Tendencia de seguir una estrategia basada en señales cruzadas OBV y MA

El autor:¿ Qué pasa?, Fecha: 2024-04-29 13:48:58Las etiquetas:Vehículo de transporte- ¿Qué es?La SMA

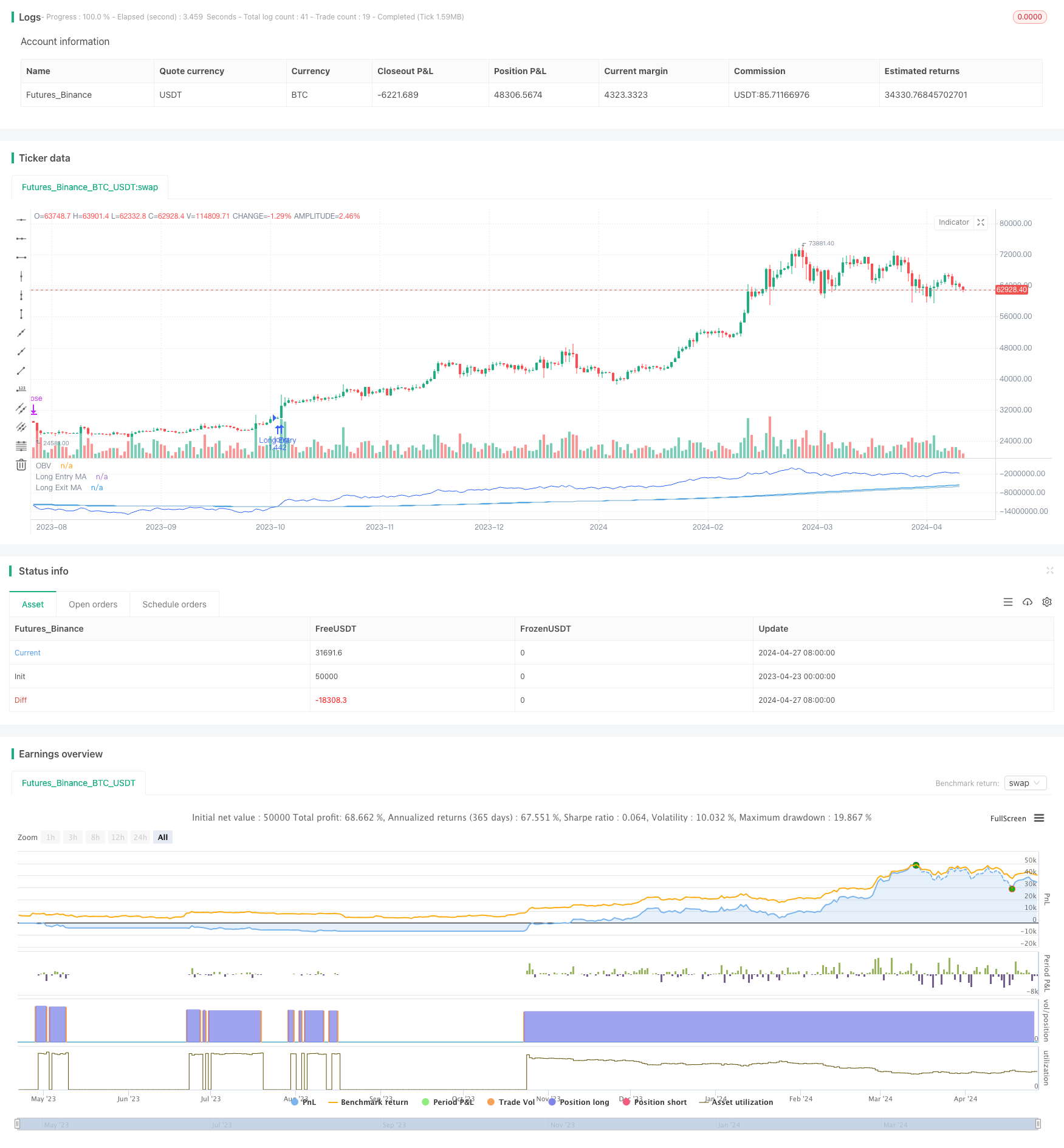

Resumen general

Esta estrategia, llamada

Principios de estrategia

- Calcular el valor del indicador OBV: si el precio de cierre actual es superior al de la vela anterior, añadir el volumen actual a OBV; de lo contrario, restar el volumen.

- Se calcularán cuatro medias móviles de la OBV: MA de entrada larga a largo plazo, MA de salida larga a largo plazo, MA de entrada corta a corto plazo y MA de salida corta a corto plazo.

- Generar señales comerciales:

- Cuando OBV cruce por encima del MA de entrada a largo plazo y el filtro de dirección no esté ajustado a corto, abra una posición larga.

- Cuando el OBV se cruce por debajo del MA de salida a largo plazo, cierre la posición larga.

- Cuando el OBV se cruce por debajo del MA de entrada corta a corto plazo y el filtro de dirección no esté configurado para largo, abra una posición corta.

- Cuando el OBV cruce por encima del MA de salida corta a corto plazo, cierre la posición corta.

- Gestión de operaciones: si se genera una señal opuesta, la posición original se cerrará antes de abrir una nueva posición.

Ventajas estratégicas

- Utilice plenamente las principales señales de tendencia de OBV para establecer posiciones al comienzo de una tendencia.

- La separación de los MA de entrada y salida permite una optimización independiente de los tiempos de entrada y salida.

- La lógica del código es simple y clara, fácil de entender y mejorar.

- La introducción de un filtro de dirección puede evitar el comercio frecuente y reducir los costes.

Riesgos estratégicos

- Se recomienda su uso en combinación con otros indicadores.

- No tiene una gestión de pérdidas y pérdidas de posición, por lo que corre el riesgo de que se amplifiquen las pérdidas de una sola operación.

- La selección incorrecta de parámetros afectará al rendimiento de la estrategia. Los parámetros deben optimizarse en función de las diferentes características y plazos del mercado.

Direcciones para la optimización de la estrategia

- Considere la posibilidad de introducir filtros de tendencia, tales como dirección MA, ATR, etc., para mejorar la calidad de la señal.

- Se pueden utilizar diferentes tipos de MAs en OBV, como EMA, WMA, etc., para capturar tendencias de velocidades variables.

- Optimizar la gestión de posiciones, como el uso de una estrategia de escala para agregar posiciones cuando la fuerza de la tendencia aumenta y reducir las posiciones cuando disminuye.

- Combinar con otros indicadores de volumen y precio, como MVA, PVT, etc., para construir señales conjuntas para mejorar las tasas de ganancia.

Resumen de las actividades

Esta estrategia demuestra un método simple de seguimiento de tendencias basado en cruces de OBV y MA. Sus ventajas son lógica clara, captura oportuna de tendencias y control flexible de retención a través de entradas y salidas separadas de MA. Sin embargo, sus desventajas incluyen la falta de medidas de control de riesgos y métodos de confirmación de señales. Se pueden hacer mejoras en áreas como filtrado de tendencias, optimización de parámetros, gestión de posiciones y señales conjuntas para obtener un rendimiento de estrategia más robusto.

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ThousandX_Trader

//@version=5

strategy(title="OBVious MA Strategy [1000X]", overlay=false,

initial_capital=10000, margin_long=0.1, margin_short=0.1,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// Direction Input ///

tradeDirection = input.string("long", title="Direction", options=["long", "short"], group = "Direction Filter")

///////////////////////////////////////

// 1000X OBV MA INDICATOR //

///////////////////////////////////////

// OBV Trend Length Inputs //

long_entry_length = input(190, title="Long Entry MA Length", group = "Moving Average Settings")

long_exit_length = input(202, title="Long Exit MA Length", group = "Moving Average Settings")

short_entry_length = input(395, title="Short MA Entry Length", group = "Moving Average Settings")

short_exit_length = input(300, title="Short Exit MA Length", group = "Moving Average Settings")

// OBV Calculation

obv = ta.cum(ta.change(close) >= 0 ? volume : -volume)

// Calculate OBV Moving Averages

obv_ma_long_entry = ta.sma(obv, long_entry_length)

obv_ma_long_exit = ta.sma(obv, long_exit_length)

obv_ma_short_entry = ta.sma(obv, short_entry_length)

obv_ma_short_exit = ta.sma(obv, short_exit_length)

///////////////////////////////////////

// STRATEGY RULES //

///////////////////////////////////////

longCondition = ta.crossover(obv, obv_ma_long_entry) and tradeDirection != "short" and strategy.position_size <= 0

longExitCondition = ta.crossunder(obv, obv_ma_long_exit)

shortCondition = ta.crossunder(obv, obv_ma_short_entry) and tradeDirection != "long" and strategy.position_size >= 0

shortExitCondition = ta.crossover(obv, obv_ma_short_exit)

///////////////////////////////////////

// ORDER EXECUTION //

///////////////////////////////////////

// Close opposite trades before entering new ones

if (longCondition and strategy.position_size < 0)

strategy.close("Short Entry")

if (shortCondition and strategy.position_size > 0)

strategy.close("Long Entry")

// Enter new trades

if (longCondition)

strategy.entry("Long Entry", strategy.long)

if (shortCondition)

strategy.entry("Short Entry", strategy.short)

// Exit conditions

if (longExitCondition)

strategy.close("Long Entry")

if (shortExitCondition)

strategy.close("Short Entry")

///////////////////////////////////////

// PLOTTING //

///////////////////////////////////////

// Plot OBV line with specified color

plot(obv, title="OBV", color=color.new(#2962FF, 0), linewidth=1)

// Conditionally plot Long MAs with specified colors based on Direction Filter

plot(tradeDirection == "long" ? obv_ma_long_entry : na, title="Long Entry MA", color=color.new(color.rgb(2, 130, 228), 0), linewidth=1)

plot(tradeDirection == "long" ? obv_ma_long_exit : na, title="Long Exit MA", color=color.new(color.rgb(106, 168, 209), 0), linewidth=1)

// Conditionally plot Short MAs with specified colors based on Direction Filter

plot(tradeDirection == "short" ? obv_ma_short_entry : na, title="Short Entry MA", color=color.new(color.rgb(163, 2, 227), 0), linewidth=1)

plot(tradeDirection == "short" ? obv_ma_short_exit : na, title="Short Exit MA", color=color.new(color.rgb(192, 119, 205), 0), linewidth=1)

- Se trata de la suma de las pérdidas de los valores de los valores de las pérdidas de los valores de las pérdidas de los valores de las pérdidas de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de las pérdidas de los valores de los valores de los valores de los valores de los valores de los valores de los valores de los valores de las

- Estrategia de cruce de impulso de la nube con promedios móviles y confirmación de volumen

- Estrategia de cruce de la media móvil

- Estrategia de cruce de la media móvil doble de la MA, SMA

- Estrategia cruzada de la MA

- Estrategia de negociación de la media móvil doble de la SMA

- Estrategia de gestión de riesgos adaptativa basada en una doble media móvil de cruz de oro

- Estrategia de cruce de dos medias móviles

- Estrategia de cruce de medias móviles basada en medias móviles dobles

- La media móvil cruzada con la estrategia de ganancias múltiples

- MA99 Estrategia de stop-loss táctil y dinámica

- Estrategia de negociación de ruptura de Donchian

- Ichimoku liderando la estrategia de escape de Span B

- La entrada larga en la EMA se cruza con la estrategia de gestión de riesgos

- Estrategia de negociación a largo plazo combinada del MACD y del RSI

- La entidad deberá presentar un plan de operaciones para el cálculo de las pérdidas y de las pérdidas.

- Estrategia de negociación de VWAP

- Estrategia de combinación de múltiples indicadores (CCI, DMI, MACD, ADX)

- RSI2 Estrategia de reversión intradiaria de la tasa de ganancia

- Las líneas futuras de la estrategia de demarcación

- GBS TOP Bottom Estrategia confirmada

- Tendencia de múltiples indicadores siguiendo la estrategia

- Transformador de prueba de retroceso v2.0

- Estrategia de inversión de tendencia de Fibonacci

- Estrategia de ruta en zigzag de la HTF

- WaveTrend Cruza la estrategia de LazyBear

- El CCI, el DMI y la estrategia de corto plazo híbrida MACD

- Estrategia de negociación de AlphaTradingBot

- Las Vegas SuperTrend Estrategia mejorada

- Estrategia de negociación cuantitativa basada en la media móvil modificada del casco y Ichimoku Kinko Hyo