TSI Crossover Strategy

Author: ChaoZhang, Date: 2024-06-07 16:36:24Tags: TSIEMAATRTEMA

Overview

This strategy uses the TSI indicator as the main trading signal. When the TSI indicator crosses its signal line, and the TSI indicator is below the lower limit or above the upper limit, the strategy will generate an open position signal. At the same time, the strategy also uses indicators such as EMA and ATR to optimize strategy performance. The strategy only runs within specific trading sessions and sets a minimum trading frequency to control overtrading.

Strategy Principle

- Calculate the TSI indicator value and signal line value.

- Determine whether the current time is within the allowable trading range, and the current bar is at least the specified minimum number of bars away from the last trade.

- If the TSI indicator crosses above the signal line from below, and the signal line is below the specified lower limit, a long signal is generated.

- If the TSI indicator crosses below the signal line from above, and the signal line is above the specified upper limit, a short signal is generated.

- If currently holding a long position, once the TSI indicator crosses below the signal line from above, close all long positions.

- If currently holding a short position, once the TSI indicator crosses above the signal line from below, close all short positions.

Advantage Analysis

- The strategy logic is clear, using the cross of the TSI indicator as the only condition for opening and closing positions, which is simple and easy to understand.

- By limiting the trading session and trading frequency, the risk of overtrading is effectively controlled.

- Timely stop loss and stop profit, once a opposite signal appears, decisively close the position, controlling the risk exposure of a single transaction.

- Multiple indicators are used to assist in judgment, such as EMA, ATR, etc., enhancing the robustness of the strategy.

Risk Analysis

- The strategy is quite sensitive to the selection of TSI indicator parameters, and different parameters will bring large performance differences, which need to be chosen carefully.

- The opening and closing conditions are relatively simple, lacking trend judgment and volatility constraints, and may result in losses in oscillating markets.

- Lack of position management and fund management, it is difficult to control the drawdown, once a continuous loss will lead to a large drawdown.

- Only doing long-short reversal, not trend tracking, will miss many trend opportunities.

Optimization Direction

- Optimize the parameters of the TSI indicator to find a more robust parameter combination. Automatic optimization methods such as genetic algorithms can be used.

- Add trend judgment indicators, such as MA or MACD, to select the trend direction when opening a position to improve the success rate.

- Add volatility indicators, such as ATR, to reduce the number of trades in high volatility market environments.

- Introduce a position management model to dynamically adjust the position size of each trade based on recent market performance and account net value.

- Trend tracking logic can be added to continue holding positions in trend market to improve the strategy’s ability to capture big trends.

Summary

This strategy is based on the TSI indicator and generates trading signals through the cross of TSI and its signal line. At the same time, it limits the trading time and frequency to control risks. The advantage of the strategy is that the logic is simple and clear, and it stops loss and profit in a timely manner. However, the disadvantage is the lack of trend judgment and position management, sensitivity to TSI parameters, and can only capture reversal market while missing trend market. In the future, the strategy can be improved from aspects such as trend and volatility judgment, position management, and parameter optimization.

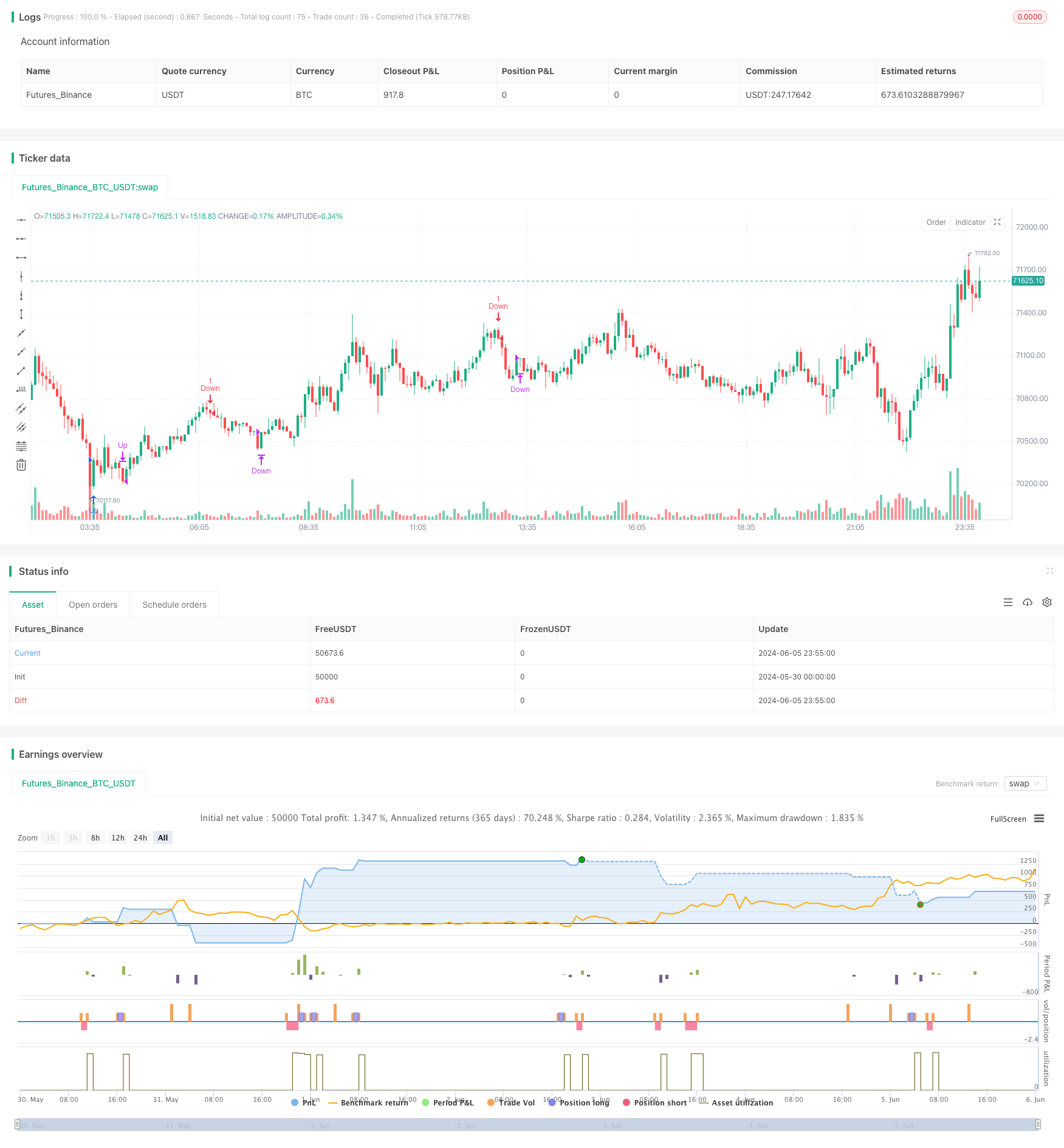

/*backtest

start: 2024-05-30 00:00:00

end: 2024-06-06 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nikgavalas

//@version=5

strategy("TSI Entries", overlay=true, margin_long=100, margin_short=100)

//

// INPUTS

//

// Define the start and end hours for trading

string sessionInput = input("1000-1530", "Session")

// Day of the week.

string daysInput = input.string("23456", tooltip = "1 = Sunday, 7 = Saturday")

// Minimum number of bar's between entries

requiredBarsBetweenEntries = input.int(12, "Required Bars Between Entries")

// Show debug labels

bool showDebugLabels = input.bool(false, "Show Debug Labels")

//

// FUNCTIONS

//

//@function Define the triple exponential moving average function

tema(src, len) => tema = 3 * ta.ema(src, len) - 3 * ta.ema(ta.ema(src, len), len) + ta.ema(ta.ema(ta.ema(src, len), len), len)

//@function Atr with EMA

atr_ema(length) =>

trueRange = na(high[1])? high-low : math.max(math.max(high - low, math.abs(high - close[1])), math.abs(low - close[1]))

//true range can be also calculated with ta.tr(true)

ta.ema(trueRange, length)

//@function Check if time is in range

timeinrange() =>

sessionString = sessionInput + ":" + daysInput

inSession = not na(time(timeframe.period, sessionString, "America/New_York"))

//@function Displays text passed to `txt` when called.

debugLabel(txt, color, y, style) =>

if (showDebugLabels)

label.new(bar_index, y, text = txt, color = color, style = style, textcolor = color.black, size = size.small)

//

// INDICATOR CODE

//

long = input(title="TSI Long Length", defval=8)

short = input(title="TSI Short Length", defval=8)

signal = input(title="TSI Signal Length", defval=3)

lowerLine = input(title="TSI Lower Line", defval=-50)

upperLine = input(title="TSI Upper Line", defval=50)

price = close

double_smooth(src, long, short) =>

fist_smooth = ta.ema(src, long)

ta.ema(fist_smooth, short)

pc = ta.change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(math.abs(pc), long, short)

tsiValue = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

signalValue = ta.ema(tsiValue, signal)

//

// COMMON VARIABLES

//

var color trendColor = na

var int lastEntryBar = na

bool tradeAllowed = timeinrange() == true and (na(lastEntryBar) or bar_index - lastEntryBar > requiredBarsBetweenEntries)

//

// CROSSOVER

//

bool crossOver = ta.crossover(tsiValue, signalValue)

bool crossUnder = ta.crossunder(tsiValue,signalValue)

if (tradeAllowed)

if (signalValue < lowerLine and crossOver == true)

strategy.entry("Up", strategy.long)

lastEntryBar := bar_index

else if (signalValue > upperLine and crossUnder == true)

strategy.entry("Down", strategy.short)

lastEntryBar := bar_index

//

// EXITS

//

if (strategy.position_size > 0 and crossUnder == true)

strategy.close("Up", qty_percent = 100)

else if (strategy.position_size < 0 and crossOver == true)

strategy.close("Down", qty_percent = 100)

- Keltner Channels EMA ATR Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- EMA Dynamic Trend Following Trading Strategy

- Triple EMA Crossover Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- K Consecutive Candles Bull Bear Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Enhanced Multi-Indicator Momentum Trading Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Trend Following Strategy Based on 200-Day Moving Average and Stochastic Oscillator

- RSI Trend Strategy

- EMA Crossover Momentum Scalping Strategy

- BB Breakout Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- Chande-Kroll Stop Dynamic ATR Trend Following Strategy

- This strategy generates trading signals based on the Chaikin Money Flow (CMF)

- Trend Filtered Pin Bar Reversal Strategy

- Quantitative Trading Strategy Based on Reversal Patterns at Support and Resistance Levels

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- EMA Dual Moving Average Crossover Strategy

- Williams %R Dynamic TP/SL Adjustment Strategy

- RSI Dynamic Drawdown Stop-Loss Strategy

- VWAP Trading Strategy with Volume Anomaly Detection

- Supertrend and EMA Combination Strategy

- TGT Falling Buy Strategy Based on Price Decline

- Dual Trend Strategy with EMA Crossover and RSI Filter

- EMA and Parabolic SAR Combination Strategy

- MACD and RSI Multi-Filter Intraday Trading Strategy

- Price Relationship-based Arbitrage Trading Strategy Between Two Markets