MACD-V and Fibonacci Multi-Timeframe Dynamic Take Profit Strategy

Author: ChaoZhang, Date: 2024-04-26 12:00:21Tags: MACDMACD-VATREMAMA

Overview

This strategy uses MACD-V (MACD with ATR volatility) and Fibonacci retracements to make trading decisions across multiple timeframes. It calculates MACD-V and Fibonacci levels on different timeframes, then decides whether to open or close positions based on the current price’s relationship to the Fibonacci levels and the values of MACD-V. The strategy aims to capture market trends and retracements while controlling risk.

Strategy Principles

- Calculate MACD-V indicator on different timeframes (e.g., 5-minute and 30-minute). MACD-V introduces ATR volatility adjustment to the standard MACD to adapt to different market conditions.

- On a higher timeframe (e.g., 30-minute), calculate the highest high and lowest low of the past certain periods (e.g., 9 periods), then calculate Fibonacci retracement levels based on this range.

- Determine whether to open a position based on the relationship between the current closing price and Fibonacci levels, as well as the value and direction of MACD-V. For example, when the price retraces to around the 38.2% Fibonacci level and MACD-V is moving downward between -50 and 150, open a short position.

- After opening a position, use a trailing stop to protect profits and control risk. The trailing stop’s position is dynamically adjusted based on price movement and strategy parameters.

- If the price hits the trailing stop or fixed stop loss level, close the position.

Advantage Analysis

- The strategy employs multi-timeframe analysis, providing a more comprehensive understanding of market trends and fluctuations.

- The MACD-V indicator considers price volatility, making it effective in both trending and ranging markets.

- Fibonacci levels can effectively capture key support and resistance areas, providing reference for trading decisions.

- Trailing stops allow for continued profitability during trend continuation while timely closing positions during price reversals, controlling risk.

- The strategy logic is clear, parameters are adjustable, and adaptability is strong.

Risk Analysis

- The strategy may experience frequent trading in ranging markets, leading to high transaction costs.

- Relying on technical indicators to judge trends may result in misjudgment when the market experiences false breakouts or prolonged oscillation.

- Fixed stop loss positions may not respond timely to extreme market conditions, leading to significant losses.

- Improper parameter selection may result in poor strategy performance.

Optimization Directions

- Introduce more timeframes and indicators, such as longer-period MAs, to improve the accuracy of trend judgment.

- Optimize position management, such as dynamically adjusting position size based on ATR or price range.

- Set different parameter combinations for different market conditions to improve adaptability.

- In addition to trailing stops, introduce trailing stop losses to better control downside risk.

- Backtest and optimize parameters to find the best parameter combination.

Summary

This strategy uses MACD-V and Fibonacci retracement levels across multiple timeframes to determine trends and entry timing, and employs trailing stops to dynamically control risk and profit. The strategy logic is clear and adaptable, but may experience frequent trading and misjudgment risks in ranging markets. By introducing more indicators, optimizing position management and stop loss logic, and optimizing parameters, the strategy’s robustness and profitability can be further improved.

Acknowledgment

The MACD-v indicator used in this strategy is credited to Alex Spiroglou, the original creator. For more details, you can refer to his work: MACD-v.

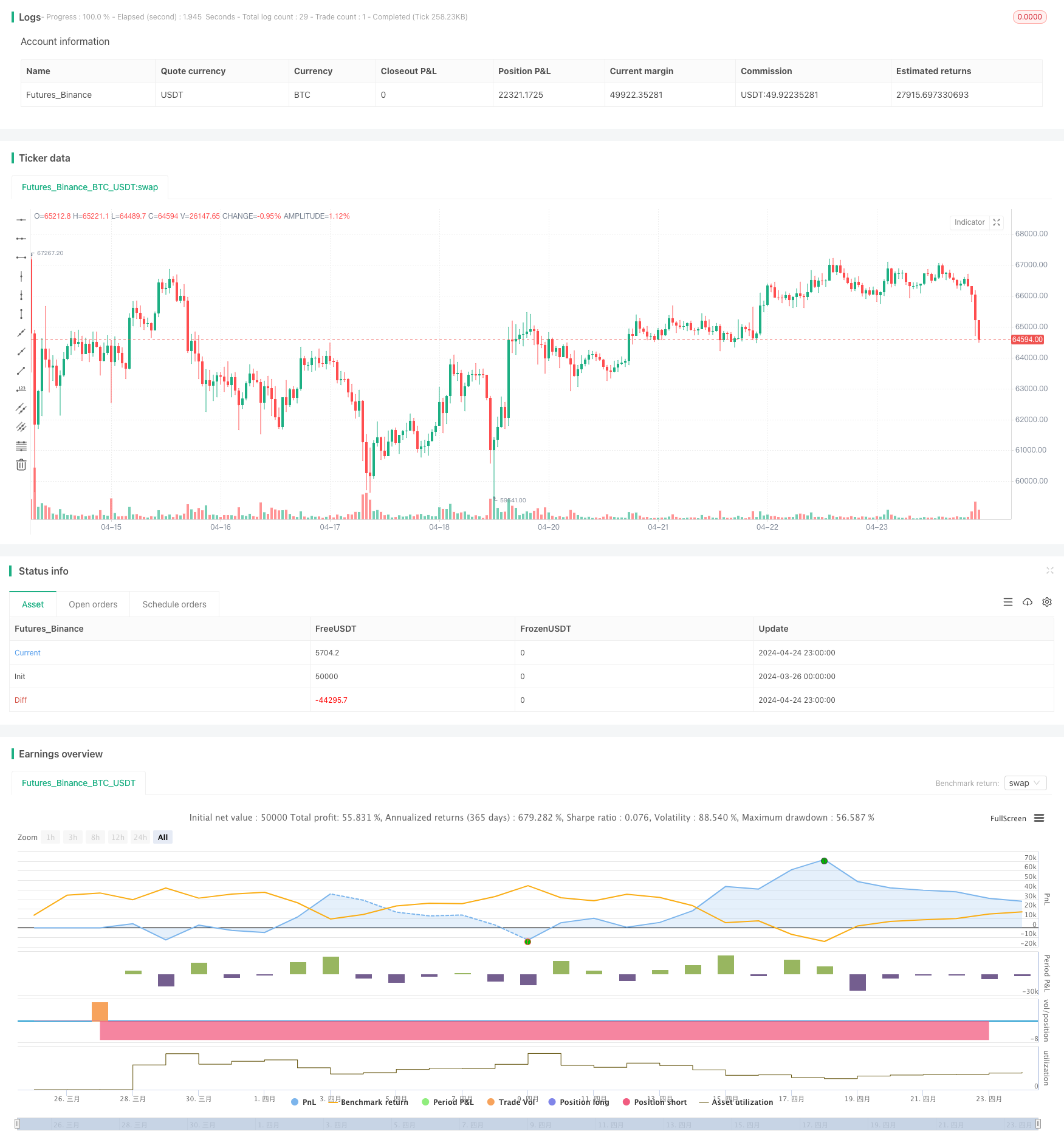

/*backtest

start: 2024-03-26 00:00:00

end: 2024-04-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © catikur

//@version=5

strategy("Advanced MACD-V and Fibonacci Strategy with EMA Trailing TP", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=1000, margin_long=1./10*50, margin_short=1./10*50, slippage=0, commission_type=strategy.commission.percent, commission_value=0.05)

// Parametreler

fast_len = input.int(12, title="Fast Length", minval=1, group="MACD-V Settings")

slow_len = input.int(26, title="Slow Length", minval=1, group="MACD-V Settings")

signal_len = input.int(9, title="Signal Smoothing", minval=1, group="MACD-V Settings")

atr_len = input.int(26, title="ATR Length", minval=1, group="MACD-V Settings")

source = input.source(close, title="Source", group="MACD-V Settings")

//ema_length = input.int(20, title="EMA Length for Trailing TP", group="Trailing TP Settings")

trailing_profit = input.float(1000, title="Trailing Profit", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_offset = input.float(30000, title="Trailing Offset", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_factor = input.float(0.01, title="Trailing Factor", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fix_loss = input.float(20000, title="Fix Loss", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fib_lookback = input.int(9, title="Fibonacci Lookback Periods", minval=1, group="Fibonacci Settings")

macd_tf = input.timeframe("5", title="MACD Timeframe", group="Timeframe Settings")

fib_tf = input.timeframe("30", title="Fibonacci Timeframe", group="Timeframe Settings")

//ema_tf = input.timeframe("30", title="EMA Timeframe for Trailing TP", group="Timeframe Settings")

// MACD-V Hesaplama

atr = ta.atr(atr_len)

ema_slow = ta.ema(source, slow_len)

ema_fast = ta.ema(source, fast_len)

atr_tf = request.security(syminfo.tickerid, macd_tf , atr)

ema_slow_tf = request.security(syminfo.tickerid, macd_tf , ema_slow)

ema_fast_tf = request.security(syminfo.tickerid, macd_tf , ema_fast)

macd = ( ema_fast_tf - ema_slow_tf ) / atr_tf * 100

signal = ta.ema(macd, signal_len)

hist = macd - signal

hist_prev = hist[1]

// log.info("MACD {0} ", macd)

// log.info("Signal {0} ", signal)

// log.info("Histogram {0} ", hist)

// log.info("Previous Histogram {0} ", hist_prev)

// EMA for Trailing TP

//ema_trailing_tf = ta.ema(close, ema_length)

//ema_trailing = request.security(syminfo.tickerid, ema_tf, ema_trailing_tf)

//log.info("EMA Trailing {0} ", ema_trailing)

// Fibonacci Seviyeleri

high_val_tf = ta.highest(high, fib_lookback)

low_val_tf = ta.lowest(low, fib_lookback)

h1 = request.security(syminfo.tickerid, fib_tf, high_val_tf)

l1 = request.security(syminfo.tickerid, fib_tf, low_val_tf)

fark = h1 - l1

//Low ile fark

hl236 = l1 + fark * 0.236

hl382 = l1 + fark * 0.382

hl500 = l1 + fark * 0.5

hl618 = l1 + fark * 0.618

hl786 = l1 + fark * 0.786

//High ile fark

lh236 = h1 - fark * 0.236

lh382 = h1 - fark * 0.382

lh500 = h1 - fark * 0.5

lh618 = h1 - fark * 0.618

lh786 = h1 - fark * 0.786

hbars_tf = -ta.highestbars(high, fib_lookback)

lbars_tf = -ta.lowestbars(low, fib_lookback)

hbars = request.security(syminfo.tickerid, fib_tf , hbars_tf)

lbars = request.security(syminfo.tickerid, fib_tf , lbars_tf)

fib_236 = hbars > lbars ? hl236 : lh236

fib_382 = hbars > lbars ? hl382 : lh382

fib_500 = hbars > lbars ? hl500 : lh500

fib_618 = hbars > lbars ? hl618 : lh618

fib_786 = hbars > lbars ? hl786 : lh786

// log.info("Fibo 382 {0} ", fib_382)

// log.info("Fibo 618 {0} ", fib_618)

// Keep track of the strategy's highest and lowest net profit

var highestNetProfit = 0.0

var lowestNetProfit = 0.0

var bool sell_retracing = false

var bool sell_reversing = false

var bool buy_rebound = false

var bool buy_rallying = false

// Satış Koşulları

sell_retracing := (signal > -20) and (macd > -50 and macd < 150) and (macd < signal) and (hist < hist_prev) and (close < fib_382)

sell_reversing := (macd > -150 and macd < -50) and (macd < signal) and (hist < hist_prev) and (close < fib_618)

// log.info("Retracing var mi: {0} ", sell_retracing)

// log.info("Reversing var mi: {0} ", sell_reversing)

// Alım Koşulları

buy_rebound := (signal < 20) and (macd > -150 and macd < 50) and (macd > signal) and (hist > hist_prev) and ((fib_618 < close) or ((fib_618 > close ) and (close > fib_382)))

buy_rallying := (macd > 50 and macd < 150) and (macd > signal) and (hist > hist_prev) and (close > fib_618)

// log.info("Rallying var mi: {0} ", buy_rallying)

// log.info("Rebound var mi: {0} ", buy_rebound)

// Emirleri Yerleştirme

if (sell_retracing == true and strategy.opentrades == 0 )

strategy.entry("sell_retracing", strategy.short)

if (sell_reversing == true and strategy.opentrades == 0 )

strategy.entry("sell_reversing", strategy.short)

if (buy_rebound == true and strategy.opentrades == 0 )

strategy.entry("buy_rebound", strategy.long)

if (buy_rallying == true and strategy.opentrades == 0 )

strategy.entry("buy_rallying", strategy.long)

// log.info("open order: {0} ", strategy.opentrades )

highestNetProfit := math.max(highestNetProfit, strategy.netprofit)

lowestNetProfit := math.min(lowestNetProfit, strategy.netprofit)

// Plot the net profit, as well as its highest and lowest value

//plot(strategy.netprofit, style=plot.style_area, title="Net profit",

// color=strategy.netprofit > 0 ? color.green : color.red)

//plot(highestNetProfit, color=color.green, title="Highest net profit")

//plot(lowestNetProfit, color=color.red, title="Lowest net profit")

// Trailing Take Profit

//long_trailing_stop = ema_trailing * trailing_factor

//short_trailing_stop = ema_trailing / trailing_factor

//log.info("long trailing stop {0} ", long_trailing_stop)

//log.info("short trailing stop {0} ", short_trailing_stop)

//log.info("avg price {0} ", strategy.position_avg_price)

//trail_price1 = strategy.position_avg_price * (1 + trailing_factor)

//trail_price2 = strategy.position_avg_price * (1 - trailing_factor)

// log.info("position_size {0} ", strategy.position_size)

// Trailing Take Profit

var float long_trailing_stop = 0.0

var float short_trailing_stop = 0.0

//if (strategy.position_size > 0)

// long_trailing_stop := math.max(long_trailing_stop, close * (1 + trailing_factor)) // Yeni bir maksimum değer belirlendiğinde güncelle

//if (strategy.position_size < 0)

// short_trailing_stop := math.min(short_trailing_stop, close * (1 - trailing_factor)) // Yeni bir minimum değer belirlendiğinde güncelle

//log.info("long trailing {0} ", long_trailing_stop)

// log.info("trailing factor{0} ", trailing_factor)

//log.info("short trailing {0} ", short_trailing_stop)

if (strategy.position_size != 0 )

strategy.exit("Exit Long", from_entry="buy_rebound", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Long", from_entry="buy_rallying", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_retracing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_reversing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

- Enhanced Price-Volume Trend Momentum Strategy

- Dual EMA Trend Momentum Trading Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Dynamic Trend Following ATR Multi-Period Trading Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- Magic Channel Price Action Trading Strategy

- H1 Trend Bias + M15 MACD Signal + M5 Fast Volatility Gap Strategy

- RSI and Dual EMA Crossover Signal Quantitative Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Stochastic Oscillator and Moving Average Crossover Strategy with Stop Loss and Stochastic Filter

- Intraday Scalable Volatility Trading Strategy

- KRK aDa Stochastic Slow Mean Reversion Strategy with AI Enhancements

- Real-time Trendline Trading Based on Pivot Points and Slope

- EMA23/EMA50 Double Moving Average Crossover Quantitative Trading Strategy

- Trend-Capturing Strategy with Horizontal Line Breakout

- Moving Average Crossover with Multiple Take Profits Strategy

- MACD Golden Cross and Death Cross Strategy

- Trend Catcher Strategy

- Quantitative Trading Strategy Based on Moving Averages and Bollinger Bands

- Bollinger Bands Breakout Strategy

- Dual Timeframe Momentum Strategy

- MACD BB Breakout Strategy

- Wavetrend Large Amplitude Oversold Rebound Grid Trading Strategy

- MACD Crossover Strategy

- Optimized MACD Trend-Following Strategy with ATR-based Risk Management

- ZeroLag MACD Long Short Strategy

- BBSR Extreme Strategy