リスクと報酬のターゲット戦略を備えた高度なダイナミックトレーリングストップ

作者: リン・ハーンチャオチャン,日付: 2024年12月11日 14:57:09タグ:RSIATRSMA

概要

この戦略は,ダイナミック・トライリング・ストップ,リスク・リターン比率,およびRSIの極端な出口を組み合わせた高度な取引システムである.これは,ダイナミック・ストップ・ロスの配置のためにATRと最近の低値を使用しながら,取引入口のための特定のパターン (並行バーパターンとピンバーパターン) を特定し,事前に設定されたリスク・リターン比率に基づいて利益目標を決定する.このシステムは,RSIベースの市場オーバー買い/オーバー売り出口メカニズムも組み込む.

戦略の原則

基本的な論理にはいくつかの重要な要素が含まれます. 1. 2つのパターンに基づくエントリー信号:平行バーパターン (大きな下落バーの後に大きな上昇バー) とダブルピンバーパターン. 2. 最近のNバー低値に調整されたATR倍数を使用して動的トレーリングストップ,ストップ損失レベルが市場の変動に適応することを保証する. 3. 固定リスク・リターン比に基づいて設定された利益目標,各取引のリスク値 ® を用いて計算される. 4. 固定リスク額と取引別リスク価値に基づいて動的に計算されるポジションサイズ化 5. RSI エクストリーム アクシート メカニズムは,市場の極値でポジション閉鎖を誘発する.

戦略 の 利点

- ダイナミックリスク管理:ストップ・ロスのレベルは,ATRと最近の低値の組み合わせによって市場の変動に動的に調整されます.

- 正確なポジション制御: 固定リスク額に基づくポジションサイズ化により,取引ごとに一貫したリスクが確保されます.

- 多次元出口メカニズム: 遅延停止,固定利益目標,およびRSIの極端を組み合わせます.

- フレキシブルな取引方向性: 長期のみ,短期のみ,または双方向取引のオプション.

- 明確なリスク・リターン設定:事前に決定されたリスク・リターン比は,各取引の明確な利益目標を定義します.

戦略リスク

- パターン認識精度リスク: 並列棒やピンバーの誤った識別の可能性

- ストップ・ロスの滑り込みリスク: 変動する市場では大きな滑り込みが発生する可能性があります.

- RSIの早期離脱: 強いトレンド市場の早期離脱につながる可能性があります.

- 固定リスク/報酬比制限:最適なリスク/報酬比は,市場状況によって異なる可能性があります.

- パラメータ最適化 過適性リスク:複数のパラメータの組み合わせが過適化につながる可能性があります.

戦略の最適化方向

- 入力シグナル強化: 容量やトレンド指標などのパターンの確認指標を追加します

- ダイナミック・リスク・リターン比: 市場の変動に基づいてリスク・リターン比を調整する.

- インテリジェントパラメータアダプテーション: ダイナミックパラメータ最適化のための機械学習アルゴリズムを導入する.

- 複数のタイムフレームの確認:複数のタイムフレームに信号の確認メカニズムを追加する.

- 市場環境の分類: 異なる市場条件に異なるパラメータセットを適用する.

概要

これは,完全な取引システムを構築するために,複数の成熟した技術分析コンセプトを組み合わせた,よく設計された取引戦略です.この戦略の強みは,包括的なリスク管理システムと柔軟な取引ルールにあります.一方で,パラメータ最適化と市場適応性に注意を払う必要があります.提案された最適化方向性を通じて,戦略のさらなる改善に余地があります.

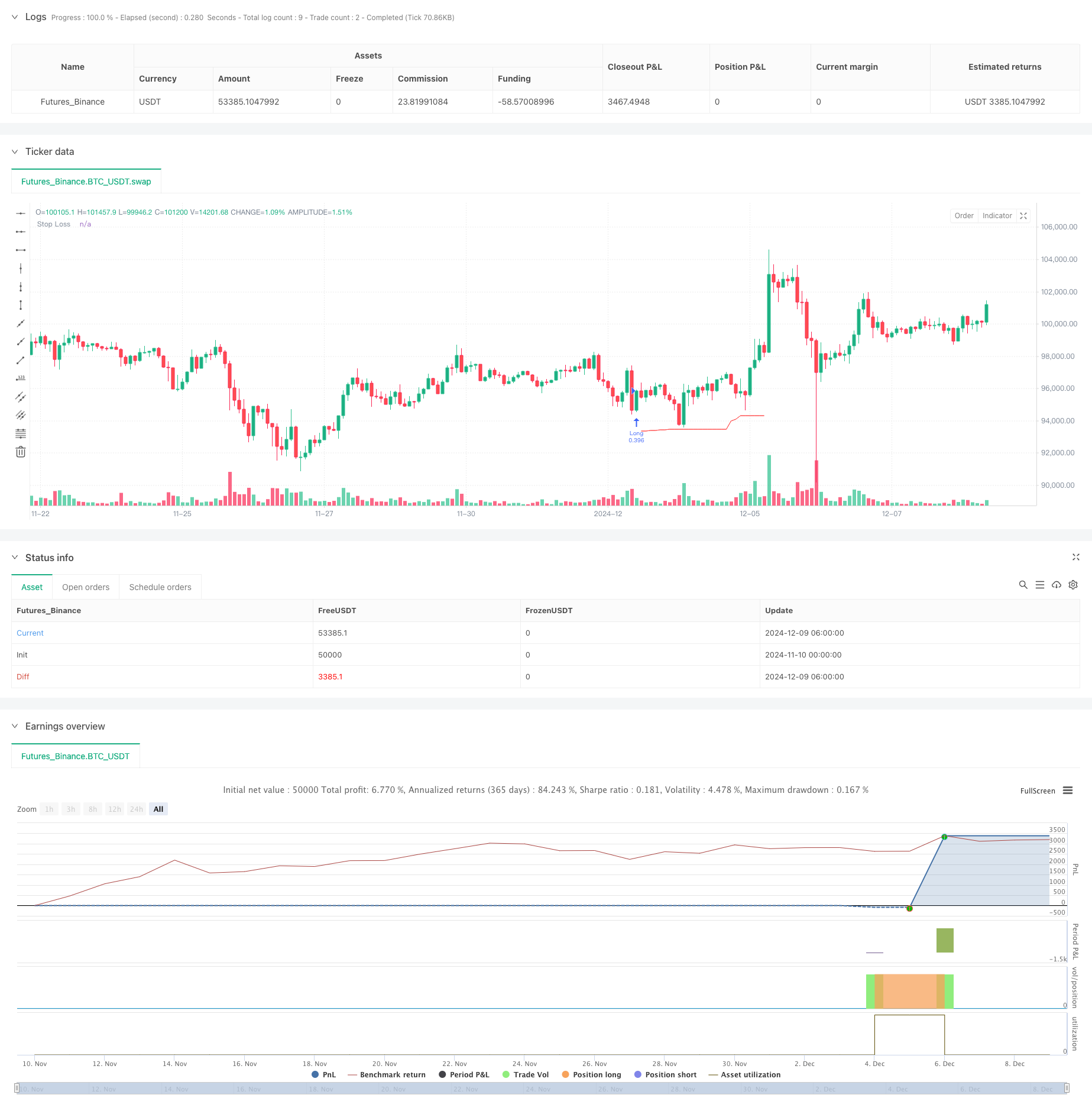

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)

関連性

- RSI 平均逆転ブレイクストラテジー

- Zスコアとスーパートレンドベースのダイナミック・トレーディング戦略: ロング・ショート・スイッチングシステム

- RSI ダイナミックストップ・ロスのインテリジェント・トレーディング戦略

- トレーリングストップ損失戦略の移動平均クロスオーバー

- 短期的定量的な取引戦略 双動平均クロスオーバー,RSI,ストカスティック指標に基づく

- 機械学習によるリスク管理強化の戦略をフォローするダイナミックな傾向

- 複数の指標を備えた インテリジェントピラミッド戦略

- 高精度なRSIとボリンジャーバンドのブレイクアウト戦略

- リスク・リターン最適化システムを持つ二重移動平均のクロスRSIモメント戦略

- ATR波動性戦略を用いた多指標動的適応位置サイズ化

もっと

- MACDと線形回帰の二重信号インテリジェント取引戦略

- 取引戦略をフォローするマルチEMA傾向

- 多期調整されたハイキン・アシ・トレンド 定量取引システム

- 動的RSIオシレーター 多項式フィッティング指標 トレンド 定量取引戦略

- 日々の範囲のブレイク・シングルダイレクト・トレーディング・戦略

- SMA-RSI-MACD マルチインジケータ ダイナミック・リミット・オーダー・トレーディング・戦略

- EMA/SMA トレンドフォロー スウィング・トレーディング戦略 総量フィルターとパーセントのテイク・プロフィート/ストップ・ロース・システム

- VWAP 標準偏差 平均逆転取引戦略

- サポートとレジスタンスの量的なシステムに基づいたダイナミック価格ゾーンブレークアウト取引戦略

- 多指標トレンド・モメント・クロスオーバー量的な戦略

- 先進的な長期のみ動的トレンドラインブレイク戦略

- Bollinger Bands と ATR に基づく多レベルインテリジェント・ダイナミック・トレリングストップ戦略

- ダイナミック・デュアル・EMA・クロスオーバー・ストラテジー

- Bollinger Bands と RSI の組み合わせたダイナミック・トレーディング・戦略

- RSI-ATR モメント・ボラティリティ コンビネード・トレーディング・ストラテジー

- 2つのEMAトレンドフォロー戦略と制限購入エントリー

- 多戦略技術分析取引システム

- 複数のタイムフレームを組み合わせたキャンドルスティックパターン認識取引戦略

- トリプル・ボリンガー・バンドは,定量的な取引戦略を踏まえて,トレンドに触れる.

- Bollinger Bands と RSI に基づく多次元ダイナミック・ブレイクアウト・トレーディング・システム