WaveTrend Oscillator Divergence Strategy

Author: ChaoZhang, Date: 2024-05-28 17:43:54Tags: WTVWAP

Overview

This strategy combines the WaveTrend Oscillator (WT) and the Volume Weighted Average Price (VWAP) to capture potential trend reversal opportunities by identifying divergences between price and the indicator. The strategy uses the Average True Range (ATR) to determine stop-loss levels and dynamically adjusts position sizing based on account risk percentage. The main strengths of the strategy lie in its trend-following capabilities and risk management measures, but it may suffer losses in choppy markets. Optimization directions include adding additional filters and improving entry and exit rules.

Strategy Principles

- Calculate the WaveTrend Oscillator (WT): Generate a momentum oscillator by comparing the current price with its channel and average.

- Calculate the Volume Weighted Average Price (VWAP): Compute a moving average price weighted by volume.

- Identify divergences between price and the WT indicator: A potential trend reversal is indicated when price makes a new high/low while the indicator fails to do so.

- Entry conditions: Open a long position when a bullish divergence is identified; close the position when a bearish divergence is identified.

- Stop-loss: Set dynamic stop-loss levels based on the Average True Range (ATR).

- Position sizing: Dynamically adjust the position size for each trade based on the account risk percentage and stop-loss distance.

- Background color: Change the background color based on the overbought/oversold levels of the indicator, providing additional visual cues.

Advantages Analysis

- Trend following: By identifying divergences between price and the indicator, the strategy can capture potential trend reversal opportunities.

- Risk management: The use of ATR-based dynamic stop-losses and position sizing based on risk percentage helps control potential losses.

- Visual cues: The background color changes based on the overbought/oversold state of the indicator, providing additional visual signals to traders.

- Flexibility: The strategy’s parameters (e.g., channel length, average length, overbought/oversold levels) can be adjusted to suit different market conditions and trading styles.

Risk Analysis

- Choppy markets: In market conditions lacking clear trends, the strategy may suffer consecutive losses.

- Parameter optimization: The strategy’s performance largely depends on the choice of parameters, and suboptimal parameter settings may lead to subpar results.

- Overtrading: Frequent entry and exit signals may result in high trading costs, affecting the overall performance of the strategy.

Optimization Directions

- Trend filters: Introduce additional trend confirmation indicators (e.g., moving averages) when divergences occur to filter out potential false signals.

- Dynamic parameters: Adjust indicator parameters based on market volatility, using shorter channel and average lengths during low volatility and longer parameters during high volatility.

- Take-profit: Introduce dynamic take-profit levels based on risk-reward ratios or target prices to better manage profitable positions.

- Long/short filters: Filter trading signals based on the overall market trend direction (e.g., long-term moving averages) to only trade in the direction of the trend.

Summary

The WaveTrend Oscillator Divergence Strategy combines the WaveTrend indicator and the Volume Weighted Average Price to identify potential trend reversal opportunities. The strategy’s strengths lie in its trend-following capabilities and risk management measures, but it may face risks in choppy markets. The strategy can be further optimized by introducing additional filters, dynamic parameter adjustments, and improved entry and exit rules. Thorough backtesting and forward-looking analysis are crucial before implementing the strategy.

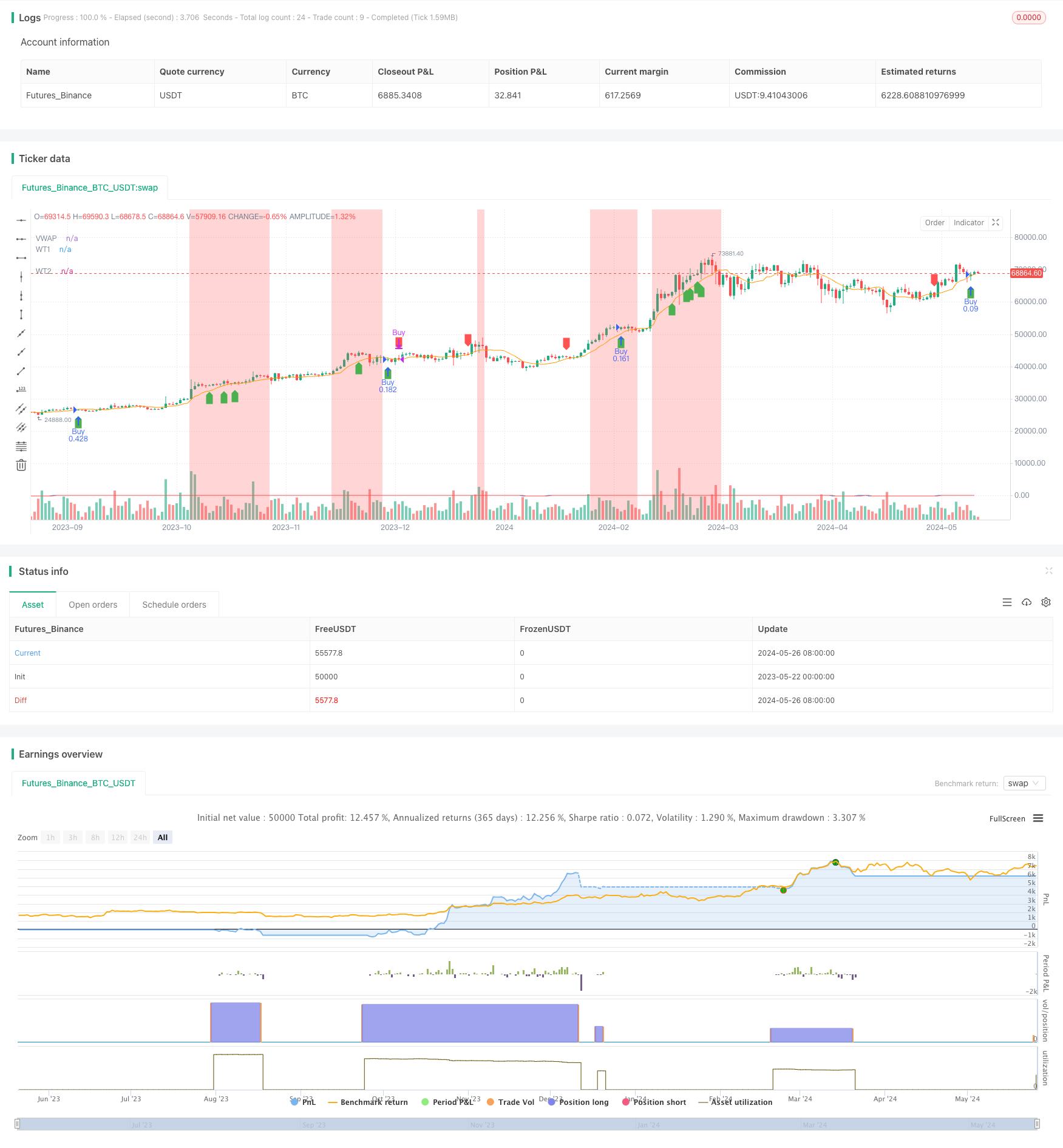

/*backtest

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("PipShiesty Swagger", overlay=true)

// WaveTrend Oscillator (WT)

n1 = input.int(10, "Channel Length")

n2 = input.int(21, "Average Length")

obLevel1 = input.float(60.0, "Overbought Level 1")

obLevel2 = input.float(53.0, "Overbought Level 2")

osLevel1 = input.float(-60.0, "Oversold Level 1")

osLevel2 = input.float(-53.0, "Oversold Level 2")

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

// VWAP

vwap = ta.vwma(close, n1)

// Signal Line

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Bullish and Bearish Divergences

bullishDivergence = (ta.lowest(close, 5) > ta.lowest(close[1], 5)) and (wt1 < wt1[1]) and (close > close[1])

bearishDivergence = (ta.highest(close, 5) < ta.highest(close[1], 5)) and (wt1 > wt1[1]) and (close < close[1])

// Plot WaveTrend Oscillator

plot(wt1, title="WT1", color=color.blue)

plot(wt2, title="WT2", color=color.red)

// Plot Divergences

plotshape(series=bullishDivergence, location=location.belowbar, color=color.green, style=shape.labelup, title="Bullish Divergence")

plotshape(series=bearishDivergence, location=location.abovebar, color=color.red, style=shape.labeldown, title="Bearish Divergence")

// Risk Management Parameters

riskPercentage = input.float(1, title="Risk Percentage per Trade", minval=0.1, step=0.1) / 100

stopLossATR = input.float(1.5, title="Stop Loss ATR Multiplier", minval=0.5, step=0.1)

// ATR Calculation

atr = ta.atr(14)

// Position Size Calculation

calculatePositionSize(stopLoss) =>

riskAmount = strategy.equity * riskPercentage

positionSize = riskAmount / stopLoss

positionSize

// Entry and Exit Logic with Stop Loss

if bullishDivergence

stopLoss = low - atr * stopLossATR

positionSize = calculatePositionSize(close - stopLoss)

strategy.entry("Buy", strategy.long, qty=positionSize)

strategy.exit("Sell", from_entry="Buy", stop=stopLoss)

if bearishDivergence

strategy.close("Buy")

// Plot VWAP

plot(vwap, title="VWAP", color=color.orange)

// Background color to indicate Overbought/Oversold conditions

bgcolor(wt1 > obLevel1 ? color.new(color.red, 90) : na, title="Overbought Level 1")

bgcolor(wt1 < osLevel1 ? color.new(color.green, 90) : na, title="Oversold Level 1")

bgcolor(wt1 > obLevel2 ? color.new(color.red, 70) : na, title="Overbought Level 2")

bgcolor(wt1 < osLevel2 ? color.new(color.green, 70) : na, title="Oversold Level 2")

- Technical Trading Strategy for BTC 15-minute Chart

- VWAP Crossover Dynamic Profit Target Trading Strategy

- VWAP and RSI Crossover Strategy

- Multi-Period EMA Crossover with VWAP High Win-Rate Intraday Trading Strategy

- VWAP and Super Trend Buy/Sell Strategy

- VWAP Trading Strategy

- Buy and Sell Volume Heatmap with Real-Time Price Strategy

- VWAP-ATR Trend Following and Price Reversal Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- Intelligent Institutional Trading Structure Momentum Strategy

- Keltner Channels EMA ATR Strategy

- MA MACD BB Multi-Indicator Trading Strategy Backtesting Tool

- RSI+Supertrend Trend-Following Trading Strategy

- Ichimoku Kumo Trading Strategy

- Dynamic ATR Stop Loss and Take Profit Moving Average Crossover Strategy

- EMA Trend Momentum Candlestick Pattern Strategy

- G-Channel Trend Detection Strategy

- Moving Average Crossover with Trailing Stop Loss Strategy

- EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

- Bollinger Bands and EMA Trend Following Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Hybrid Binomial Z-Score Quantitative Strategy

- RSI and MA Combination Strategy

- EMA Momentum Trading Strategy

- FVG Momentum Scalping Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Trend Following with Breakout and Frequency Filter (Long Only)

- Fibonacci Golden Harmony Breakout Strategy

- Dynamic Market Regime Identification Strategy Based on Linear Regression Slope

- Trend Reversal Trading Strategy Based on RSI Divergence