Tren Mengikuti Strategi Berdasarkan Sinyal Crossover OBV dan MA

Penulis:ChaoZhang, Tanggal: 2024-04-29 13:48:58Tag:OBVMASMA

Gambaran umum

Strategi ini, bernama

Prinsip Strategi

- Menghitung nilai indikator OBV: Jika harga penutupan saat ini lebih tinggi dari lilin sebelumnya, tambahkan volume saat ini ke OBV; jika tidak, kurangi volume.

- Hitung empat rata-rata bergerak OBV: MA entry panjang jangka panjang, MA exit panjang jangka panjang, MA entry pendek jangka pendek, dan MA exit pendek jangka pendek.

- Menghasilkan sinyal perdagangan:

- Ketika OBV melintasi di atas long-term long entry MA dan filter arah tidak diatur menjadi short, buka posisi panjang.

- Ketika OBV melintasi di bawah MA long-term long exit, tutup posisi panjang.

- Ketika OBV melintasi di bawah MA entri pendek jangka pendek dan filter arah tidak diatur untuk panjang, buka posisi pendek.

- Ketika OBV melintasi di atas MA keluar pendek jangka pendek, tutup posisi pendek.

- Manajemen perdagangan: Jika sinyal sebaliknya dihasilkan, posisi asli akan ditutup sebelum membuka posisi baru.

Keuntungan Strategi

- Menggunakan sepenuhnya sinyal tren utama OBV untuk membangun posisi di awal tren.

- Memisahkan MAs masuk dan keluar memungkinkan untuk mengoptimalkan waktu masuk dan keluar secara independen.

- Logika kode sederhana dan jelas, mudah dipahami dan ditingkatkan.

- Memperkenalkan filter arah dapat menghindari perdagangan yang sering dan mengurangi biaya.

Risiko Strategi

- Tidak memiliki indikator konfirmasi lainnya, yang dapat menghasilkan sinyal palsu.

- Kurangnya stop loss dan manajemen posisi, menghadapi risiko kerugian tunggal yang diperkuat.

- Pemilihan parameter yang tidak tepat akan mempengaruhi kinerja strategi. Parameter perlu dioptimalkan berdasarkan karakteristik pasar dan kerangka waktu yang berbeda.

Arah Optimasi Strategi

- Pertimbangkan untuk memperkenalkan filter tren, seperti arah MA, ATR, dll, untuk meningkatkan kualitas sinyal.

- Berbagai jenis MAs dapat digunakan pada OBV, seperti EMA, WMA, dll, untuk menangkap tren kecepatan yang berbeda.

- Mengoptimalkan manajemen posisi, seperti menggunakan strategi skala untuk menambahkan posisi ketika kekuatan tren meningkat dan mengurangi posisi ketika menurun.

- Gabungkan dengan indikator volume dan harga lainnya, seperti MVA, PVT, dll., Untuk membangun sinyal bersama untuk meningkatkan tingkat kemenangan.

Ringkasan

Strategi ini menunjukkan metode mengikuti tren yang sederhana berdasarkan OBV dan MA crossover. Keuntungannya adalah logika yang jelas, penangkapan tren yang tepat waktu, dan kontrol tahan fleksibel melalui MAs masuk dan keluar yang terpisah. Namun, kekurangannya termasuk kurangnya langkah-langkah pengendalian risiko dan metode konfirmasi sinyal. Perbaikan dapat dilakukan di bidang seperti penyaringan tren, optimasi parameter, manajemen posisi, dan sinyal gabungan untuk mendapatkan kinerja strategi yang lebih kuat. Strategi ini lebih cocok sebagai sinyal panduan untuk digunakan bersamaan dengan strategi lain.

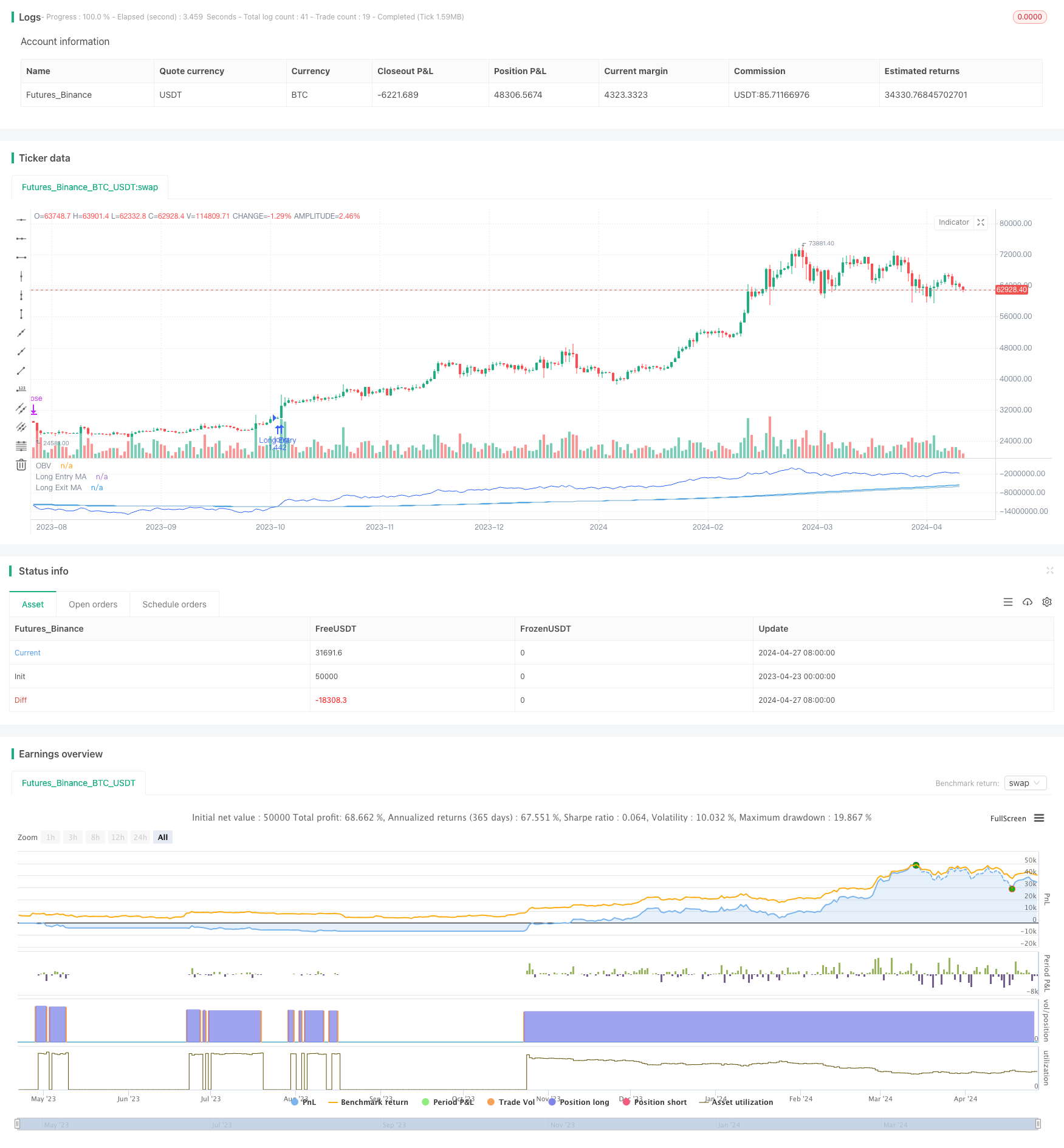

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ThousandX_Trader

//@version=5

strategy(title="OBVious MA Strategy [1000X]", overlay=false,

initial_capital=10000, margin_long=0.1, margin_short=0.1,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

slippage=1, commission_type=strategy.commission.percent, commission_value=0.1)

// Direction Input ///

tradeDirection = input.string("long", title="Direction", options=["long", "short"], group = "Direction Filter")

///////////////////////////////////////

// 1000X OBV MA INDICATOR //

///////////////////////////////////////

// OBV Trend Length Inputs //

long_entry_length = input(190, title="Long Entry MA Length", group = "Moving Average Settings")

long_exit_length = input(202, title="Long Exit MA Length", group = "Moving Average Settings")

short_entry_length = input(395, title="Short MA Entry Length", group = "Moving Average Settings")

short_exit_length = input(300, title="Short Exit MA Length", group = "Moving Average Settings")

// OBV Calculation

obv = ta.cum(ta.change(close) >= 0 ? volume : -volume)

// Calculate OBV Moving Averages

obv_ma_long_entry = ta.sma(obv, long_entry_length)

obv_ma_long_exit = ta.sma(obv, long_exit_length)

obv_ma_short_entry = ta.sma(obv, short_entry_length)

obv_ma_short_exit = ta.sma(obv, short_exit_length)

///////////////////////////////////////

// STRATEGY RULES //

///////////////////////////////////////

longCondition = ta.crossover(obv, obv_ma_long_entry) and tradeDirection != "short" and strategy.position_size <= 0

longExitCondition = ta.crossunder(obv, obv_ma_long_exit)

shortCondition = ta.crossunder(obv, obv_ma_short_entry) and tradeDirection != "long" and strategy.position_size >= 0

shortExitCondition = ta.crossover(obv, obv_ma_short_exit)

///////////////////////////////////////

// ORDER EXECUTION //

///////////////////////////////////////

// Close opposite trades before entering new ones

if (longCondition and strategy.position_size < 0)

strategy.close("Short Entry")

if (shortCondition and strategy.position_size > 0)

strategy.close("Long Entry")

// Enter new trades

if (longCondition)

strategy.entry("Long Entry", strategy.long)

if (shortCondition)

strategy.entry("Short Entry", strategy.short)

// Exit conditions

if (longExitCondition)

strategy.close("Long Entry")

if (shortExitCondition)

strategy.close("Short Entry")

///////////////////////////////////////

// PLOTTING //

///////////////////////////////////////

// Plot OBV line with specified color

plot(obv, title="OBV", color=color.new(#2962FF, 0), linewidth=1)

// Conditionally plot Long MAs with specified colors based on Direction Filter

plot(tradeDirection == "long" ? obv_ma_long_entry : na, title="Long Entry MA", color=color.new(color.rgb(2, 130, 228), 0), linewidth=1)

plot(tradeDirection == "long" ? obv_ma_long_exit : na, title="Long Exit MA", color=color.new(color.rgb(106, 168, 209), 0), linewidth=1)

// Conditionally plot Short MAs with specified colors based on Direction Filter

plot(tradeDirection == "short" ? obv_ma_short_entry : na, title="Short Entry MA", color=color.new(color.rgb(163, 2, 227), 0), linewidth=1)

plot(tradeDirection == "short" ? obv_ma_short_exit : na, title="Short Exit MA", color=color.new(color.rgb(192, 119, 205), 0), linewidth=1)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Cloud Momentum Crossover Strategy dengan Moving Averages dan Volume Konfirmasi

- Strategi Crossover Rata-rata Bergerak

- MA,SMA Dual Moving Average Crossover Strategi

- Strategi lintas MA

- Strategi perdagangan SMA Dual Moving Average

- Strategi Manajemen Risiko Adaptif Berdasarkan Rata-rata Bergerak Gelas Emas Ganda

- Strategi Crossover Rata-rata Bergerak Ganda

- Strategi crossover rata-rata bergerak berdasarkan rata-rata bergerak ganda

- Moving Average Crossover dengan Strategi Multiple Take Profits

- MA99 Strategi Stop-Loss Touch dan Dinamis

- Donchian Breakout Trading Strategy

- Ichimoku memimpin Span B Breakout Strategi

- Long Entry pada EMA Cross dengan Strategi Manajemen Risiko

- Strategi perdagangan jangka panjang gabungan MACD dan RSI

- DCA Dual Moving Average Turtle Trading Strategy (Strategi Perdagangan Rata-rata Bergerak Berganda)

- Strategi Perdagangan VWAP

- Strategi Kombinasi Multi-Indikator (CCI, DMI, MACD, ADX)

- RSI2 Strategi Intraday Reversal Win Rate Backtest

- Hurst Garis Masa Depan Strategi Demarkasi

- GBS TOP Bottom Strategi dikonfirmasi

- Tren Multi-Indikator Mengikuti Strategi

- Squeeze Backtest Transformer v2.0

- Strategi Pembalikan Tren Fibonacci

- HTF Zigzag Path Strategi

- Strategi WaveTrend Cross LazyBear

- Strategi jangka pendek hibrida CCI, DMI, dan MACD

- Strategi Perdagangan AlphaTradingBot

- Vegas SuperTrend Strategi Ditingkatkan

- Strategi perdagangan kuantitatif berdasarkan Modified Hull Moving Average dan Ichimoku Kinko Hyo