Dual RSI Strategy: Advanced Trend Capture System Combining Divergence and Crossover

Author: ChaoZhang, Date: 2024-07-31 11:55:12Tags: RSI

Overview

The Dual RSI Strategy is an advanced quantitative trading approach that combines two classic RSI-based trading methods: RSI divergence and RSI crossover. This strategy aims to capture more reliable buy and sell signals in the market by simultaneously monitoring both divergence and crossover signals from the RSI indicator. The core idea is to generate trading signals only when both RSI divergence and RSI crossover occur simultaneously, providing a double confirmation mechanism that enhances the accuracy and reliability of trades.

Strategy Principles

RSI Divergence:

- Bullish Divergence: Occurs when price makes a new low, but RSI fails to make a new low.

- Bearish Divergence: Occurs when price makes a new high, but RSI fails to make a new high.

RSI Crossover:

- Buy Signal: RSI crosses above the oversold level (30).

- Sell Signal: RSI crosses below the overbought level (70).

Signal Generation:

- Buy Condition: Bullish RSI divergence AND RSI crosses above the oversold level.

- Sell Condition: Bearish RSI divergence AND RSI crosses below the overbought level.

Parameter Settings:

- RSI Period: 14 (adjustable)

- Overbought Level: 70 (adjustable)

- Oversold Level: 30 (adjustable)

- Divergence Lookback Period: 90 bars (adjustable)

Strategy Advantages

High Reliability: By combining RSI divergence and crossover signals, the strategy significantly improves the reliability of trading signals and reduces the risk of false signals.

Trend Capture: Effectively identifies market trend reversal points, suitable for medium to long-term trading.

Flexibility: Key parameters are adjustable, allowing adaptation to different market environments and trading instruments.

Risk Control: The strict double confirmation mechanism effectively controls trading risk.

Visual Support: The strategy provides clear chart markings, facilitating intuitive understanding of market conditions.

Strategy Risks

Lag: Due to the need for double confirmation, the strategy may miss the early stages of some rapid market movements.

Over-reliance on RSI: In certain market conditions, a single indicator may not fully reflect market dynamics.

Parameter Sensitivity: Different parameter settings can lead to vastly different trading results, requiring careful optimization.

False Signal Risk: Although the double confirmation mechanism reduces false signal risk, it can still occur in highly volatile markets.

Lack of Stop-Loss Mechanism: The strategy itself does not include a built-in stop-loss mechanism, requiring traders to set additional risk management measures.

Strategy Optimization Directions

Multi-Indicator Integration: Introduce other technical indicators (e.g., MACD, Bollinger Bands) for cross-validation to further improve signal reliability.

Adaptive Parameters: Dynamically adjust RSI period and thresholds based on market volatility to adapt to different market environments.

Implement Stop-Loss: Design a stop-loss strategy based on ATR or fixed percentage to control single trade risk.

Time Filtering: Add trading time window restrictions to avoid trading during unfavorable periods.

Volatility Filtering: Suppress trading signals in low volatility environments to reduce false breakout risks.

Volume Analysis: Incorporate volume analysis to increase signal credibility.

Machine Learning Optimization: Use machine learning algorithms to optimize parameter selection and improve strategy adaptability.

Conclusion

The Dual RSI Strategy cleverly combines RSI divergence and crossover signals to create a powerful and flexible trading system. It not only effectively captures important turning points in market trends but also significantly improves the reliability of trading signals through its double confirmation mechanism. While the strategy has certain risks such as lag and parameter sensitivity, these issues can be effectively mitigated through proper optimization and risk management. In the future, by introducing advanced techniques such as multi-indicator cross-validation, adaptive parameters, and machine learning, this strategy has great potential for improvement. For quantitative traders seeking a robust and reliable trading system, the Dual RSI Strategy is undoubtedly a worthy choice for in-depth study and practice.

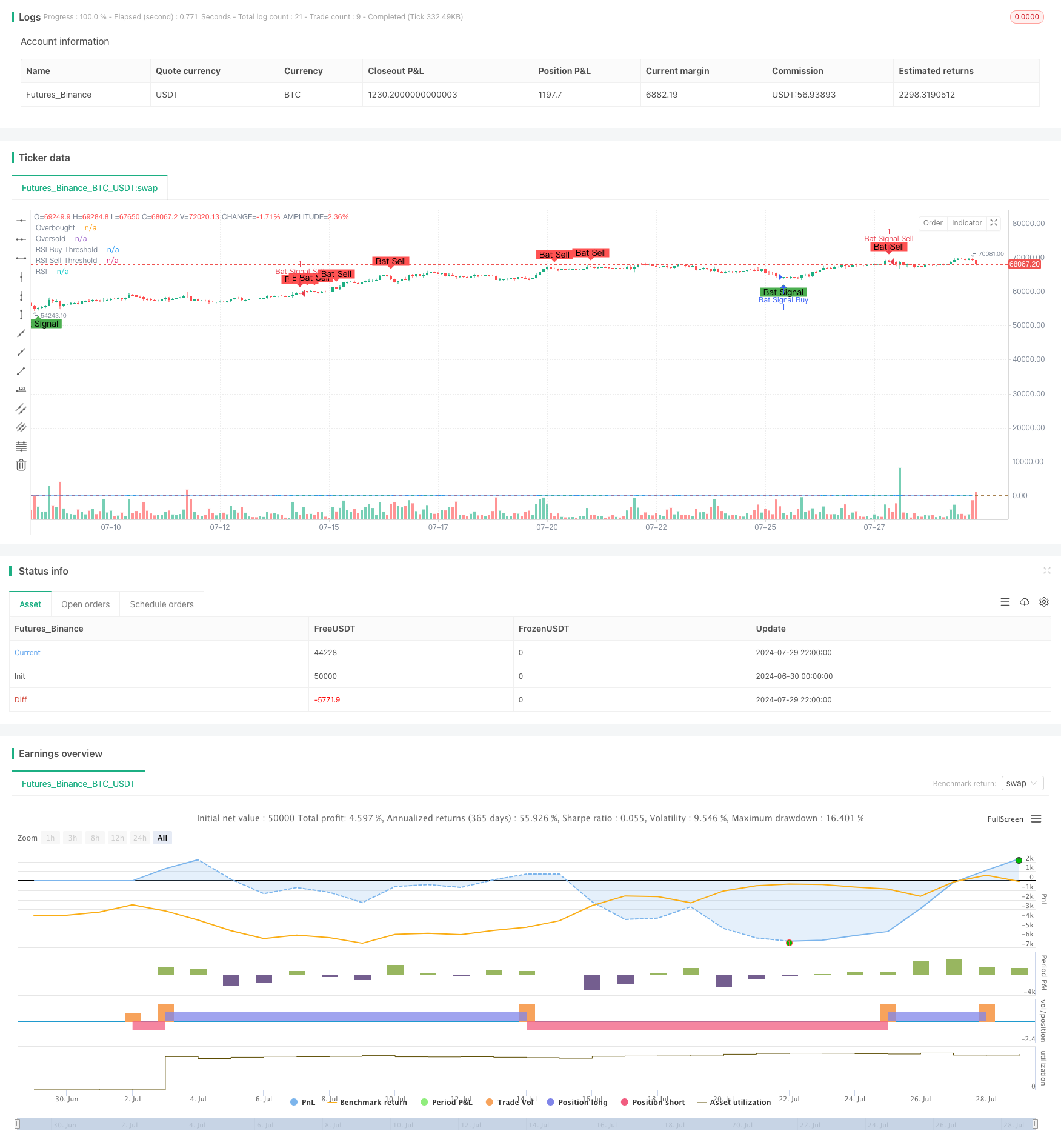

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Combined RSI Strategies", overlay=true)

// Input parameters for the first strategy (RSI Divergences)

len = input(14, minval=1, title="RSI Length")

ob = input(defval=70, title="Overbought", type=input.integer, minval=0, maxval=100)

os = input(defval=30, title="Oversold", type=input.integer, minval=0, maxval=100)

xbars = input(defval=90, title="Div lookback period (bars)?", type=input.integer, minval=1)

// Input parameters for the second strategy (RSI Crossover)

rsiBuyThreshold = input(30, title="RSI Buy Threshold")

rsiSellThreshold = input(70, title="RSI Sell Threshold")

// RSI calculation

rsi = rsi(close, len)

// Calculate highest and lowest bars for divergences

hb = abs(highestbars(rsi, xbars))

lb = abs(lowestbars(rsi, xbars))

// Initialize variables for divergences

var float max = na

var float max_rsi = na

var float min = na

var float min_rsi = na

var bool pivoth = na

var bool pivotl = na

var bool divbear = na

var bool divbull = na

// Update max and min values for divergences

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare current bar's high/low with max/min values for divergences

if close > max

max := close

if rsi > max_rsi

max_rsi := rsi

if close < min

min := close

if rsi < min_rsi

min_rsi := rsi

// Detect pivot points for divergences

pivoth := (max_rsi == max_rsi[2]) and (max_rsi[2] != max_rsi[3]) ? true : na

pivotl := (min_rsi == min_rsi[2]) and (min_rsi[2] != min_rsi[3]) ? true : na

// Detect divergences

if (max[1] > max[2]) and (rsi[1] < max_rsi) and (rsi <= rsi[1])

divbear := true

if (min[1] < min[2]) and (rsi[1] > min_rsi) and (rsi >= rsi[1])

divbull := true

// Conditions for RSI crossovers

isRSICrossAboveThreshold = crossover(rsi, rsiBuyThreshold)

isRSICrossBelowThreshold = crossunder(rsi, rsiSellThreshold)

// Combined buy and sell conditions

buyCondition = divbull and isRSICrossAboveThreshold

sellCondition = divbear and isRSICrossBelowThreshold

// Generate buy/sell signals

if buyCondition

strategy.entry("Bat Signal Buy", strategy.long)

if sellCondition

strategy.entry("Bat Signal Sell", strategy.short)

// Plot RSI

plot(rsi, "RSI", color=color.blue)

hline(ob, title="Overbought", color=color.red)

hline(os, title="Oversold", color=color.green)

hline(rsiBuyThreshold, title="RSI Buy Threshold", color=color.green)

hline(rsiSellThreshold, title="RSI Sell Threshold", color=color.red)

// Plot signals

plotshape(series=buyCondition, title="Bat Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Bat Signal")

plotshape(series=sellCondition, title="Bat Sell", location=location.abovebar, color=color.red, style=shape.labeldown, text="Bat Sell")

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Dynamic EMA System Combined with RSI Momentum Indicator for Optimized Intraday Trading Strategy

- Multi-Technical Indicator Crossover Momentum Trend Following Strategy

- Dynamic Stop-Loss Adjustment Elephant Bar Trend Following Strategy

- Dual-Period RSI Trend Momentum Strategy with Pyramiding Position Management System

- Dynamic RSI Quantitative Trading Strategy with Multiple Moving Average Crossover

- Dynamic Trend RSI Indicator Crossing Strategy

- Multi-Dimensional KNN Algorithm with Volume-Price Candlestick Pattern Trading Strategy

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Ichimoku Kinko Hyo Trend Following and Support Resistance Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGY

- Adaptive Trend Following Strategy Based on Fibonacci Retracement

- Advanced Markov Model Technical Indicator Fusion Trading Strategy

- Multi-Layer Volatility Band Trading Strategy

- Multi-Period Moving Average Crossover Strategy with Dynamic Volatility Filter

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Triple EMA with Dynamic Support/Resistance Trading Strategy

- Lorenzian Classification Multi-Timeframe Target Strategy

- Dual Moving Average Trend Capture Strategy with Dynamic Stop-Loss and Filter

- Multi-Indicator Trend Following with Volume Confirmation Strategy

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Elliott Wave and Tom DeMark Trend-Following Trading Strategy

- Multi-Timeframe Unified Strategy Based on Quantitative Momentum and Convergence-Divergence

- RSI Oversold Periodic Investment Strategy with Cooldown Optimization

- Optimized Multi-Timeframe HMA Quantitative Trading Strategy with Dynamic Stop-Loss

- Bollinger Band Crossover with Slippage and Price Impact Combined Strategy

- Trend Structure Break with Order Block and Fair Value Gap Strategy