概述

该策略基于MACD指标的连续金叉和死叉信号进行交易。当出现连续的金叉信号时,开多头仓位;当出现连续的死叉信号时,开空头仓位。同时,策略允许用户设置止盈和止损点位,以控制风险。此外,策略还提供了回测时间范围的选择,方便用户在指定时间段内评估策略表现。

策略原理

该策略的核心是利用MACD指标的金叉和死叉信号来判断市场趋势的转折点。MACD指标由快速移动平均线(EMA)和慢速移动平均线(EMA)构成,当快速EMA与慢速EMA交叉时,形成金叉或死叉信号。连续的金叉信号表明市场可能进入上升趋势,此时开多头仓位;连续的死叉信号则表明市场可能进入下降趋势,此时开空头仓位。通过捕捉这些趋势转折点,策略试图在市场趋势中获利。

策略优势

- 简单易懂:该策略基于广泛使用的MACD指标,指标原理简单,易于理解和实现。

- 趋势跟踪:通过捕捉连续的金叉和死叉信号,策略能够跟踪市场的主要趋势,有助于在趋势中获利。

- 风险控制:策略允许用户设置止盈和止损点位,帮助控制潜在的风险和损失。

- 灵活回测:策略提供了回测时间范围的选择,用户可以根据需要评估不同时间段内的策略表现。

策略风险

- 参数敏感性:MACD指标的表现取决于快速EMA和慢速EMA的周期选择,不同的参数设置可能导致不同的交易信号。

- 市场噪音:在震荡或不明朗的市场条件下,MACD指标可能产生较多的虚假信号,导致频繁交易和潜在损失。

- 趋势延迟:MACD指标是一个滞后指标,交易信号可能在趋势已经确立后才出现,错过最佳入场时机。

- 止损风险:如果市场剧烈波动,价格可能快速突破止损位,导致比预期更大的损失。

策略优化方向

- 结合其他指标:考虑将MACD指标与其他技术指标(如RSI、布林带等)结合使用,以提高信号的可靠性和过滤掉虚假信号。

- 优化参数:通过对不同的快速EMA和慢速EMA周期进行回测和优化,找到最适合特定市场和资产的参数组合。

- 动态止盈止损:根据市场波动性或价格水平,动态调整止盈和止损点位,以更好地适应市场变化并控制风险。

- 引入仓位管理:根据信号强度或市场环境,调整每笔交易的仓位大小,以优化风险回报比。

总结

该策略基于连续的MACD金叉和死叉信号进行交易,试图捕捉市场趋势的转折点。它简单易懂,可以跟踪主要趋势,并提供风险控制和灵活回测的功能。然而,策略的表现可能受到参数选择、市场噪音和趋势延迟等因素的影响。为了进一步改进,可以考虑与其他指标结合使用,优化参数,引入动态止盈止损和仓位管理。总体而言,该策略为趋势交易提供了一个基本框架,但在实际应用中需要谨慎评估和调整,以适应具体的市场环境和个人风险偏好。

策略源码

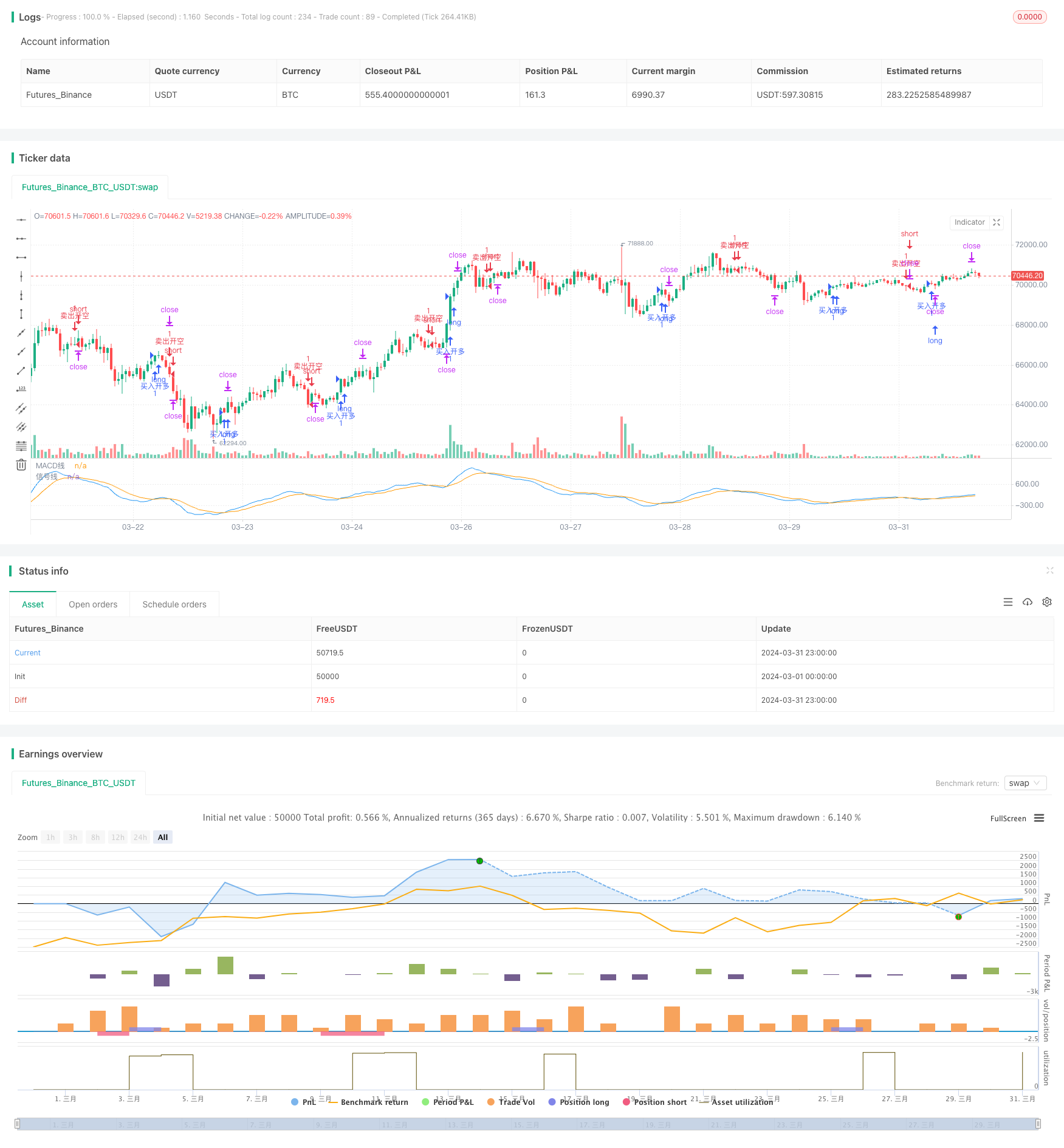

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("连续MACD交叉和回测范围")

//策略初始化時間設置

useDateFilter = input.bool(true, title="启用时间回测范围", group="回测范围")

backtestStartDate = input(timestamp("1 Jan 2023"), title="开始时间", group="回测范围")

backtestEndDate = input(timestamp("1 Jan 2024"), title="结束时间", group="回测范围")

inTradeWindow = true

// 定义MACD指标参数

fastLength = input.int(12, "快速EMA周期")

slowLength = input.int(26, "慢速EMA周期")

signalSmoothing = input.int(9, "信号线平滑周期")

long_win = input.float(defval = 0.01,title = "多单止盈设置", tooltip = "0.01代表1%" )

long_lose= input.float(0.01,"多单止损设置")

short_win = input.float(0.01,"空单止盈设置")

short_lose = input.float(0.01,"空单止损设置")

// 计算MACD值

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// 定义金叉和死叉的条件

crossUp = ta.crossover(macdLine, signalLine)

crossDown = ta.crossunder(macdLine, signalLine)

// 使用历史状态记录上一次交叉情况

var lastCrossUp = false

var lastCrossDown = false

// 更新历史状态

if crossUp

lastCrossUp := true

else if crossDown

lastCrossUp := false

if crossDown

lastCrossDown := true

else if crossUp

lastCrossDown := false

// 交易执行逻辑:检查是否存在连续的金叉或死叉

if lastCrossUp and crossUp and inTradeWindow

strategy.entry("买入开多", strategy.long)

strategy.exit("买入止盈止损", "买入开多", limit=close * (1 + long_win), stop=close * (1 - long_lose))

if lastCrossDown and crossDown and inTradeWindow

strategy.entry("卖出开空", strategy.short)

strategy.exit("卖出止盈止损", "卖出开空", limit=close * (1 - short_win), stop=close * (1 + short_lose))

// 显示MACD线和信号线

plot(macdLine, "MACD线", color=color.blue)

plot(signalLine, "信号线", color=color.orange)

相关推荐