ATR 변동성 전략과 함께 다중 지표 동적 적응 위치 사이징

저자:차오장, 날짜: 2024-11-12 11:41:30태그:ATREMARSISMA

전반적인 설명

이 전략은 다중 기술 지표를 동적 리스크 관리와 결합 한 양적 거래 시스템입니다. EMA 트렌드 다음, ATR 변동성, RSI 과잉 구매 / 과잉 판매 조건 및 촛불 패턴 인식을 통합하여 적응형 위치 사이즈 및 동적 스톱 로스 메커니즘을 통해 균형 잡힌 수익을 달성합니다.

전략 원칙

이 전략은 다음을 통해 거래를 실행합니다.

- 트렌드 방향에 대해 5주기 및 10주기 EMA 크로스오버를 사용하는 것

- 과잉 구매/ 과잉 판매 구역의 RSI 지표

- 동적 스톱 로스 및 포지션 사이즈링을 위한 ATR 표시기

- 출입 신호로서 촛불 패턴 (물망, 망치, 내리는 별)

- ATR 기반의 동적 미끄러짐 보상

- 신호 필터링 용량 확인

전략적 장점

- 복수 신호의 교차 검증으로 신뢰성이 향상됩니다.

- 역동적 리스크 관리 시장 변동성에 적응

- 부분적인 수익 전략은 이윤에 고정됩니다.

- 트래일링 스톱 로스는 축적된 이익을 보호합니다.

- 일일 손실 제한 위험 노출 통제

- 동적 미끄러짐 보상

전략 위험

- 여러 표시기가 신호 지연을 일으킬 수 있습니다.

- 빈번 한 거래 는 높은 비용 을 초래 할 수 있다

- 스톱 손실은 다양한 시장에서 자주 발생 할 수 있습니다.

- 촛불 패턴 인식의 주관적 요인

- 매개 변수 최적화 위험 과잉 조정

최적화 방향

- 동적 매개 변수 조정을 위한 시장주기 탐지 도입

- 잘못된 신호를 줄이기 위해 트렌드 강도 필터를 추가

- 더 나은 자본 효율성을 위해 위치 사이징 알고리즘을 최적화

- 추가 시장 감정 지표를 포함

- 적응적 매개 변수 최적화 시스템을 개발

요약

이것은 여러 기술적 지표를 결합한 정교한 전략 시스템으로, 동적 리스크 관리 및 여러 신호 검증을 통해 거래 안정성을 향상시킵니다. 핵심 강점은 적응력과 포괄적 인 리스크 제어 시스템, 그러나 라이브 거래에서 철저한 검증과 지속적인 최적화를 필요로합니다.

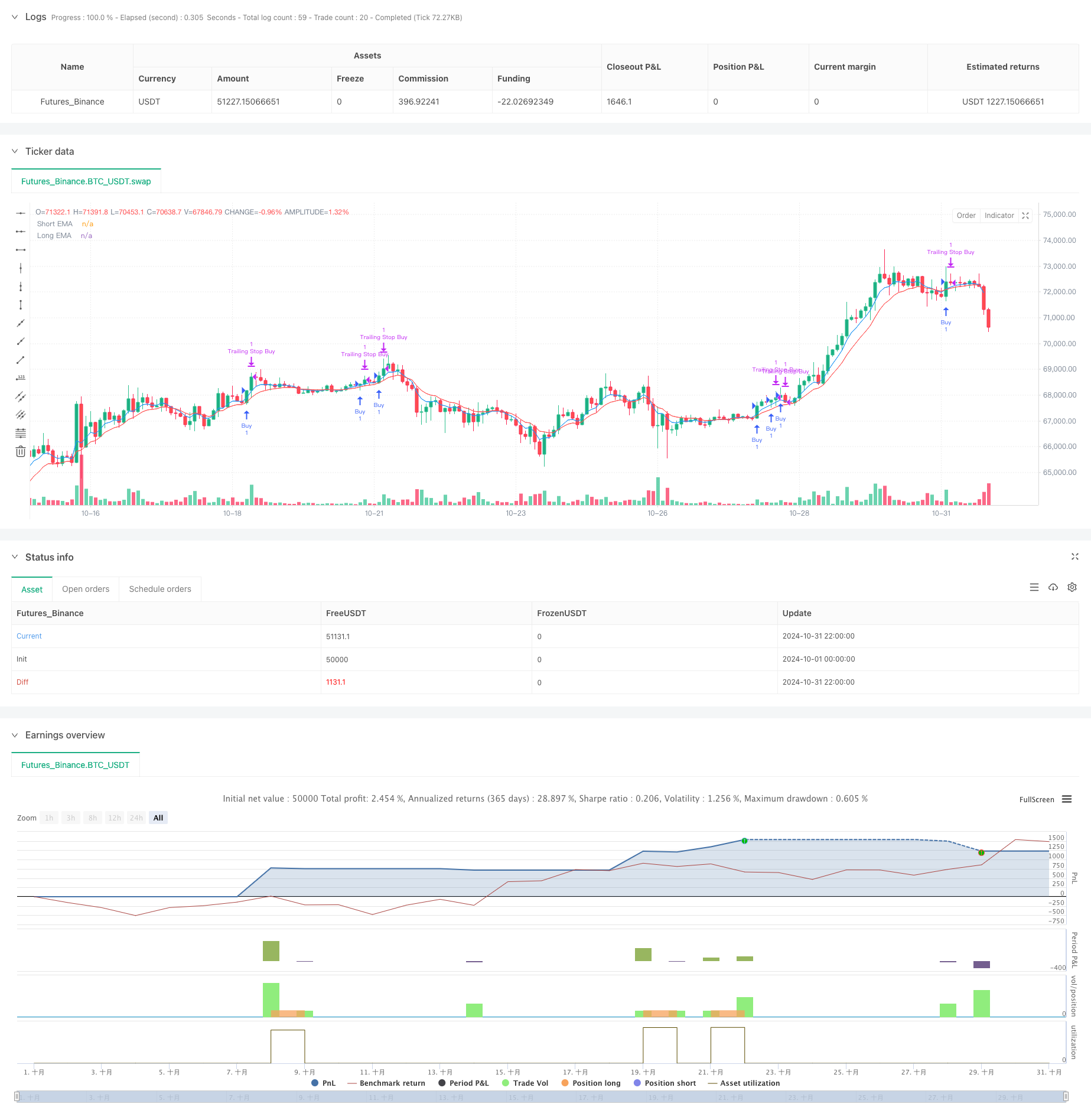

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Scalping with High Risk-Reward", overlay=true)

// Input for EMA periods

shortEMA_length = input(5, title="Short EMA Length")

longEMA_length = input(10, title="Long EMA Length")

// ATR for dynamic stop-loss

atrPeriod = input(14, title="ATR Period")

atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

// Calculate EMAs

shortEMA = ta.ema(close, shortEMA_length)

longEMA = ta.ema(close, longEMA_length)

// ATR calculation for dynamic stop loss

atr = ta.atr(atrPeriod)

// RSI for overbought/oversold conditions

rsi = ta.rsi(close, 14)

// Plot EMAs

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// Dynamic Slippage based on ATR

dynamic_slippage = math.max(5, atr * 0.5)

// Candlestick pattern recognition

bullish_engulfing = close[1] < open[1] and close > open and close > open[1] and close > close[1]

hammer = close > open and (high - close) / (high - low) > 0.6 and (open - low) / (high - low) < 0.2

bearish_engulfing = open[1] > close[1] and open > close and open > open[1] and close < close[1]

shooting_star = close < open and (high - open) / (high - low) > 0.6 and (close - low) / (high - low) < 0.2

// Enhanced conditions with volume and RSI check

buy_condition = (bullish_engulfing or hammer) and close > shortEMA and shortEMA > longEMA and volume > ta.sma(volume, 20) and rsi < 70

sell_condition = (bearish_engulfing or shooting_star) and close < shortEMA and shortEMA < longEMA and volume > ta.sma(volume, 20) and rsi > 30

// Dynamic ATR multiplier based on recent volatility

volatility = atr

adaptiveMultiplier = atrMultiplier + (volatility - ta.sma(volatility, 50)) / ta.sma(volatility, 50) * 0.5

// Execute buy trades with slippage consideration

if (buy_condition)

strategy.entry("Buy", strategy.long)

stop_loss_buy = strategy.position_avg_price - atr * adaptiveMultiplier - dynamic_slippage

take_profit_buy = strategy.position_avg_price + atr * adaptiveMultiplier * 3 + dynamic_slippage

strategy.exit("Exit Buy", "Buy", stop=stop_loss_buy, limit=take_profit_buy)

// Execute sell trades with slippage consideration

if (sell_condition)

strategy.entry("Sell", strategy.short)

stop_loss_sell = strategy.position_avg_price + atr * adaptiveMultiplier + dynamic_slippage

take_profit_sell = strategy.position_avg_price - atr * adaptiveMultiplier * 3 - dynamic_slippage

strategy.exit("Exit Sell", "Sell", stop=stop_loss_sell, limit=take_profit_sell)

// Risk Management

maxLossPerTrade = input.float(0.01, title="Max Loss Per Trade (%)", minval=0.01, maxval=1, step=0.01) // 1% max loss per trade

dailyLossLimit = input.float(0.03, title="Daily Loss Limit (%)", minval=0.01, maxval=1, step=0.01) // 3% daily loss limit

maxLossAmount_buy = strategy.position_avg_price * maxLossPerTrade

maxLossAmount_sell = strategy.position_avg_price * maxLossPerTrade

if (strategy.position_size > 0)

strategy.exit("Max Loss Buy", "Buy", stop=strategy.position_avg_price - maxLossAmount_buy - dynamic_slippage)

if (strategy.position_size < 0)

strategy.exit("Max Loss Sell", "Sell", stop=strategy.position_avg_price + maxLossAmount_sell + dynamic_slippage)

// Daily loss limit logic

var float dailyLoss = 0.0

if (dayofweek != dayofweek[1])

dailyLoss := 0.0 // Reset daily loss tracker at the start of a new day

if (strategy.closedtrades > 0)

dailyLoss := dailyLoss + strategy.closedtrades.profit(strategy.closedtrades - 1)

if (dailyLoss < -strategy.initial_capital * dailyLossLimit)

strategy.close_all("Daily Loss Limit Hit")

// Breakeven stop after a certain profit with a delay

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Buy", from_entry="Buy", stop=strategy.position_avg_price)

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Sell", from_entry="Sell", stop=strategy.position_avg_price)

// Partial Profit Taking

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5)

strategy.close("Partial Close Buy", qty_percent=50) // Use strategy.close for partial closure at market price

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5)

strategy.close("Partial Close Sell", qty_percent=50) // Use strategy.close for partial closure at market price

// Trailing Stop with ATR type

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Buy", from_entry="Buy", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Sell", from_entry="Sell", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

관련

- 다중 지표 트렌드 모멘텀 크로스오버 양적 전략

- 다중 시간 프레임 이동 평균 및 RSI 트렌드 거래 전략

- 고주파 동적 다중 지표 이동 평균 크로스오버 전략

- 다중 EMA 트렌드 동적 ATR 목표와 함께 전략에 따라

- 옵션 거래 제안 시스템과 함께 다 기간 기하급수적 이동 평균 크로스오버 전략

- 유동성 높은 통화 쌍을 위한 단기 단기 판매 전략

- 골든 모멘텀 캡처 전략: 멀티 타임프레임 기하급수적 이동 평균 크로스오버 시스템

- RSI 모멘텀 필터와 함께 전략에 따른 다기술 지표 트렌드

- 리스크 관리 시스템과 함께 멀티 EMA 트렌드 모멘텀 거래 전략

- 이동 평균 크로스오버 신호 시스템으로 동적 장기/단기 스윙 거래 전략

더 많은

- 시장 감정 및 저항 레벨 최적화 시스템과 결합된 모멘텀 SMA 크로스오버 전략

- 복합 전략에 따른 다기간의 RSI 모멘텀 및 트리플 EMA 트렌드

- 전략에 따른 다중 이동 평균 동력 추세

- E9 상어-32 패턴 양적 가격 유출 전략

- 오픈 마켓 노출 동적 위치 조정 양적 거래 전략

- 높은 승률 트렌드는 반전 거래 전략을 의미합니다.

- 이중 이동 평균 RSI 트렌드 모멘텀 전략

- 다중 지표 융합 평균 반전 추세 전략

- 다이내믹 ATR 기반 포지션 관리와 함께 오픈 이후의 브레이크오프 거래 전략

- 다중 지표 통합 및 지능형 리스크 제어 양적 거래 시스템

- RSI 동적 스톱 로스 지능형 거래 전략

- 이동 평균 필터 전략과 함께 세 번 검증된 RSI 평균 역전

- 보린거 밴드 및 RSI 통합을 이용한 적응적인 오스실레이션 트렌드 거래 전략

- ADX (평균 방향 지표) 및 부피 동적 트렌드 추적 전략

- 다량 동력 결합 거래 전략

- 피보나치 리트레이싱 및 확장 다중 지표 양적 거래 전략

- EMA 필터와 함께 시장을 넘나드는 오프나이트 포지션 전략

- 다기술 지표 기반의 평균 역전 및 트렌드 다음 전략

- 웹소켓 가속 드라이버

- 다중 스레드 자금을 얻는 상징