K Consecutive Candles Bull Bear Strategy

Author: ChaoZhang, Date: 2024-05-17 13:54:06Tags: EMAATR

Overview

This strategy determines bull or bear markets based on the number of consecutive up or down candles and makes trades accordingly. When the closing price is consecutively higher than the previous candle’s close for a specified number of times, it enters a long position; when the closing price is consecutively lower than the previous candle’s close for a specified number of times, it enters a short position. Stop loss and take profit are set, and a trailing stop mechanism is introduced to protect profits.

Strategy Principle

- Record the number of times the consecutive bullish and bearish conditions are met. If the close is higher than the previous candle, the bullish count increases by 1 and the bearish count resets to 0; if the close is lower, the bearish count increases by 1 and the bullish count resets to 0; otherwise, both counts reset to 0.

- When the bullish count reaches the specified number k, enter a long position with stop loss and take profit.

- For long positions, record the highest price after entry. When the highest price exceeds the entry price by iTGT minimum price variation units and the close pulls back below the highest price by iPcnt%, close the position.

- When the bearish count reaches the specified number k2, enter a short position with stop loss and take profit.

- For short positions, record the lowest price after entry. When the lowest price is lower than the entry price by iTGT minimum price variation units and the close rebounds above the lowest price by iPcnt%, close the position.

Strategy Advantages

- Simple and easy to understand, making trading decisions based on the continuity of candles with clear logic.

- Introduces a trailing stop mechanism to actively protect profits after the price moves a certain distance in the favorable direction.

- Setting stop loss and take profit can effectively control risks and lock in profits.

- Adjustable parameters to suit different markets and trading styles.

Strategy Risks

- In choppy markets, frequent opening and closing of positions may lead to large slippage costs.

- The judgment of consecutive candle numbers is affected by market noise, which may result in frequent signals.

- Fixed stop loss and take profit levels may not adapt to changes in market volatility.

Strategy Optimization Directions

- Introduce more technical indicators, such as moving averages and volatility, to assist in judging the strength and direction of trends.

- Optimize the trigger conditions for the trailing stop, such as adjusting the pullback percentage based on ATR.

- Adopt more dynamic stop loss and take profit methods, such as trailing stops and stepped take profits.

- Optimize parameters to find the optimal combination for different markets and instruments.

Summary

This strategy captures bull and bear trends through the continuity of candles while setting stop loss and take profit to control risks. The introduction of a trailing stop can better protect profits. However, it may generate frequent signals in choppy markets, requiring further optimization of signal reliability. In addition, the setting of stop loss and take profit can be more flexible to adapt to dynamic market changes. Overall, the strategy has a simple and clear idea, suitable for trending markets, but there is still room for optimization.

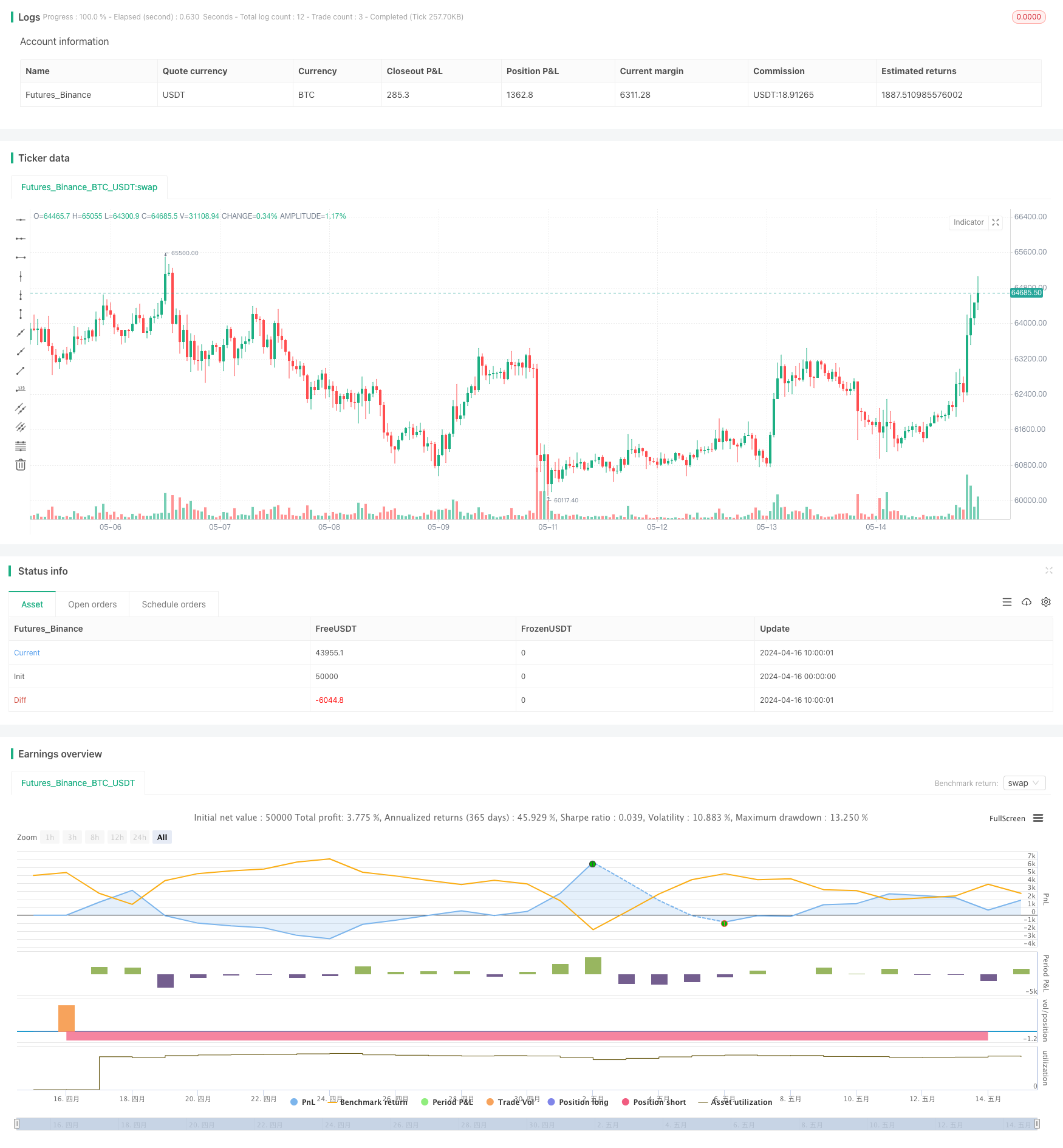

/*backtest

start: 2024-04-16 00:00:00

end: 2024-05-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("K Consecutive Candles 數來寶V2", max_bars_back=300, overlay=true)

// 定義用戶輸入

k = input.int(3, title="Number of Consecutive Candles for Long", minval=1)

k2 = input.int(3, title="Number of Consecutive Candles for Short", minval=1)

stopLossTicks = input.int(500, title="Stop Loss (Ticks)")

takeProfitTicks = input.int(500, title="Take Profit (Ticks)")

iTGT = input.int(200,"iTGT") // 移動停利點

iPcnt = input.int(50,"iPcnt") // 移動停利%

var float TrailValue = 0

var float TrailExit = 0

var float vMP = 0

BarsSinceEntry = ta.barssince(strategy.position_size == 0)

vMP := strategy.position_size

// 创建一个包含键值对的字典

addArrayData(type, value) =>

alert_array = array.new_string()

array.push(alert_array, '"timenow": ' + str.tostring(timenow))

array.push(alert_array, '"seqNum": ' + str.tostring(value))

array.push(alert_array, '"type": "' + type + '"')

alertstring = '{' + array.join(alert_array,', ') + '}'

// 定義條件變量

var int countLong = 0 // 記錄連續多頭條件成立的次數

var int countShort = 0 // 記錄連續空頭條件成立的次數

// 計算連續大於或小於前一根的收盤價格的次數

if close > close[1]

countLong += 1

countShort := 0 // 重置空頭計數

else if close < close[1]

countShort += 1

countLong := 0 // 重置多頭計數

else

countLong := 0

countShort := 0

// 開設多頭倉位條件

if countLong >= k

strategy.entry("Long Entry", strategy.long)

strategy.exit("Exit Long", "Long Entry", loss=stopLossTicks, profit=takeProfitTicks)

if vMP>0

TrailValue := ta.highest(high,BarsSinceEntry)

TrailExit := TrailValue - iPcnt*0.01*(TrailValue - strategy.position_avg_price)

if TrailValue > strategy.position_avg_price + iTGT * syminfo.minmove/syminfo.pricescale and close < TrailExit

strategy.close("Long Entry", comment = "Trl_LX"+ str.tostring(close[0]))

// 開設空頭倉位條件

if countShort >= k2

strategy.entry("Short Entry", strategy.short)

strategy.exit("Exit Short", "Short Entry", loss=stopLossTicks, profit=takeProfitTicks)

if vMP<0

TrailValue := ta.lowest(low,BarsSinceEntry)

TrailExit := TrailValue - iPcnt*0.01*(TrailValue - strategy.position_avg_price)

if TrailValue < strategy.position_avg_price - iTGT * syminfo.minmove/syminfo.pricescale and close > TrailExit

strategy.close("short60", comment = "Trl_SX"+ str.tostring(close[0]))

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- G-Trend EMA ATR Intelligent Trading Strategy

- EMA Dynamic Trend Following Trading Strategy

- Enhanced Multi-Indicator Momentum Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Triple EMA Crossover Strategy

- Keltner Channels EMA ATR Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Supertrend and EMA Combination Strategy

- Multi-EMA Cross with Oscillator and Dynamic Support/Resistance Trading Strategy

- Alligator Long-Term Trend Following Trading Strategy

- Multi-timeframe Trend Tracking Strategy Based on Impulse MACD and Dual Moving Average Crossover

- EMA5 and EMA13 Crossover Strategy

- EMA SAR Medium-to-Long-Term Trend Following Strategy

- Reverse Volatility Breakout Strategy

- Nifty 50 3-Minute Opening Range Breakout Strategy

- Dynamic Stop Loss and Take Profit Bollinger Bands Strategy

- Improved Swing High/Low Breakout Strategy with Bullish and Bearish Engulfing Patterns

- Laguerre RSI with ADX Filtered Trading Signals Strategy

- Price and Volume Breakout Buy Strategy

- Super Moving Average and Upperband Crossover Strategy

- Multi-factor Trend Following Quantitative Trading Strategy Based on RSI, ADX, and Ichimoku Cloud

- RSI and MACD Combined Long-Short Strategy

- Ichimoku Cloud and Moving Average Strategy

- William Alligator Moving Average Trend Catcher Strategy

- Dynamic MACD and Ichimoku Cloud Trading Strategy

- MA Rejection Strategy with ADX Filter

- Bollinger Bands Strategy: Precision Trading for Maximum Gains

- ATR Average Breakout Strategy

- KNN Machine Learning Strategy: Trend Prediction Trading System Based on K-Nearest Neighbors Algorithm