EMA and Bollinger Bands Breakout Strategy

Author: ChaoZhang, Date: 2024-06-03 16:23:06Tags: EMABB

Overview

This strategy utilizes the 5-day Exponential Moving Average (EMA) and Bollinger Bands (BB) to identify potential trading opportunities in the market. When the price breaks out above the upper Bollinger Band or below the lower Bollinger Band, and specific conditions are met, the strategy generates buy or sell signals. The strategy aims to capture significant price movements in the market while using stop loss and target price levels to manage risk and maximize returns.

Strategy Principles

The core of this strategy is to use the 5-day EMA and Bollinger Bands to determine market trends and volatility. When the price breaks above the upper Bollinger Band, and the previous candle’s high is above the 5-day EMA, the strategy generates a sell signal. Conversely, when the price breaks below the lower Bollinger Band, and the previous candle’s low is below the 5-day EMA, the strategy generates a buy signal. This approach helps identify potential trend reversals or breakout points.

Once a trade is entered, the strategy sets a stop loss level and a target price level. The stop loss is placed in the opposite direction of the entry price to limit potential losses. The target price level is calculated based on a fixed number of points (e.g., 1000 points) to lock in expected profits. If the price reaches the stop loss level or the target price level, the strategy closes the trade and exits the position.

Strategy Advantages

- By using both EMA and Bollinger Bands, the strategy provides a more comprehensive assessment of market trends and volatility.

- Clear entry conditions help identify high-probability trading opportunities.

- Setting stop loss and target price levels effectively manages risk and locks in profits.

- The strategy logic is straightforward and easy to understand and implement.

Strategy Risks

- During periods of increased market volatility, Bollinger Bands may generate frequent trading signals, leading to over-trading and increased transaction costs.

- In choppy or trendless markets, the strategy may generate false signals, resulting in losses.

- Fixed stop loss and target price levels may not adapt well to different market conditions, limiting the strategy’s flexibility.

Strategy Optimization Directions

- Consider using adaptive stop loss and target price levels that dynamically adjust based on market volatility and trend strength to improve the strategy’s adaptability.

- Introduce additional technical indicators or signal filtering mechanisms, such as the Relative Strength Index (RSI) or Average True Range (ATR), to confirm trends and reduce false signals.

- Optimize the parameters, such as adjusting the EMA period, Bollinger Bands’ standard deviation multiplier, etc., to suit different market characteristics and trading instruments.

Summary

The EMA and Bollinger Bands Breakout Strategy leverages two commonly used technical indicators to capture significant price movements in the market. The strategy has clear entry conditions, risk management measures, and profit targets, making it easy to understand and implement. However, the strategy’s performance may be influenced by market volatility and trendless conditions. By introducing adaptive parameters, signal filtering mechanisms, and parameter optimization, the strategy’s robustness and profitability can be further enhanced.

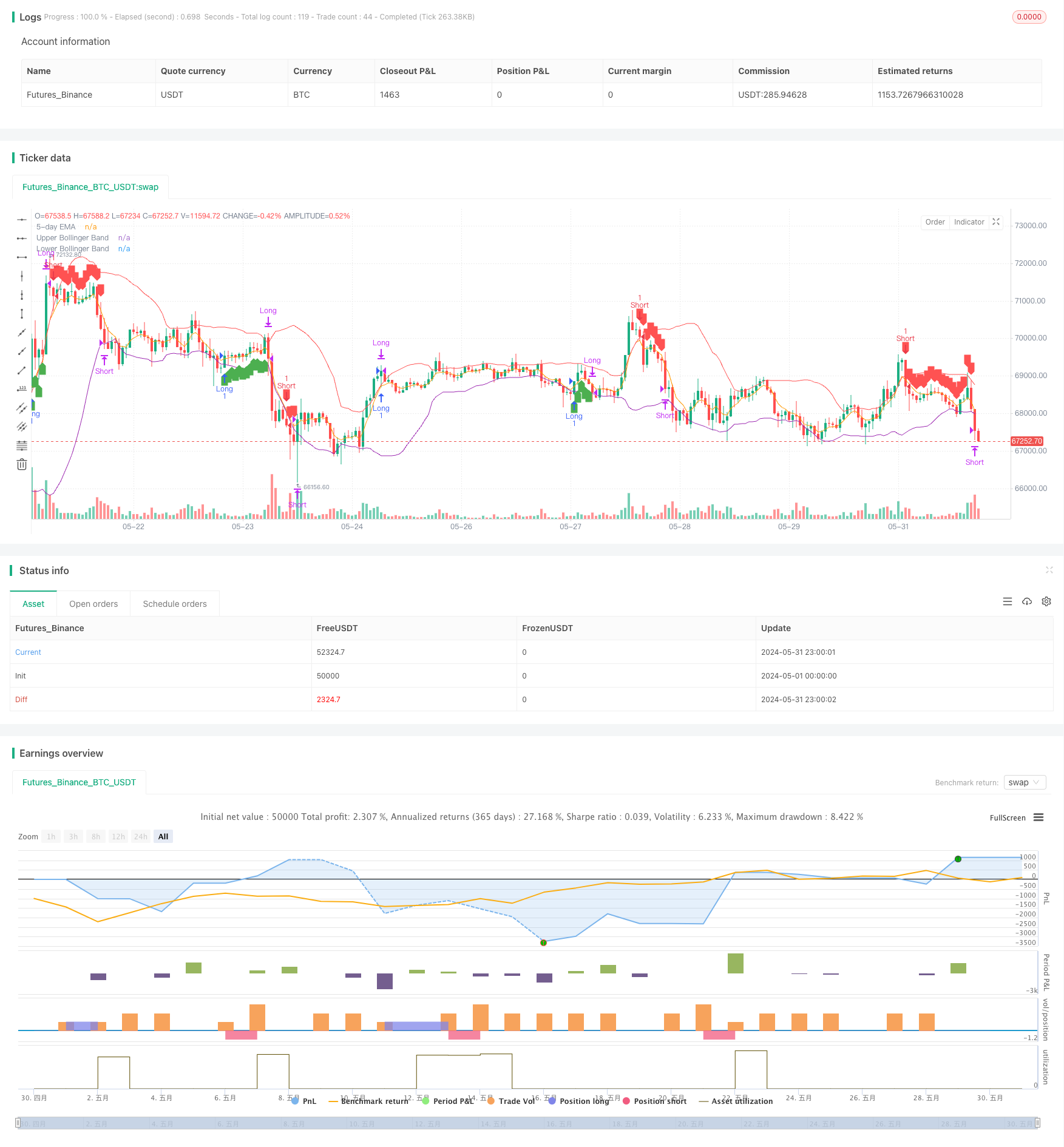

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Nifty Bank Strategy", overlay=true)

// Parameters

lengthEMA = 5

lengthBB = 20

multBB = 1.5

targetPoints = 1000

// Calculate 5-day EMA

ema5 = ta.ema(close, lengthEMA)

// Calculate Bollinger Bands (length 20, multiplier 1.5)

basis = ta.sma(close, lengthBB)

dev = multBB * ta.stdev(close, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Define strategy variables

var float entryPrice = na

var float stopLoss = na

var float targetPrice = na

var bool inTrade = false

var bool isLong = false

var float triggerHigh = na

var float triggerLow = na

var float triggerClose = na

if not inTrade

// Short Entry Trigger Condition

if low > ema5 and low > upperBB and high > upperBB

triggerLow := low

triggerHigh := high

triggerClose := close

label.new(bar_index, high, "Waiting for short trigger", color=color.yellow)

// Long Entry Trigger Condition

else if high < ema5 and high < lowerBB and low < lowerBB

triggerHigh := high

triggerLow := low

triggerClose := close

label.new(bar_index, low, "Waiting for long trigger", color=color.yellow)

// Check for Short Entry

if not inTrade and na(triggerClose) == false and close < triggerClose

if low < triggerLow

entryPrice := close

stopLoss := triggerHigh

targetPrice := entryPrice - targetPoints

strategy.entry("Short", strategy.short)

label.new(bar_index, high, "Short", color=color.red, style=label.style_label_down)

inTrade := true

isLong := false

triggerLow := na

triggerHigh := na

triggerClose := na

// Check for Long Entry

if not inTrade and na(triggerClose) == false and close > triggerClose

if high > triggerHigh

entryPrice := close

stopLoss := triggerLow

targetPrice := entryPrice + targetPoints

strategy.entry("Long", strategy.long)

label.new(bar_index, low, "Long", color=color.green, style=label.style_label_up)

inTrade := true

isLong := true

triggerLow := na

triggerHigh := na

triggerClose := na

// Manage Short Trade

if inTrade and not isLong

if high >= stopLoss

strategy.close("Short", comment="SL Hit")

label.new(bar_index, high, "SL Hit", color=color.red, style=label.style_label_down)

inTrade := false

else if low <= targetPrice

strategy.close("Short", comment="Target Hit")

label.new(bar_index, low, "Target Hit", color=color.green, style=label.style_label_up)

inTrade := false

// Manage Long Trade

if inTrade and isLong

if low <= stopLoss

strategy.close("Long", comment="SL Hit")

label.new(bar_index, low, "SL Hit", color=color.red, style=label.style_label_down)

inTrade := false

else if high >= targetPrice

strategy.close("Long", comment="Target Hit")

label.new(bar_index, high, "Target Hit", color=color.green, style=label.style_label_up)

inTrade := false

// Plotting

plot(ema5, color=color.orange, title="5-day EMA")

plot(upperBB, color=color.red, title="Upper Bollinger Band")

plot(lowerBB, color=color.purple, title="Lower Bollinger Band")

// Plot trade entry and exit points

plotshape(series=inTrade and isLong ? entryPrice : na, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=inTrade and not isLong ? entryPrice : na, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

- Multi-Indicator Trend Breakout Quantitative Trading Strategy

- Bollinger Bands and Exponential Moving Average Crossover Trading Strategy

- EMA Crossover with Bollinger Bands Double Entry Strategy: A Quantitative Trading System Combining Trend Following and Volatility Breakout

- Multi-Technical Indicator Based Mean Reversion and Trend Following Strategy

- Dynamic Risk-Managed EMA Crossover with Bollinger Bands Strategy

- Multi-Order Breakout Trend Following Strategy

- Multi-Factor Counter-Trend Trading Strategy

- Mean Reversion Bollinger Band Dollar-Cost Averaging Investment Strategy

- MACD BB Breakout Strategy

- Bollinger Bands and EMA Trend Following Strategy

- Dynamic Timeframe High-Low Breakout Strategy

- Dynamic Trend Following Strategy

- Smooth Moving Average Stop Loss & Take Profit Strategy with Trend Filter and Exception Exit

- MACD Convergence Strategy with R:R, Daily Limits, and Tighter Stop Loss

- Starlight Moving Average Crossover Strategy

- Percentage Threshold Quantitative Trading Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- MACD and Supertrend Combination Strategy

- Buy/Sell Strategy Based on Volume & Candlestick Patterns

- SMA Trend Following Strategy with Trailing Stop-Loss and Disciplined Re-Entry

- CDC Action Zone Trading Bot Strategy with ATR for Take Profit and Stop Loss

- Continuous Candle Based Dynamic Grid Adaptive Moving Average with Dynamic Stop Loss Strategy

- MA Cross Strategy

- Trend-Following Trading Strategy with Momentum Filtering

- RSI and Linear Regression Channel Trading Strategy

- Double Vegas Channel Volatility-Adjusted SuperTrend Quantitative Trading Strategy

- EMA RSI Crossover Strategy

- Moving Average Convergence Momentum Cloud Strategy

- Dual Moving Average Crossover Stop Loss and Take Profit Strategy

- TEMA Dual Moving Average Crossover Strategy