多段階波動性調整ダイナミック・スーパートレンド戦略

作者: リン・ハーンチャオチャン,日付: 2024-11-29 16:57:19タグ:ATRSMA性感染症TP

概要

マルチステップ・ボラティリティ調整ダイナミック・スーパートレンド戦略 (Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy) は,ベガス・チャネルとスーパートレンド指標を組み合わせた革新的な取引システムである.この戦略のユニークさは,市場の波動に動的に適応する能力と,リスク・リターン比率を最適化するためのマルチステップ・テイク・プロフィートメカニズムにある.ベガス・チャネルの波動性分析とスーパートレンドのトレンドフォロー機能を組み合わせることで,この戦略は市場の状況が変化するにつれて自動的にパラメータを調整し,より正確な取引信号を提供します.

戦略原則

この戦略は,ベガスチャネル計算,トレンド検出,マルチステップテイク・プロフィートメカニズムという3つのコアコンポーネントで動作する.ベガスチャネルは,価格変動範囲を定義するためにシンプル・ムービング・平均値 (SMA) と標準偏差値 (STD) を使用し,スーパートレンドインジケータは調整されたATR値に基づいてトレンド方向を決定する.市場のトレンドが変化するときに取引信号が生成される.マルチステップテイク・プロフィートメカニズムは,利益をロックし,残りのポジションが利益を得ることを可能にする方法である.この戦略のユニークさは,ベガスチャネル幅に基づいてスーパートレンド倍数を動的に調整する波動性調整因子にあります.

戦略 の 利点

- 動的適応性: 戦略は変動調整因子によって,異なる市場状況に自動的に適応する.

- リスク管理:多段階の利益獲得メカニズムは,利益実現の体系的なアプローチを提供します.

- カスタマイズ可能: 異なる取引スタイルに対応するために複数のパラメータ設定を提供します.

- 全面的な市場カバー: 長期取引と短期取引の両方をサポートします.

- 視覚的なフィードバック: 分析と意思決定のための明確なグラフィックインターフェースを提供します.

戦略リスク

- パラメータの感度:異なるパラメータの組み合わせにより,性能が大きく変化する可能性があります.

- 遅延: 移動平均をベースにした指標には固有の遅延がある.

- 誤ったブレイクリスク: 変動する市場で誤った信号を生む可能性があります.

- 早期の収益は主要なトレンドを見逃し,遅めの利益は蓄積された利益を失うリスクがあります.

戦略の最適化方向

- 市場環境フィルターを導入し,異なる市場条件下で戦略パラメータを調整する.

- 信号の信頼性を向上させるため,音量分析を追加します.

- 市場変動に基づいて 収益レベルを動的に調整する 適応性のある収益メカニズムを開発する.

- 信号確認のための追加の技術指標を組み込む.

- 市場リスクに基づく動的ポジションサイズを導入する.

概要

マルチステップ・ボラティリティ調整ダイナミック・スーパートレンド戦略は,複数の技術指標と革新的な収益メカニズムを組み合わせて,トレーダーに包括的な取引システムを提供する先進的な定量的な取引アプローチを表しています.そのダイナミックな適応性とリスク管理機能により,さまざまな市場環境での運用に特に適しており,スケーラビリティと最適化の可能性が良好です.継続的な改善と最適化により,戦略は将来的により安定した取引パフォーマンスを提供することを約束しています.

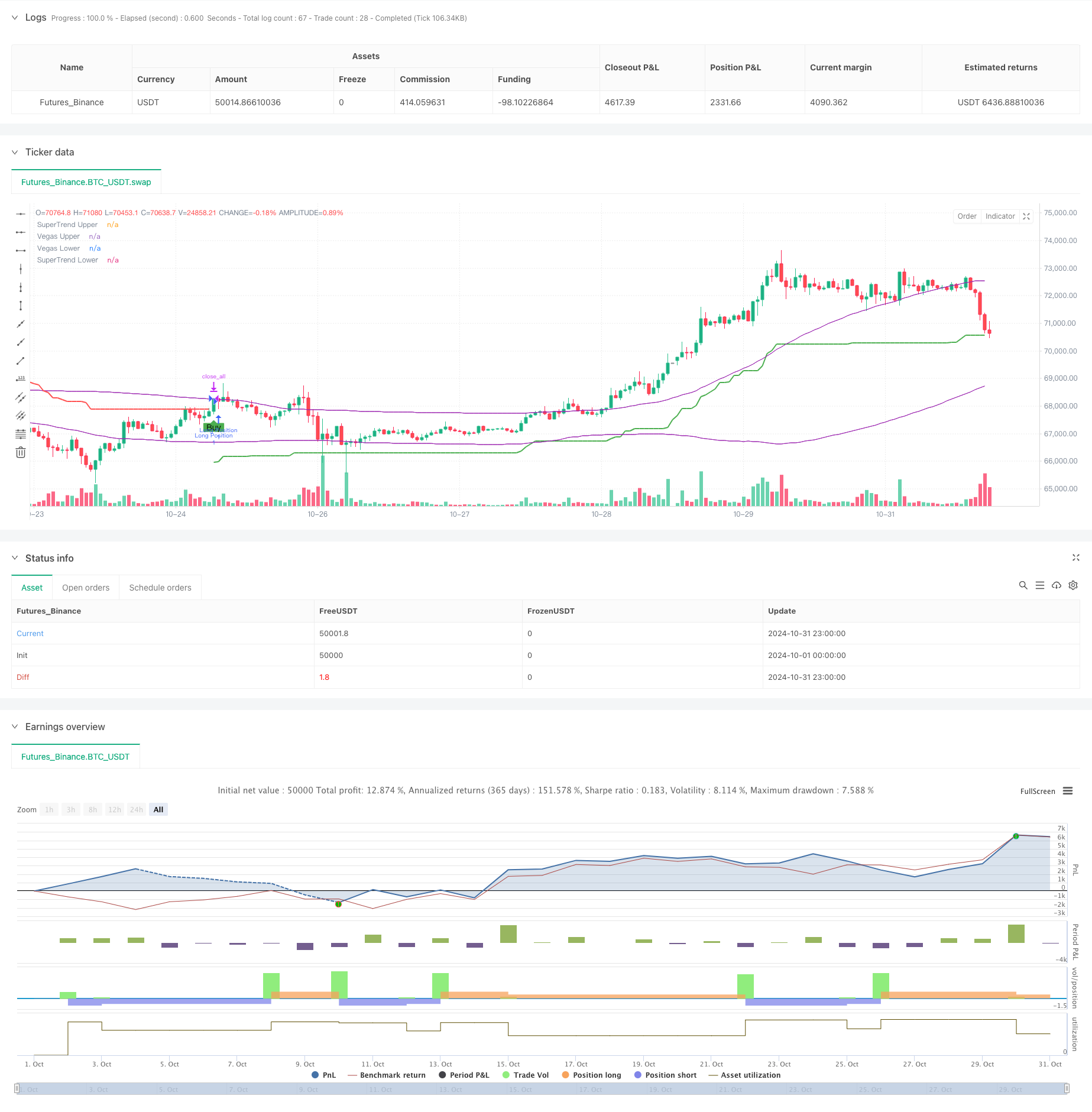

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multi-Step Vegas SuperTrend - strategy [presentTrading]", shorttitle="Multi-Step Vegas SuperTrend - strategy [presentTrading]", overlay=true, precision=3, commission_value=0.1, commission_type=strategy.commission.percent, slippage=1, currency=currency.USD)

// Input settings allow the user to customize the strategy's parameters.

tradeDirectionChoice = input.string(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"]) // Option to select the trading direction

atrPeriod = input(10, "ATR Period for SuperTrend") // Length of the ATR for volatility measurement

vegasWindow = input(100, "Vegas Window Length") // Length of the moving average for the Vegas Channel

superTrendMultiplier = input(5, "SuperTrend Multiplier Base") // Base multiplier for the SuperTrend calculation

volatilityAdjustment = input.float(5, "Volatility Adjustment Factor") // Factor to adjust the SuperTrend sensitivity to the Vegas Channel width

// User inputs for take profit settings

useTakeProfit = input.bool(true, title="Use Take Profit", group="Take Profit Settings")

takeProfitPercent1 = input.float(3.0, title="Take Profit % Step 1", group="Take Profit Settings")

takeProfitPercent2 = input.float(6.0, title="Take Profit % Step 2", group="Take Profit Settings")

takeProfitPercent3 = input.float(12.0, title="Take Profit % Step 3", group="Take Profit Settings")

takeProfitPercent4 = input.float(21.0, title="Take Profit % Step 4", group="Take Profit Settings")

takeProfitAmount1 = input.float(25, title="Take Profit Amount % Step 1", group="Take Profit Settings")

takeProfitAmount2 = input.float(20, title="Take Profit Amount % Step 2", group="Take Profit Settings")

takeProfitAmount3 = input.float(10, title="Take Profit Amount % Step 3", group="Take Profit Settings")

takeProfitAmount4 = input.float(15, title="Take Profit Amount % Step 4", group="Take Profit Settings")

numberOfSteps = input.int(4, title="Number of Take Profit Steps", minval=1, maxval=4, group="Take Profit Settings")

// Calculate the Vegas Channel using a simple moving average and standard deviation.

vegasMovingAverage = ta.sma(close, vegasWindow)

vegasChannelStdDev = ta.stdev(close, vegasWindow)

vegasChannelUpper = vegasMovingAverage + vegasChannelStdDev

vegasChannelLower = vegasMovingAverage - vegasChannelStdDev

// Adjust the SuperTrend multiplier based on the width of the Vegas Channel.

channelVolatilityWidth = vegasChannelUpper - vegasChannelLower

adjustedMultiplier = superTrendMultiplier + volatilityAdjustment * (channelVolatilityWidth / vegasMovingAverage)

// Calculate the SuperTrend indicator values.

averageTrueRange = ta.atr(atrPeriod)

superTrendUpper = hlc3 - (adjustedMultiplier * averageTrueRange)

superTrendLower = hlc3 + (adjustedMultiplier * averageTrueRange)

var float superTrendPrevUpper = na

var float superTrendPrevLower = na

var int marketTrend = 1

// Update SuperTrend values and determine the current trend direction.

superTrendPrevUpper := nz(superTrendPrevUpper[1], superTrendUpper)

superTrendPrevLower := nz(superTrendPrevLower[1], superTrendLower)

marketTrend := close > superTrendPrevLower ? 1 : close < superTrendPrevUpper ? -1 : nz(marketTrend[1], 1)

superTrendUpper := marketTrend == 1 ? math.max(superTrendUpper, superTrendPrevUpper) : superTrendUpper

superTrendLower := marketTrend == -1 ? math.min(superTrendLower, superTrendPrevLower) : superTrendLower

superTrendPrevUpper := superTrendUpper

superTrendPrevLower := superTrendLower

// Enhanced Visualization

// Plot the SuperTrend and Vegas Channel for visual analysis.

plot(marketTrend == 1 ? superTrendUpper : na, "SuperTrend Upper", color=color.green, linewidth=2)

plot(marketTrend == -1 ? superTrendLower : na, "SuperTrend Lower", color=color.red, linewidth=2)

plot(vegasChannelUpper, "Vegas Upper", color=color.purple, linewidth=1)

plot(vegasChannelLower, "Vegas Lower", color=color.purple, linewidth=1)

// Apply a color to the price bars based on the current market trend.

barcolor(marketTrend == 1 ? color.green : marketTrend == -1 ? color.red : na)

// Detect trend direction changes and plot entry/exit signals.

trendShiftToBullish = marketTrend == 1 and marketTrend[1] == -1

trendShiftToBearish = marketTrend == -1 and marketTrend[1] == 1

plotshape(series=trendShiftToBullish, title="Enter Long", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=trendShiftToBearish, title="Enter Short", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Define conditions for entering long or short positions, and execute trades based on these conditions.

enterLongCondition = marketTrend == 1

enterShortCondition = marketTrend == -1

// Check trade direction choice before executing trade entries.

if enterLongCondition and (tradeDirectionChoice == "Long" or tradeDirectionChoice == "Both")

strategy.entry("Long Position", strategy.long)

if enterShortCondition and (tradeDirectionChoice == "Short" or tradeDirectionChoice == "Both")

strategy.entry("Short Position", strategy.short)

// Close all positions when the market trend changes.

if marketTrend != marketTrend[1]

strategy.close_all()

// Multi-Stage Take Profit Logic

if (strategy.position_size > 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Long Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 + takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Long Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 + takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Long Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 + takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Long Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 + takeProfitPercent4 / 100))

if (strategy.position_size < 0)

entryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

if numberOfSteps >= 1

strategy.exit("Take Profit 1", from_entry="Short Position", qty_percent=takeProfitAmount1, limit=entryPrice * (1 - takeProfitPercent1 / 100))

if numberOfSteps >= 2

strategy.exit("Take Profit 2", from_entry="Short Position", qty_percent=takeProfitAmount2, limit=entryPrice * (1 - takeProfitPercent2 / 100))

if numberOfSteps >= 3

strategy.exit("Take Profit 3", from_entry="Short Position", qty_percent=takeProfitAmount3, limit=entryPrice * (1 - takeProfitPercent3 / 100))

if numberOfSteps >= 4

strategy.exit("Take Profit 4", from_entry="Short Position", qty_percent=takeProfitAmount4, limit=entryPrice * (1 - takeProfitPercent4 / 100))

- ダブル・ベガス・チャネル・ボラティリティ調整スーパートレンド量的な取引戦略

- アダプティブ標準偏差ブレイクアウト取引戦略: ダイナミック・ボラティリティに基づく多期最適化システム

- ダイナミックなリスクマネジメントを伴う二重移動平均のクロスオーバー戦略

- ATRベースのリスク管理システムによる戦略をフォローする二重移動平均傾向

- 先進的な長期のみ動的トレンドラインブレイク戦略

- ダイナミックな二重SMAトレンド 賢明なリスク管理の戦略に従う

- 量確認による構造の破裂 多条件のインテリジェント・トレーディング戦略

- ダイナミックATRストップ・ロスのRSI 過売度リバウンド量的な戦略

- アダプティブ・ボラティリティ・アンド・モメント・量子トレード・システム (AVMQTS)

- 固定ストップ・ロスの最適化モデルによる動的移動平均値とボリンジャー・バンドのクロス戦略

- ダイナミック・サポート・レジスタンス 価格・アクション・トレーディング・システム

- Bollinger Bands 高周波定量戦略と高低ブレイクシステム

- MACD-RSI ダイナミッククロスオーバー量的な取引システム

- RSIとスーパートレンド 傾向を踏まえた適応性変動戦略

- RSIモメンタム強化取引戦略とダブルEMAクロスオーバー

- 取引戦略をフォローするマルチテクニカル指標傾向

- 量に基づくATR動的ストップ損失最適化による多指数移動平均のクロスオーバー戦略

- 双鎖ハイブリッドモメント EMA トレーディングシステム

- ダイナミック・シグナル・ライン・トレンド・フォロー&ボラティリティ・フィルタリング戦略

- Hull 移動平均値による多期ボリンガー・モメンタム・ブレイクアウト戦略

- 定量的な取引戦略をフォローする三重EMA傾向

- 二重船体移動平均クロスオーバー量的な戦略

- 統計的偏差に基づく市場極限減額戦略

- ダイナミックな利益/損失管理システムによる4期間のSMA突破取引戦略

- RSIとボリンジャー帯のクロスレグレッション・ダブル戦略

- 価格分析戦略を踏まえた多波動傾向

- SMAのクロスオーバートレンドと戦略を順守するハイキン・アシのスムーズ化

- Hull移動平均値に基づく EMAの傾向決定戦略を反映した

- ダイナミックストップ・ロストとテイク・プロフィート戦略を持つダブル・EMAインジケーター・スマート・クロシング・トレーディング・システム

- RSIフィルターと OBV-SMAクロスオーバー 多次元モメンタム取引戦略