Strategi Pemulihan Trend EMA Gaussian Cross

Penulis:ChaoZhang, Tarikh: 2024-09-26 15:34:01Tag:EMARSIMACDATRADX

Ringkasan

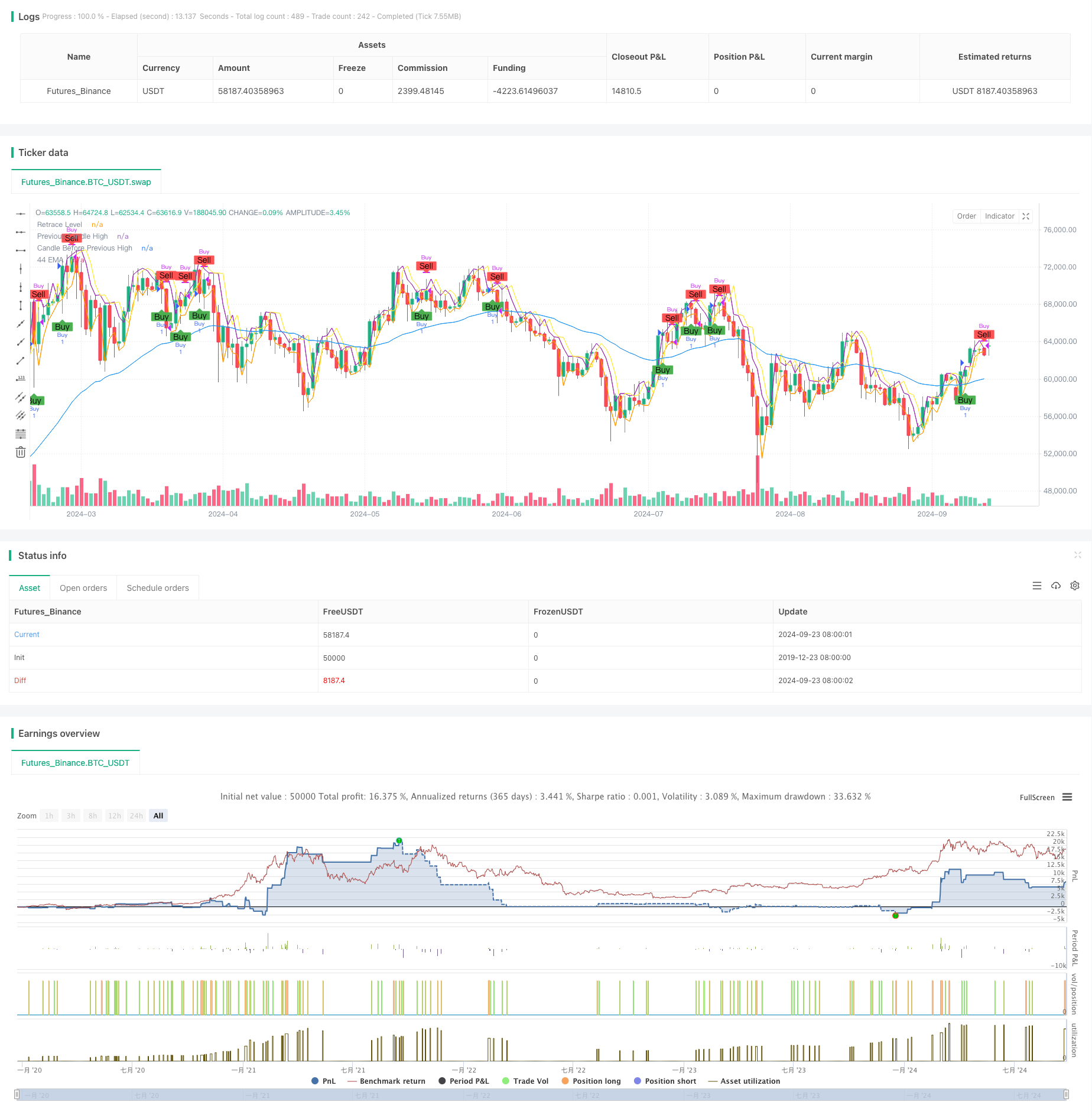

Ini adalah strategi yang mengikuti trend berdasarkan purata bergerak eksponen (EMA) 44 tempoh. Strategi ini terutamanya mencari peluang membeli dalam aliran naik dengan menganalisis pelbagai keadaan termasuk kemiringan EMA, corak lilin, dan retracement harga. Direka untuk jangka masa yang lebih pendek seperti carta 2 minit dan 5 minit, ia bertujuan untuk menangkap peluang perdagangan dalam turun naik harga jangka pendek.

Prinsip Strategi

- Mengira EMA 44-period dan cerunnya untuk menentukan sama ada trendnya cukup miring.

- Menganalisis corak lilin sebelumnya, yang memerlukan ia menjadi bullish dan dekat di atas EMA.

- Amati sama ada lilin semasa telah kembali ke 50% badan lilin sebelumnya.

- Memastikan penutupan lilin sebelumnya lebih tinggi daripada tinggi lilin sebelumnya, mengesahkan kesinambungan trend menaik.

- Apabila semua syarat dipenuhi, masukkan kedudukan panjang pada tahap retracement lilin semasa.

- Keadaan keluar: apabila lilin sebelumnya menurun atau lilin semasa terendah pecah di bawah lilin sebelumnya.

Kelebihan Strategi

- Pelbagai Penapis: Menggabungkan EMA, corak candlestick, dan retracement harga untuk mengurangkan isyarat palsu dengan berkesan.

- Mengikuti Trend: Menggunakan kemiringan EMA untuk memastikan perdagangan dalam trend menaik yang jelas, meningkatkan kadar kemenangan.

- Pemasukan Retracement: Menggunakan penurunan harga sebagai titik masuk, mengoptimumkan harga beli dan berpotensi meningkatkan margin keuntungan.

- Fleksibiliti: Boleh digunakan untuk pelbagai jangka masa, sesuai untuk peniaga jangka pendek dan intraday.

- Kawalan Risiko: Melaksanakan syarat berhenti rugi yang jelas, membantu mengawal risiko untuk setiap perdagangan.

Risiko Strategi

- Lag: EMA sebagai penunjuk lag mungkin tidak bertindak balas tepat pada masanya di pasaran yang sangat tidak menentu.

- Penembusan palsu: Boleh menghasilkan isyarat palsu yang kerap di kawasan penyatuan sisi.

- Overtrading: Pasaran turun naik yang tinggi boleh mencetuskan terlalu banyak perdagangan, meningkatkan kos transaksi.

- Pembalikan Trend: Pembalikan trend yang cepat boleh membawa kepada kerugian yang ketara.

- Sensitiviti Parameter: Prestasi strategi sensitif kepada tetapan parameter seperti tempoh EMA.

Arahan pengoptimuman

- Memperkenalkan Penapis Tambahan: Seperti RSI atau MACD untuk mengesahkan lagi kekuatan trend dan arah.

- Stop-Loss Dinamik: Melaksanakan stop-loss dinamik berasaskan ATR untuk menyesuaikan diri dengan lebih baik dengan turun naik pasaran.

- Menggabungkan Analisis Volume: Mengintegrasikan penunjuk jumlah untuk meningkatkan kebolehpercayaan isyarat kemasukan.

- Mengoptimumkan Tempoh EMA: Uji semula tempoh EMA yang berbeza untuk mencari kombinasi parameter yang optimum.

- Tambah Indikator Kekuatan Trend: Seperti ADX untuk memastikan entri hanya dalam trend yang kuat.

- Meningkatkan Mekanisme Keluar: Merancang strategi mengambil keuntungan yang lebih canggih, seperti hentian.

Ringkasan

Gaussian Cross EMA Trend Retracement Strategy adalah sistem trend-mengikuti yang menggabungkan beberapa penunjuk teknikal. Dengan mengintegrasikan EMA, analisis corak lilin, dan retracement harga, strategi ini menunjukkan potensi yang baik dalam mengenal pasti trend menaik dan mengoptimumkan masa kemasukan. Walau bagaimanapun, pengguna perlu berhati-hati tentang risiko overtrading dan mengoptimumkan parameter untuk persekitaran pasaran yang berbeza. Dengan memperkenalkan penunjuk teknikal tambahan dan meningkatkan mekanisme pengurusan risiko, strategi ini berpotensi untuk mencapai prestasi yang lebih stabil dalam perdagangan jangka pendek.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Strategy with EMA and Candle Conditions", overlay=true)

// Define parameters

ema_length = 44

// Calculate EMA

ema_44 = ta.ema(close, ema_length)

// Calculate the slope of the EMA

ema_slope = ta.ema(close, ema_length) - ta.ema(close[9], ema_length)

// Define a threshold for considering the EMA flat

flat_threshold = 0.5

// Check if the EMA is flat or inclined

ema_is_inclined = math.abs(ema_slope) > flat_threshold

// Define the previous candle details

prev_candle_high = high[1]

prev_candle_low = low[1]

prev_candle_close = close[1]

prev_candle_open = open[1]

// Candle before the previous candle (for high comparison)

candle_before_prev_high = high[2]

// Current candle details

current_candle_high = high

current_candle_low = low

current_candle_close = close

current_candle_open = open

// Previous to previous candle details

prev_prev_candle_low = low[2]

// Previous candle body and wick length

prev_candle_body = math.abs(prev_candle_close - prev_candle_open)

prev_candle_wick_length = math.max(prev_candle_high - prev_candle_close, prev_candle_close - prev_candle_low)

// Calculate retrace level for the current candle

retrace_level = prev_candle_close - (prev_candle_close - prev_candle_low) * 0.5

// Check if the previous candle's wick is smaller than its body

prev_candle_condition = prev_candle_wick_length < prev_candle_body

// Check if the previous candle is a green (bullish) candle and if the previous candle's close is above EMA

prev_candle_green = prev_candle_close > prev_candle_open

prev_candle_red = prev_candle_close < prev_candle_open

prev_candle_above_ema = prev_candle_close > ema_44

// Entry condition: The current candle has retraced to 50% of the previous candle's range, previous candle was green and above EMA, and the high of the current candle is above the retrace level, and EMA is inclined

entry_condition = prev_candle_close > candle_before_prev_high and

prev_candle_green and

prev_candle_above_ema and

current_candle_low <= retrace_level and

current_candle_high >= retrace_level and ema_is_inclined

// Exit condition

exit_condition = (strategy.position_size > 0 and prev_candle_red) or (strategy.position_size > 0 and current_candle_low < prev_candle_low)

// Ensure only one trade is open at a time

single_trade_condition = strategy.position_size == 0

// Plot EMA for visualization

plot(ema_44, color=color.blue, title="44 EMA")

// Plot conditions for debugging

plotshape(series=entry_condition and single_trade_condition, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=exit_condition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Print entry condition value on chart

var label entry_label = na

if (entry_condition and single_trade_condition)

entry_label := label.new(bar_index, low, text="Entry Condition: TRUE", color=color.green, textcolor=color.white, size=size.small, yloc=yloc.belowbar)

else

entry_label := label.new(bar_index, high, text="Entry Condition: FALSE", color=color.red, textcolor=color.white, size=size.small, yloc=yloc.abovebar)

// Debugging: Plot retrace level and other key values

plot(retrace_level, color=color.orange, title="Retrace Level")

plot(prev_candle_high, color=color.purple, title="Previous Candle High")

plot(candle_before_prev_high, color=color.yellow, title="Candle Before Previous High")

// Trigger buy order if entry condition and single trade condition are met

if (entry_condition and single_trade_condition)

strategy.entry("Buy", strategy.long)

// Trigger sell order if exit condition is met

if (exit_condition)

strategy.close("Buy")

- Strategi Grid Kedudukan Berubah Mengikut Trend

- Strategi DCA dinamik berasaskan jumlah

- Teori Gelombang Elliott 4-9 Impulse Wave Automatic Detection Strategi Dagangan

- Strategi Pengesanan Tren Dinamik ATR Berbilang Jangka Masa

- Strategi Pengesan Lembah MACD

- Strategi silang EMA yang dipertingkatkan dengan RSI/MACD/ATR

- EMA/MACD/RSI Strategy Crossover

- Strategi Dagangan Jangka Pendek dengan Leverage Tinggi Multi-Indikator

- Strategi Crossover Momentum Pasaran Berbilang Jangka Masa

- Trend Multi-Indikator Berikutan Strategi Pengurusan Risiko Dinamik

- Strategi Dagangan Purata Bergerak yang Beradaptasi-Melalui Harga

- Trend Stop-Loss Dinamik Multi-Indikator Mengikut Strategi

- Dual Coral Trend Crossover Strategi

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategi dengan Sistem Perdagangan Otomatik Indikator Trend Magic

- 52-minggu tinggi-rendah / purata Jilid / Jilid Breakout Strategi

- Multi-EMA dan CCI Trend Crossover Mengikut Strategi

- Strategi Crossover EMA yang Dinamis Mengikuti Trend

- Trend Penyesuaian Dinamik Berbilang Faktor Mengikut Strategi

- Strategi Pembalikan RSI Berbilang Jangka Masa

- Struktur Perdagangan Institusional Pintar Strategi Momentum

- Strategi Pengesanan Momentum EMA MACD

- Strategi Penguasaan Posisi Dinamis RSI Overbought Reversal

- Strategi Perdagangan RSI Berbilang Zon

- Trend Dinamik Mengikuti Strategi Dengan Pembelajaran Mesin Pengurusan Risiko yang Ditingkatkan

- Purata bergerak silang dengan strategi momentum candlestick yang dilencangkan

- Strategi silang purata bergerak berganda dengan sasaran keuntungan harian

- Strategi penyambungan purata bergerak stop-loss dinamik

- MACD-ATR-EMA Multi-Indikator Trend Dinamik Mengikut Strategi

- RSI Momentum Divergence Breakout Strategi

- Strategi Dagangan Jangka Panjang Sinergi Pelbagai Penunjuk