Open Market Exposure Dynamic Position Adjustment Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-12 14:48:05Tags: OMESMAstdevSRTPSL

Overview

This strategy is a quantitative trading system based on Open Market Exposure (OME), which makes trading decisions by calculating cumulative OME values to judge market trends, combined with risk control indicators such as the Sharpe Ratio. The strategy adopts a dynamic take-profit and stop-loss mechanism to effectively control risk while ensuring returns. It mainly focuses on how price movements after market opening affect overall trends, using scientific methods to judge changes in market sentiment and trends.

Strategy Principle

The core of the strategy is to measure market trends by calculating Open Market Exposure (OME). OME is calculated as the ratio of the difference between the current closing price and the previous day’s opening price relative to the previous opening price. The strategy sets cumulative OME thresholds as trading signals, entering long positions when cumulative OME exceeds the set threshold and closing positions when it falls below the negative threshold. The Sharpe Ratio is introduced as a risk assessment indicator, measuring the risk-return ratio by calculating the mean and standard deviation of cumulative OME. The strategy also includes a fixed percentage take-profit and stop-loss mechanism to protect profits and control losses.

Strategy Advantages

- High market sensitivity: Quickly captures trend changes after market opening through the OME indicator

- Comprehensive risk control: Forms a multi-level risk control system combining Sharpe Ratio and stop-loss mechanisms

- Good adaptability: Strategy parameters can be adjusted according to different market conditions

- Clear calculation logic: Simple and intuitive indicator calculations, easy to understand and implement

- High capital efficiency: Adopts dynamic position management to improve capital utilization

Strategy Risks

- Market volatility risk: May generate false signals in highly volatile markets

- Slippage risk: Frequent trading may lead to higher slippage costs

- Parameter sensitivity: Strategy effectiveness is sensitive to parameter settings

- Trend dependency: May underperform in oscillating markets

- Drawdown risk: Major trend turning points may cause significant drawdowns

Strategy Optimization Directions

- Introduce volatility filtering: Add indicators like ATR or Bollinger Bands to filter market volatility

- Optimize take-profit and stop-loss: Consider replacing fixed percentages with dynamic mechanisms

- Enhance market environment judgment: Introduce trend strength indicators to optimize trading timing

- Improve position management: Dynamically adjust position sizes based on Sharpe Ratio

- Add fund management: Design more comprehensive fund management rules

Summary

The Open Market Exposure Dynamic Position Adjustment Strategy is a complete trading system that combines technical analysis and risk management. Through innovative application of the OME indicator, it achieves effective grasp of market trends. The strategy’s overall design is reasonable, with strong practicality and scalability. Through continuous optimization and improvement, this strategy has the potential to achieve better performance in actual trading.

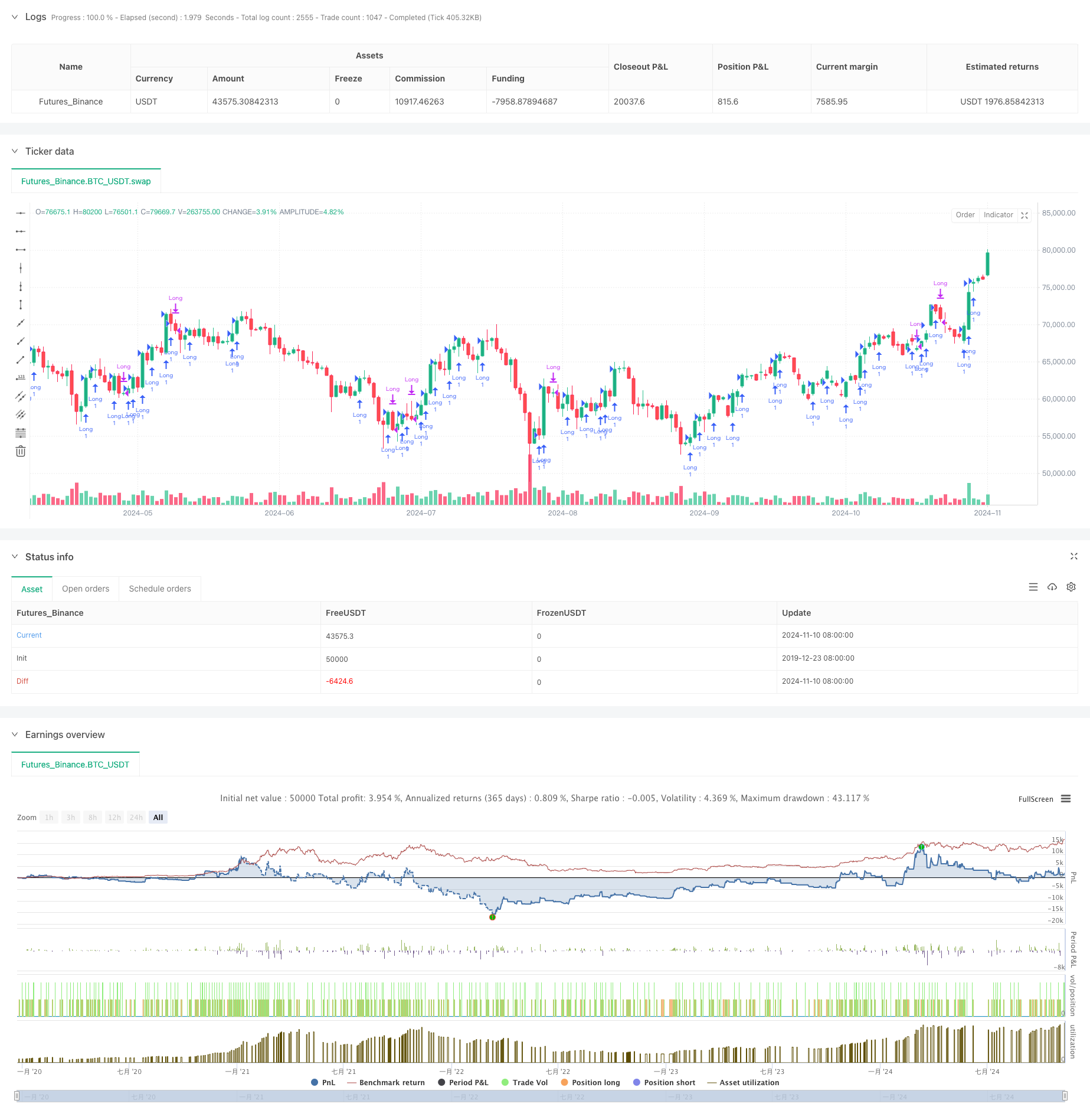

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Open Market Exposure (OME) Strategy", overlay=true)

// Input parameters

length = input(14, title="Length for Variance")

sharpe_length = input(30, title="Length for Sharpe Ratio")

threshold = input(0.01, title="Cumulative OME Threshold") // Define a threshold for entry

take_profit = input(0.02, title="Take Profit (%)") // Define a take profit percentage

stop_loss = input(0.01, title="Stop Loss (%)") // Define a stop loss percentage

// Calculate Daily Returns

daily_return = (close - close[1]) / close[1]

// Open Market Exposure (OME) calculation

ome = (close - open[1]) / open[1]

// Cumulative OME

var float cum_ome = na

if na(cum_ome)

cum_ome := 0.0

if (dayofweek != dayofweek[1]) // Reset cumulative OME daily

cum_ome := 0.0

cum_ome := cum_ome + ome

// Performance Metrics Calculation (Sharpe Ratio)

mean_return = ta.sma(cum_ome, sharpe_length)

std_dev = ta.stdev(cum_ome, sharpe_length)

sharpe_ratio = na(cum_ome) or (std_dev == 0) ? na : mean_return / std_dev

// Entry Condition: Buy when Cumulative OME crosses above the threshold

if (cum_ome > threshold)

strategy.entry("Long", strategy.long)

// Exit Condition: Sell when Cumulative OME crosses below the threshold

if (cum_ome < -threshold)

strategy.close("Long")

// Take Profit and Stop Loss

if (strategy.position_size > 0)

// Calculate target and stop levels

target_price = close * (1 + take_profit)

stop_price = close * (1 - stop_loss)

// Place limit and stop orders

strategy.exit("Take Profit", "Long", limit=target_price)

strategy.exit("Stop Loss", "Long", stop=stop_price)

- Dynamic Take-Profit and Stop-Loss Dual Moving Average Crossover Trading Strategy

- Intelligent Moving Average Crossover Strategy with Dynamic Profit/Loss Management System

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- Dual Moving Average Trend Following Strategy with RSI Filter

- Multi-Target Intelligent Volume Momentum Trading Strategy

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Parabolic SAR Divergence Trading Strategy

- Combined Momentum SMA Crossover Strategy with Market Sentiment and Resistance Level Optimization System

- Multi-Period RSI Momentum and Triple EMA Trend Following Composite Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- E9 Shark-32 Pattern Quantitative Price Breakout Strategy

- High Win Rate Trend Mean Reversion Trading Strategy

- Dual Moving Average RSI Trend Momentum Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- Multi-Indicator Integration and Intelligent Risk Control Quantitative Trading System

- Multi-Indicator Dynamic Adaptive Position Sizing with ATR Volatility Strategy

- RSI Dynamic Stop-Loss Intelligent Trading Strategy

- Triple-Validated RSI Mean Reversion with Moving Average Filter Strategy

- Adaptive Oscillation Trend Trading Strategy with Bollinger Bands and RSI Integration

- ADX (Average Directional Index) and Volume Dynamic Trend Tracking Strategy