Stratégie dynamique de super-tendance ajustée à la volatilité en plusieurs étapes

Auteur:ChaoZhang est là., Date: 2024-11-29 16h57 et 19hLes étiquettes:ATRSMAMaladie sexuellement transmissibleTP

Résumé

La Stratégie dynamique SuperTrend ajustée à la volatilité en plusieurs étapes est un système de trading innovant qui combine les indicateurs Vegas Channel et SuperTrend. La particularité de la stratégie réside dans sa capacité à s'adapter dynamiquement à la volatilité du marché et son mécanisme de prise de profit en plusieurs étapes pour optimiser les ratios risque-rendement. En combinant l'analyse de la volatilité du canal Vegas avec les capacités de suivi des tendances de SuperTrend, la stratégie ajuste automatiquement ses paramètres à mesure que les conditions du marché changent, fournissant des signaux de trading plus précis.

Principe de stratégie

La stratégie fonctionne sur trois composants principaux: le calcul du canal de Vegas, la détection de tendance et le mécanisme de prise de profit en plusieurs étapes. Le canal de Vegas utilise la moyenne mobile simple (SMA) et l'écart type (STD) pour définir les plages de volatilité des prix, tandis que l'indicateur SuperTrend détermine la direction de la tendance en fonction des valeurs ATR ajustées. Les signaux de trading sont générés lorsque les tendances du marché changent. Le mécanisme de prise de profit en plusieurs étapes permet des sorties partielles à différents niveaux de prix, une méthode qui bloque les profits et permet aux positions restantes de capturer des gains potentiels.

Les avantages de la stratégie

- Adaptabilité dynamique: la stratégie s'adapte automatiquement aux différentes conditions du marché grâce au facteur d'ajustement à la volatilité.

- Gestion des risques: le mécanisme de prise de profit en plusieurs étapes offre une approche systématique de la réalisation des bénéfices.

- Personnalisabilité: offre plusieurs paramètres pour s'adapter à différents styles de négociation.

- Couverture complète du marché: soutient les transactions à long terme et à court terme.

- Réaction visuelle: offre une interface graphique claire pour l'analyse et la prise de décision.

Risques stratégiques

- Sensibilité des paramètres: différentes combinaisons de paramètres peuvent entraîner des variations significatives des performances.

- Décalage: Les indicateurs basés sur des moyennes mobiles présentent un décalage inhérent.

- Risque de fausse rupture: peut générer de faux signaux sur des marchés variés.

- Compromises de prise de bénéfices: les prises de bénéfices précoces peuvent manquer les tendances majeures, les prises de bénéfices tardives risquent de perdre les gains accumulés.

Directions d'optimisation de la stratégie

- Mettre en place des filtres de l'environnement du marché pour ajuster les paramètres de la stratégie dans différentes conditions du marché.

- Ajoutez une analyse de volume pour améliorer la fiabilité du signal.

- Développer des mécanismes adaptatifs de prise de profit qui ajustent dynamiquement les niveaux de profit en fonction de la volatilité du marché.

- Intégrer des indicateurs techniques supplémentaires pour la confirmation du signal.

- Mettre en œuvre une dimensionnement dynamique des positions basé sur le risque de marché.

Résumé

La Stratégie dynamique multi-étape ajustée à la volatilité est une approche quantitative avancée du trading, combinant plusieurs indicateurs techniques et des mécanismes innovants de prise de profit pour fournir aux traders un système de trading complet.

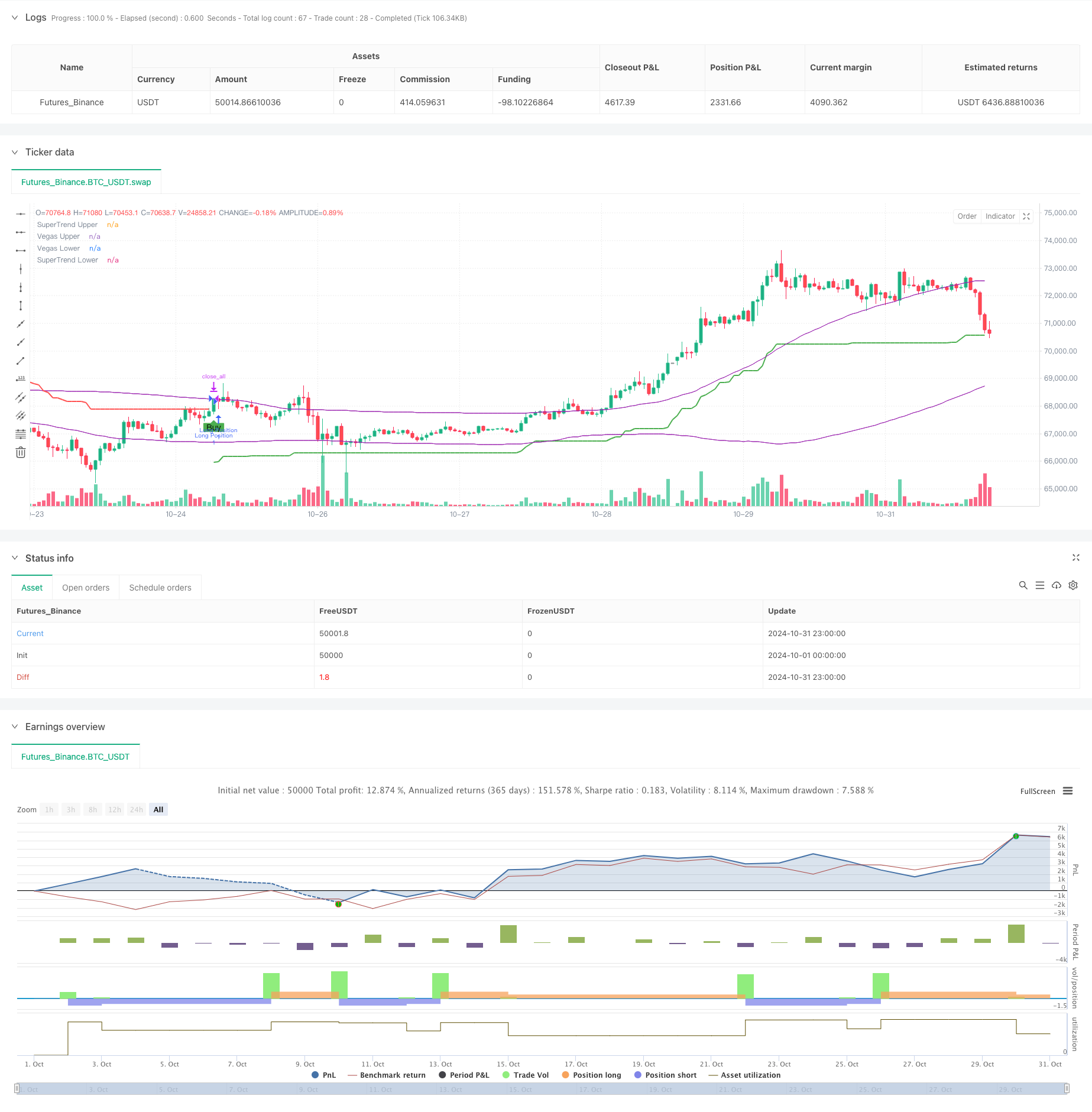

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Step Vegas SuperTrend - strategy [presentTrading]", shorttitle="Multi-Step Vegas SuperTrend - strategy [presentTrading]", overlay=true, precision=3, commission_value=0.1, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD)

// Input settings allow the user to customize the strategy's parameters.

tradeDirectionChoice = input.string(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"]) // Option to select the trading direction

atrPeriod = input(10, "ATR Period for SuperTrend") // Length of the ATR for volatility measurement

vegasWindow = input(100, "Vegas Window Length") // Length of the moving average for the Vegas Channel

superTrendMultiplier = input(5, "SuperTrend Multiplier Base") // Base multiplier for the SuperTrend calculation

volatilityAdjustment = input.float(5, "Volatility Adjustment Factor") // Factor to adjust the SuperTrend sensitivity to the Vegas Channel width

// User inputs for take profit settings

useTakeProfit = input.bool(true, title="Use Take Profit", group="Take Profit Settings")

takeProfitPercent1 = input.float(3.0, title="Take Profit % Step 1", group="Take Profit Settings")

takeProfitPercent2 = input.float(6.0, title="Take Profit % Step 2", group="Take Profit Settings")

takeProfitPercent3 = input.float(12.0, title="Take Profit % Step 3", group="Take Profit Settings")

takeProfitPercent4 = input.float(21.0, title="Take Profit % Step 4", group="Take Profit Settings")

takeProfitAmount1 = input.float(25, title="Take Profit Amount % Step 1", group="Take Profit Settings")

takeProfitAmount2 = input.float(20, title="Take Profit Amount % Step 2", group="Take Profit Settings")

takeProfitAmount3 = input.float(10, title="Take Profit Amount % Step 3", group="Take Profit Settings")

takeProfitAmount4 = input.float(15, title="Take Profit Amount % Step 4", group="Take Profit Settings")

numberOfSteps = input.int(4, title="Number of Take Profit Steps", minval=1, maxval=4, group="Take Profit Settings")

// Calculate the Vegas Channel using a simple moving average and standard deviation.

vegasMovingAverage = ta.sma(close, vegasWindow)

vegasChannelStdDev = ta.stdev(close, vegasWindow)

vegasChannelUpper = vegasMovingAverage + vegasChannelStdDev

vegasChannelLower = vegasMovingAverage - vegasChannelStdDev

// Adjust the SuperTrend multiplier based on the width of the Vegas Channel.

channelVolatilityWidth = vegasChannelUpper - vegasChannelLower

adjustedMultiplier = superTrendMultiplier + volatilityAdjustment * (channelVolatilityWidth / vegasMovingAverage)

// Calculate the SuperTrend indicator values.

averageTrueRange = ta.atr(atrPeriod)

superTrendUpper = hlc3 - (adjustedMultiplier * averageTrueRange)

superTrendLower = hlc3 + (adjustedMultiplier * averageTrueRange)

var float superTrendPrevUpper = na

var float superTrendPrevLower = na

var int marketTrend = 1

// Update SuperTrend values and determine the current trend direction.

superTrendPrevUpper := nz(superTrendPrevUpper[1], superTrendUpper)

superTrendPrevLower := nz(superTrendPrevLower[1], superTrendLower)

marketTrend := close > superTrendPrevLower ? 1 : close < superTrendPrevUpper ? -1 : nz(marketTrend[1], 1)

superTrendUpper := marketTrend == 1 ? math.max(superTrendUpper, superTrendPrevUpper) : superTrendUpper

superTrendLower := marketTrend == -1 ? math.min(superTrendLower, superTrendPrevLower) : superTrendLower

superTrendPrevUpper := superTrendUpper

superTrendPrevLower := superTrendLower

// Enhanced Visualization

// Plot the SuperTrend and Vegas Channel for visual analysis.

plot(marketTrend == 1 ? superTrendUpper : na, "SuperTrend Upper", color=color.green, linewidth=2)

plot(marketTrend == -1 ? superTrendLower : na, "SuperTrend Lower", color=color.red, linewidth=2)

plot(vegasChannelUpper, "Vegas Upper", color=color.purple, linewidth=1)

plot(vegasChannelLower, "Vegas Lower", color=color.purple, linewidth=1)

// Apply a color to the price bars based on the current market trend.

barcolor(marketTrend == 1 ? color.green : marketTrend == -1 ? color.red : na)

// Detect trend direction changes and plot entry/exit signals.

trendShiftToBullish = marketTrend == 1 and marketTrend[1] == -1

trendShiftToBearish = marketTrend == -1 and marketTrend[1] == 1

plotshape(series=trendShiftToBullish, title="Enter Long", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=trendShiftToBearish, title="Enter Short", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Define conditions for entering long or short positions, and execute trades based on these conditions.

enterLongCondition = marketTrend == 1

enterShortCondition = marketTrend == -1

// Check trade direction choice before executing trade entries.

if enterLongCondition and (tradeDirectionChoice == "Long" or tradeDirectionChoice == "Both")

strategy.entry("Long Position", strategy.long)

if enterShortCondition and (tradeDirectionChoice == "Short" or tradeDirectionChoice == "Both")

strategy.entry("Short Position", strategy.short)

// Close all positions when the market trend changes.

if marketTrend != marketTrend[1]

strategy.close_all()

// Multi-Stage Take Profit Logic

if (strategy.position_size > 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Long Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 + takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Long Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 + takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Long Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 + takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Long Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 + takeProfitPercent4 / 100))

if (strategy.position_size < 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Short Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 - takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Short Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 - takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Short Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 - takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Short Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 - takeProfitPercent4 / 100))

- Stratégie de négociation quantitative de SuperTrend ajustée à la volatilité par double canal Vegas

- Stratégie de négociation de rupture de déviation type adaptative: système d'optimisation à plusieurs périodes basé sur la volatilité dynamique

- Stratégie double de croisement des moyennes mobiles avec gestion dynamique des risques

- La valeur de l'émission de l'émission de l'émission de l'émission de l'émission de l'émission de l'émission de l'émission

- Stratégie avancée de rupture dynamique de la ligne de tendance à long terme uniquement

- Tendance dynamique à la double AME en suivant une stratégie de gestion intelligente des risques

- Détails de la stratégie de négociation intelligente multi-condition

- La stratégie quantitative de rebond sur les ventes excédentaires de l'ATR

- Système de négociation quantitative de volatilité et de dynamique adaptative (AVMQTS)

- Stratégie croisée de moyenne mobile dynamique et de bandes de Bollinger avec modèle d'optimisation de stop-loss fixe

- Système de négociation dynamique de support ou de résistance

- La stratégie quantitative à haute fréquence des bandes de Bollinger combinée à un système de rupture à haute fréquence et à faible fréquence

- Système de négociation quantitative croisée dynamique MACD-RSI

- RSI et stratégie de volatilité adaptative suivant la tendance des supertrends

- La stratégie de négociation améliorée par le double croisement EMA et le dynamisme RSI

- Tendance de l'indicateur multi-technique à la suite d'une stratégie de négociation

- Stratégie de croisement des moyennes mobiles multi-exponentielles avec optimisation dynamique de l'arrêt-perte par ATR basée sur le volume

- Système de négociation de suivi de la dynamique EMA hybride à double chaîne

- Stratégie de suivi de la tendance de la ligne de signal dynamique et de filtrage de la volatilité

- Stratégie de rupture de Bollinger Momentum sur plusieurs délais avec moyenne mobile Hull

- Tendance à la triple EMA à la suite d' une stratégie de négociation quantitative

- Stratégie quantitative de croisement de la moyenne mobile à double coque

- Stratégie de réduction extrême du marché basée sur des écarts statistiques

- Stratégie de négociation de rupture SMA à quatre périodes avec système de gestion dynamique des profits/pertes

- La stratégie de double régression croisée de l'indice de volatilité et des bandes de Bollinger

- Tendance multi-onde à la suite de la stratégie d'analyse des prix

- Heikin-Ashi lissé avec la tendance croisée SMA

- Stratégie de détermination de la tendance de l'EMA basée sur les moyennes mobiles de Hull

- Système de négociation de croisement intelligent avec double indicateur EMA avec stratégie dynamique de stop-loss et de take-profit

- La stratégie de négociation multi-dimensionnelle de la dynamique OBV-SMA crossover avec filtre RSI