Стратегия обратного отклонения тенденции EMA по гауссианскому перекрестку

Автор:Чао Чжан, Дата: 2024-09-26 15:34:01Тэги:ЕМАРСИMACDATRADX

Обзор

Это стратегия, основанная на 44-периодных экспоненциальных скользящих средних (EMA). Стратегия в первую очередь ищет возможности покупки в восходящих тенденциях путем анализа нескольких условий, включая наклон EMA, шаблоны свечей и снижение цены.

Принципы стратегии

- Вычислить 44-периодную EMA и ее наклон, чтобы определить, достаточно ли склонна тенденция.

- Проанализируйте предыдущую модель свечей, требуя, чтобы она была быстрой и близкой выше EMA.

- Наблюдайте, если текущая свеча отступила до 50% от тела предыдущей.

- Убедитесь, что закрытие предыдущей свечи выше, чем максимум свечи перед ней, подтверждая непрерывность восходящего тренда.

- При выполнении всех условий, ввести длинную позицию на уровне ретрассемента текущей свечи.

- Условия выхода: когда предыдущая свеча является медвежьей или текущая свеча прорывается ниже предыдущей.

Преимущества стратегии

- Многочисленные фильтры: сочетает в себе EMA, модели свечей и ретрассов цены для эффективного снижения ложных сигналов.

- Следование тенденции: использует наклон EMA для обеспечения торговли в ясных восходящих тенденциях, улучшая уровень выигрыша.

- Ретрассемент вход: использует ценовые отступления в качестве точек входа, оптимизируя цены покупки и потенциально увеличивая маржу прибыли.

- Гибкость: применима к различным временным рамкам, подходит для краткосрочных и внутридневных трейдеров.

- Контроль рисков: реализует четкие условия стоп-лосса, помогая контролировать риск для каждой сделки.

Стратегические риски

- Отставание: EMA как отстающий показатель может не реагировать своевременно на сильно волатильных рынках.

- Ложные прорывы: могут вызывать частые ложные сигналы в зонах боковой консолидации.

- Переоценка: высокая волатильность рынков может привести к слишком большому количеству сделок, увеличивая затраты на транзакции.

- Обратные тенденции: быстрые обратные тенденции могут привести к значительным потерям.

- Чувствительность параметров: производительность стратегии чувствительна к параметрам, таким как период EMA.

Руководство по оптимизации

- Введите дополнительные фильтры: такие как RSI или MACD для дальнейшего подтверждения силы и направления тренда.

- Динамическая стоп-лосс: внедрить динамическую стоп-лосс на основе ATR для лучшего адаптации к волатильности рынка.

- Включить анализ объема: интегрировать показатели объема для повышения надежности входного сигнала.

- Оптимизировать период EMA: отслеживать различные периоды EMA, чтобы найти оптимальную комбинацию параметров.

- Добавить индикатор силы тренда: например, ADX, чтобы обеспечить записи только в сильных тенденциях.

- Улучшить механизм выхода: разработать более сложные стратегии получения прибыли, такие как остановки.

Резюме

Гауссианская кросс-стратегия EMA - это система отслеживания тренда, которая сочетает в себе несколько технических индикаторов. Интегрируя EMA, анализ моделей свечей и отслеживание цен, эта стратегия показывает хороший потенциал в определении восходящих тенденций и оптимизации времени входа. Однако пользователям необходимо быть осторожными в отношении рисков переоценки и оптимизировать параметры для различных рыночных условий. Внедряя дополнительные технические индикаторы и улучшая механизмы управления рисками, эта стратегия имеет потенциал для достижения более стабильной производительности в краткосрочной торговле.

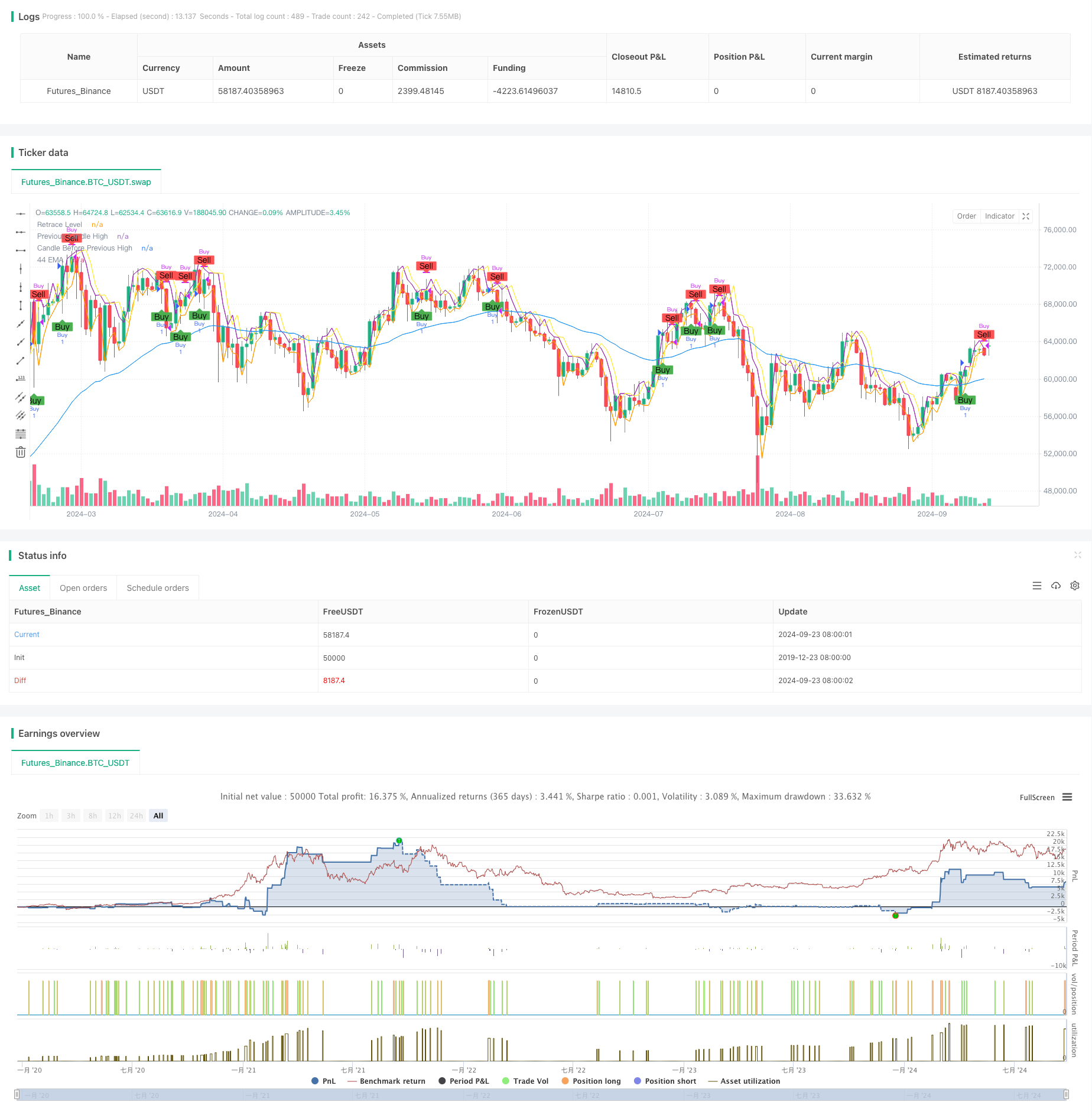

/*backtest

start: 2019-12-23 08:00:00

end: 2024-09-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Strategy with EMA and Candle Conditions", overlay=true)

// Define parameters

ema_length = 44

// Calculate EMA

ema_44 = ta.ema(close, ema_length)

// Calculate the slope of the EMA

ema_slope = ta.ema(close, ema_length) - ta.ema(close[9], ema_length)

// Define a threshold for considering the EMA flat

flat_threshold = 0.5

// Check if the EMA is flat or inclined

ema_is_inclined = math.abs(ema_slope) > flat_threshold

// Define the previous candle details

prev_candle_high = high[1]

prev_candle_low = low[1]

prev_candle_close = close[1]

prev_candle_open = open[1]

// Candle before the previous candle (for high comparison)

candle_before_prev_high = high[2]

// Current candle details

current_candle_high = high

current_candle_low = low

current_candle_close = close

current_candle_open = open

// Previous to previous candle details

prev_prev_candle_low = low[2]

// Previous candle body and wick length

prev_candle_body = math.abs(prev_candle_close - prev_candle_open)

prev_candle_wick_length = math.max(prev_candle_high - prev_candle_close, prev_candle_close - prev_candle_low)

// Calculate retrace level for the current candle

retrace_level = prev_candle_close - (prev_candle_close - prev_candle_low) * 0.5

// Check if the previous candle's wick is smaller than its body

prev_candle_condition = prev_candle_wick_length < prev_candle_body

// Check if the previous candle is a green (bullish) candle and if the previous candle's close is above EMA

prev_candle_green = prev_candle_close > prev_candle_open

prev_candle_red = prev_candle_close < prev_candle_open

prev_candle_above_ema = prev_candle_close > ema_44

// Entry condition: The current candle has retraced to 50% of the previous candle's range, previous candle was green and above EMA, and the high of the current candle is above the retrace level, and EMA is inclined

entry_condition = prev_candle_close > candle_before_prev_high and

prev_candle_green and

prev_candle_above_ema and

current_candle_low <= retrace_level and

current_candle_high >= retrace_level and ema_is_inclined

// Exit condition

exit_condition = (strategy.position_size > 0 and prev_candle_red) or (strategy.position_size > 0 and current_candle_low < prev_candle_low)

// Ensure only one trade is open at a time

single_trade_condition = strategy.position_size == 0

// Plot EMA for visualization

plot(ema_44, color=color.blue, title="44 EMA")

// Plot conditions for debugging

plotshape(series=entry_condition and single_trade_condition, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=exit_condition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Print entry condition value on chart

var label entry_label = na

if (entry_condition and single_trade_condition)

entry_label := label.new(bar_index, low, text="Entry Condition: TRUE", color=color.green, textcolor=color.white, size=size.small, yloc=yloc.belowbar)

else

entry_label := label.new(bar_index, high, text="Entry Condition: FALSE", color=color.red, textcolor=color.white, size=size.small, yloc=yloc.abovebar)

// Debugging: Plot retrace level and other key values

plot(retrace_level, color=color.orange, title="Retrace Level")

plot(prev_candle_high, color=color.purple, title="Previous Candle High")

plot(candle_before_prev_high, color=color.yellow, title="Candle Before Previous High")

// Trigger buy order if entry condition and single trade condition are met

if (entry_condition and single_trade_condition)

strategy.entry("Buy", strategy.long)

// Trigger sell order if exit condition is met

if (exit_condition)

strategy.close("Buy")

- Стратегия сетки переменной позиции, следующая за тенденцией

- Динамическая стратегия DCA на основе объема

- Теория волн Эллиота 4-9 Импульсная волна Автоматическое обнаружение Стратегия торговли

- Стратегия динамического отслеживания тенденций ATR на несколько временных рамок

- Стратегия MACD Valley Detector

- Улучшенная стратегия перекрестного использования EMA с RSI/MACD/ATR

- Стратегия перекрестного использования EMA/MACD/RSI

- Многопоказательная краткосрочная стратегия торговли с высоким уровнем кредитного плеча

- Стратегия перекрестного использования рыночного импульса в различных периодах времени

- Многопоказательная тенденция после динамической стратегии управления рисками

- Стратегия торговли адаптивными пересекающими цены скользящими средними

- Многопоказательная динамическая тенденция стоп-лосса по стратегии

- Стратегия перекрестного использования двойной коралловой тенденции

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Стратегия с автоматической системой торговли индикатором тренда

- 52-недельная стратегия высоко-низкого/среднего объема/прорыва объема

- Тенденция перекрестного использования мульти-EMA и CCI в соответствии со стратегией

- Динамическая стратегия перекрестного использования EMA в соответствии с тенденцией

- Многофакторная динамическая адаптивная тенденция в соответствии со стратегией

- Стратегия реверсии сверхпроданных показателей RSI на несколько временных рамок

- Интеллектуальная структура институциональной торговли Стратегия импульса

- Стратегия отслеживания импульса EMA MACD

- Динамическое управление позицией Стратегия переокупления RSI

- Стратегия торговли РСИ в нескольких зонах

- Динамическая тенденция после стратегии с машинным обучением повышенного управления рисками

- Кроссоверная скользящая средняя со сглаженной стратегией импульса свечей

- Стратегия перекрестного использования двойной скользящей средней с ежедневной целью прибыли

- Динамическая стратегия перекрестного использования скользящей средней величины с остановкой потери

- Динамическая тенденция MACD-ATR-EMA по многоиндикаторам в соответствии со стратегией

- Стратегия прорыва от дивергенции импульса RSI

- Многопоказательная долгосрочная стратегия торговли с синергией