Gambaran keseluruhan

Strategi ini berdasarkan purata bergerak sederhana (SMA) pada skala masa yang berbeza untuk menangkap trend pasaran. Ia menghasilkan isyarat beli dan jual dengan membandingkan kedudukan relatif SMA jangka pendek dan jangka panjang. Ia juga menggunakan syarat pengesahan trend untuk menapis isyarat palsu dan meningkatkan ketepatan perdagangan.

Prinsip Strategi

- Mengira SMA jangka pendek dan jangka panjang untuk menentukan arah trend pasaran.

- Apabila SMA pendek di atas SMA panjang, ia menghasilkan isyarat beli; apabila SMA pendek di bawah SMA panjang, ia menghasilkan isyarat jual.

- Menggunakan syarat pengesahan trend untuk menyaring isyarat palsu, hanya melakukan pembelian apabila trend utama adalah lebih banyak, dan hanya melakukan penjualan apabila trend utama adalah kosong.

- Tetapkan fungsi hentikan dan hentikan untuk mengawal risiko perdagangan. Apabila harga mencapai tahap hentikan atau hentikan yang ditetapkan, keluar dari kedudukan.

- Mengubah kedudukan secara dinamik mengikut keadaan pengesahan trend. Apabila trend utama berubah, tutup kedudukan tepat pada masanya, untuk mengelakkan kerugian yang disebabkan oleh pembalikan trend.

Kelebihan Strategik

- Pengesanan Trend: Strategi ini berdasarkan SMA pada skala masa yang berbeza, mampu menangkap trend utama pasaran dengan berkesan dan menyesuaikan diri dengan keadaan pasaran yang berbeza.

- Pengesahan Trend: Meningkatkan kebolehpercayaan isyarat perdagangan, mengurangkan perdagangan yang tidak sah dengan memperkenalkan syarat pengesahan trend, menapis isyarat palsu.

- Pengurusan Risiko: Penangguhan dan Hentikan Kerosakan yang dibina untuk membantu mengawal risiko perdagangan dan melindungi keselamatan dana pelabur.

- Penyesuaian dinamik: Penyesuaian dinamik kedudukan pemegang mengikut keadaan pengesahan trend, bertindak balas tepat pada masanya terhadap perubahan pasaran, mengurangkan kerugian yang disebabkan oleh pembalikan trend.

Risiko Strategik

- Risiko pengoptimuman parameter: Prestasi strategi bergantung kepada kitaran SMA, pilihan parameter paras paras paras paras paras. Tetapan parameter yang tidak sesuai boleh menyebabkan kesan strategi yang tidak baik.

- Risiko pasaran goyah: Dalam persekitaran pasaran goyah, isyarat dagangan yang kerap boleh menyebabkan perdagangan berlebihan, meningkatkan kos dan risiko perdagangan.

- Risiko Kejadian Tiba-tiba: Pasaran mungkin mengalami turun naik yang teruk dalam menghadapi peristiwa besar yang tiba-tiba, strategi ini mungkin tidak dapat bertindak balas tepat pada masanya, menyebabkan kerugian yang lebih besar.

Arah pengoptimuman strategi

- Memperkenalkan lebih banyak petunjuk teknikal: Gabungan dengan petunjuk teknikal lain, seperti MACD, RSI dan lain-lain, meningkatkan ketepatan dan kestabilan penilaian trend.

- Pilihan parameter pengoptimuman: mencari kitaran SMA yang optimum melalui pengesanan semula data sejarah dan pengoptimuman parameter, kombinasi parameter paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras paras

- Peningkatan pengurusan risiko: memperkenalkan teknik pengurusan risiko yang lebih maju, seperti hentian dinamik, pengurusan kedudukan, dan lain-lain, untuk mengawal lebih jauh risiko.

- Sesuaikan dengan keadaan pasaran yang berbeza: menyesuaikan parameter strategi secara dinamik mengikut turun naik pasaran dan kekuatan trend, membolehkan strategi menyesuaikan diri dengan keadaan pasaran yang berbeza.

ringkaskan

Strategi SMA trend pemantauan pelbagai skala masa dan strategi berhenti bergerak menggunakan SMA yang merangkumi trend pasaran dalam skala masa yang berbeza, menapis isyarat palsu melalui syarat pengesahan tren, sambil menyediakan fungsi penyesuaian kedudukan berhenti berhenti dan dinamik, dan mencapai tujuan pemantauan trend dan pengurusan risiko. Walaupun strategi ini mempunyai kelebihan, ia masih menghadapi risiko seperti pengoptimuman parameter, pasaran yang bergolak dan peristiwa mendadak.

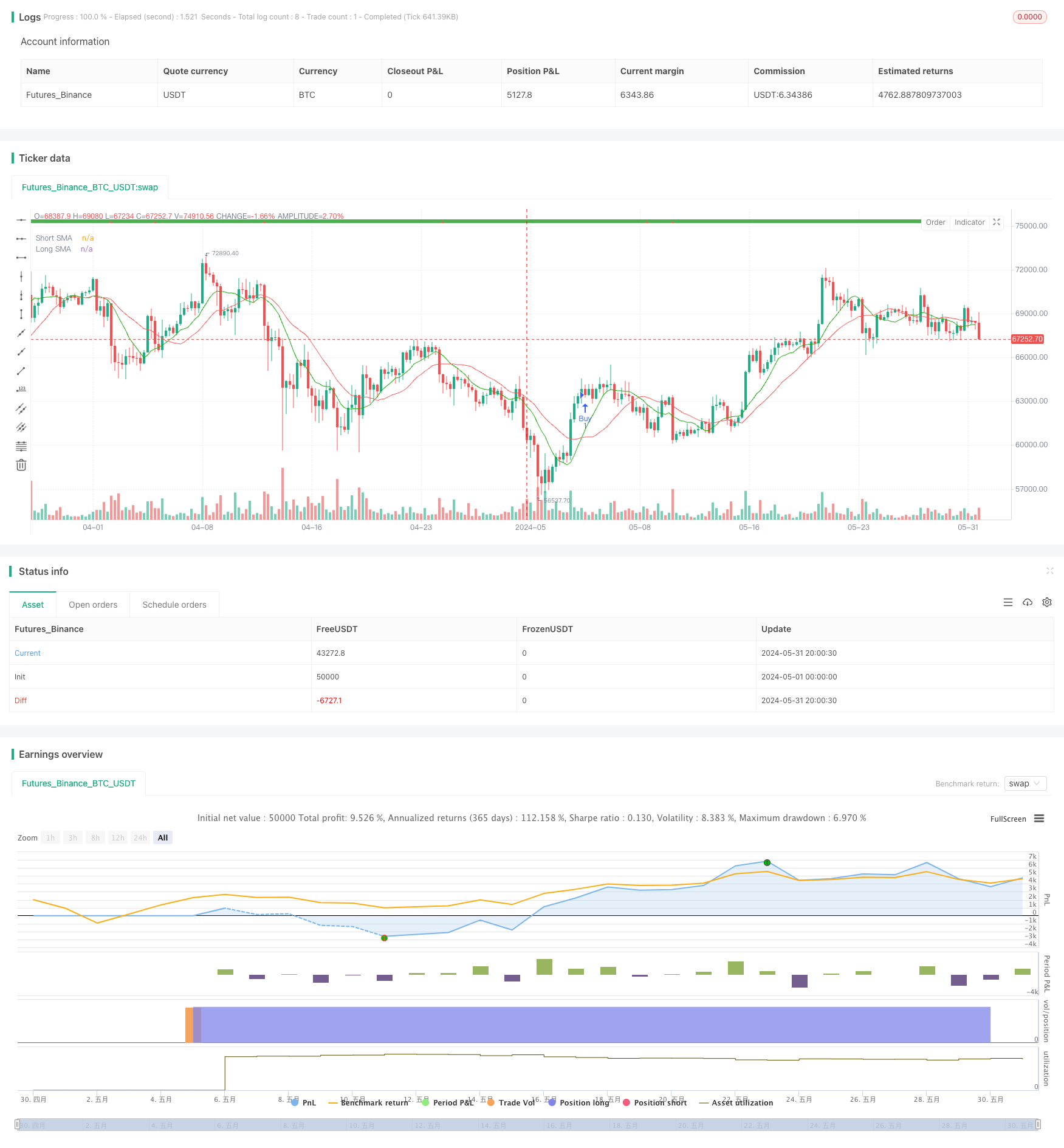

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("market slayer v3", overlay=true)

// Input parameters

showConfirmationTrend = input(title='Show Trend', defval=true)

confirmationTrendTimeframe = input.timeframe(title='Main Trend', defval='240')

confirmationTrendValue = input(title='Main Trend Value', defval=2)

showConfirmationBars = input(title='Show Confirmation Bars', defval=true)

topCbarValue = input(title='Top Confirmation Value', defval=60)

short_length = input.int(10, minval=1, title="Short SMA Length")

long_length = input.int(20, minval=1, title="Long SMA Length")

takeProfitEnabled = input(title="Take Profit Enabled", defval=false)

takeProfitValue = input.float(title="Take Profit (points)", defval=20, minval=1)

stopLossEnabled = input(title="Stop Loss Enabled", defval=false)

stopLossValue = input.float(title="Stop Loss (points)", defval=50, minval=1)

// Calculate SMAs

short_sma = ta.sma(close, short_length)

long_sma = ta.sma(close, long_length)

// Generate buy and sell signals based on SMAs

buy_signal = ta.crossover(short_sma, long_sma)

sell_signal = ta.crossunder(short_sma, long_sma)

// Plot SMAs

plot(short_sma, color=color.rgb(24, 170, 11), title="Short SMA")

plot(long_sma, color=color.red, title="Long SMA")

// Confirmation Bars

f_confirmationBarBullish(cbValue) =>

cBarClose = close

slowConfirmationBarSmaHigh = ta.sma(high, cbValue)

slowConfirmationBarSmaLow = ta.sma(low, cbValue)

slowConfirmationBarHlv = int(na)

slowConfirmationBarHlv := cBarClose > slowConfirmationBarSmaHigh ? 1 : cBarClose < slowConfirmationBarSmaLow ? -1 : slowConfirmationBarHlv[1]

slowConfirmationBarSslDown = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaHigh : slowConfirmationBarSmaLow

slowConfirmationBarSslUp = slowConfirmationBarHlv < 0 ? slowConfirmationBarSmaLow : slowConfirmationBarSmaHigh

slowConfirmationBarSslUp > slowConfirmationBarSslDown

fastConfirmationBarBullish = f_confirmationBarBullish(topCbarValue)

fastConfirmationBarBearish = not fastConfirmationBarBullish

fastConfirmationBarClr = fastConfirmationBarBullish ? color.green : color.red

fastConfirmationChangeBullish = fastConfirmationBarBullish and fastConfirmationBarBearish[1]

fastConfirmationChangeBearish = fastConfirmationBarBearish and fastConfirmationBarBullish[1]

confirmationTrendBullish = request.security(syminfo.tickerid, confirmationTrendTimeframe, f_confirmationBarBullish(confirmationTrendValue), lookahead=barmerge.lookahead_on)

confirmationTrendBearish = not confirmationTrendBullish

confirmationTrendClr = confirmationTrendBullish ? color.green : color.red

// Plot trend labels

plotshape(showConfirmationTrend, style=shape.square, location=location.top, color=confirmationTrendClr, title='Trend Confirmation Bars')

plotshape(showConfirmationBars and (fastConfirmationChangeBullish or fastConfirmationChangeBearish), style=shape.triangleup, location=location.top, color=fastConfirmationChangeBullish ? color.green : color.red, title='Fast Confirmation Bars')

plotshape(showConfirmationBars and buy_signal and confirmationTrendBullish, style=shape.triangleup, location=location.top, color=color.green, title='Buy Signal')

plotshape(showConfirmationBars and sell_signal and confirmationTrendBearish, style=shape.triangledown, location=location.top, color=color.red, title='Sell Signal')

// Generate trade signals

buy_condition = buy_signal and confirmationTrendBullish and not (strategy.opentrades > 0)

sell_condition = sell_signal and confirmationTrendBearish and not (strategy.opentrades > 0)

strategy.entry("Buy", strategy.long, when=buy_condition, comment ="BUY CALLS")

strategy.entry("Sell", strategy.short, when=sell_condition, comment ="BUY PUTS")

// Take Profit

if (takeProfitEnabled)

strategy.exit("Take Profit Buy", from_entry="Buy", profit=takeProfitValue)

strategy.exit("Take Profit Sell", from_entry="Sell", profit=takeProfitValue)

// Stop Loss

if (stopLossEnabled)

strategy.exit("Stop Loss Buy", from_entry="Buy", loss=stopLossValue)

strategy.exit("Stop Loss Sell", from_entry="Sell", loss=stopLossValue)

// Close trades based on trend confirmation bars

if strategy.opentrades > 0

if strategy.position_size > 0

if not confirmationTrendBullish

strategy.close("Buy", comment ="CLOSE CALLS")

else

if not confirmationTrendBearish

strategy.close("Sell", comment ="CLOSE PUTS")

// Define alert conditions as booleans

buy_open_alert = buy_condition

sell_open_alert = sell_condition

buy_closed_alert = strategy.opentrades < 0

sell_closed_alert = strategy.opentrades > 0

// Alerts

alertcondition(buy_open_alert, title='Buy calls', message='Buy calls Opened')

alertcondition(sell_open_alert, title='buy puts', message='buy Puts Opened')

alertcondition(buy_closed_alert, title='exit calls', message='exit calls ')

alertcondition(sell_closed_alert, title='exit puts', message='exit puts Closed')