Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

Author: ChaoZhang, Date: 2024-12-11 17:17:50Tags: CMOSMORSISMAMRTS

Overview

The Mean-Reversion Trading Strategy based on the Chande Momentum Oscillator (CMO) is a technical analysis strategy that identifies overbought and oversold zones by calculating price momentum over a specific period. The strategy monitors momentum changes in asset prices and trades when prices show extreme deviations, aiming to capture mean-reversion opportunities. It uses a 9-day CMO indicator as the core signal, entering long positions when CMO falls below -50 and exiting when CMO rises above 50 or the holding period exceeds 5 days.

Strategy Principle

The core of the strategy lies in the calculation and application of the CMO indicator. CMO measures momentum by computing the ratio of the difference between gains and losses to their sum over a specified period. The formula is: CMO = 100 × (Sum of Gains - Sum of Losses)/(Sum of Gains + Sum of Losses)

Unlike traditional RSI, CMO uses both up and down movements in the numerator, providing a more symmetrical momentum measurement. The strategy enters long positions when CMO falls below -50, indicating oversold conditions and expecting price recovery. Positions are closed when CMO rises above 50 or after holding for 5 days.

Strategy Advantages

- Clear Signals - CMO provides definitive overbought and oversold criteria, generating unambiguous trading signals

- Robust Risk Control - Maximum holding period prevents long-term position trapping

- High Adaptability - Parameters can be adjusted for different market conditions

- Solid Theoretical Foundation - Based on well-established mean-reversion theory with academic support

- Simple Calculation - Indicator methodology is straightforward and easy to understand

Strategy Risks

- Trend Market Risk - Mean-reversion strategies may suffer frequent losses in strong trending markets

- Parameter Sensitivity - Strategy performance heavily depends on CMO period and threshold selection

- False Signal Risk - Volatile markets may generate false signals

- Time Risk - Fixed exit timing might miss better profit opportunities

- Slippage Risk - May face significant slippage in low liquidity markets

Optimization Directions

- Trend Filtering - Add long-term trend indicators to trade only with the trend

- Dynamic Parameter Optimization - Adjust CMO period and thresholds based on market volatility

- Enhanced Stop-Loss - Implement dynamic stop-loss to protect profits

- Holding Period Optimization - Dynamically adjust maximum holding time based on volatility

- Volume Confirmation - Incorporate volume indicators to improve signal reliability

Summary

The strategy captures market overbought and oversold opportunities through the CMO indicator, combining fixed-time stop-loss to build a robust mean-reversion trading system. It features clear logic and reasonable risk control with practical value. The strategy’s stability and profitability can be further enhanced through parameter optimization and additional auxiliary indicators.

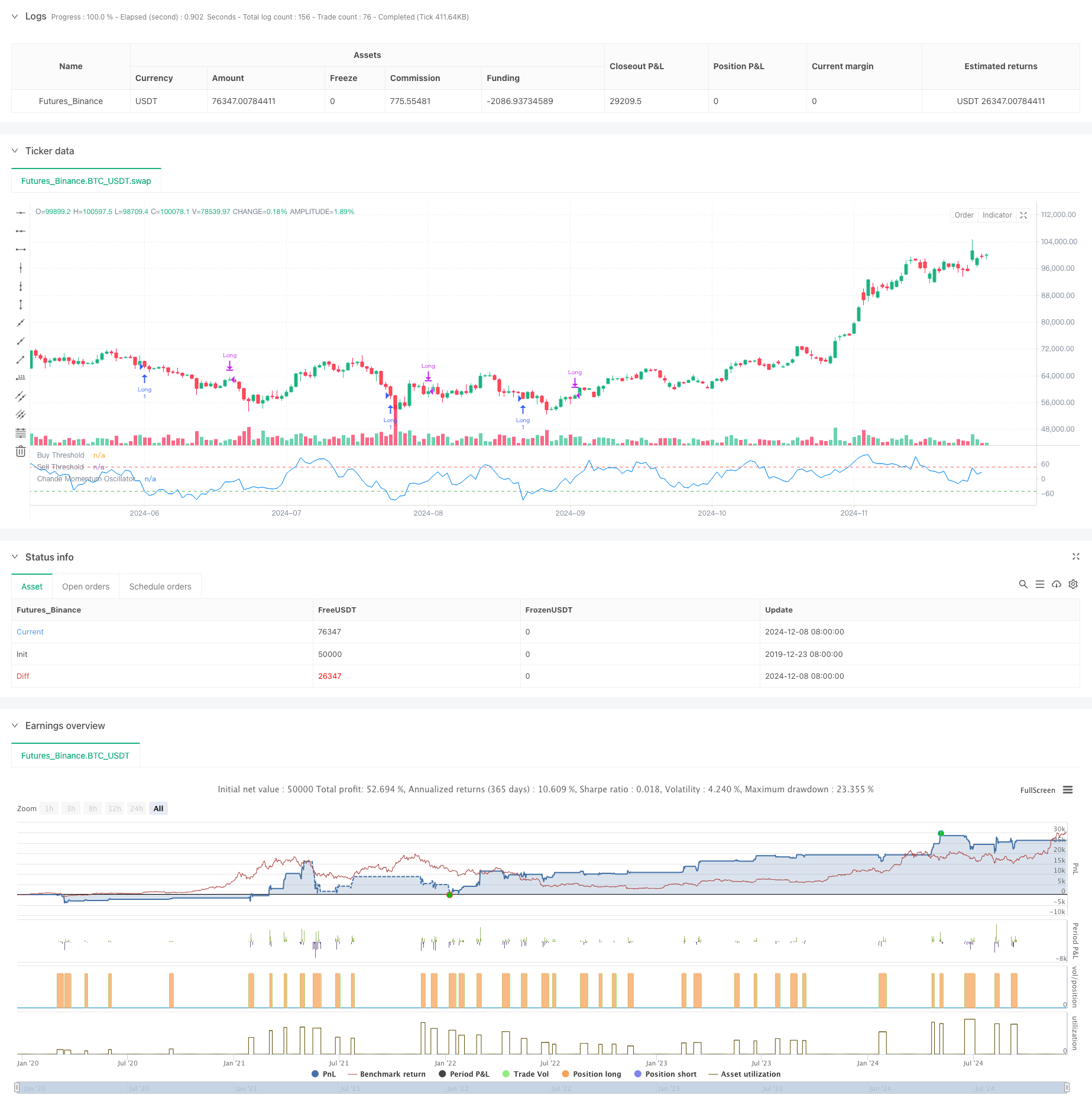

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Chande Momentum Oscillator Strategy", overlay=false)

// Input for the CMO period

cmoPeriod = input.int(9, minval=1, title="CMO Period")

// Calculate price changes

priceChange = ta.change(close)

// Separate positive and negative changes

up = priceChange > 0 ? priceChange : 0

down = priceChange < 0 ? -priceChange : 0

// Calculate the sum of ups and downs using a rolling window

sumUp = ta.sma(up, cmoPeriod) * cmoPeriod

sumDown = ta.sma(down, cmoPeriod) * cmoPeriod

// Calculate the Chande Momentum Oscillator (CMO)

cmo = 100 * (sumUp - sumDown) / (sumUp + sumDown)

// Define the entry and exit conditions

buyCondition = cmo < -50

sellCondition1 = cmo > 50

sellCondition2 = ta.barssince(buyCondition) >= 5

// Track if we are in a long position

var bool inTrade = false

if (buyCondition and not inTrade)

strategy.entry("Long", strategy.long)

inTrade := true

if (sellCondition1 or sellCondition2)

strategy.close("Long")

inTrade := false

// Plot the Chande Momentum Oscillator

plot(cmo, title="Chande Momentum Oscillator", color=color.blue)

hline(-50, "Buy Threshold", color=color.green)

hline(50, "Sell Threshold", color=color.red)

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Bollinger Bands RSI Neutral Market Quantitative Trading Strategy

- SMA Crossover Strategy with RSI Filter and Alerts

- RSI Trend Momentum Trading Strategy with Dual MA and Volume Confirmation

- Dynamic Stop-Loss and Take-Profit Dual Moving Average Trend Following Strategy with Candlestick Reactions

- Relative Strength Index Mean Reversion Strategy

- Intraday BUY/SELL

- Trading the Equity Curve Position Sizing Example

- Advanced Volatility Mean Reversion Trading Strategy: Multi-Dimensional Quantitative Trading System Based on VIX and Moving Average

- Gold Trend Channel Reversal Momentum Strategy

- Advanced EMA Momentum Trend Trading Strategy

- Multi-MA Trend Intensity Trading Strategy - A Flexible Smart Trading System Based on MA Deviation

- Volume-Weighted Dual Trend Detection System

- Multi-Factor Counter-Trend Trading Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Period SuperTrend Dynamic Trading Strategy

- Multi-Timeframe EMA with Fibonacci Retracement and Pivot Points Trading Strategy

- Multi-Timeframe Dynamic Stop-Loss EMA-Squeeze Trading Strategy

- MACD and Linear Regression Dual Signal Intelligent Trading Strategy

- Multi-EMA Trend Following Trading Strategy

- Multi-Timeframe Smoothed Heikin Ashi Trend Following Quantitative Trading System

- Dynamic RSI Oscillator Polynomial Fitting Indicator Trend Quantitative Trading Strategy

- Daily Range Breakout Single-Direction Trading Strategy

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy