Overview

This strategy is a mean reversion trading system based on Bollinger Bands, optimized with trend filters and dynamic stop-loss mechanisms. It applies statistical principles to trade price deviations from the mean while using technical indicators to improve win rates and manage risks.

Strategy Principles

The strategy is built on several key components: 1. Uses 20-period Bollinger Bands as the primary signal source with 2 standard deviation bandwidth 2. Incorporates 50-period EMA as a trend filter to ensure trade direction aligns with medium-term trends 3. Employs 14-period ATR for dynamic stop-loss and profit targets to improve risk-reward ratios 4. Enters long when price touches lower band and is above EMA, shorts when price touches upper band and is below EMA 5. Sets profit target at 2x ATR and stop-loss at 1x ATR

Strategy Advantages

- Combines benefits of mean reversion and trend following for improved reliability

- Dynamic stop-loss and profit targets adapt to market volatility

- Clear entry and exit rules minimize subjective judgment

- Fixed 2:1 risk-reward ratio promotes long-term profitability

- Technical indicator combination reduces false signals

Strategy Risks

- May miss major trends in strongly trending markets

- Frequent trading possible in narrow consolidation ranges

- Slippage risk during market gaps

- Requires ongoing parameter monitoring and adjustment

- Trading costs may impact strategy returns

Optimization Directions

- Add volume indicators for confirmation

- Implement volatility filters to avoid high volatility periods

- Optimize parameter adaptation mechanisms

- Include additional technical indicators for cross-validation

- Enhance money management system

Summary

This strategy combines classical technical analysis with modern quantitative methods. Through multiple indicator confirmations and strict risk control, the strategy demonstrates good practicality. Thorough backtesting and demo trading are recommended before live implementation.

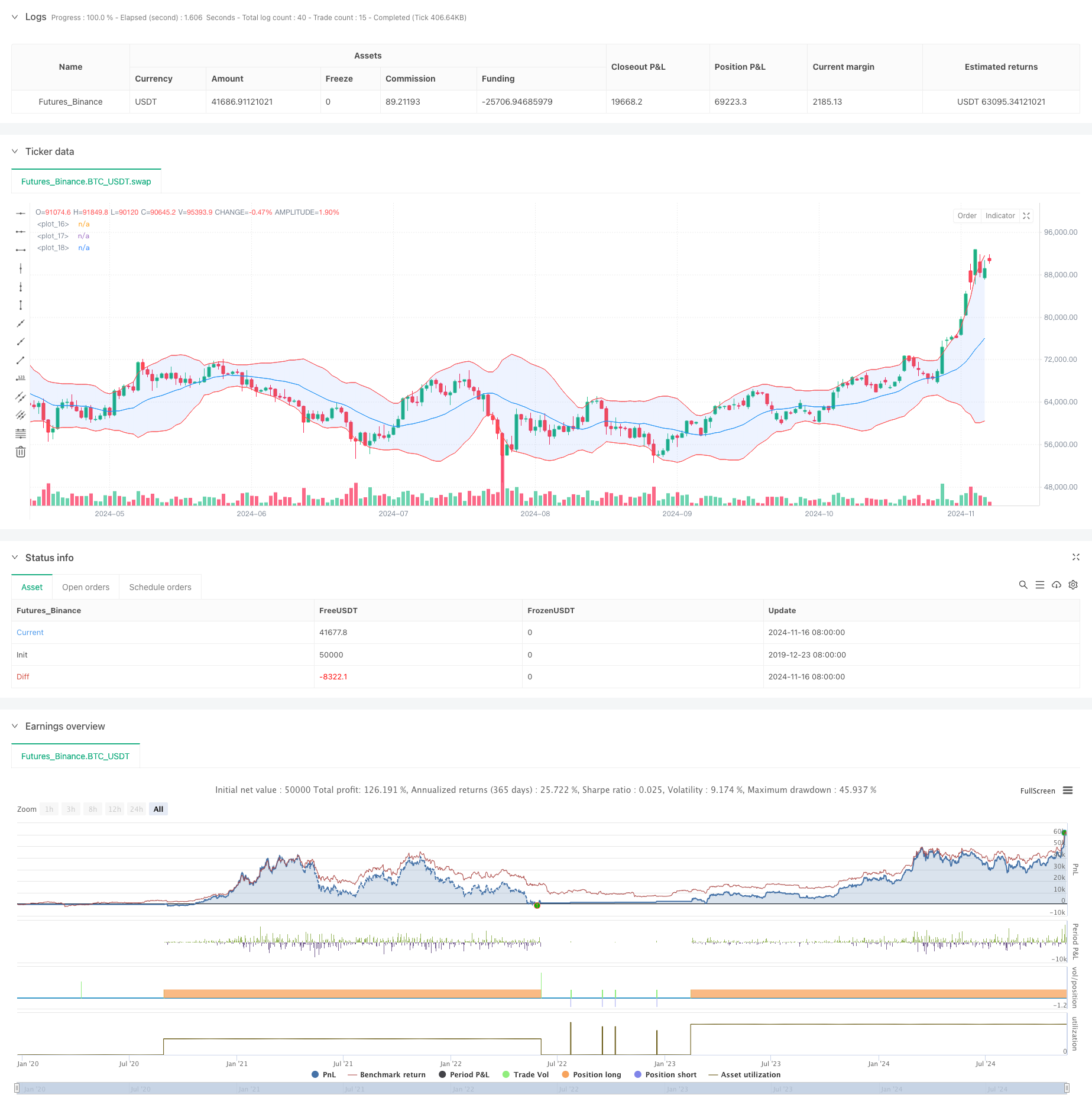

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-17 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Bollinger Mean Reversion", overlay=true)

// Bollinger Band Settings

length = input.int(20, title="BB Length")

src = input(close, title="Source")

mult = input.float(2.0, title="BB Multiplier")

// Bollinger Bands Calculation

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot the Bollinger Bands

plot(basis, color=color.blue)

p1 = plot(upper, color=color.red)

p2 = plot(lower, color=color.red)

fill(p1, p2, color=color.rgb(41, 98, 255, 90))

// Trend Filter - 50 EMA

ema_filter = ta.ema(close, 50)

// ATR for Dynamic Stop Loss/Take Profit

atr_value = ta.atr(14)

// Buy condition - price touches lower band and above 50 EMA

buy_condition = ta.crossover(close, lower) and close > ema_filter

// Sell condition - price touches upper band and below 50 EMA

sell_condition = ta.crossunder(close, upper) and close < ema_filter

// Strategy Execution

if (buy_condition)

strategy.entry("Buy", strategy.long)

if (sell_condition)

strategy.entry("Sell", strategy.short)

// Exit with dynamic ATR-based stop loss and take profit

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=2*atr_value, stop=1*atr_value)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", limit=2*atr_value, stop=1*atr_value)