Стратегия торговли EMA по тренду и импульсу в течение нескольких периодов времени

Автор:Чао Чжан, Дата: 2024-11-12 16:35:41Тэги:ЕМАATRККSMALR

Обзор

Это количественная торговая стратегия, которая сочетает в себе многочасовую тенденцию EMA с анализом импульса. Стратегия в основном анализирует выравнивание 20, 50, 100 и 200-дневных экспоненциальных скользящих средних (EMA) в сочетании с индикаторами импульса как в ежедневных, так и в еженедельных временных рамках.

Принципы стратегии

Основная логика включает в себя несколько ключевых компонентов:

- Система выравнивания EMA: требует 20-дневной EMA выше 50-дневной EMA, которая выше 100-дневной EMA, которая выше 200-дневной EMA, формируя идеальное бычье выравнивание.

- Система подтверждения импульса: рассчитывает пользовательские индикаторы импульса на основе линейной регрессии как в ежедневных, так и в еженедельных временных рамках.

- Система обратного входа: цена должна вернуться в пределах определенного процентного диапазона 20-дневной EMA для входа, избегая погони за покупкой.

- Система управления рисками: использует множители ATR для установления целей стоп-лосса и прибыли, по умолчанию на 1,5x ATR для стоп-лосса и 3x ATR для цели прибыли.

Преимущества стратегии

- Механизм множественного подтверждения: уменьшает ложные сигналы при нескольких условиях, включая выравнивание EMA, многочасовой импульс и снижение цены.

- Научное управление рисками: использует ATR для динамической корректировки целей стоп-лосса и прибыли, адаптируясь к изменениям волатильности рынка.

- Следование трендов с помощью импульса: захватывает основные тенденции при оптимизации времени входа в тренды.

- Высокая настраиваемость: все параметры стратегии могут быть оптимизированы для различных характеристик рынка.

- Многочасовой анализ: улучшает надежность сигнала за счет координации ежедневных и еженедельных временных рамок.

Стратегические риски

- EMA Lag: EMA, как отстающие показатели, могут привести к задержке ввода.

- Плохая производительность на рыночных рынках: стратегия может часто генерировать ложные сигналы на боковых рынках.

- Риск снижения: несмотря на остановки ATR, значительные снижения возможны в экстремальных условиях.

- Чувствительность параметров: производительность стратегии чувствительна к параметрам. Рекомендуется тщательное тестирование оптимизации параметров.

Руководство по оптимизации

- Признание рыночной среды: Добавление показателей волатильности или силы тренда для использования различных наборов параметров в различных рыночных условиях.

- Оптимизация входа: Добавьте осцилляторы, такие как RSI, для более точных точек входа в зоны отступления.

- Динамическая корректировка параметров: автоматически корректируются кратности ATR и диапазоны отклонения на основе волатильности рынка.

- Интеграция анализа объема: подтверждение силы тренда с помощью анализа объема для повышения надежности сигнала.

- Реализация машинного обучения: Использование алгоритмов машинного обучения для динамической оптимизации параметров и улучшения адаптивности стратегии.

Резюме

Это хорошо продуманная, логически строгая стратегия, следующая за трендом. Благодаря сочетанию нескольких технических индикаторов, она обеспечивает как надежность стратегии, так и эффективное управление рисками. Высокая настраиваемость стратегии позволяет оптимизировать ее для различных рыночных характеристик.

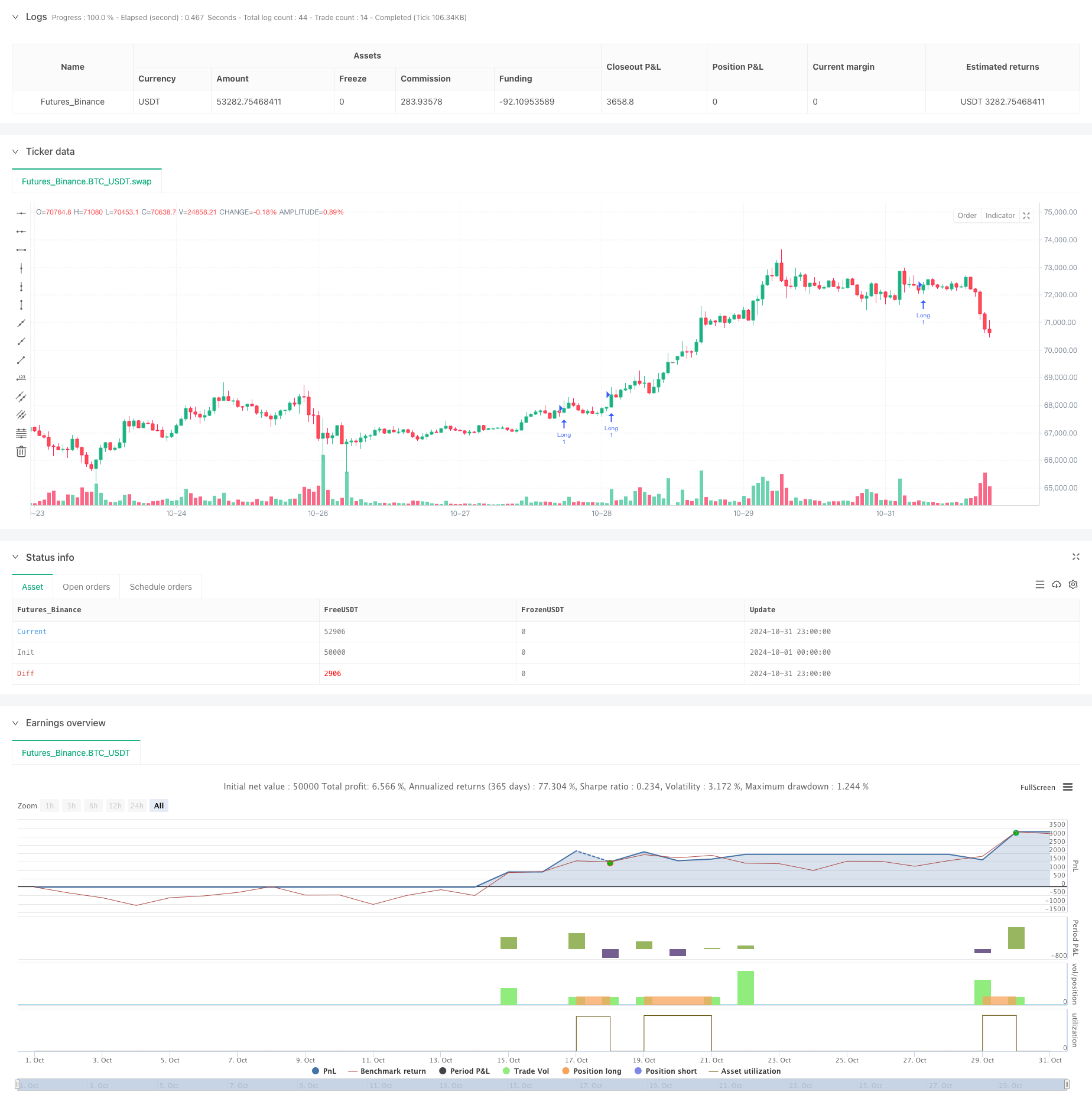

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Swing Trading with EMA Alignment and Custom Momentum", overlay=true)

// User inputs for customization

atrLength = input.int(14, title="ATR Length", minval=1)

atrMultiplierSL = input.float(1.5, title="Stop-Loss Multiplier (ATR)", minval=0.1) // Stop-loss at 1.5x ATR

atrMultiplierTP = input.float(3.0, title="Take-Profit Multiplier (ATR)", minval=0.1) // Take-profit at 3x ATR

pullbackRangePercent = input.float(1.0, title="Pullback Range (%)", minval=0.1) // 1% range for pullback around 20 EMA

lengthKC = input.int(20, title="Length for Keltner Channels (Momentum Calculation)", minval=1)

// EMA settings

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// ATR calculation

atrValue = ta.atr(atrLength)

// Custom Momentum Calculation based on Linear Regression for Daily Timeframe

highestHighKC = ta.highest(high, lengthKC)

lowestLowKC = ta.lowest(low, lengthKC)

smaCloseKC = ta.sma(close, lengthKC)

// Manually calculate the average of highest high and lowest low

averageKC = (highestHighKC + lowestLowKC) / 2

// Calculate daily momentum using linear regression

dailyMomentum = ta.linreg(close - (averageKC + smaCloseKC) / 2, lengthKC, 0) // Custom daily momentum calculation

// Fetch weekly data for momentum calculation using request.security()

[weeklyHigh, weeklyLow, weeklyClose] = request.security(syminfo.tickerid, "W", [high, low, close])

// Calculate weekly momentum using linear regression on weekly timeframe

weeklyHighestHighKC = ta.highest(weeklyHigh, lengthKC)

weeklyLowestLowKC = ta.lowest(weeklyLow, lengthKC)

weeklySmaCloseKC = ta.sma(weeklyClose, lengthKC)

weeklyAverageKC = (weeklyHighestHighKC + weeklyLowestLowKC) / 2

weeklyMomentum = ta.linreg(weeklyClose - (weeklyAverageKC + weeklySmaCloseKC) / 2, lengthKC, 0) // Custom weekly momentum calculation

// EMA alignment condition (20 EMA > 50 EMA > 100 EMA > 200 EMA)

emaAligned = ema20 > ema50 and ema50 > ema100 and ema100 > ema200

// Momentum increasing condition (daily and weekly momentum is positive and increasing)

dailyMomentumIncreasing = dailyMomentum > 0 and dailyMomentum > dailyMomentum[1] //and dailyMomentum[1] > dailyMomentum[2]

weeklyMomentumIncreasing = weeklyMomentum > 0 and weeklyMomentum > weeklyMomentum[1] //and weeklyMomentum[1] > weeklyMomentum[2]

// Redefine Pullback condition: price within 1% range of the 20 EMA

upperPullbackRange = ema20 * (1 + pullbackRangePercent / 100)

lowerPullbackRange = ema20 * (1 - pullbackRangePercent / 100)

pullbackToEma20 = (close <= upperPullbackRange) and (close >= lowerPullbackRange)

// Entry condition: EMA alignment and momentum increasing on both daily and weekly timeframes

longCondition = emaAligned and dailyMomentumIncreasing and weeklyMomentumIncreasing and pullbackToEma20

// Initialize stop loss and take profit levels as float variables

var float longStopLevel = na

var float longTakeProfitLevel = na

// Calculate stop loss and take profit levels based on ATR

if (longCondition)

longStopLevel := close - (atrMultiplierSL * atrValue) // Stop loss at 1.5x ATR below the entry price

longTakeProfitLevel := close + (atrMultiplierTP * atrValue) // Take profit at 3x ATR above the entry price

// Strategy execution

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions: Stop-loss at 1.5x ATR and take-profit at 3x ATR

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Long", stop=longStopLevel, limit=longTakeProfitLevel)

Связанные

- Образец предупреждений ML

- Расширенная многовременная стратегия торговли Ichimoku Cloud с динамическим многомерным анализом

- Стратегия отслеживания волатильности черного лебедя и скользящей средней кроссоверной импульса

- Динамическая стратегия обратного импульса канала Келтнера

- Многоиндикаторное динамическое адаптивное размещение позиций со стратегией волатильности ATR

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Стратегия с автоматической системой торговли индикатором тренда

- Многопоказательная тенденционная и динамическая пересекающаяся количественная стратегия

- Гибридный SSL

- Динамическая тенденция MACD-ATR-EMA по многоиндикаторам в соответствии со стратегией

- Villa Dynamic Pivot Supertrend Стратегия

Больше

- Стратегия двойного направления торговли с высокой волатильностью: точка-основанная система входа в порог

- Усовершенствованная количественная стратегия реверсии среднего значения Боллинджера

- Динамический Darvas Box Breakout с движущейся средней торговой системой подтверждения тренда

- Динамическая стратегия пересечения количественных операций EMA

- Тенденция перекрестного использования многоэма с использованием стратегии с динамической оптимизацией стоп-лосса и оптимизацией получения прибыли

- Стратегия перекрестного использования двойной скользящей средней с динамическим управлением рисками

- Двойной перекресток скользящей средней с динамической стратегией управления рисками

- Установление силы тренда с использованием стратегии получения прибыли

- Многостратегическая адаптивная торговая система, следующая за трендом и торговая система прорыва

- Многоуровневая скользящая средняя с торговой системой распознавания моделей свечей

- Интеллектуальная стратегия сбалансированной торговли на основе долгосрочной и краткосрочной ротации

- Продвинутая динамическая стратегия торговли MACD

- Тенденционная торговая система с скользящей средней (ТБМА-стратегия)

- Стратегия многотенденционного следования на базе ATR с системой оптимизации получения прибыли и остановки убытков

- Смарт адаптивная торговая система с управлением рисками на нескольких уровнях, основанная на RSI Momentum

- Динамическая стратегия торговли с адаптивным осциллятором RSI с оптимизацией порога

- Синергетическая тенденция RSI и AO вследствие количественной стратегии торговли

- Стратегия адаптивного тренда импульса RSI с системой фильтра скользящих средних

- Стратегия импульса двойного скользящего среднего с системой оптимизации риска и вознаграждения

- Многопоказательная кроссоверная система динамической стратегии: количественная модель торговли на основе EMA, RVI и торговых сигналов