अवलोकन

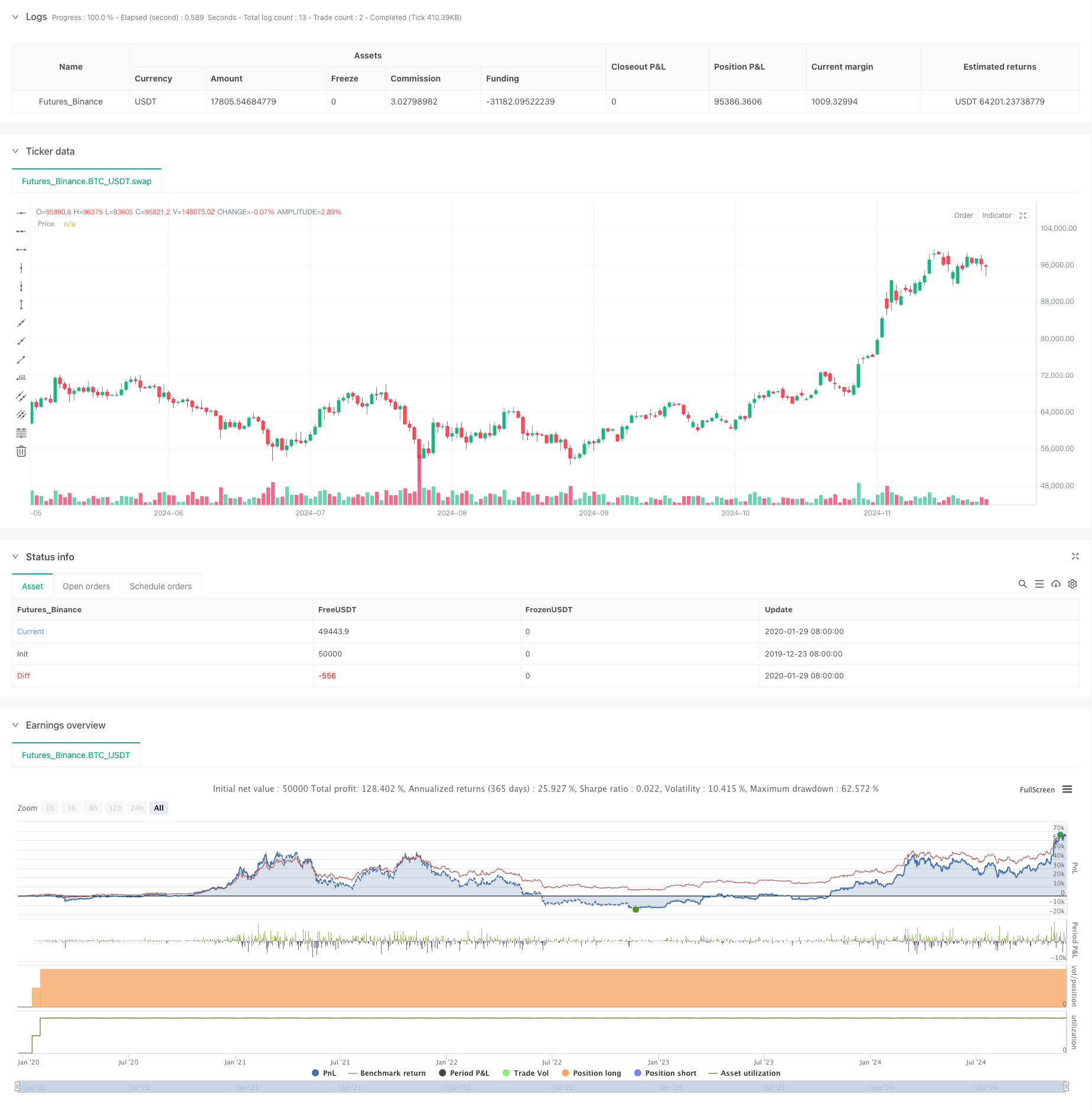

यह रणनीति एक बहुस्तरीय ट्रेडिंग प्रणाली है जो गतिशीलता और रुझानों पर आधारित है। यह विलियम्स टैंक सूचक, विलियम्स स्प्लिट, मैजिक ऑब्जर्वेशन सूचक (एओ) और इंडेक्स मूविंग एवरेज (ईएमए) के संयोजन के माध्यम से उच्च संभावना वाले कई अवसरों की पहचान करता है। यह रणनीति पूंजी के स्तरित निवेश तंत्र को अपनाती है, जो प्रवृत्ति में वृद्धि के रूप में धीरे-धीरे बढ़ जाती है, एक साथ अधिकतम 5 पदों पर कब्जा कर सकती है, प्रत्येक पद 10% धन का उपयोग करता है।

रणनीति सिद्धांत

रणनीति ट्रेडिंग दिशा की सटीकता सुनिश्चित करने के लिए एक बहु-फ़िल्टरिंग तंत्र का उपयोग करती है। सबसे पहले, ईएमए के माध्यम से दीर्घकालिक प्रवृत्ति निर्णय, केवल ईएमए से ऊपर की कीमतों पर अधिक अवसरों की तलाश करें। इसके बाद, विलियम्स के टैंक सूचक और स्प्लिट के संयोजन के माध्यम से अल्पकालिक प्रवृत्ति का न्याय करें, जब स्प्लिट के शीर्ष पर स्प्लिट ब्रेक होता है, तो एक उभरती प्रवृत्ति की पुष्टि करें। अंत में, प्रवृत्ति की पुष्टि के बाद, रणनीति एओ सूचक के “बाउल” बहु-संकेतों को एक विशिष्ट अवसर के रूप में देखता है। सिस्टम प्रत्येक स्थिति खोलने पर केवल 10% धन का उपयोग करता है, और जब प्रवृत्ति मजबूत होती रहती है, तो अधिकतम 5 बहु-स्थिति खोले जा सकते हैं। जब स्प्लिट और टैंक सूचक संयोजन ने प्रवृत्ति को उलट दिया है, तो सिस्टम सभी पदों को बंद कर देगा।

रणनीतिक लाभ

- मल्टीलेयर फ़िल्टरिंग तंत्र, जो झूठे सिग्नल की गड़बड़ी को कम करता है

- धन प्रबंधन का विज्ञान, धीरे-धीरे जमा करने का तरीका

- ट्रेंड-फॉलोइंग विशेषताएं इसे बड़े रुझानों को पकड़ने में सक्षम बनाती हैं

- कोई निश्चित स्टॉप-लॉस नहीं, तकनीकी संकेतक गतिशीलता के आधार पर प्रवृत्ति को समाप्त करना

- सिस्टम अच्छी तरह से विन्यास योग्य है, विभिन्न बाजार स्थितियों के अनुसार पैरामीटर को समायोजित करने के लिए आसान है

- रिटर्न्स में अच्छा रिटर्न फैक्टर और औसत रिटर्न दिखाया गया

रणनीतिक जोखिम

- बाजार में उतार-चढ़ाव के बीच लगातार झूठे संकेत

- जब प्रवृत्ति उलट जाती है तो एक बड़ा रिट्रेसमेंट हो सकता है

- कई फ़िल्टरिंग स्थितियों के कारण कुछ व्यापारिक अवसरों को याद किया जा सकता है

- धन प्रबंधन के मामले में, लगातार बढ़ी हुई स्थिति में भारी उतार-चढ़ाव के दौरान जोखिम हो सकता है

- EMA पैरामीटर का चयन रणनीति के प्रदर्शन पर अधिक प्रभाव डालता है

इन जोखिमों को कम करने के लिए, यह सलाह दी जाती हैः

- विभिन्न बाजार स्थितियों में पैरामीटर का अनुकूलन

- अस्थिरता फ़िल्टर जोड़ने पर विचार करें

- अधिक सख्त शर्तों का निर्माण

- अधिकतम निकासी सीमा सेट करें

रणनीति अनुकूलन दिशा

- एटीआर सूचकांक में उतार-चढ़ाव फ़िल्टर करें

- सिग्नल विश्वसनीयता में सुधार के लिए ट्रेडिंग वॉल्यूम विश्लेषण जोड़ें

- गतिशील पैरामीटर अनुकूलन तंत्र विकसित करना

- रुझान कम होने पर समय पर मुनाफा कमाने के लिए रोकथाम तंत्र में सुधार

- विभिन्न बाजार स्थितियों में विभिन्न मापदंडों का उपयोग करने के लिए बाजार स्थिति पहचान मॉड्यूल जोड़ा गया

संक्षेप

यह एक अच्छी तरह से डिज़ाइन की गई प्रवृत्ति ट्रैकिंग रणनीति है, जो कई तकनीकी संकेतकों के संयोजन के माध्यम से सुरक्षा की गारंटी देते हुए, अच्छी कमाई का प्रदर्शन करती है। रणनीति की नवीनता बहु-स्तरीय प्रवृत्ति मान्यता तंत्र और एक प्रगतिशील धन प्रबंधन पद्धति में है। हालांकि कुछ जगहों पर अनुकूलन की आवश्यकता है, लेकिन कुल मिलाकर यह एक कोशिश के लायक ट्रेडिंग प्रणाली है।

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrexio

//@version=6

//_______ <licence>

strategy(title = "MultiLayer Awesome Oscillator Saucer Strategy [Skyrexio]",

shorttitle = "AO Saucer",

overlay = true,

format = format.inherit,

pyramiding = 5,

calc_on_order_fills = false,

calc_on_every_tick = false,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5,

use_bar_magnifier = true)

//_______ <constant_declarations>

var const color skyrexGreen = color.new(#2ECD99, 0)

var const color skyrexGray = color.new(#F2F2F2, 0)

var const color skyrexWhite = color.new(#FFFFFF, 0)

//________<variables declarations>

var int trend = 0

var float upFractalLevel = na

var float upFractalActivationLevel = na

var float downFractalLevel = na

var float downFractalActivationLevel = na

var float saucerActivationLevel = na

bool highCrossesUpfractalLevel = ta.crossover(high, upFractalActivationLevel)

bool lowCrossesDownFractalLevel = ta.crossunder(low, downFractalActivationLevel)

var int signalsQtyInRow = 0

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "🤖Trading Bot Settings🤖")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "🤖Trading Bot Settings🤖")

// Trading period settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "🕐Trading Period Settings🕐")

// Strategy settings

EMaLength = input.int(100, minval = 10, step = 10, title = "EMA Length", group = "📈Strategy settings📈")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

var float smma = na

sma_value = ta.sma(src, length)

smma := na(smma) ? sma_value : (smma * (length - 1) + src) / length

smma

//_______ <calculations>

//Upfractal calculation

upFractalPrice = ta.pivothigh(2, 2)

upFractal = not na(upFractalPrice)

//Downfractal calculation

downFractalPrice = ta.pivotlow(2, 2)

downFractal = not na(downFractalPrice)

//Calculating Alligator's teeth

teeth = smma(hl2, 8)[5]

//Calculating upfractal and downfractal levels

if upFractal

upFractalLevel := upFractalPrice

else

upFractalLevel := upFractalLevel[1]

if downFractal

downFractalLevel := downFractalPrice

else

downFractalLevel := downFractalLevel[1]

//Calculating upfractal activation level, downfractal activation level to approximate the trend and this current trend

if upFractalLevel > teeth

upFractalActivationLevel := upFractalLevel

if highCrossesUpfractalLevel

trend := 1

upFractalActivationLevel := na

downFractalActivationLevel := downFractalLevel

if downFractalLevel < teeth

downFractalActivationLevel := downFractalLevel

if lowCrossesDownFractalLevel

trend := -1

downFractalActivationLevel := na

upFractalActivationLevel := upFractalLevel

if trend == 1

upFractalActivationLevel := na

if trend == -1

downFractalActivationLevel := na

//Calculating filter EMA

filterEMA = ta.ema(close, EMaLength)

//Сalculating AO saucer signal

ao = ta.sma(hl2,5) - ta.sma(hl2,34)

diff = ao - ao[1]

saucerSignal = ao > ao[1] and ao[1] < ao[2] and ao > 0 and ao[1] > 0 and ao[2] > 0 and trend == 1 and close > filterEMA

//Calculating sauser activation level

if saucerSignal

saucerActivationLevel := high

else

saucerActivationLevel := saucerActivationLevel[1]

if not na(saucerActivationLevel[1]) and high < saucerActivationLevel[1] and diff > 0

saucerActivationLevel := high

saucerSignal := true

if (high > saucerActivationLevel[1] and not na(saucerActivationLevel)) or diff < 0

saucerActivationLevel := na

//Calculating number of valid saucer signal in current trading cycle

if saucerSignal and not saucerSignal[1]

signalsQtyInRow := signalsQtyInRow + 1

if not na(saucerActivationLevel[1]) and diff < 0 and na(saucerActivationLevel) and not (strategy.opentrades[1] <= strategy.opentrades - 1)

signalsQtyInRow := signalsQtyInRow - 1

if trend == -1 and trend[1] == 1

signalsQtyInRow := 0

//_______ <strategy_calls>

//Defining trade close condition

closeCondition = trend[1] == 1 and trend == -1

//Cancel stop buy order if current Awesome oscillator column lower, than prevoius

if diff < 0

strategy.cancel_all()

//Strategy entry

if (signalsQtyInRow == 1 and not na(saucerActivationLevel))

strategy.entry(id = "entry1", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 2 and not na(saucerActivationLevel))

strategy.entry(id = "entry2", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry2",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 3 and not na(saucerActivationLevel))

strategy.entry(id = "entry3", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry3",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 4 and not na(saucerActivationLevel))

strategy.entry(id = "entry4", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry4",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if (signalsQtyInRow == 5 and not na(saucerActivationLevel))

strategy.entry(id = "entry5", direction = strategy.long, stop = saucerActivationLevel + syminfo.mintick, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry5",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//Strategy exit

if (closeCondition)

strategy.close_all(alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

//Plotting shapes for adding to current long trades

gradPercent = if strategy.opentrades == 2

90

else if strategy.opentrades == 3

80

else if strategy.opentrades == 4

70

else if strategy.opentrades == 5

60

pricePlot = plot(close, title="Price", color=color.new(color.blue, 100))

teethPlot = plot(strategy.opentrades > 1 ? teeth : na, title="Teeth", color= skyrexGreen, style=plot.style_linebr, linewidth = 2)

fill(pricePlot, teethPlot, color = color.new(skyrexGreen, gradPercent))

if strategy.opentrades != 1 and strategy.opentrades[1] == strategy.opentrades - 1

label.new(bar_index, teeth, style = label.style_label_up, color = color.lime, size = size.tiny, text="Buy More", textcolor = color.black, text_formatting = text.format_bold)

//_______ <alerts>