に,日・週間のタイムフレームの両方でモメンタム指標と組み合わせた20,50,100,200日指数関数移動平均 (EMA) の調整を分析する.ATRベースのストップロスを採用し,EMAが調整されモメンタム条件が満たされたときに取引を開始し,ATR多期ストップロスと利益目標を介してリスクを管理する.

戦略の原則

基本的な論理にはいくつかの重要な要素が含まれます.

- EMA アライナメントシステム: 50 日間の EMA を上回る 20 日間の EMA を必要とし,これは 100 日間の EMA を上回る 200 日間の EMA を上回る,完璧な上昇のアライナメントを形成する.

- モメント確認システム: 日時と週間の時間枠の両方で線形回帰に基づいてカスタムモメント指標を計算する.このモメントは,ケルトナーチャネルの中間線からの価格偏差の線形回帰によって測定される.

- Pullback Entry System: 価格が20日間の EMAの指定された割合範囲内で引き下げられ,チェイス・カプニングを避ける.

- リスクマネジメントシステム:停止損失と利益目標の設定のためにATR倍数を使用し,停止損失のためのATRの1.5倍と利益目標のためのATRの3倍にデフォルトします.

戦略 の 利点

- 多重確認メカニズム: EMA アライナメント,マルチタイムフレームモメンタム,価格プルバックを含む複数の条件を通じて偽信号を減少させる.

- 科学的リスク管理:市場変動の変化に適応し,ストップ損失と利益目標を動的に調整するためにATRを使用する.

- トレンドフォローとモメント: トレンド内のエントリータイミングを最適化しながら主要なトレンドを把握します.

- 高度なカスタマイズ可能性:すべての戦略パラメータは,異なる市場特性に最適化できます.

- 複数のタイムフレーム分析: 日々の時間枠と週間の時間枠の調整によって信号の信頼性を向上させる.

戦略リスク

- EMA 遅延: EMA は遅延する指標として,遅延したエントリを引き起こす可能性があります.主要指標を組み込むことを検討してください.

- レンジング市場での不良パフォーマンス: 戦略は横向市場で頻繁に誤った信号を生む可能性があります. 市場環境フィルターを追加することを検討してください.

- 引き上げリスク: ATR の停止にもかかわらず,極端な条件では大きな引き上げが可能です. 最大引き上げ制限の実施を検討してください.

- パラメータ感度: 戦略のパフォーマンスはパラメータ設定に敏感である. 徹底的なパラメータ最適化テストが推奨される.

オプティマイゼーションの方向性

- 市場環境の認識: 異なる市場条件で異なるパラメータセットを使用するために波動性または傾向強さの指標を追加する.

- 入口最適化: 引き下げゾーン内のより正確な入口ポイントのために,RSIのような振動子を追加します.

- ダイナミックパラメータ調整: 市場の変動に基づいて,ATR倍数と引き下げ範囲を自動的に調整します.

- 音量分析統合: 音量分析を通じてトレンド強さを確認し,信号の信頼性を向上させる.

- 機械学習の実施: 機械学習アルゴリズムを使用して,パラメータを動的に最適化し,戦略の適応性を向上させる.

概要

これは,よく設計された,論理的に厳格なトレンドフォロー戦略である.複数の技術指標の組み合わせを通じて,戦略の堅牢性と効果的なリスク管理の両方を保証する. 戦略の高いカスタマイズ可能性は,異なる市場特性に最適化することを可能にします. 固有のリスクが存在する一方で,提案された最適化方向は戦略のパフォーマンスをさらに向上させることができます. 全体的に,これは実験し,深く研究する価値のある定量的な取引戦略です.

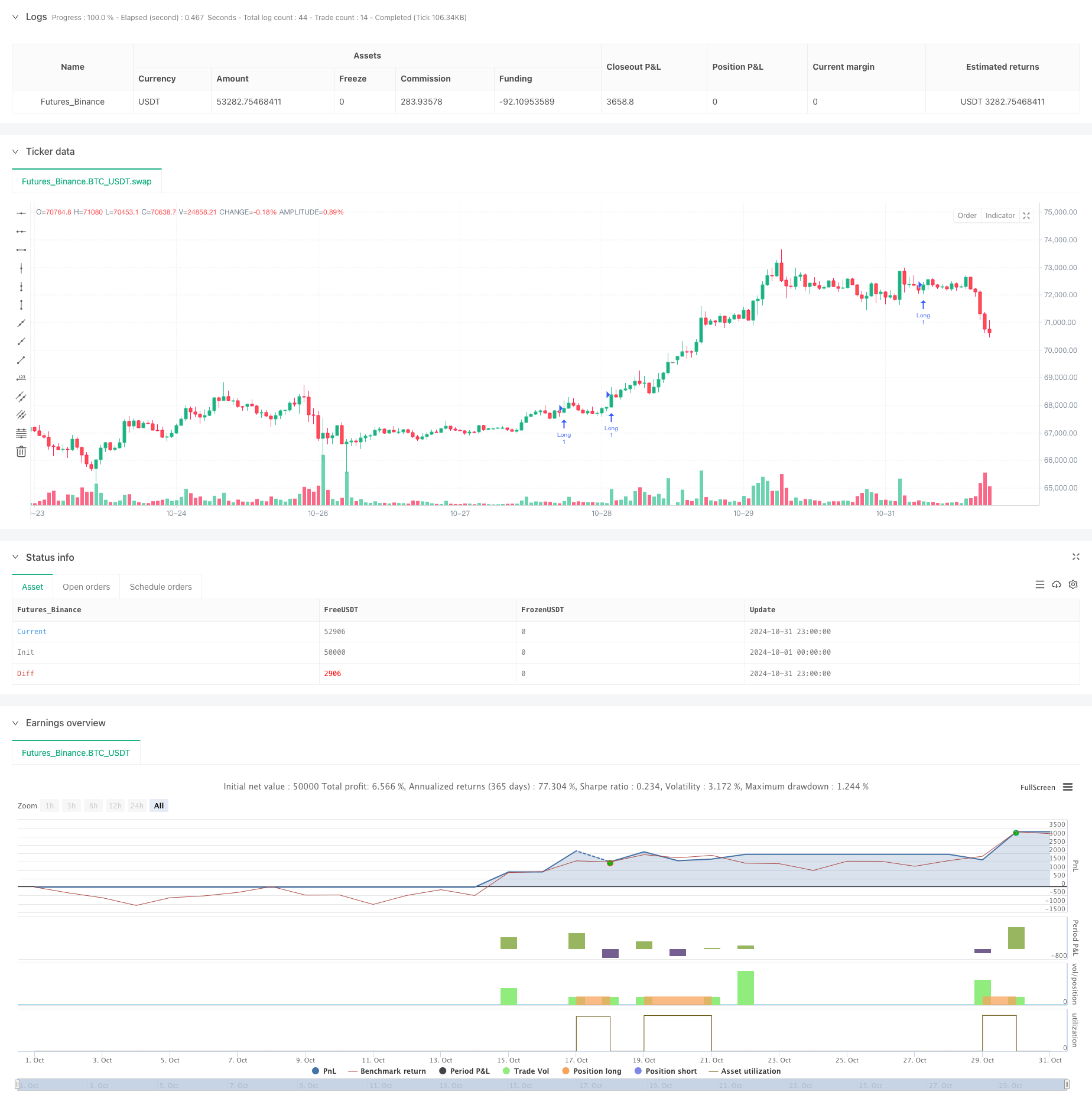

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading with EMA Alignment and Custom Momentum", overlay=true)

// User inputs for customization

atrLength = input.int(14, title="ATR Length", minval=1)

atrMultiplierSL = input.float(1.5, title="Stop-Loss Multiplier (ATR)", minval=0.1) // Stop-loss at 1.5x ATR

atrMultiplierTP = input.float(3.0, title="Take-Profit Multiplier (ATR)", minval=0.1) // Take-profit at 3x ATR

pullbackRangePercent = input.float(1.0, title="Pullback Range (%)", minval=0.1) // 1% range for pullback around 20 EMA

lengthKC = input.int(20, title="Length for Keltner Channels (Momentum Calculation)", minval=1)

// EMA settings

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// ATR calculation

atrValue = ta.atr(atrLength)

// Custom Momentum Calculation based on Linear Regression for Daily Timeframe

highestHighKC = ta.highest(high, lengthKC)

lowestLowKC = ta.lowest(low, lengthKC)

smaCloseKC = ta.sma(close, lengthKC)

// Manually calculate the average of highest high and lowest low

averageKC = (highestHighKC + lowestLowKC) / 2

// Calculate daily momentum using linear regression

dailyMomentum = ta.linreg(close - (averageKC + smaCloseKC) / 2, lengthKC, 0) // Custom daily momentum calculation

// Fetch weekly data for momentum calculation using request.security()

[weeklyHigh, weeklyLow, weeklyClose] = request.security(syminfo.tickerid, "W", [high, low, close])

// Calculate weekly momentum using linear regression on weekly timeframe

weeklyHighestHighKC = ta.highest(weeklyHigh, lengthKC)

weeklyLowestLowKC = ta.lowest(weeklyLow, lengthKC)

weeklySmaCloseKC = ta.sma(weeklyClose, lengthKC)

weeklyAverageKC = (weeklyHighestHighKC + weeklyLowestLowKC) / 2

weeklyMomentum = ta.linreg(weeklyClose - (weeklyAverageKC + weeklySmaCloseKC) / 2, lengthKC, 0) // Custom weekly momentum calculation

// EMA alignment condition (20 EMA > 50 EMA > 100 EMA > 200 EMA)

emaAligned = ema20 > ema50 and ema50 > ema100 and ema100 > ema200

// Momentum increasing condition (daily and weekly momentum is positive and increasing)

dailyMomentumIncreasing = dailyMomentum > 0 and dailyMomentum > dailyMomentum[1] //and dailyMomentum[1] > dailyMomentum[2]

weeklyMomentumIncreasing = weeklyMomentum > 0 and weeklyMomentum > weeklyMomentum[1] //and weeklyMomentum[1] > weeklyMomentum[2]

// Redefine Pullback condition: price within 1% range of the 20 EMA

upperPullbackRange = ema20 * (1 + pullbackRangePercent / 100)

lowerPullbackRange = ema20 * (1 - pullbackRangePercent / 100)

pullbackToEma20 = (close <= upperPullbackRange) and (close >= lowerPullbackRange)

// Entry condition: EMA alignment and momentum increasing on both daily and weekly timeframes

longCondition = emaAligned and dailyMomentumIncreasing and weeklyMomentumIncreasing and pullbackToEma20

// Initialize stop loss and take profit levels as float variables

var float longStopLevel = na

var float longTakeProfitLevel = na

// Calculate stop loss and take profit levels based on ATR

if (longCondition)

longStopLevel := close - (atrMultiplierSL * atrValue) // Stop loss at 1.5x ATR below the entry price

longTakeProfitLevel := close + (atrMultiplierTP * atrValue) // Take profit at 3x ATR above the entry price

// Strategy execution

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions: Stop-loss at 1.5x ATR and take-profit at 3x ATR

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Long", stop=longStopLevel, limit=longTakeProfitLevel)

関連性

- ブラック・スワン・ボラティリティと移動平均のクロスオーバー・モメント・トラッキング戦略

- ML 警告 テンプレート

- ダイナミック・マルチディメンショナル・アナリティスによる高度なマルチタイムフレーム・イチモク・クラウド・トレーディング・戦略

- ダイナミック・ケルトナー・チャネル・モメンタム・リバース・戦略

- EMA,SMA,CCI,ATR,トレンドマジックインジケーター自動取引システムを持つ完璧な順序移動平均戦略

- ATR波動性戦略を用いた多指標動的適応位置サイズ化

- SSL ハイブリッド

- 多指標トレンド・モメント・クロスオーバー量的な戦略

- MACD-ATR-EMA マルチインジケーター 戦略をフォローする動的トレンド

- ビラ・ダイナミック・ピボット・スーパートレンド戦略

もっと

- 大波動性ブレイク 双方向取引戦略:ポイントベースの

値エントリーシステム - 強化されたボリンガー平均逆転量的な戦略

- 動向平均トレンド確認取引システムを持つダイナミック・ダーバス・ボックス・ブレイクアウト

- ダイナミック・テイク・プロフィット・ストップ・ロスト EMAクロスオーバー量的な取引戦略

- 多EMAクロスオーバートレンド ダイナミックストップ・ロストとテイク・プロフィートの最適化による戦略

- ダイナミックなリスクマネジメントを伴う二重移動平均のクロスオーバー戦略

- ダイナミック・リスク管理戦略による二重移動平均の交差

- マルチMA トレンド強さをモメンタム・プロフィート・テイキング戦略で把握する

- 多戦略適応トレンドフォローとブレイクトレードシステム

- マルチレベル移動平均値とキャンドルスティックパターン認識取引システム

- 賢明な時間に基づく長短回転バランスのとれた取引戦略

- 先進的なMACD動的トレンド量的な取引戦略

- トレンド・ブレイク・トレーディング・システム (TBMA戦略)

- ATRベースの多トレンドフォロー戦略,利益とストップ損失最適化システム

- RSI モメントベースのスマートアダプティブ・トレーディング・システム

- アダプティブ RSI オシレーター

値最適化によるダイナミック・トレーディング・戦略 - RSIとAOの相乗効果傾向 定量的な取引戦略

- アダプティブ・トレンド・モメンタム・RSI戦略 移動平均フィルターシステム

- リスク・リターン最適化システムを持つ二重移動平均のクロスRSIモメント戦略

- 多指標クロスオーバー・ダイナミック・戦略システム: EMA,RVI,取引信号に基づく定量的な取引モデル