Volatility Range Trading Strategy Based on Stochastic Oscillator

Author: ChaoZhang, Date: 2024-06-17 14:52:10Tags: ATR

Overview

This strategy utilizes the Stochastic Oscillator to identify overbought and oversold market conditions, triggering trades with predefined risk and reward parameters to capitalize on price fluctuations within a volatile trading range. The main idea behind this strategy is to buy at the low end of the trading range and sell at the high end, while strictly controlling risk.

Strategy Logic

- When the Stochastic Oscillator crosses below the oversold level (20), the strategy enters a long position; when it crosses above the overbought level (80), the strategy enters a short position.

- Stop-loss and take-profit levels are set based on 2x the Average True Range (ATR), and each trade risks 1% of the account equity.

- To prevent overtrading, the strategy enforces a minimum of 20 bars between each trade, allowing for a cool-down period and avoiding whipsaws.

Strategy Advantages

- The strategy can capture price fluctuations within a volatile trading range, buying at the low points and selling at the high points to potentially profit.

- It employs strict risk management measures, including ATR-based stop-loss and take-profit levels and a fixed 1% risk per trade, which helps control drawdowns and single-trade losses.

- By setting a minimum interval between trades (20 bars), the strategy avoids frequent trading and being fooled by market noise.

- The strategy logic is clear, easy to understand, and implement, making it suitable for application in various market environments.

Strategy Risks

- The success of the strategy largely depends on correctly identifying the trading range; if the range is misidentified, it may lead to losing trades.

- If the market breaks out of the trading range and forms a trend, the strategy may miss out on trend-following opportunities.

- Despite the risk management measures in place, the strategy may still experience losses exceeding expectations under extreme market conditions.

- The strategy parameters (e.g., overbought/oversold levels, ATR multiple) need to be optimized for different market conditions; inappropriate parameters may lead to poor performance.

Strategy Optimization Directions

- Consider combining other technical indicators (e.g., MACD, RSI) to confirm trading signals and improve signal reliability.

- Introduce dynamic stop-loss and take-profit mechanisms, such as adjusting the stop-loss level as the price moves in a favorable direction, to potentially achieve higher returns.

- For trading range identification, explore using more advanced techniques, such as machine learning algorithms, to improve accuracy.

- In trending markets, consider introducing a trend filter to avoid trading against the trend.

Summary

The volatility range trading strategy based on the Stochastic Oscillator attempts to capitalize on the oscillator’s overbought and oversold signals within a predefined trading range. The strategy controls risk through strict risk management and trade intervals. While the strategy has certain advantages, its success largely depends on correctly identifying the trading range. Future optimization directions include combining other technical indicators, introducing dynamic stop-loss and take-profit levels, using more advanced range identification techniques, and adding a trend filter. When applying the strategy in practice, be sure to adjust the parameters and risk management rules according to personal preferences and risk tolerance.

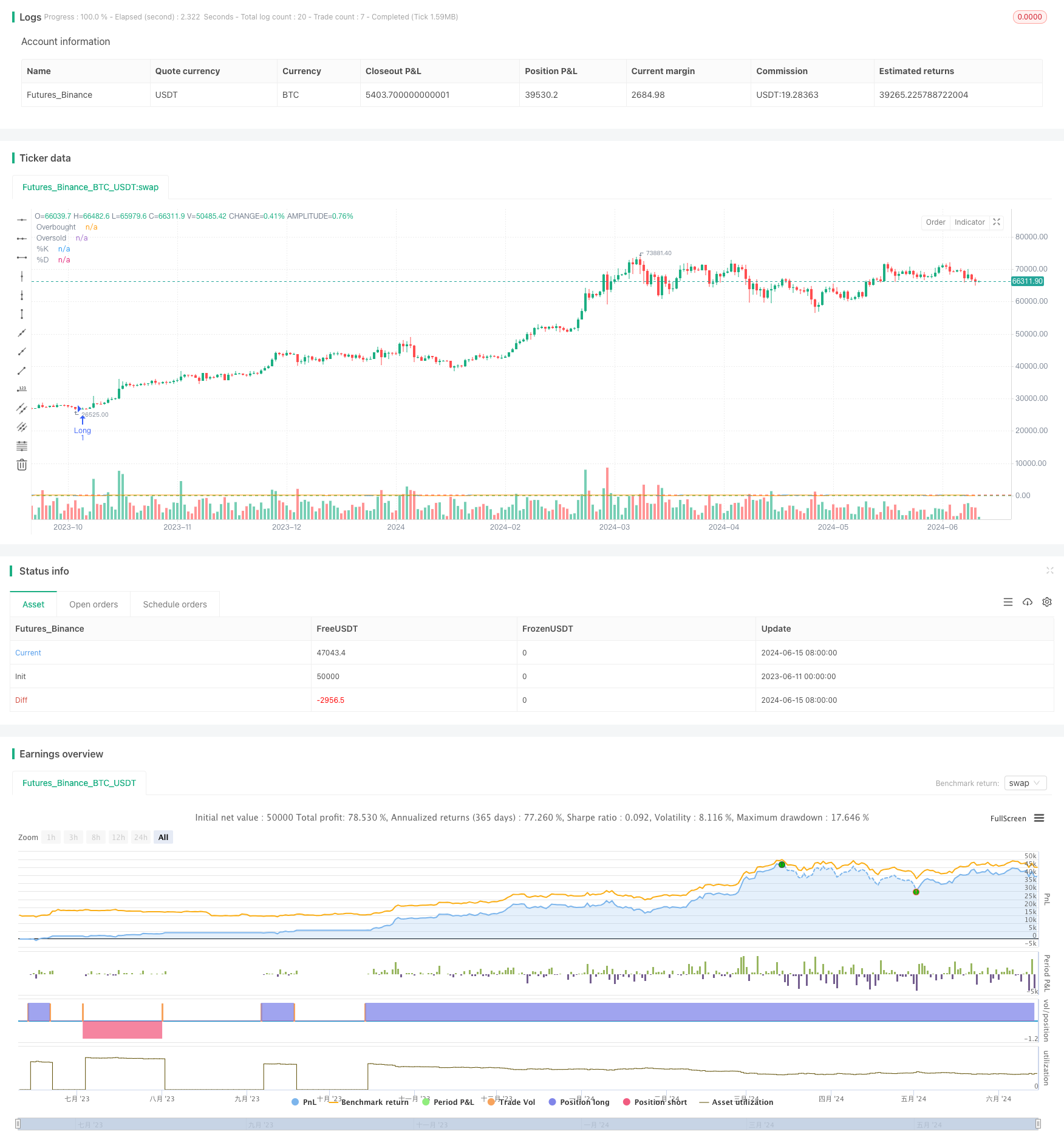

/*backtest

start: 2023-06-11 00:00:00

end: 2024-06-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Range Trading with Stochastic", overlay=true)

// Input Parameters

overboughtLevel = input.int(80, title="Overbought Level", minval=1, maxval=100)

oversoldLevel = input.int(20, title="Oversold Level", minval=1, maxval=100)

stochLength = input.int(14, title="Stochastic Length", minval=1)

riskPerTrade = input.float(0.01, title="Risk per Trade (%)", minval=0.01, maxval=100, step=0.01)

barsBetweenTrades = input.int(20, title="Bars Between Trades", minval=1)

// Calculate Stochastic Oscillator

k = ta.sma(ta.stoch(close, high, low, stochLength), 3)

d = ta.sma(k, 3)

// Variables to Track Time Since Last Trade

var lastTradeBar = 0

barsSinceLastTrade = bar_index - lastTradeBar

// Risk Management

atr = ta.atr(14)

stopLoss = 2 * atr

takeProfit = 2 * atr

riskAmount = strategy.equity * riskPerTrade / 100

positionSize = 1

// Entry Conditions

longCondition = k < oversoldLevel and strategy.position_size == 0 and barsSinceLastTrade >= barsBetweenTrades

shortCondition = k > overboughtLevel and strategy.position_size == 0 and barsSinceLastTrade >= barsBetweenTrades

// Entry/Exit Orders

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("Long Exit", "Long", stop=close - stopLoss, limit=close + takeProfit)

lastTradeBar := bar_index // Update last trade bar

if shortCondition

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("Short Exit", "Short", stop=close + stopLoss, limit=close - takeProfit)

lastTradeBar := bar_index // Update last trade bar

// Plot Stochastic

plot(k, color=color.blue, title="%K")

plot(d, color=color.orange, title="%D")

hline(overboughtLevel, color=color.red, title="Overbought")

hline(oversoldLevel, color=color.green, title="Oversold")

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Multi-Dimensional Trend Analysis with ATR-Based Dynamic Stop Management Strategy

- Advanced Multi-Indicator Trend Confirmation Trading Strategy

- SMA-Based Intelligent Trailing Stop Strategy with Intraday Pattern Recognition

- Multi-Factor Regression and Dynamic Price Band Quantitative Trading System

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Advanced Dynamic Stop-Loss Strategy Based on Large Candles and RSI Divergence

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Multi-Channel Dynamic Support Resistance Keltner Channel Strategy

- Machine Learning Adaptive SuperTrend Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- Trend Following Adaptive Expected Value Assessment Strategy Based on Crossover Moving Averages

- EMA Bullish Crossover Strategy

- EMA Dynamic Stop-Loss Trading Strategy

- RSI, MACD, Bollinger Bands and Volume-Based Hybrid Trading Strategy

- ZLSMA-Enhanced Chandelier Exit Strategy with Volume Spike Detection

- Short-term Quantitative Trading Strategy Based on Dual Moving Average Crossover, RSI, and Stochastic Indicators

- RSI Low Point Reversal Strategy

- Fisher Transform Dynamic Threshold Trend Following Strategy

- Mean Reversion Strategy

- EMA100 and NUPL Relative Unrealized Profit Quantitative Trading Strategy

- Simple Combined Strategy: Pivot Point SuperTrend and DEMA

- EMA Trend Filter Strategy

- Moving Average Crossover Strategy

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- Advanced Entry Strategy based on Moving Average, Support/Resistance, and Volume

- EMA RSI MACD Dynamic Take Profit and Stop Loss Trading Strategy

- G-Trend EMA ATR Intelligent Trading Strategy

- Trend Following Strategy Based on 200-Day Moving Average and Stochastic Oscillator

- RSI Trend Strategy

- EMA Crossover Momentum Scalping Strategy