Advanced MACD Dynamic Trend Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-12 16:27:01Tags: MACDMAEMARSI

Overview

This strategy is an advanced quantitative trading system based on the Moving Average Convergence Divergence (MACD) indicator, enhancing trading decisions through dynamic background display and multiple preset parameter combinations. The core of the strategy lies in capturing market trend transition points through MACD crossover signals and visually displaying market conditions.

Strategy Principle

The strategy employs ten different MACD parameter presets, including Standard (12,26,9), Short-term (5,35,5), Long-term (19,39,9), etc., to adapt to different market environments and trading styles. The system generates buy signals when the MACD line crosses above the signal line (golden cross) and sell signals when it crosses below (death cross). The strategy enhances visual recognition through dynamic background color changes (green for bullish, red for bearish) to help traders better grasp market trends.

Strategy Advantages

- Parameter Flexibility: Offers ten preset parameter combinations for different market environments

- Clear Visual Feedback: Dynamic background color changes provide intuitive market trend display

- Clear Signals: Generates explicit buy/sell signals based on MACD crossovers

- High Adaptability: Applicable to different timeframe trading

- Clear Code Structure: Uses switch structure for parameter switching, easy to maintain and extend

Strategy Risks

- Lag Risk: MACD as a lagging indicator may generate delayed signals in volatile markets

- False Breakout Risk: May generate false crossover signals in ranging markets

- Parameter Dependency: Different parameter combinations perform differently in various market conditions

- Market Condition Limitations: May underperform in highly volatile or illiquid market environments

Strategy Optimization Directions

- Implement volatility filters to filter out trading signals during highly volatile periods

- Add trend confirmation indicators like RSI or ATR to improve signal reliability

- Implement adaptive parameter optimization based on market conditions

- Add stop-loss and take-profit functionality to enhance risk management

- Include volume analysis to improve signal reliability

Summary

This is a well-structured, logically sound advanced version of the MACD strategy. Through multiple parameter presets and dynamic visual feedback, it significantly enhances the strategy’s practicality and operability. While inherent risks exist, the strategy has the potential to become a robust trading system with the suggested optimizations. Traders are advised to conduct thorough backtesting before live implementation and choose appropriate parameter settings based on specific market conditions.

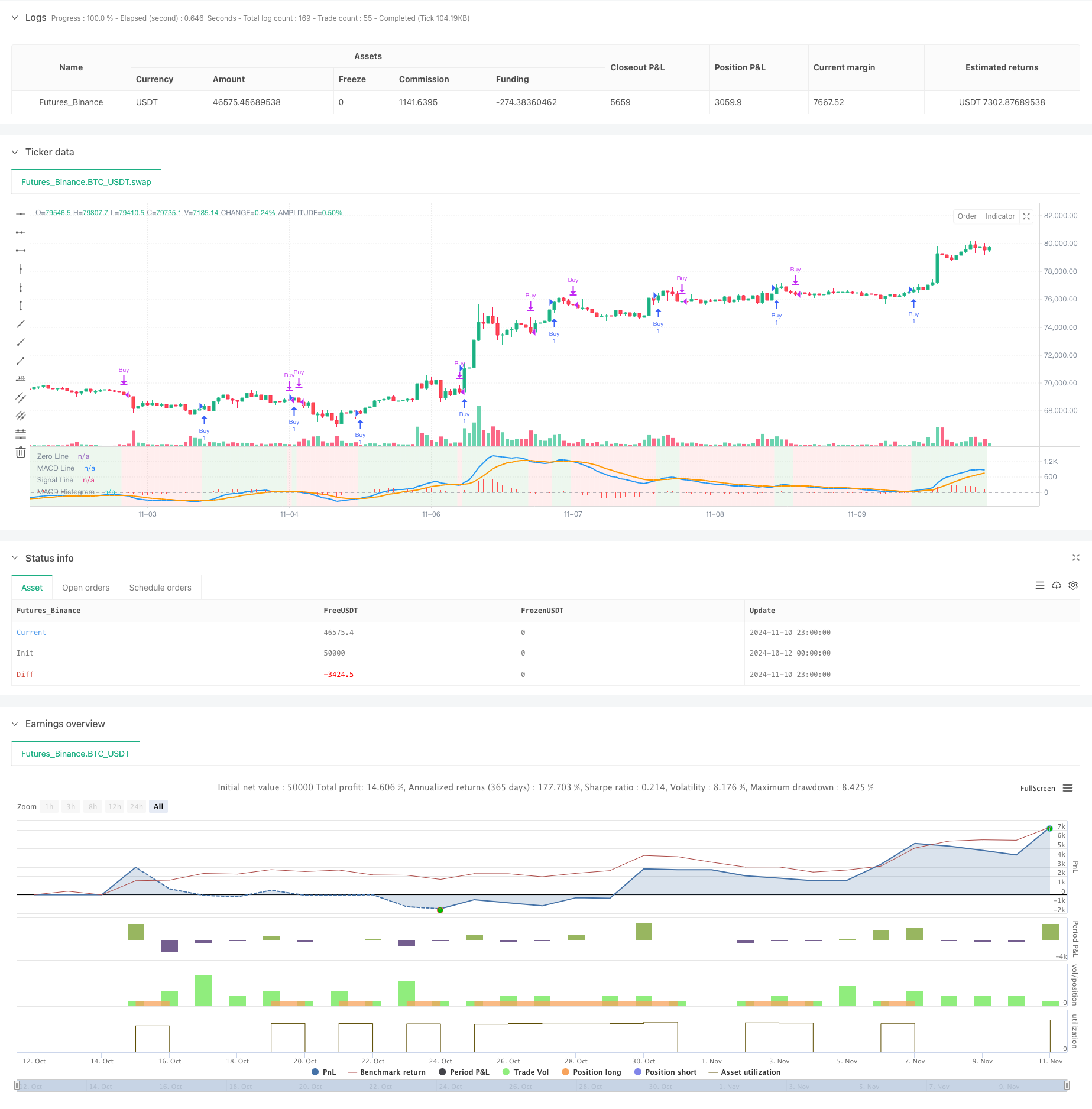

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hanzo - Top 10 MACD Strategy", overlay=false) // MACD in a separate pane

// Define dropdown options for MACD settings

macdOption = input.string(title="Select MACD Setting",

defval="Standard (12, 26, 9)",

options=["Standard (12, 26, 9)",

"Short-Term (5, 35, 5)",

"Long-Term (19, 39, 9)",

"Scalping (3, 10, 16)",

"Cryptocurrency (20, 50, 9)",

"Forex (8, 17, 9)",

"Conservative (24, 52, 18)",

"Trend-Following (7, 28, 7)",

"Swing Trading (5, 15, 5)",

"Contrarian (15, 35, 5)"])

// MACD setting based on user selection

var int fastLength = 12

var int slowLength = 26

var int signalLength = 9

switch macdOption

"Standard (12, 26, 9)" =>

fastLength := 12

slowLength := 26

signalLength := 9

"Short-Term (5, 35, 5)" =>

fastLength := 5

slowLength := 35

signalLength := 5

"Long-Term (19, 39, 9)" =>

fastLength := 19

slowLength := 39

signalLength := 9

"Scalping (3, 10, 16)" =>

fastLength := 3

slowLength := 10

signalLength := 16

"Cryptocurrency (20, 50, 9)" =>

fastLength := 20

slowLength := 50

signalLength := 9

"Forex (8, 17, 9)" =>

fastLength := 8

slowLength := 17

signalLength := 9

"Conservative (24, 52, 18)" =>

fastLength := 24

slowLength := 52

signalLength := 18

"Trend-Following (7, 28, 7)" =>

fastLength := 7

slowLength := 28

signalLength := 7

"Swing Trading (5, 15, 5)" =>

fastLength := 5

slowLength := 15

signalLength := 5

"Contrarian (15, 35, 5)" =>

fastLength := 15

slowLength := 35

signalLength := 5

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

macdHist = macdLine - signalLine

// Buy and Sell conditions based on MACD crossovers

enterLong = ta.crossover(macdLine, signalLine)

exitLong = ta.crossunder(macdLine, signalLine)

// Execute buy and sell orders with price labels in the comments

if (enterLong)

strategy.entry("Buy", strategy.long, comment="Buy at " + str.tostring(close, "#.##"))

if (exitLong)

strategy.close("Buy", comment="Sell at " + str.tostring(close, "#.##"))

// Plot the signal price using plotchar for buy/sell prices

//plotchar(enterLong ? close : na, location=location.belowbar, color=color.green, size=size.small, title="Buy Price", offset=0)

//plotchar(exitLong ? close : na, location=location.abovebar, color=color.red, size=size.small, title="Sell Price", offset=0)

// Background highlighting based on bullish or bearish MACD

isBullish = macdLine > signalLine

isBearish = macdLine < signalLine

// Change background to green for bullish periods and red for bearish periods

bgcolor(isBullish ? color.new(color.green, 90) : na, title="Bullish Background")

bgcolor(isBearish ? color.new(color.red, 90) : na, title="Bearish Background")

// Plot the MACD and Signal line in a separate pane

plot(macdLine, title="MACD Line", color=color.blue, linewidth=2)

plot(signalLine, title="Signal Line", color=color.orange, linewidth=2)

hline(0, "Zero Line", color=color.gray)

plot(macdHist, title="MACD Histogram", style=plot.style_histogram, color=color.red)

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- Multi-Strategy Technical Analysis Trading System

- Multi-Level Dynamic MACD Trend Following Strategy with 52-Week High/Low Extension Analysis System

- Multi-EMA Dynamic Trend Capture Quantitative Trading Strategy

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Dual EMA Trend Momentum Trading Strategy

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Multi-Technical Indicator Synergistic Trading System

- No Upper Wick Bullish Candle Breakout Strategy

- Dynamic Take-Profit Stop-Loss EMA Crossover Quantitative Trading Strategy

- Multi-EMA Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit Optimization

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- The two platforms hedge balancing strategy

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy