概述

这是一个结合了双重MACD指标和价格行为分析的交易策略。策略通过观察15分钟周期上的双重MACD直方图颜色变化来确定市场趋势,同时在5分钟周期上寻找强势蜡烛形态,并在1分钟周期上确认突破信号。策略采用基于ATR的动态止损和追踪止盈机制,有效管理风险的同时最大化盈利空间。

策略原理

策略使用两组不同参数的MACD指标(34/144/9和100/200/50)来确认市场趋势。当两个MACD直方图都显示相同的颜色趋势时,系统会在5分钟图上寻找强势蜡烛形态,这种形态的特征是实体大于影线的1.5倍。一旦找到强势蜡烛,系统会在1分钟图上监控是否出现突破。在上升趋势中突破高点或下降趋势中突破低点时,系统会开仓。止损基于ATR指标设置,同时使用ATR的1.5倍作为动态追踪止盈。

策略优势

- 多周期分析:结合15分钟、5分钟和1分钟三个时间周期,提高信号可靠性

- 趋势确认:使用双重MACD交叉验证,降低假信号

- 价格行为分析:通过强势蜡烛形态识别关键价格水平

- 动态风险管理:基于ATR的自适应止损和追踪止盈机制

- 信号过滤:严格的入场条件减少误操作

- 自动化程度高:全程自动化交易,减少人为干预

策略风险

- 趋势反转风险:在剧烈波动市场中可能出现虚假突破

- 滑点风险:1分钟周期的高频交易可能面临滑点影响

- 过度交易风险:频繁的信号可能导致过度交易

- 市场环境依赖:在震荡市场中表现可能不佳 缓解措施:

- 增加趋势过滤器

- 设置最小波动阈值

- 添加交易次数限制

- 引入市场环境识别机制

策略优化方向

- MACD参数优化:可根据不同市场特征调整MACD参数

- 止损优化:考虑添加基于波动率的动态止损

- 交易时间过滤:加入交易时间窗口限制

- 位置管理:实现分批建仓和出场机制

- 市场环境过滤:添加趋势强度指标

- 回撤控制:引入基于权益曲线的风险控制机制

总结

这是一个综合运用技术分析和风险管理的策略系统。通过多周期分析和严格的信号过滤确保交易质量,同时利用动态止损和追踪止盈机制有效管理风险。策略具有较强的适应性,但仍需要根据市场环境进行持续优化。在实盘应用时,建议先进行充分的回测和参数优化,并结合市场特征进行针对性调整。

策略源码

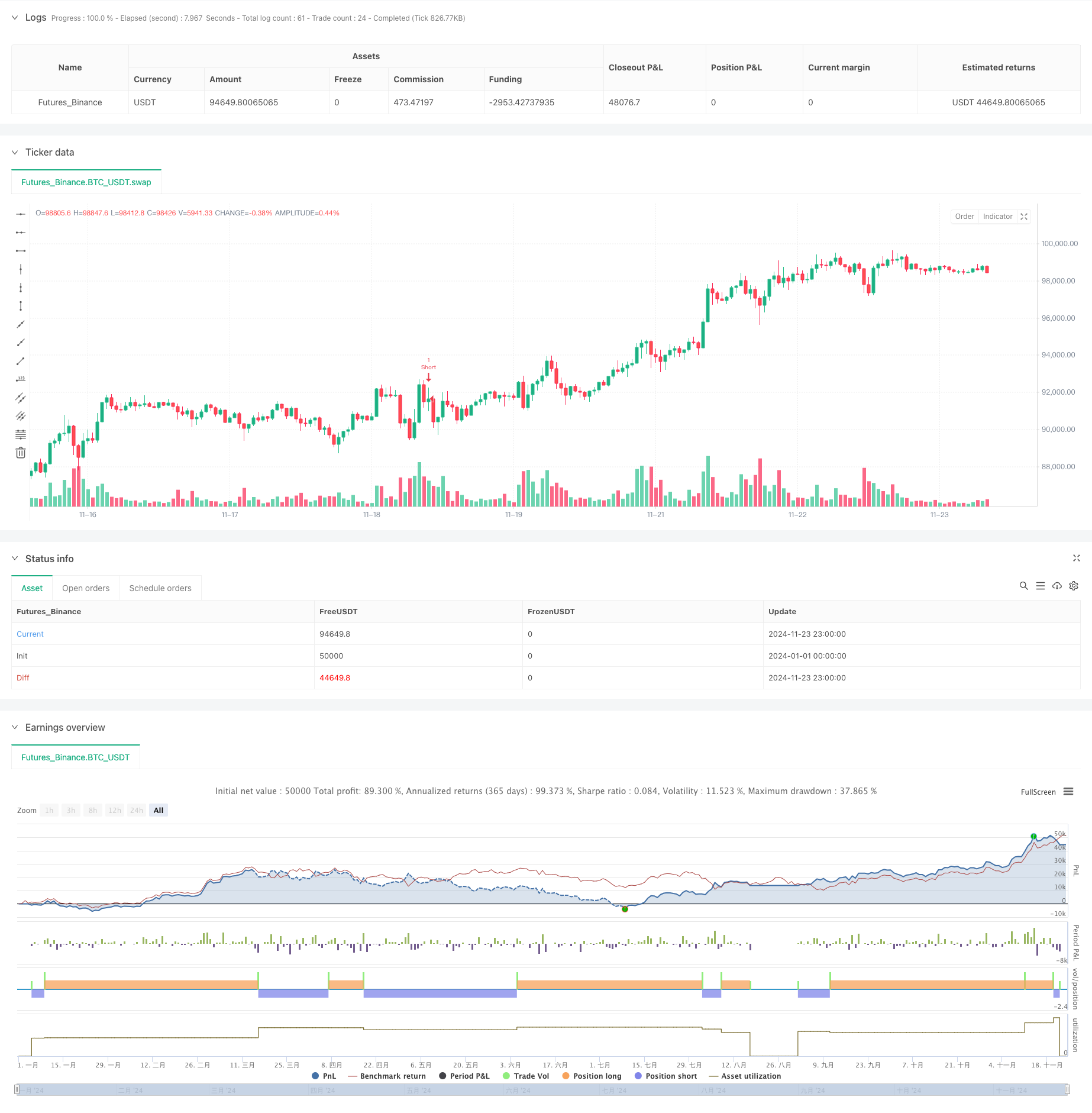

/*backtest

start: 2024-01-01 00:00:00

end: 2024-11-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=5

strategy("Price Action + Double MACD Strategy with ATR Trailing", overlay=true)

// Inputs for MACD

fastLength1 = input.int(34, title="First MACD Fast Length")

slowLength1 = input.int(144, title="First MACD Slow Length")

signalLength1 = input.int(9, title="First MACD Signal Length")

fastLength2 = input.int(100, title="Second MACD Fast Length")

slowLength2 = input.int(200, title="Second MACD Slow Length")

signalLength2 = input.int(50, title="Second MACD Signal Length")

// Input for ATR Trailing

atrMultiplier = input.float(1.5, title="ATR Multiplier for Trailing")

// Inputs for Stop Loss

atrStopMultiplier = input.float(1.0, title="ATR Multiplier for Stop Loss")

// MACD Calculations

[macdLine1, signalLine1, macdHist1] = ta.macd(close, fastLength1, slowLength1, signalLength1)

[macdLine2, signalLine2, macdHist2] = ta.macd(close, fastLength2, slowLength2, signalLength2)

// Get 15M MACD histogram colors

macdHist1Color = request.security(syminfo.tickerid, "15", (macdHist1 >= 0 ? (macdHist1[1] < macdHist1 ? #26A69A : #B2DFDB) : (macdHist1[1] < macdHist1 ? #FFCDD2 : #FF5252)))

macdHist2Color = request.security(syminfo.tickerid, "15", (macdHist2 >= 0 ? (macdHist2[1] < macdHist2 ? #26A69A : #B2DFDB) : (macdHist2[1] < macdHist2 ? #FFCDD2 : #FF5252)))

// Check MACD color conditions

isMacdUptrend = macdHist1Color == #26A69A and macdHist2Color == #26A69A

isMacdDowntrend = macdHist1Color == #FF5252 and macdHist2Color == #FF5252

// Function to detect strong 5M candles

isStrongCandle(open, close, high, low) =>

body = math.abs(close - open)

tail = math.abs(high - low) - body

body > tail * 1.5 // Ensure body is larger than the tail

// Variables to track state

var float fiveMinuteHigh = na

var float fiveMinuteLow = na

var bool tradeExecuted = false

var bool breakoutDetected = false

var float entryPrice = na

var float stopLossPrice = na

var float longTakeProfit = na

var float shortTakeProfit = na

// Check for new 15M candle and reset flags

if ta.change(time("15"))

tradeExecuted := false // Reset trade execution flag

breakoutDetected := false // Reset breakout detection

if isStrongCandle(open[1], close[1], high[1], low[1])

fiveMinuteHigh := high[1]

fiveMinuteLow := low[1]

else

fiveMinuteHigh := na

fiveMinuteLow := na

// Get 1-minute close prices

close1m = request.security(syminfo.tickerid, "5", close)

// Ensure valid breakout direction and avoid double breakouts

if not na(fiveMinuteHigh) and not breakoutDetected

for i = 1 to 3

if close1m[i] > fiveMinuteHigh and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdUptrend

// Open Long trade

entryPrice := close

stopLossPrice := close - (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

longTakeProfit := close + (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Long", strategy.long)

tradeExecuted := true

break // Exit the loop after detecting a breakout

else if close1m[i] < fiveMinuteLow and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdDowntrend

// Open Short trade

entryPrice := close

stopLossPrice := close + (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

shortTakeProfit := close - (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Short", strategy.short)

tradeExecuted := true

break // Exit the loop after detecting a breakout

// Update trailing take-profit dynamically

if tradeExecuted and strategy.position_size > 0 // Long trade

longTakeProfit := math.max(longTakeProfit, close + (atrMultiplier * ta.atr(14)))

strategy.exit("Long TP/SL", "Long", stop=stopLossPrice, limit=longTakeProfit)

else if tradeExecuted and strategy.position_size < 0 // Short trade

shortTakeProfit := math.min(shortTakeProfit, close - (atrMultiplier * ta.atr(14)))

strategy.exit("Short TP/SL", "Short", stop=stopLossPrice, limit=shortTakeProfit)

// Reset trade state when position is closed

if strategy.position_size == 0

tradeExecuted := false

entryPrice := na

longTakeProfit := na

shortTakeProfit := na

相关推荐

- 基于MACD信号线交叉与ATR风险管理的优化趋势跟踪策略

- MACD与限制性马丁格尔相结合的高级策略

- H1趋势偏差+M15 MACD信号+M5快速波动率缺口策略

- 基于MACD与Supertrend的双重验证趋势跟踪交易策略

- EMA-MACD高频量化策略与智能风控系统

- EMA MACD 动量跟踪策略

- 多指标趋势追踪策略

- 趋势跟随与动量过滤相结合的交易策略

- 多指标趋势追踪策略结合布林带和 ATR 动态止损

- 逆向波动率突破策略

更多内容

- 均值回归型布林带RSI策略结合ATR动态止损优化系统

- 基于抛物线SAR指标的动态交易策略系统

- 自适应波动率与动量量化交易系统(AVMQTS)

- 基于玻林格带与蜡烛图形态的高级趋势交易策略

- 基于ATR波动率和均线的自适应趋势跟踪退出策略

- 双均线动量趋势交易策略结合满实体烛线信号系统

- 双时间周期超级趋势与RSI策略优化系统

- 双均线交叉趋势追踪策略结合动态止盈止损系统

- 多重时间框架趋势跟踪交易系统(MTF-ATR-MACD)

- 双时间周期超趋势RSI智能交易策略

- 多重均线趋势动量识别与止损交易系统

- 双均线成交量趋势确认量化交易策略

- 双均线RSI交叉动态止盈止损量化策略

- 增强型多周期动态自适应趋势跟踪交易系统

- 大幅波动突破型双向交易策略:基于点位阈值的多空进场系统

- 强化波林格均值回归量化策略

- 动态达瓦斯箱体突破与均线趋势确认交易系统

- EMA双均线交叉动态止盈止损量化交易策略

- 多重EMA交叉趋势跟踪与动态止盈止损优化策略

- 双均线交叉自适应动态止盈止损策略