Estratégia de tendência do RSI

Autora:ChaoZhang, Data: 2024-06-14 15:28:38Tags:RSISMAEMA

Resumo

Esta estratégia baseia-se no indicador Relative Strength Index (RSI). Determina os sinais de compra e venda julgando se o valor do RSI excede os limiares superior e inferior pré-estabelecidos. Além disso, a estratégia define limites de stop-loss e duração da posição para controlar o risco.

Princípio da estratégia

- Calcular o valor do indicador RSI.

- Quando o valor do RSI estiver abaixo do limiar de compra pré-definido, gerar um sinal de compra; quando o valor do RSI estiver acima do limiar de venda pré-definido, gerar um sinal de venda.

- Com base no sinal de compra, calcule a quantidade de compra ao preço de fechamento atual e coloque uma ordem de compra.

- Se for definida uma percentagem de stop-loss, calcular o preço do stop-loss e colocar uma ordem de stop-loss.

- Fechar todas as posições com base no sinal de venda ou na condição de stop-loss.

- Se for fixada uma duração máxima da posição, fechar todas as posições após a duração da posição exceder a duração máxima, independentemente do lucro ou da perda.

Vantagens da estratégia

- O indicador RSI é um indicador de análise técnica amplamente utilizado que pode captar efetivamente os sinais de sobrecompra e sobrevenda no mercado.

- A estratégia incorpora limites de stop-loss e de duração da posição, que ajudam a controlar o risco.

- A lógica estratégica é clara e fácil de compreender e implementar.

- Ao ajustar os parâmetros e limiares do RSI, a estratégia pode adaptar-se aos diferentes ambientes de mercado.

Riscos estratégicos

- Em alguns casos, o indicador RSI pode gerar sinais falsos, levando a perdas na estratégia.

- A estratégia não considera os fatores fundamentais do instrumento de negociação e baseia-se unicamente em indicadores técnicos, que podem enfrentar riscos decorrentes de eventos inesperados no mercado.

- As percentagens fixas de stop-loss podem não se adaptar às alterações da volatilidade do mercado.

- O desempenho da estratégia pode ser afetado pelas definições dos parâmetros e parâmetros inadequados podem levar a um desempenho da estratégia fraco.

Orientações para a otimização da estratégia

- Introduzir outros indicadores técnicos, tais como médias móveis, para melhorar a fiabilidade da estratégia.

- Otimizar a estratégia de stop-loss, como o uso de stop-loss de atraso ou stop-loss dinâmico com base na volatilidade.

- Ajustar dinamicamente os parâmetros e limiares do RSI de acordo com as condições do mercado.

- Combinar a análise dos aspectos fundamentais do instrumento de negociação para melhorar a capacidade de controlo do risco da estratégia.

- Realizar backtesting e otimização de parâmetros na estratégia para encontrar a combinação ideal de parâmetros.

Resumo

Esta estratégia utiliza o indicador RSI para capturar sinais de sobrecompra e sobrevenda no mercado, ao mesmo tempo em que introduz limites de stop-loss e duração de posição para controlar o risco. A lógica da estratégia é simples e direta, fácil de implementar e otimizar. No entanto, o desempenho da estratégia pode ser afetado pela volatilidade do mercado e configurações de parâmetros. Portanto, é necessário combinar outros métodos de análise e medidas de gerenciamento de risco para melhorar a robustez e lucratividade da estratégia.

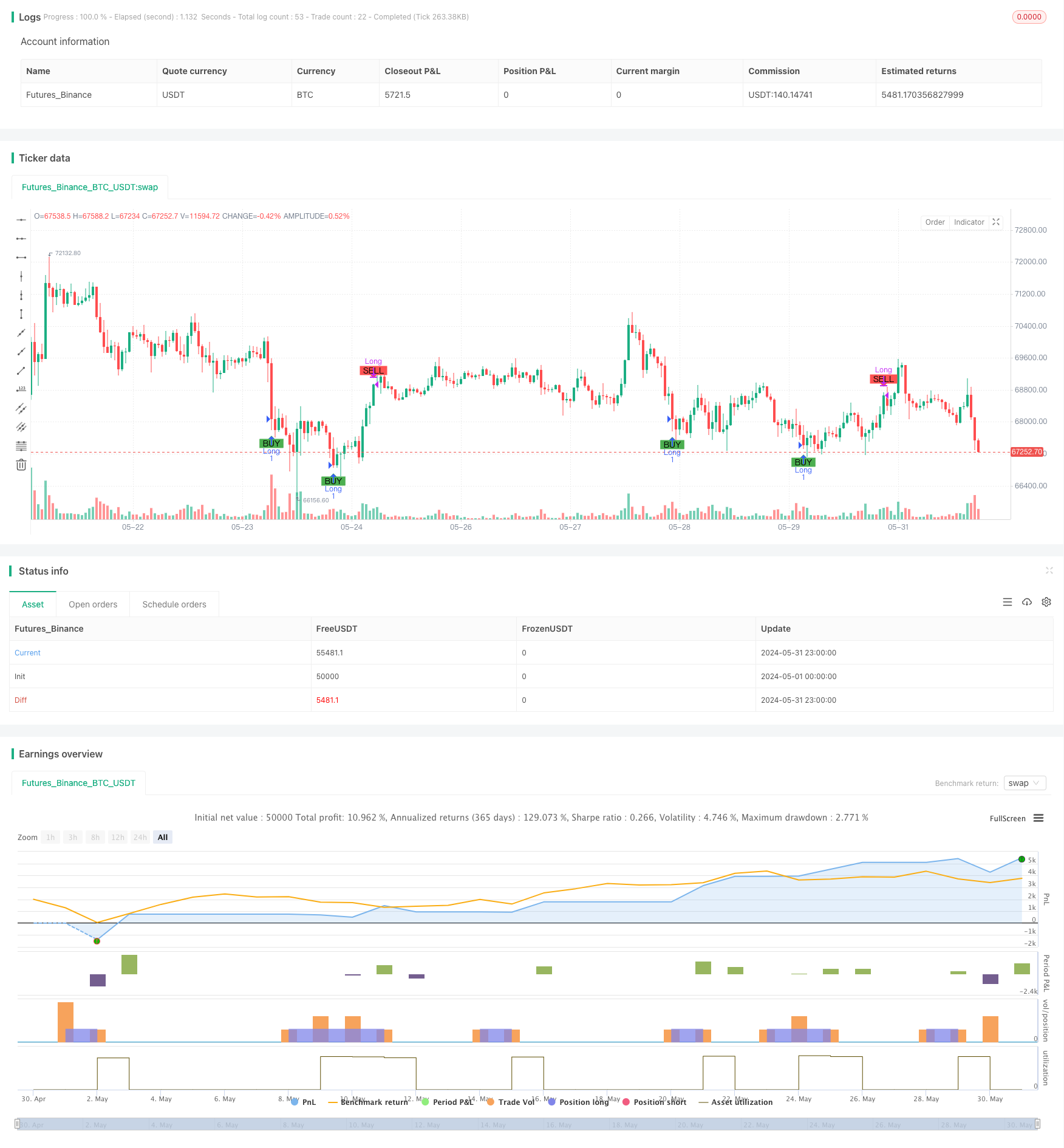

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple RSI Strategy", overlay=true, initial_capital=20, commission_value=0.1, commission_type=strategy.commission.percent)

// Define the hardcoded date (Year, Month, Day, Hour, Minute)

var hardcodedYear = 2024

var hardcodedMonth = 6

var hardcodedDay = 10

// Convert the hardcoded date to a timestamp

var start_date = timestamp(hardcodedYear, hardcodedMonth, hardcodedDay)

// settings

order_size_usdt = input.float(20, title="Order Size (USDT)")

rsiLength = input.int(9, title="RSI Length")

rsiBuyThreshold = input.int(30, title="RSI Buy Threshold")

rsiSellThreshold = input.int(70, title="RSI Sell Threshold")

rsibuystrat = input.int(1, title="buy strat 1=achieved,2=recross")

rsisellstrat = input.int(1, title="sell strat 1=achieved,2=recross")

stoploss = input.int(1, title="Stop loss percent")

max_duration = input(24, title="Max Position Duration (hours)")*60

// emaPeriod = input.int(50, title="EMA Period")

// smaPeriod = input.int(200, title="SMA Period")

rsi = ta.rsi(close, rsiLength)

// ma_rsi = ta.sma(rsi, rsiLength)

// ema = ta.ema(close,emaPeriod)

// sma = ta.sma(close,smaPeriod)

// plot(sma, color=color.red, title="exp Moving Average")

// plot(smal, color=color.blue, title="Simple Moving Average")

longCondition = ((ta.crossunder(rsi, rsiBuyThreshold) and rsibuystrat==1) or (ta.crossover(rsi, rsiBuyThreshold) and rsibuystrat==2) ) and strategy.position_size == 0

shortCondition = ( (ta.crossover(rsi, rsiSellThreshold) and rsisellstrat==1) or (ta.crossunder(rsi, rsiSellThreshold) and rsisellstrat==2) ) and strategy.position_size > 0

// Execute Buy and Sell orders

if (longCondition)

positionSize = order_size_usdt / close

strategy.entry("Long", strategy.long,qty=positionSize)

if (stoploss>0)

stopLossPrice = close * (1 - stoploss/100 )

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossPrice)

if (shortCondition )//or stopCondition)

strategy.close("Long")

//add condition open time

if (strategy.position_size > 0 and max_duration >0)

var float entry_time = na

if (strategy.opentrades > 0)

entry_time := nz(strategy.opentrades.entry_time(0), na)

else

entry_time := na

current_time = time

var float duration_minutes = -1

if (not na(entry_time))

duration_minutes := (current_time - entry_time) / 60000

// Close positions after a certain duration (e.g., 60 minutes)

// if ( duration_minutes > max_duration and close>=strategy.opentrades.entry_price(0))

if ( duration_minutes > max_duration )

label.new(bar_index, high, text="Duration: " + str.tostring(duration_minutes/60) + " hrs", color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.small)

strategy.close("Long")

// Plot Buy and Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

//plotshape(series=stopCondition, title="stop Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot RSI

// hline(rsiBuyThreshold, "RSI Buy Threshold", color=color.green)

// hline(rsiSellThreshold, "RSI Sell Threshold", color=color.red)

- QQE MOD + SSL híbrido + Waddah Attar Explosão

- RSI Estratégia de negociação bilateral

- SIGNALES de comércio de balanço

- 44 SMA e 9 EMA Crossover Strategy com RSI Filter e TP/SL

- Estratégia de otimização de indicadores dinâmicos duplos

- Tendência de indicador multi-técnico Seguindo estratégia com Ichimoku Cloud Breakout e Stop-Loss System

- O valor da posição de referência deve ser calculado de acordo com o método de classificação do mercado.

- Estratégia RSI-EMA-ATR de negociação de volatilidade com vários indicadores

- Estratégia quantitativa cruzada de tendências de vários indicadores

- Estratégia de negociação quantitativa de múltiplos indicadores - Superindicador de estratégia 7 em 1

- Estratégia quantitativa de negociação do EMA100 e do NUPL relativa aos lucros não realizados

- Estratégia de negociação baseada no oscilador estocástico

- Estratégia combinada simples: Ponto de Pivot SuperTrend e DEMA

- Estratégia de filtragem da tendência da EMA

- Estratégia de cruzamento da média móvel

- Estratégia de ruptura intradiária baseada em pontos baixos de 3 minutos

- Estratégia de entrada avançada baseada em média móvel, suporte/resistência e volume

- EMA RSI MACD Dinâmica Take Profit e Stop Loss estratégia de negociação

- G-Trend EMA ATR Estratégia de negociação inteligente

- Tendência Seguindo uma estratégia baseada na média móvel de 200 dias e no oscilador estocástico

- Estratégia de Scalping de Momentum Crossover da EMA

- Estratégia de fuga do BB

- VWAP e RSI Dynamic Bollinger Bands Take Profit and Stop Loss estratégia

- Chande-Kroll Stop Dinâmica ATR Tendência Seguindo a Estratégia

- Esta estratégia gera sinais de negociação baseados no fluxo de dinheiro de Chaikin (CMF)

- Estratégia de inversão da barra de pin filtrada de tendência

- Estratégia de negociação quantitativa baseada em padrões de reversão em níveis de suporte e resistência

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa.

- Estratégia da ETI Crossover

- Estratégia de cruzamento de médias móveis duplas da EMA