Estrategia de predicción cruzada de la oscilación dinámica del MACD

El autor:¿ Qué pasa?, Fecha: 2024-11-27 14:54:02Las etiquetas:El MACDEl EMALa SMALa ROC

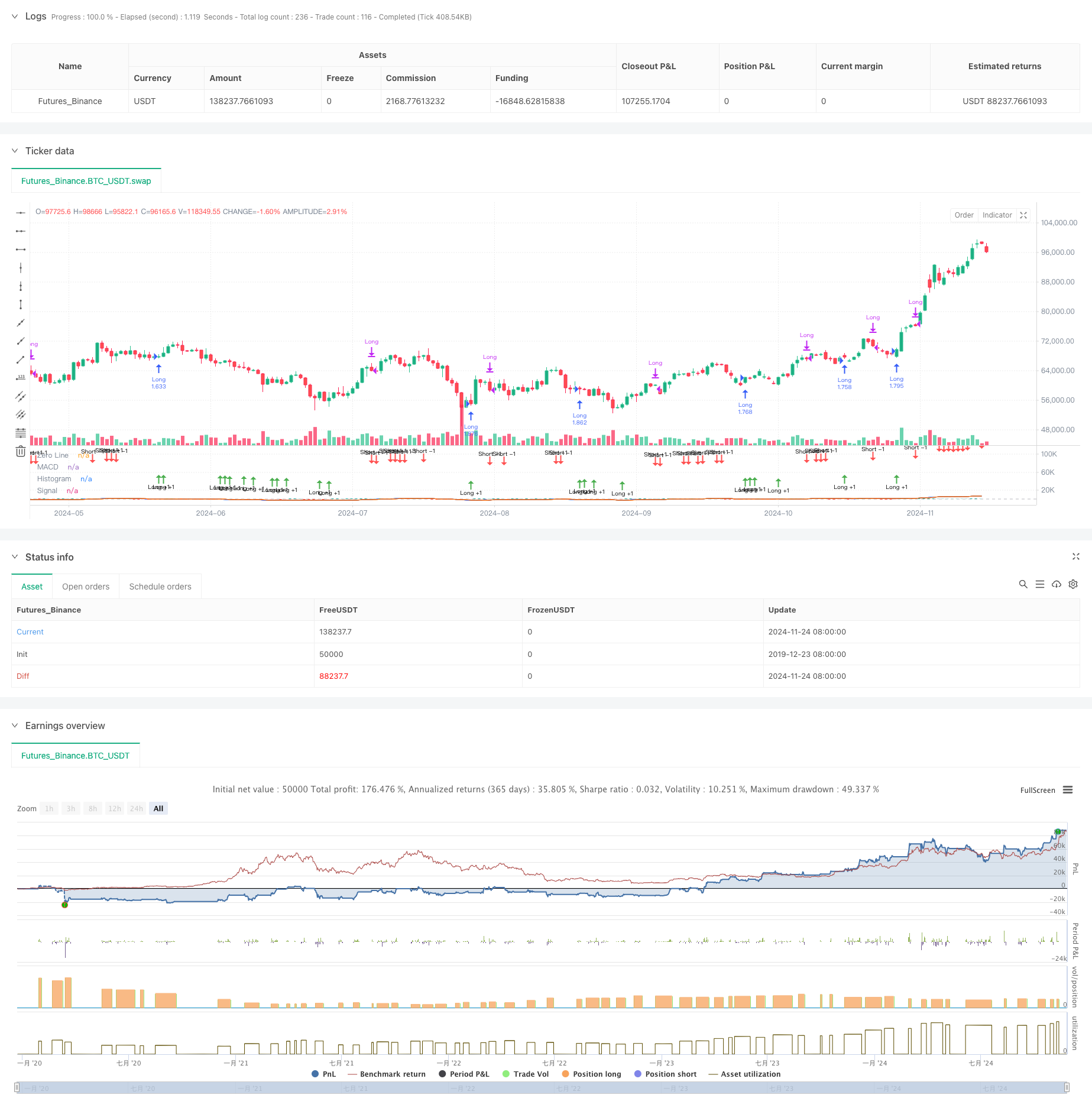

Resumen general

Esta estrategia basa las decisiones comerciales en las características dinámicas del indicador MACD (Moving Average Convergence Divergence). El enfoque central se centra en observar los cambios en el histograma MACD para predecir posibles cruces de oro y muerte, lo que permite el establecimiento temprano de posiciones.

Principios de estrategia

La estrategia emplea un sistema de indicadores MACD modificado, que incorpora la diferencia entre las medias móviles rápidas (EMA12) y lentas (EMA26), junto con una línea de señal de 2 períodos.

- Calcular la tasa de cambio del histograma (hist_change) para juzgar la dinámica de la tendencia

- Anticipación de señales de cruz dorada al entrar en posiciones largas cuando el histograma es negativo y muestra una tendencia al alza durante tres períodos consecutivos

- Anticipación de señales cruzadas de muerte cerrando posiciones cuando el histograma es positivo y muestra una tendencia a la baja durante tres períodos consecutivos

- Implementación de un mecanismo de filtración temporal para negociar únicamente dentro de intervalos de tiempo especificados

Ventajas estratégicas

- Predicción de señales fuertes: Anticipa señales potenciales de cruce observando la dinámica del histograma, mejorando el tiempo de entrada

- Control de riesgos razonable: Incorpora una comisión del 0,1% y un deslizamiento de 3 puntos, lo que refleja condiciones comerciales realistas

- Gestión de capital flexible: utiliza el tamaño de las posiciones basado en el porcentaje en relación con el patrimonio neto de la cuenta para un control eficaz del riesgo

- Excelente visualización: utiliza histogramas codificados por colores y marcadores de flechas para señales comerciales, facilitando el análisis

Riesgos estratégicos

- Riesgo de ruptura falsa: pueden producirse señales falsas frecuentes en mercados variados

- Riesgo de retraso: a pesar de los mecanismos predictivos, el MACD conserva cierto retraso inherente

- Dependencia del entorno del mercado: la estrategia tiene un mejor rendimiento en mercados de tendencia, con un rendimiento potencialmente inferior en condiciones variables

- Sensibilidad de parámetros: el rendimiento de la estrategia depende en gran medida de la configuración del período de línea rápida y lenta

Direcciones de optimización

- Filtración del entorno de mercado: añadir indicadores de identificación de tendencias para ajustar los parámetros de negociación en función de las condiciones del mercado

- Mejora de la gestión de la posición: Implementar dimensionamiento dinámico de la posición basado en la intensidad de la señal

- Implementación de pérdidas de parada: añadir pérdidas de parada de espera o fijas para controlar el descenso

- Mejora de la confirmación de la señal: incorporar indicadores técnicos adicionales para la validación cruzada

- Optimización de parámetros: Implementar parámetros adaptativos que se ajustan según las condiciones del mercado

Resumen de las actividades

Esta estrategia utiliza de manera innovadora las características dinámicas del histograma MACD para mejorar los sistemas de negociación MACD tradicionales. El mecanismo predictivo proporciona señales de entrada más tempranas, mientras que las estrictas condiciones de negociación y las medidas de control de riesgos aseguran la estabilidad de la estrategia.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Demo GPT - Moving Average Convergence Divergence", shorttitle="MACD", commission_type=strategy.commission.percent, commission_value=0.1, slippage=3, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Getting inputs

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

src = input(title="Source", defval=close)

signal_length = input.int(title="Signal Smoothing", minval=1, maxval=50, defval=2) // Set smoothing line to 2

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"])

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"])

// Date inputs

start_date = input(title="Start Date", defval=timestamp("2018-01-01T00:00:00"))

end_date = input(title="End Date", defval=timestamp("2069-12-31T23:59:59"))

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

// Strategy logic

isInDateRange = true

// Calculate the rate of change of the histogram

hist_change = hist - hist[1]

// Anticipate a bullish crossover: histogram is negative, increasing, and approaching zero

anticipate_long = isInDateRange and hist < 0 and hist_change > 0 and hist > hist[1] and hist > hist[2]

// Anticipate an exit (bearish crossover): histogram is positive, decreasing, and approaching zero

anticipate_exit = isInDateRange and hist > 0 and hist_change < 0 and hist < hist[1] and hist < hist[2]

if anticipate_long

strategy.entry("Long", strategy.long)

if anticipate_exit

strategy.close("Long")

// Plotting

hline(0, "Zero Line", color=color.new(#787B86, 50))

plot(hist, title="Histogram", style=plot.style_columns, color=(hist >= 0 ? (hist > hist[1] ? #26A69A : #B2DFDB) : (hist < hist[1] ? #FF5252 : #FFCDD2)))

plot(macd, title="MACD", color=#2962FF)

plot(signal, title="Signal", color=#FF6D00)

// Plotting arrows when anticipating the crossover

plotshape(anticipate_long, title="Long +1", location=location.belowbar, color=color.green, style=shape.arrowup, size=size.tiny, text="Long +1")

plotshape(anticipate_exit, title="Short -1", location=location.abovebar, color=color.red, style=shape.arrowdown, size=size.tiny, text="Short -1")

- Indicador de inversión de K I

- Indicador personalizado CM MACD - Marco de tiempo múltiple - V2

- Sistema de negociación de confirmación de tendencia MACD doble

- La media móvil cruzada + la estrategia de impulso de la línea lenta del MACD

- La estrategia de negociación de doble cruce MACD de Lag Cero - Negociación de alta frecuencia basada en la captura de tendencias a corto plazo

- Estrategia corta y larga del MACD ZeroLag

- Sistema de negociación dinámico de stop-loss y take-profit de intervalo múltiple MACD

- Estrategia de combinación MACD y Martingale para una operación larga optimizada

- Estrategia de negociación cuantitativa ajustable para el cruce de fechas de la media móvil MACD doble

- Estrategia de ruptura del MACD BB

- Seguimiento de la tendencia de la media móvil triple e integración del impulso Estrategia de negociación cuantitativa

- Estrategia de negociación dinámica basada en Z-Score y Supertrend: sistema de conmutación larga-corta

- Breakout de Bollinger adaptativo con sistema de estrategia cuantitativa de media móvil

- Sistema de negociación de stop-loss adaptativo optimizado por IA con integración de múltiples indicadores técnicos

- Cruce de la media móvil de varios períodos con sistema de análisis de volumen

- Estrategia cuantitativa de seguimiento del impulso de la media móvil doble

- Estrategia doble de cruce de promedio móvil con stop-loss y take-profit adaptativos

- Tendencia adaptativa siguiendo una estrategia basada en el oscilador de impulso

- Estrategia de volumen-precio cruzada de tendencias de PVT-EMA

- Sistema de negociación cuantitativa de cruce dinámico de varios períodos MACD-EMA

- Sistema de negociación dinámico de acción de precios VWAP-ATR

- Estrategia cuantitativa de tendencia dinámica basada en bandas de Bollinger y cruce RSI

- En el caso de los instrumentos financieros, el valor de los activos financieros de la entidad será el valor de los activos financieros de la entidad.

- Sistema dinámico de estrategia de negociación basado en el indicador SAR parabólico

- Sistema de negociación cuantitativo de volatilidad y impulso adaptativos (AVMQTS)

- Estrategia de negociación de tendencias avanzadas basada en bandas de Bollinger y patrones de candlestick

- Tendencia de adaptación basada en la volatilidad del ATR y la media móvil tras la estrategia de salida

- Estrategia de negociación de tendencia de doble EMA con sistema de señal de vela de cuerpo completo

- Supertrend de doble marco de tiempo con sistema de optimización de RSI

- Tendencia cruzada de media móvil doble siguiendo una estrategia con sistema dinámico de stop-loss y take-profit