Trend nach der auf OBV- und MA-Kreuzsignalen basierenden Strategie

Schriftsteller:ChaoZhang, Datum: 2024-04-29 13:48:58Tags:OBV- Nein.SMA

Übersicht

Diese Strategie mit dem Namen

Strategieprinzipien

- Berechnen Sie den OBV-Indikatorwert: Wenn der aktuelle Schlusskurs höher ist als der vorherige Wert der Kerze, addieren Sie das aktuelle Volumen zum OBV; andernfalls subtrahieren Sie das Volumen.

- Berechnen Sie vier gleitende Durchschnitte des OBV: langfristige langfristige Eintritts-MA, langfristige langfristige Austritts-MA, kurzfristige kurze Eintritts-MA und kurzfristige kurze Austritts-MA.

- Erstellen von Handelssignalen:

- Wenn der OBV über den langfristigen langen Einstiegs-MA hinausgeht und der Richtungsfilter nicht auf Short gesetzt ist, wird eine Long-Position eröffnet.

- Wenn der OBV unter den langfristigen langen Ausgang MA fällt, schließt man die Long-Position.

- Wenn der OBV unter den kurzfristigen kurzfristigen Eingangs-MA fällt und der Richtungsfilter nicht auf lang eingestellt ist, wird eine Short-Position eröffnet.

- Wenn der OBV über den kurzfristigen kurzen Ausgang MA geht, schließt man die Shortposition.

- Handelsmanagement: Wird ein entgegengesetztes Signal erzeugt, wird die ursprüngliche Position geschlossen, bevor eine neue Position eröffnet wird.

Strategische Vorteile

- Die wichtigsten Trendsignale von OBV vollständig nutzen, um Positionen zu Beginn eines Trends zu erstellen.

- Durch die Trennung von Ein- und Ausstiegsmärkten ist eine unabhängige Optimierung der Ein- und Ausstiegszeit möglich.

- Die Code-Logik ist einfach und klar, leicht zu verstehen und zu verbessern.

- Die Einführung eines Richtungsfilters kann häufigen Handel vermeiden und Kosten senken.

Strategische Risiken

- Es fehlen andere Bestätigungsindikatoren, die falsche Signale erzeugen können.

- Es fehlt an Stop-Loss- und Positionsmanagement, da das Risiko eines verstärkten Verlusts bei einem einzigen Handel besteht.

- Eine falsche Parameterwahl beeinträchtigt die Leistung der Strategie.Die Parameter müssen auf der Grundlage verschiedener Marktmerkmale und Zeitrahmen optimiert werden.

Strategieoptimierungsrichtlinien

- Es sollte in Betracht gezogen werden, Trendfilter wie MA-Richtung, ATR usw. einzuführen, um die Signalqualität zu verbessern.

- Bei OBV können verschiedene Arten von MAs verwendet werden, z. B. EMA, WMA usw., um Trends unterschiedlicher Geschwindigkeiten zu erfassen.

- Optimieren Sie die Positionsverwaltung, z. B. mit einer Skalierungsstrategie, um Positionen hinzuzufügen, wenn die Trendstärke steigt, und Positionen zu reduzieren, wenn sie sinkt.

- Kombination mit anderen Volumen- und Preisindikatoren wie MVA, PVT usw., um gemeinsame Signale zur Verbesserung der Gewinnraten zu erzeugen.

Zusammenfassung

Diese Strategie zeigt eine einfache Trend-Folge-Methode auf der Grundlage von OBV und MA-Crossovers. Ihre Vorteile sind klare Logik, zeitnahe Trend-Erfassung und flexible Halte-Kontrolle durch separate Ein- und Ausstiegs-MAs. Zu ihren Nachteilen gehören jedoch ein Mangel an Risikokontrollmaßnahmen und Signalbestätigungsmethoden. Verbesserungen können in Bereichen wie Trendfilterung, Parameteroptimierung, Positionsmanagement und gemeinsamen Signalen vorgenommen werden, um eine robustere Strategieleistung zu erzielen. Diese Strategie eignet sich besser als Leitsignal, das in Verbindung mit anderen Strategien verwendet werden kann.

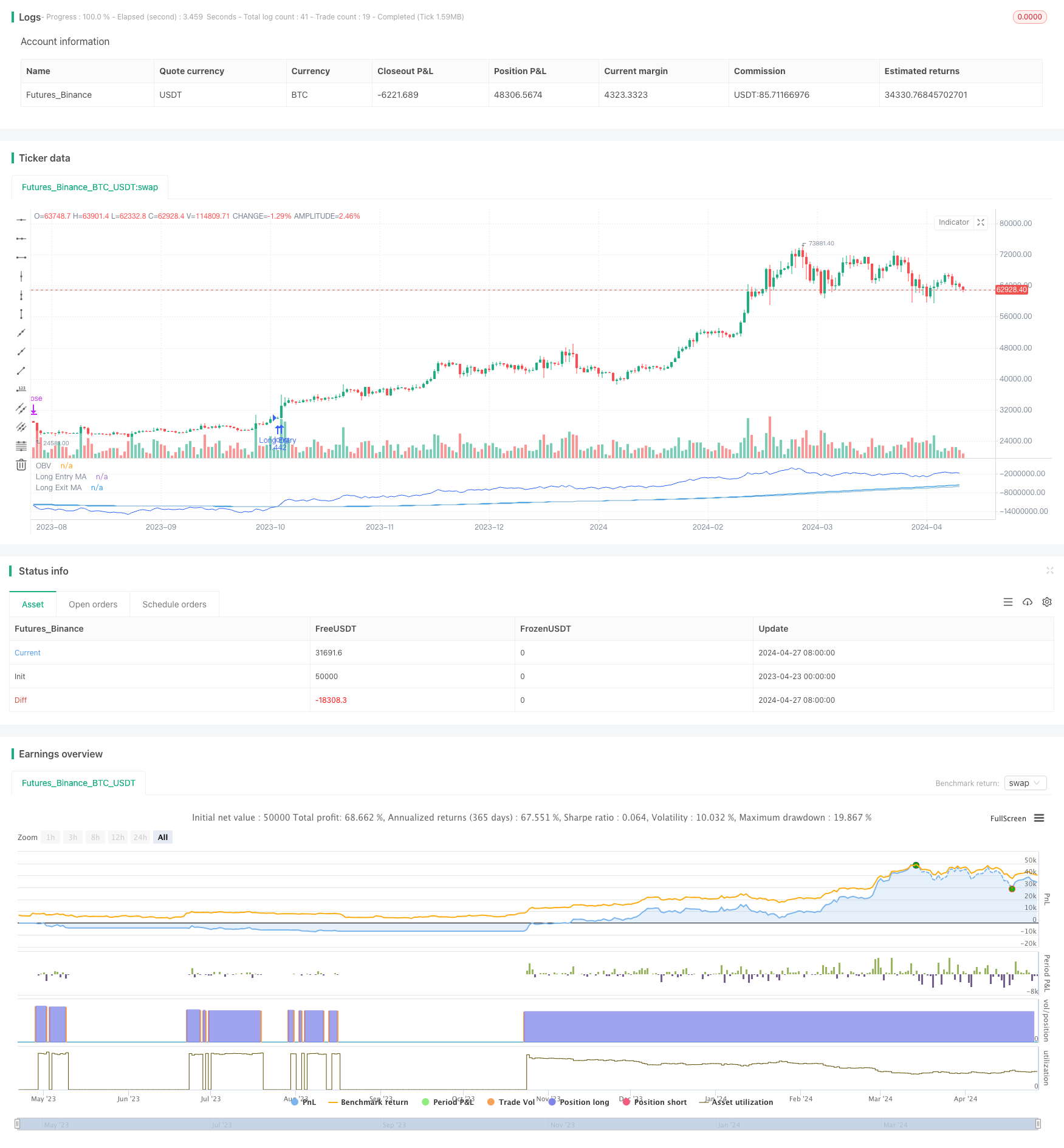

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ThousandX_Trader

//@version=5

strategy(title="OBVious MA Strategy [1000X]", overlay=false,

initial_capital=10000, margin_long=0.1, margin_short=0.1,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// Direction Input ///

tradeDirection = input.string("long", title="Direction", options=["long", "short"], group = "Direction Filter")

///////////////////////////////////////

// 1000X OBV MA INDICATOR //

///////////////////////////////////////

// OBV Trend Length Inputs //

long_entry_length = input(190, title="Long Entry MA Length", group = "Moving Average Settings")

long_exit_length = input(202, title="Long Exit MA Length", group = "Moving Average Settings")

short_entry_length = input(395, title="Short MA Entry Length", group = "Moving Average Settings")

short_exit_length = input(300, title="Short Exit MA Length", group = "Moving Average Settings")

// OBV Calculation

obv = ta.cum(ta.change(close) >= 0 ? volume : -volume)

// Calculate OBV Moving Averages

obv_ma_long_entry = ta.sma(obv, long_entry_length)

obv_ma_long_exit = ta.sma(obv, long_exit_length)

obv_ma_short_entry = ta.sma(obv, short_entry_length)

obv_ma_short_exit = ta.sma(obv, short_exit_length)

///////////////////////////////////////

// STRATEGY RULES //

///////////////////////////////////////

longCondition = ta.crossover(obv, obv_ma_long_entry) and tradeDirection != "short" and strategy.position_size <= 0

longExitCondition = ta.crossunder(obv, obv_ma_long_exit)

shortCondition = ta.crossunder(obv, obv_ma_short_entry) and tradeDirection != "long" and strategy.position_size >= 0

shortExitCondition = ta.crossover(obv, obv_ma_short_exit)

///////////////////////////////////////

// ORDER EXECUTION //

///////////////////////////////////////

// Close opposite trades before entering new ones

if (longCondition and strategy.position_size < 0)

strategy.close("Short Entry")

if (shortCondition and strategy.position_size > 0)

strategy.close("Long Entry")

// Enter new trades

if (longCondition)

strategy.entry("Long Entry", strategy.long)

if (shortCondition)

strategy.entry("Short Entry", strategy.short)

// Exit conditions

if (longExitCondition)

strategy.close("Long Entry")

if (shortExitCondition)

strategy.close("Short Entry")

///////////////////////////////////////

// PLOTTING //

///////////////////////////////////////

// Plot OBV line with specified color

plot(obv, title="OBV", color=color.new(#2962FF, 0), linewidth=1)

// Conditionally plot Long MAs with specified colors based on Direction Filter

plot(tradeDirection == "long" ? obv_ma_long_entry : na, title="Long Entry MA", color=color.new(color.rgb(2, 130, 228), 0), linewidth=1)

plot(tradeDirection == "long" ? obv_ma_long_exit : na, title="Long Exit MA", color=color.new(color.rgb(106, 168, 209), 0), linewidth=1)

// Conditionally plot Short MAs with specified colors based on Direction Filter

plot(tradeDirection == "short" ? obv_ma_short_entry : na, title="Short Entry MA", color=color.new(color.rgb(163, 2, 227), 0), linewidth=1)

plot(tradeDirection == "short" ? obv_ma_short_exit : na, title="Short Exit MA", color=color.new(color.rgb(192, 119, 205), 0), linewidth=1)

- Bei der Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte für die Berechnung der Vermögenswerte

- Cloud-Momentum-Crossover-Strategie mit gleitenden Durchschnitten und Volumenbestätigung

- Strategie für die Verlagerung des gleitenden Durchschnitts

- Strategie für die Verknüpfung von MA,SMA mit einem doppelten gleitenden Durchschnitt

- Strategie der MA

- Handelsstrategie mit SMA-Doppel gleitendem Durchschnitt

- Anpassungsfähige Risikomanagementstrategie auf der Grundlage eines doppelten gleitenden Durchschnitts

- Strategie für eine doppelte Kreuzung von gleitenden Durchschnitten

- Strategie für die Übertragung gleitender Durchschnitte auf Basis von doppelten gleitenden Durchschnitten

- Kreuzung des gleitenden Durchschnitts mit mehrfacher Gewinnstrategie

- MA99 Touch und dynamische Stop-Loss-Strategie

- Donchian Breakout Handelsstrategie

- Ichimoku führt Span B Breakout Strategie

- Langzeit-Eintritt auf EMA-Kreuzung mit Risikomanagementstrategie

- Kombination von MACD und RSI für die langfristige Handelsstrategie

- DCA-Doppel-bewegter Durchschnittshandel

- VWAP-Handelsstrategie

- Strategie zur Kombination von mehreren Indikatoren (CCI, DMI, MACD, ADX)

- RSI2-Strategie Intraday-Umkehrung Gewinnrate Rücktest

- Hurst künftige Linien der Abgrenzungsstrategie

- GBS TOP Bottom Strategie bestätigt

- Mehrindikatortrend nach Strategie

- Squeeze Backtest Transformer v2.0

- Fibonacci-Trendumkehrstrategie

- HTF-Zigzag-Pfadstrategie

- WaveTrend Kreuz LazyBear Strategie

- Die Kommission stellt fest, dass die in den Erwägungsgründen 1 und 2 genannten Risikopositionen nicht berücksichtigt werden dürfen.

- AlphaTradingBot Handelsstrategie

- Vegas SuperTrend verbesserte Strategie

- Quantitative Handelsstrategie auf Basis des modifizierten Hull Moving Average und Ichimoku Kinko Hyo