Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

Author: ChaoZhang, Date: 2024-07-31 14:19:48Tags: BBSMASD

Overview

The Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support is a trading approach that utilizes Bollinger Bands to identify potential buying opportunities and uses the middle band as a dynamic support level for taking profits. This strategy aims to enter long positions when the price shows signs of moving above the middle band and to exit positions either when the price returns to the middle band or if the price drops significantly from the entry level.

The core concept of this strategy is based on the principle of mean reversion, which suggests that prices tend to return to their average level. In this case, the middle Bollinger Band represents this average level. By waiting for confirmation of the price movement above the middle band and using dynamic exit conditions, the strategy seeks to enhance the probability of profitable trades while managing risk.

Strategy Principles

The strategy operates on the following principles:

Entry Condition:

- A long position is established when the price crosses above the middle Bollinger Band and remains above it for two consecutive trading days.

- This condition helps ensure that the upward movement is sustained and not just a temporary fluctuation.

Take Profit Condition:

- The long position is closed when the price touches the middle Bollinger Band from above.

- The middle band acts as a dynamic support level for taking profits.

Stop Loss Condition:

- The long position is closed if the price drops below 2% of the entry price.

- This stop-loss condition helps protect against significant losses.

No Same-Day Trading:

- The strategy ensures that no buy and sell occur on the same day unless the stop-loss condition is met.

- This helps in avoiding unnecessary transactions and potential whipsaws.

The strategy uses a 20-period Simple Moving Average (SMA) as the middle Bollinger Band, with the upper and lower bands set at 2 standard deviations above and below the middle band. These parameters can be adjusted based on trader preferences and market conditions.

Strategy Advantages

Dynamic Market Adaptation:

- Bollinger Bands automatically adjust to market volatility, allowing the strategy to adapt to different market environments.

Clear Entry and Exit Signals:

- The strategy provides well-defined entry and exit rules, reducing the need for subjective judgment.

Risk Management:

- By using a fixed percentage stop-loss, the strategy effectively controls risk for each trade.

Mean Reversion Principle:

- The strategy capitalizes on the common phenomenon of mean reversion in financial markets, increasing the probability of profitable trades.

Avoidance of Frequent Trading:

- By requiring the price to remain above the middle band for two trading days before entry, the strategy reduces unnecessary trades caused by false breakouts.

Flexibility:

- The strategy’s parameters (such as Bollinger Band length, standard deviation multiplier, stop-loss percentage) can be adjusted to suit different markets and personal preferences.

Strategy Risks

Underperformance in Trending Markets:

- In strongly trending markets, prices may deviate from the mean for extended periods, causing the strategy to miss out on significant trends.

Overtrading Risk:

- In highly volatile markets, price may frequently cross the middle band, leading to excessive trading and higher transaction costs.

Limitations of Fixed Stop-Loss:

- The 2% fixed stop-loss may be too large or too small in certain situations, not adapting well to all market conditions.

Slippage and Liquidity Risk:

- In less liquid markets, it may be difficult to execute trades at precise price levels, affecting strategy performance.

Parameter Sensitivity:

- The strategy’s performance may be sensitive to Bollinger Band parameter settings, requiring careful optimization and backtesting.

False Breakout Risk:

- Despite the two-day confirmation mechanism, false breakouts can still occur, leading to unnecessary trades.

Strategy Optimization Directions

Dynamic Stop-Loss:

- Consider using a volatility-based dynamic stop-loss, such as ATR (Average True Range) multiples, to better adapt to different market conditions.

Multi-Timeframe Analysis:

- Incorporate longer-term timeframe analysis to ensure trade direction aligns with larger market trends.

Quantitative Confirmation Indicators:

- Add other technical indicators (e.g., RSI or MACD) as filters to improve the quality of entry signals.

Dynamic Parameter Optimization:

- Implement dynamic adjustment of Bollinger Band parameters to adapt to different market cycles and volatility.

Partial Position Management:

- Introduce a mechanism for scaling in and out of positions to better manage risk and capture price movements.

Market Environment Filtering:

- Add a market environment recognition mechanism to pause trading in conditions unsuitable for mean reversion strategies.

Take Profit Optimization:

- Consider setting additional take profit conditions near the upper band to capture larger price movements.

Transaction Cost Consideration:

- Incorporate transaction costs into the strategy logic to avoid excessively frequent small trades.

Conclusion

The Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support is a quantitative trading approach that combines technical analysis with statistical principles. By utilizing Bollinger Bands, this strategy attempts to capture opportunities for price reversion to the mean after deviations, while managing risk through dynamic support and stop-loss mechanisms.

The main advantages of this strategy lie in its clear trading rules and ability to dynamically adapt to market volatility. However, it also faces risks such as underperformance in strong trending markets and potential overtrading.

To further enhance the strategy’s robustness and adaptability, considerations can be made to introduce dynamic stop-losses, multi-timeframe analysis, additional confirmation indicators, and more sophisticated position management techniques. Continuous optimization and backtesting of strategy parameters are also crucial.

Overall, this strategy provides traders with a systematic approach to capturing price movements and managing risk. However, like all trading strategies, it is not infallible and requires adjustment and optimization based on specific market conditions and individual risk preferences. In practical application, it is recommended that traders conduct thorough backtesting and paper trading before implementing the strategy in live trading to fully understand its characteristics and potential risks.

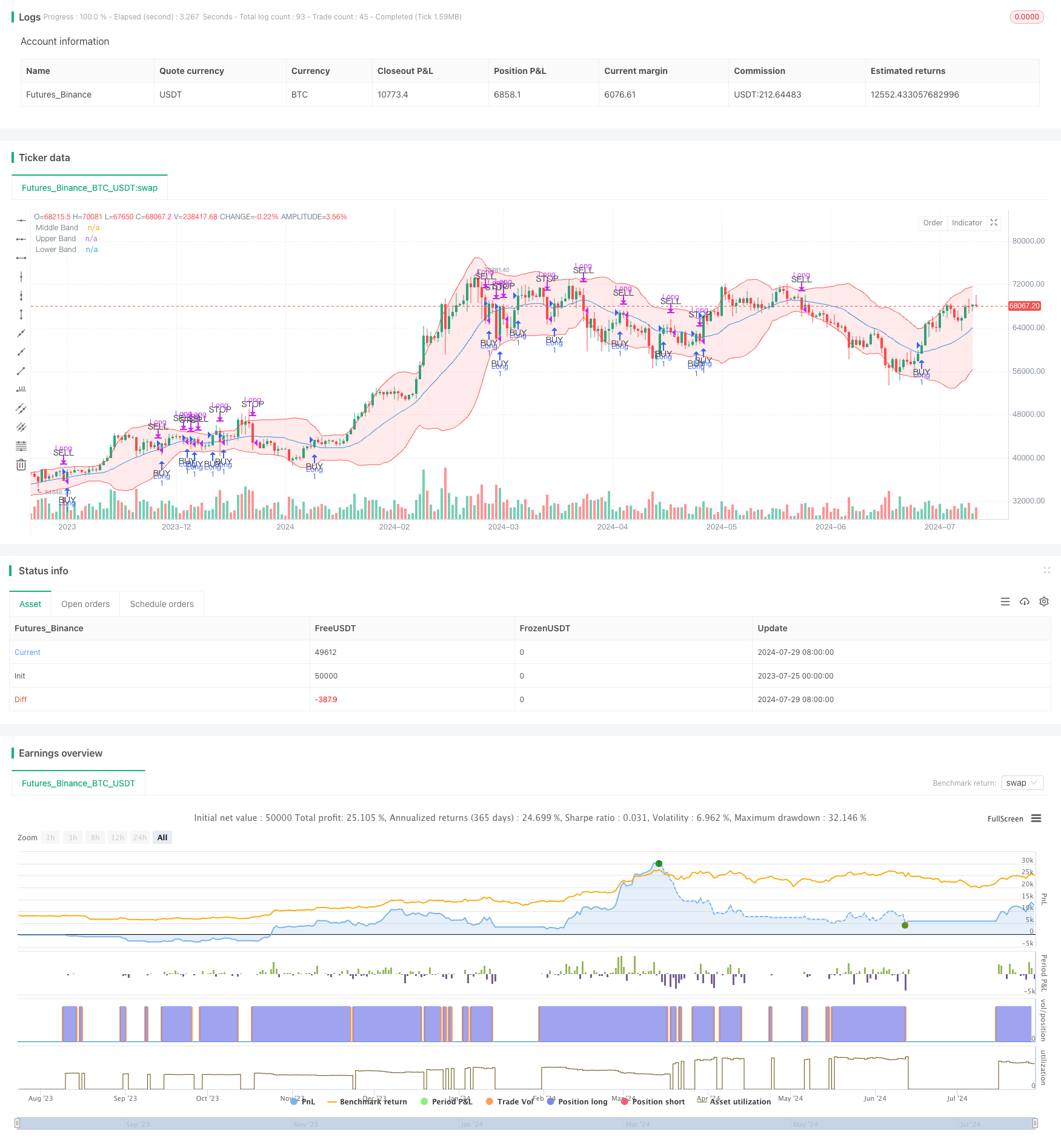

/*backtest

start: 2023-07-25 00:00:00

end: 2024-07-30 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Mean Reversion Strategy with Bollinger Bands", overlay=true)

// Bollinger Bands settings

length = input.int(20, minval=1, title="Bollinger Bands Length")

src = input(close, title="Source")

mult = input.float(2.0, minval=0.1, title="Bollinger Bands Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(basis, title="Middle Band", color=color.blue)

p1 = plot(upper, title="Upper Band", color=color.red)

p2 = plot(lower, title="Lower Band", color=color.red)

fill(p1, p2, color=color.rgb(255, 0, 0, 90))

// Buy condition: Price crosses above the middle band

longCondition = ta.crossover(close, basis)

// Close condition: Price touches the middle band

closeCondition = ta.crossunder(close, basis)

// Emergency stop condition: Price drops below 2% of entry price

dropCondition = strategy.position_size > 0 and close < strategy.position_avg_price * 0.98

// Plot Buy/Sell Signals only on initial cross

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.triangleup, textcolor=color.black, text="BUY", size=size.small)

plotshape(series=closeCondition and not dropCondition, location=location.abovebar, color=color.red, style=shape.triangledown, textcolor=color.black, text="SELL", size=size.small)

plotshape(series=dropCondition, location=location.abovebar, color=color.red, style=shape.triangledown, textcolor=color.black, text="STOP", size=size.small)

// Track entry date to ensure no same-day buy/sell

var float entryPrice = na

var int entryYear = na

var int entryMonth = na

var int entryDay = na

// Strategy Logic

if (longCondition and (na(entryDay) or (year != entryYear or month != entryMonth or dayofmonth != entryDay)))

strategy.entry("Long", strategy.long)

entryPrice := close

entryYear := year

entryMonth := month

entryDay := dayofmonth

if ((closeCondition or dropCondition) and strategy.position_size > 0 and (na(entryDay) or (year != entryYear or month != entryMonth or dayofmonth != entryDay or dropCondition)))

strategy.close("Long")

entryDay := na

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Bollinger Bands Precise Crossover Quantitative Strategy

- Enhanced Dynamic Bollinger Bands Trading Strategy

- Triple Standard Deviation Bollinger Bands Breakout Strategy with 100-Day Moving Average Optimization

- Bollinger Bands and RSI Combined Trading Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Volume Filter

- Bollinger Bands and RSI Crossover Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Triple Supertrend Crossover Strategy

- Advanced Multi-Timeframe Ichimoku Cloud Trading Strategy with Dynamic Multidimensional Analysis

- Dual Moving Average Momentum Trading Strategy: Time-Optimized Trend Following System

- Enhanced EMA/WMA Crossover Strategy with Comprehensive Exit Conditions

- Supertrend and EMA Crossover Quantitative Trading Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- Comprehensive Trading System Combining SMA Crossover Strategy with Fair Value Gap Pullback

- Dynamic Support-Resistance Breakout Moving Average Crossover Strategy

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Ichimoku Kinko Hyo Trend Following and Support Resistance Strategy

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGY

- Adaptive Trend Following Strategy Based on Fibonacci Retracement

- Advanced Markov Model Technical Indicator Fusion Trading Strategy

- Multi-Layer Volatility Band Trading Strategy

- Multi-Period Moving Average Crossover Strategy with Dynamic Volatility Filter

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Triple EMA with Dynamic Support/Resistance Trading Strategy

- Dual RSI Strategy: Advanced Trend Capture System Combining Divergence and Crossover

- Lorenzian Classification Multi-Timeframe Target Strategy

- Dual Moving Average Trend Capture Strategy with Dynamic Stop-Loss and Filter