Overview

This strategy is a short-term trading system based on the crossover of Weighted Moving Averages (WMA) and oversold conditions of the Relative Strength Index (RSI). It focuses on capturing upward market trends by only executing long trades. The strategy utilizes the crossover of 7-period and 9-period WMAs to identify potential trend changes, while incorporating the RSI indicator to confirm if the market is in an oversold state. To effectively manage risk and secure profits, the strategy also incorporates fixed-point Stop Loss (SL) and Take Profit (TP) mechanisms.

The core of this quantitative trading strategy lies in combining technical analysis indicators with risk management tools, aiming to achieve robust trading performance in volatile markets. By focusing solely on long opportunities, the strategy simplifies the decision-making process, potentially reducing the number of false signals. Furthermore, the use of fixed-point SL and TP provides a clear risk-reward framework, contributing to long-term profitability maintenance.

Strategy Principles

Signal Generation:

- The primary signal comes from the 7-period WMA crossing above the 9-period WMA. This indicates strengthening short-term momentum, potentially signaling the start of an uptrend.

- The RSI below 40 condition is used to confirm if the market is in an oversold state, increasing the likelihood of a trend reversal.

Entry Conditions:

- The strategy initiates a long position when the WMA crossover occurs and the RSI is below 40.

- This combination aims to capture potential rebound opportunities in oversold markets.

Risk Management:

- A 20-point stop loss is set immediately upon entry to limit potential losses.

- Simultaneously, a 40-point take profit is set to secure profits and ensure a positive risk-reward ratio.

Exit Mechanism:

- The position is automatically closed when the price hits either the stop loss or take profit level.

- This mechanized exit strategy eliminates emotional factors, ensuring the execution of trading discipline.

Visualization:

- The strategy only displays a “LONG” label on the chart to maintain a clean interface.

- This minimalist approach helps traders focus on important signals without being distracted by excessive indicators.

Strategy Advantages

Combination of Trend Following and Reversal:

- WMA crossover helps capture the early stages of trends.

- RSI oversold condition increases the possibility of trend reversals, potentially improving entry timing accuracy.

Risk Management Optimization:

- Fixed-point SL and TP provide a clear risk-reward framework.

- The 2:1 risk-reward ratio (40-point TP vs 20-point SL) is favorable for long-term profitability.

Simplified Decision-Making Process:

- Long-only strategy reduces decision complexity.

- Clear entry and exit rules minimize subjective judgment, helping maintain trading discipline.

High Adaptability:

- Although designed for a 5-minute timeframe, the strategy logic can easily adapt to other time periods.

Automation Potential:

- Clear rule set makes the strategy easy to program and automate.

Low-Interference Visualization:

- Concise chart markings facilitate quick identification of trading signals.

Strategy Risks

False Breakout Risk:

- WMA crossovers may generate false signals in ranging markets.

- Mitigation: Consider adding additional filters such as volume confirmation or trend strength indicators.

Overtrading:

- Frequent crossovers in highly volatile markets may lead to excessive trading.

- Mitigation: Implement trading frequency limits or add signal confirmation conditions.

Fixed Stop Loss Risk:

- Using fixed-point stop losses may not adapt to changes in market volatility.

- Mitigation: Consider using volatility-based dynamic stop losses, such as ATR multiples.

Limitations of Long-Only Strategy:

- May miss opportunities or incur losses in bear markets or downtrends.

- Mitigation: Consider adding short-selling logic or disabling the strategy during strong downtrends.

Fixed RSI Threshold:

- A fixed RSI oversold threshold may not be applicable to all market conditions.

- Mitigation: Consider using dynamic RSI thresholds or combining with other indicators to confirm oversold conditions.

Strategy Optimization Directions

Dynamic Parameter Adjustment:

- Implement dynamic adjustment of WMA periods and RSI thresholds based on market volatility.

- Reason: Improve strategy adaptability to different market conditions.

Multi-Timeframe Analysis:

- Integrate trend information from higher timeframes to filter trading signals.

- Reason: Reduce counter-trend trades and improve overall accuracy.

Volatility-Based Risk Management:

- Use the ATR indicator to set dynamic stop loss and take profit levels.

- Reason: Better adapt to changes in market volatility, enhancing risk management effectiveness.

Incorporate Volume Analysis:

- Use volume as an additional confirmation indicator.

- Reason: Improve signal quality and reduce false breakouts.

Implement Partial Take Profit:

- Close part of the position upon reaching a profit target and move the stop loss.

- Reason: Lock in partial profits while allowing the remaining position to continue profiting.

Add Market Regime Filtering:

- Adjust strategy parameters or pause trading based on broader market indicators (e.g., VIX).

- Reason: Reduce trading in unfavorable market conditions, improving overall performance.

Conclusion

This WMA and RSI crossover strategy combines elements of trend following and momentum reversal, providing a concise yet effective short-term trading system. By focusing on long opportunities and implementing clear risk management rules, the strategy aims to achieve stable returns while maintaining simplicity. The fixed-point stop loss and take profit mechanisms provide a clear risk-reward framework, contributing to long-term profitability maintenance.

However, the strategy also faces challenges such as false breakout risks and limitations of fixed parameters. To address these issues and further enhance the strategy’s robustness, considerations can be made to implement dynamic parameter adjustments, multi-timeframe analysis, and volatility-based risk management optimizations. Additionally, incorporating volume analysis and market regime filtering could significantly improve signal quality and overall performance.

Overall, this strategy provides a solid foundation for short-term trend trading with clear rules and a good risk management framework. Through continuous optimization and adjustments, it has the potential to become a reliable trading tool applicable to various market conditions. However, as with all trading strategies, it should be used cautiously in live trading, always keeping in mind the unpredictability of markets and potential risks.

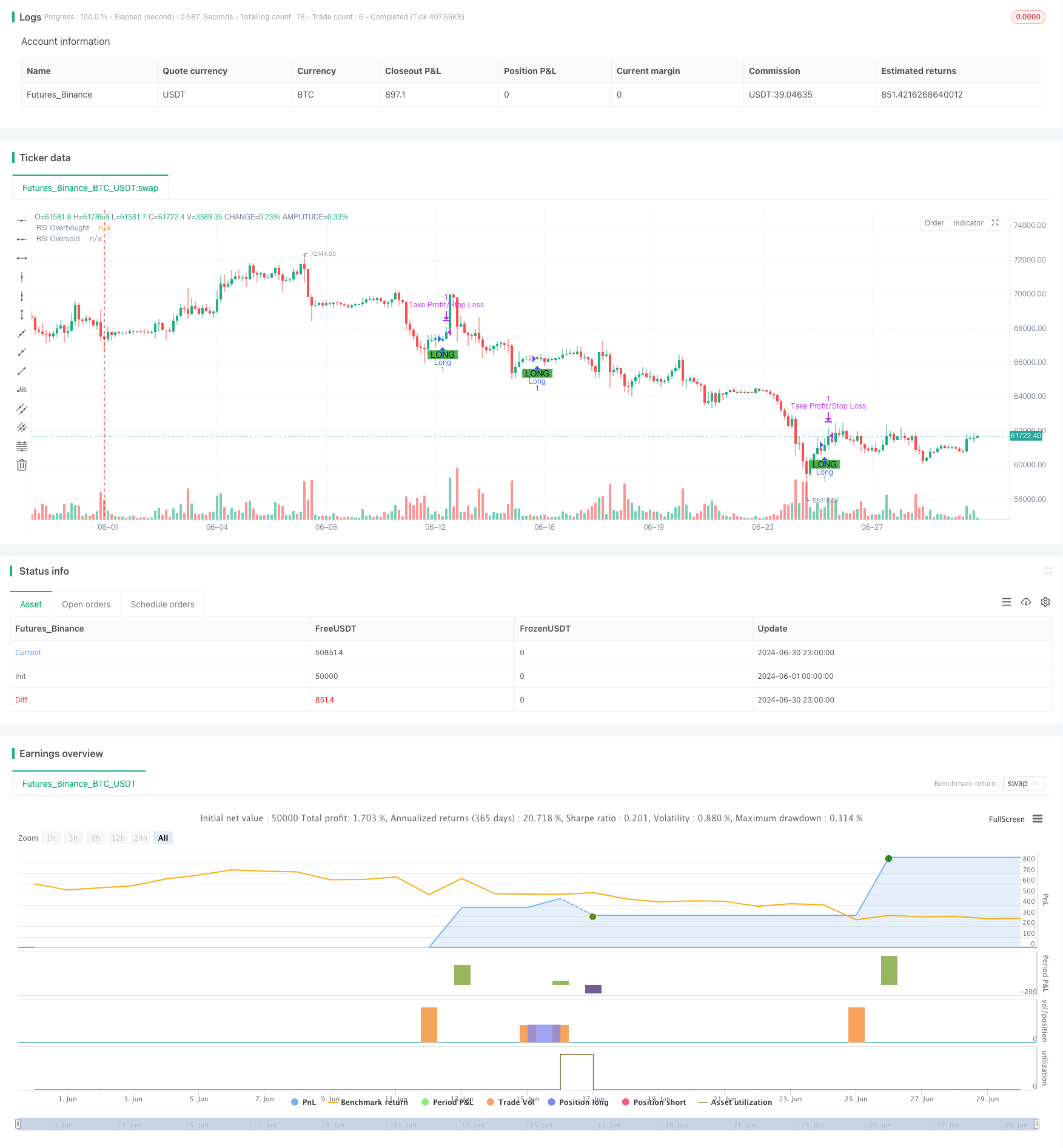

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Cruce de WMA Optimizada con Stop Loss, Take Profit y RSI (Solo Long) - por Jesús Bruzón", overlay=true)

// Configuración de las WMA

wma7 = ta.wma(close, 7)

wma14 = ta.wma(close, 9)

// Configuración del RSI

rsi = ta.rsi(close, 14)

rsiOverbought = 60

rsiOversold = 40

// Parámetros de entrada para stop loss y take profit en puntos

long_tp_points = 40

long_sl_points = 20

// Condiciones para las señales de trading

longCondition = ta.crossover(wma7, wma14) and rsi < rsiOversold

// Ejecución de las órdenes de entrada y salida

if (longCondition)

strategy.entry("Long", strategy.long)

// Cálculo de los niveles de stop loss y take profit para posiciones largas

long_take_level = strategy.position_avg_price + long_tp_points

long_stop_level = strategy.position_avg_price - long_sl_points

// Salidas de las órdenes basadas en el precio actual

if (strategy.position_size > 0)

strategy.exit("Take Profit/Stop Loss", "Long", limit=long_take_level, stop=long_stop_level)

// Visualización de las señales

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="LONG")

// Deshabilitar otros gráficos

plot(na, title="WMA 7", editable=false)

plot(na, title="WMA 9", editable=false)

plot(na, title="RSI", editable=false)

hline(na, title="RSI Overbought", editable=false)

hline(na, title="RSI Oversold", editable=false)