Dynamic ATR Stop Loss and Take Profit Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-05-29 17:19:21Tags: SMAATRMA

Overview

This strategy is a quantitative trading strategy based on moving average crossovers and dynamic ATR stop loss and take profit. The strategy uses two simple moving averages (SMAs) with different periods to generate trading signals while employing the Average True Range (ATR) to dynamically set stop loss and take profit levels for better risk control. Additionally, the strategy filters trading signals based on different trading sessions to improve its robustness.

Strategy Principles

The core principle of this strategy is to capture changes in price trends using moving average crossovers. When the fast moving average crosses above the slow moving average, a buy signal is generated; conversely, when the fast moving average crosses below the slow moving average, a sell signal is generated. Simultaneously, the strategy uses ATR to dynamically set stop loss and take profit levels. The take profit level is set at the entry price plus 3 times the ATR, while the stop loss level is set at the entry price minus 1.5 times the ATR. Furthermore, the strategy only generates trading signals during the European trading session to avoid trading during periods of low liquidity.

Strategy Advantages

- Simplicity: The strategy uses common technical indicators such as simple moving averages and ATR, making it easy to understand and implement.

- Dynamic risk control: By dynamically setting stop loss and take profit levels, the strategy can adaptively control risk based on market volatility.

- Time filtering: By limiting the trading session, the strategy can avoid trading during periods of low liquidity, enhancing its robustness.

Strategy Risks

- Parameter optimization risk: The strategy’s performance depends on the selection of moving average periods and the ATR calculation period. Different parameter settings may lead to significant differences in strategy performance, posing the risk of parameter optimization.

- Trend recognition risk: Moving average crossover strategies may generate numerous false signals in choppy markets, resulting in poor performance.

- Stop loss risk: Although the strategy sets dynamic stop loss levels, significant losses may still occur during severe market fluctuations.

Strategy Optimization Directions

- Signal filtering: Consider introducing other technical indicators or market sentiment indicators to further filter trading signals and improve signal quality.

- Dynamic parameter optimization: Utilize machine learning or adaptive algorithms to dynamically adjust strategy parameters to adapt to different market states.

- Risk management optimization: Incorporate more advanced risk management techniques, such as volatility adjustment and dynamic capital allocation, to further control strategy risk.

Summary

This strategy is a simple and easy-to-understand trend-following strategy that captures price trends using moving average crossovers while controlling risk with ATR. Although the strategy has certain risks, it can be further improved through parameter optimization, signal filtering, and risk management enhancements. For beginners, this strategy serves as an excellent learning and practice example.

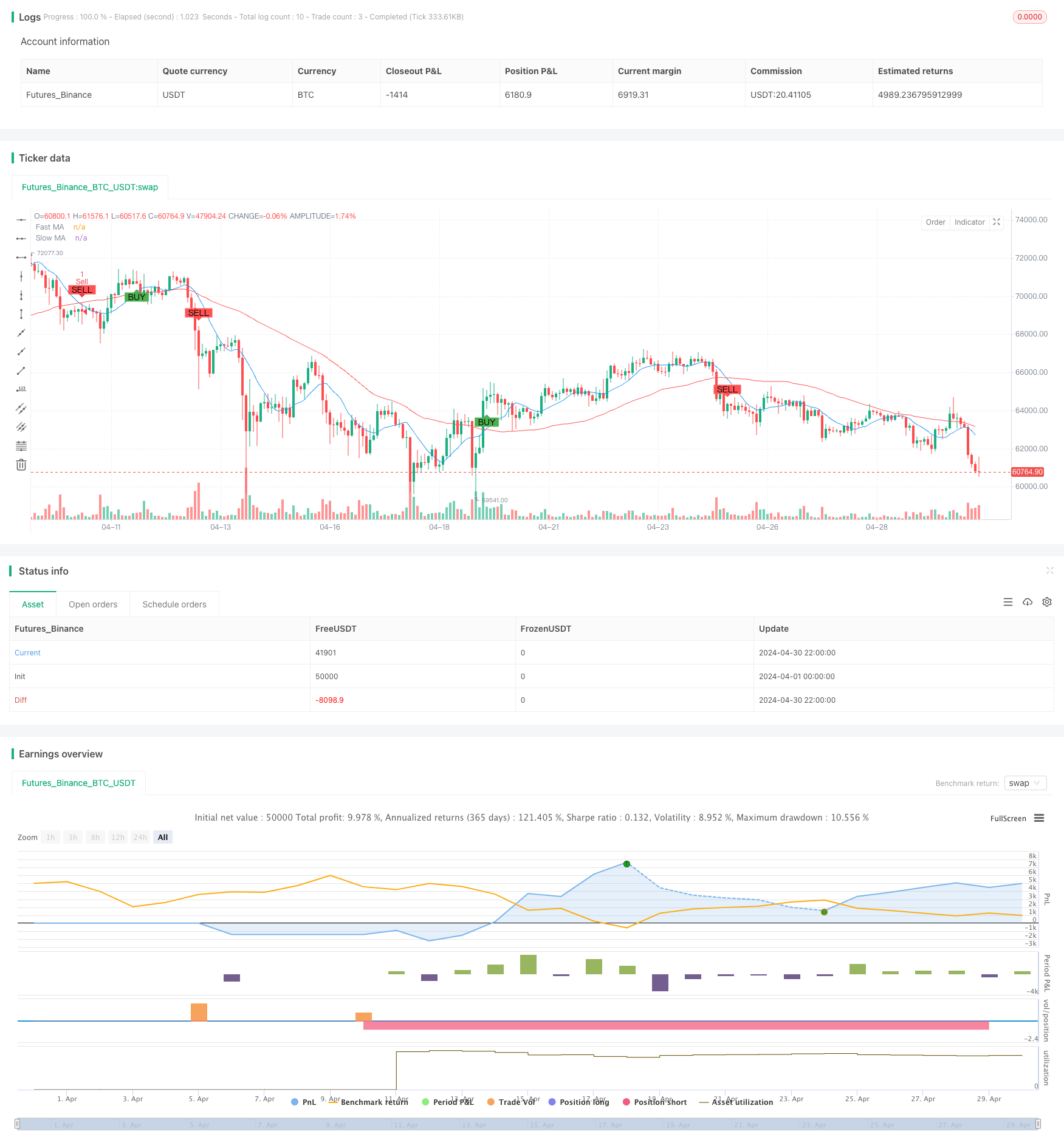

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced Moving Average Crossover Strategy", overlay=true)

// Input parameters

fastLength = input(10, title="Fast MA Length")

slowLength = input(50, title="Slow MA Length")

atrLength = input(14, title="ATR Length")

riskPerTrade = input(1, title="Risk Per Trade (%)") / 100

// Time-based conditions

isLondonSession = hour >= 8 and hour <= 15

isAsianSession = hour >= 0 and hour <= 7

isEuropeanSession = hour >= 7 and hour <= 14

// Moving Averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Average True Range (ATR) for dynamic stop loss and take profit

atr = ta.atr(atrLength)

// Buy and Sell Conditions

buySignal = ta.crossover(fastMA, slowMA)

sellSignal = ta.crossunder(fastMA, slowMA)

// Dynamic stop loss and take profit

stopLoss = close - atr * 1.5

takeProfit = close + atr * 3

// Strategy Logic

if (buySignal and isEuropeanSession)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=takeProfit, stop=stopLoss)

if (sellSignal and isEuropeanSession)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=takeProfit, stop=stopLoss)

// Plotting

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- Triple Bottom Rebound Momentum Breakthrough Strategy

- ATR Volatility and Moving Average Based Adaptive Trend Following Exit Strategy

- High/Low Breakout Strategy with Alpha Trend and Moving Average Filter

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Dynamic Volatility-Adjusted Trend Following Strategy Based on DI Indicators with ATR Stop Management

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Enhanced Price-Volume Trend Momentum Strategy

- Multi-Timeframe SMA Trend Following Strategy with Dynamic Stop Loss

- Bollinger Bands Accurate Entry And Risk Control Strategy

- Bollinger Bands + RSI + Stochastic RSI Strategy Based on Volatility and Momentum Indicators

- TURTLE-ATR Bollinger Bands Breakout Strategy

- VWAP and Super Trend Buy/Sell Strategy

- Advanced MACD Strategy with Limited Martingale

- Keltner Channels EMA ATR Strategy

- MA MACD BB Multi-Indicator Trading Strategy Backtesting Tool

- RSI+Supertrend Trend-Following Trading Strategy

- Ichimoku Kumo Trading Strategy

- EMA Trend Momentum Candlestick Pattern Strategy

- G-Channel Trend Detection Strategy

- Moving Average Crossover with Trailing Stop Loss Strategy

- EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

- Bollinger Bands and EMA Trend Following Strategy

- WaveTrend Oscillator Divergence Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Hybrid Binomial Z-Score Quantitative Strategy

- RSI and MA Combination Strategy

- EMA Momentum Trading Strategy