Multi-Indicator Trend Following Strategy

Author: ChaoZhang, Date: 2024-04-28 14:25:12Tags: MACDMARSIATR

Overview

The strategy named “Jancok Strategycs v3” is a multi-indicator trend following strategy based on Moving Averages (MA), Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Average True Range (ATR). The main idea of this strategy is to use a combination of multiple indicators to determine market trends and trade in the direction of the trend. Additionally, the strategy employs dynamic stop-loss and take-profit methods, as well as ATR-based risk management, to control risk and optimize returns.

Strategy Principle

The strategy uses the following four indicators to determine market trends: 1. Moving Averages (MA): Calculate short-term (9-period) and long-term (21-period) moving averages. When the short-term MA crosses above the long-term MA, it indicates an uptrend; when the short-term MA crosses below the long-term MA, it indicates a downtrend. 2. Moving Average Convergence Divergence (MACD): Calculate the MACD line and signal line. When the MACD line crosses above the signal line, it indicates an uptrend; when the MACD line crosses below the signal line, it indicates a downtrend. 3. Relative Strength Index (RSI): Calculate the 14-period RSI. When RSI is above 70, it suggests that the market may be overbought; when RSI is below 30, it suggests that the market may be oversold. 4. Average True Range (ATR): Calculate the 14-period ATR to measure market volatility and set stop-loss and take-profit points.

The trading logic of the strategy is as follows: - When the short-term MA crosses above the long-term MA, the MACD line crosses above the signal line, the trading volume is greater than its moving average, and the volatility is below the threshold, enter a long position. - When the short-term MA crosses below the long-term MA, the MACD line crosses below the signal line, the trading volume is greater than its moving average, and the volatility is below the threshold, enter a short position. - Stop-loss and take-profit points are dynamically set based on ATR, with the stop-loss point being 2 times the ATR and the take-profit point being 4 times the ATR. - An optional trailing stop based on ATR can be used, with the trailing stop point being 2.5 times the ATR.

Strategy Advantages

- Multi-indicator combination for trend determination, improving the accuracy of trend identification.

- Dynamic stop-loss and take-profit, adaptively adjusting based on market volatility, better controlling risk and optimizing returns.

- Introduction of volume and volatility filters to avoid trading during low liquidity and high volatility periods, reducing false signals.

- Optional trailing stop to retain more profits when trends persist.

Strategy Risks

- False signals may be generated during market consolidation or trend reversals, leading to losses.

- Parameter settings have a significant impact on strategy performance and need to be optimized for different markets and assets.

- Over-optimization of parameters may lead to overfitting and poor performance in actual trading.

- The strategy may incur significant losses during abnormal market fluctuations or black swan events.

Strategy Optimization Directions

- Introduce more indicators, such as Bollinger Bands, Stochastic Oscillator, etc., to further improve trend identification accuracy.

- Optimize parameter selection using methods like genetic algorithms or grid search to find the optimal parameter combination.

- Set different parameters and rules for different markets and assets to improve the adaptability of the strategy.

- Incorporate position sizing, dynamically adjusting position size based on trend strength and account risk.

- Set a maximum drawdown limit, suspending trading or reducing position size when the account reaches the maximum drawdown, to control risk.

Summary

“Jancok Strategycs v3” is a trend following strategy based on a combination of multiple indicators, using Moving Averages, MACD, RSI, and ATR to determine market trends, and employing risk management techniques such as dynamic stop-loss and take-profit, and trailing stop to control risk and optimize returns. The strategy’s advantages lie in its high accuracy of trend identification, flexible risk management, and strong adaptability. However, it also carries certain risks, such as false signals, sensitivity to parameter settings, and black swan events. In the future, the strategy’s performance and stability can be further enhanced by introducing more indicators, optimizing parameter selection, incorporating position sizing, and setting a maximum drawdown limit.

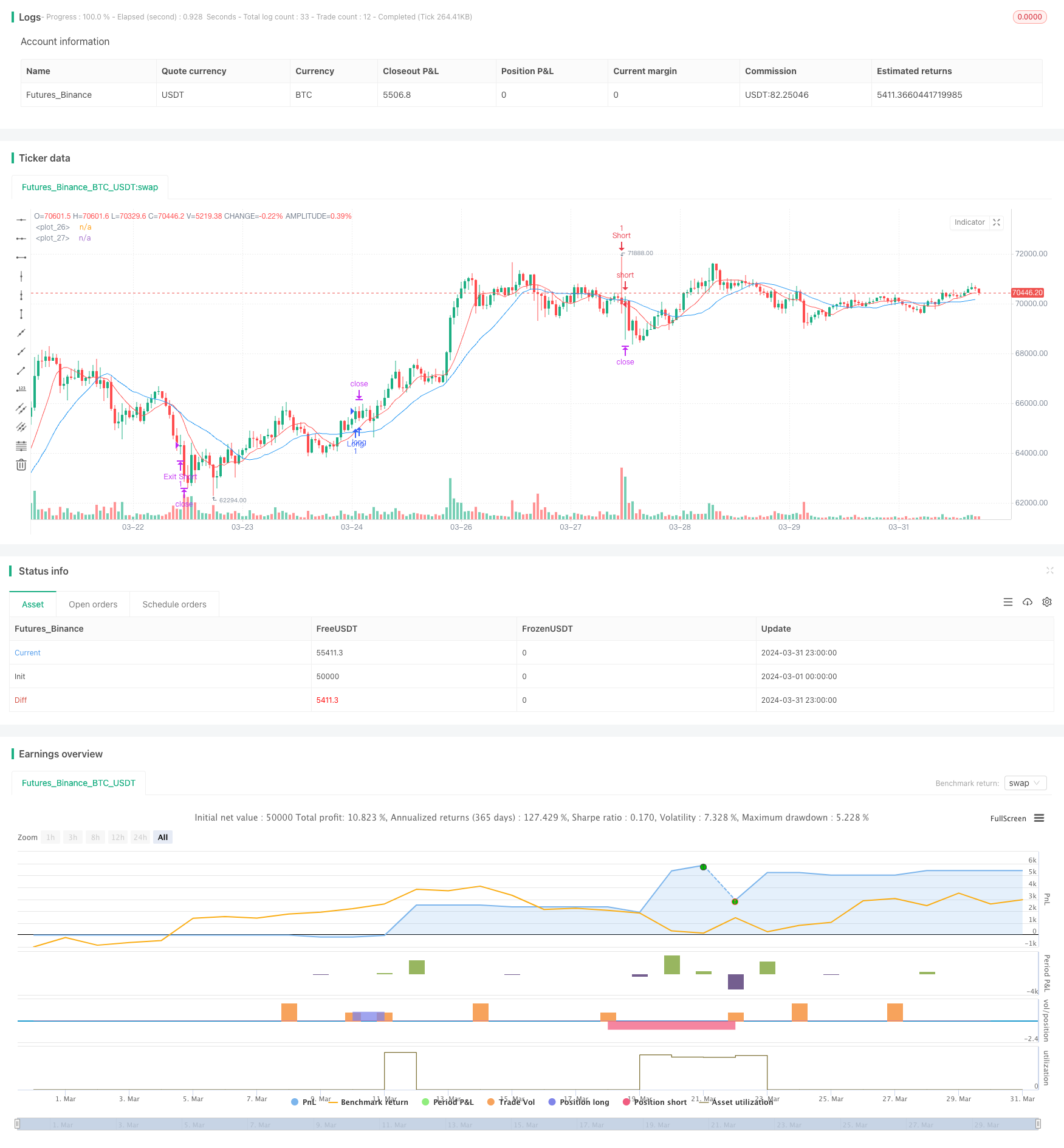

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © financialAccou42381

//@version=5

strategy("Jancok Strategycs v3", overlay=true, initial_capital=100, currency="USD")

// Inputs

short_ma_length = input.int(9, title="Short MA Length", minval=1)

long_ma_length = input.int(21, title="Long MA Length", minval=1)

atr_multiplier_for_sl = input.float(2, title="ATR Multiplier for Stop Loss", minval=1.0)

atr_multiplier_for_tp = input.float(4, title="ATR Multiplier for Take Profit", minval=1.0)

volume_ma_length = input.int(20, title="Volume MA Length", minval=1)

volatility_threshold = input.float(1.5, title="Volatility Threshold", minval=0.1, step=0.1)

use_trailing_stop = input.bool(false, title="Use Trailing Stop")

trailing_stop_atr_multiplier = input.float(2.5, title="Trailing Stop ATR Multiplier", minval=1.0)

// Calculating indicators

short_ma = ta.sma(close, short_ma_length)

long_ma = ta.sma(close, long_ma_length)

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

atr = ta.atr(14)

volume_ma = ta.sma(volume, volume_ma_length)

volatility = atr / close

// Plotting indicators

plot(short_ma, color=color.red)

plot(long_ma, color=color.blue)

// Defining entry conditions with added indicators and filters

long_condition = ta.crossover(short_ma, long_ma) and (macdLine > signalLine) and (volume > volume_ma) and (volatility < volatility_threshold)

short_condition = ta.crossunder(short_ma, long_ma) and (macdLine < signalLine) and (volume > volume_ma) and (volatility < volatility_threshold)

// Entering trades with dynamic stop loss and take profit based on ATR

if (long_condition)

strategy.entry("Long", strategy.long)

if use_trailing_stop

strategy.exit("Exit Long", "Long", trail_points=atr * trailing_stop_atr_multiplier, trail_offset=atr * 0.5)

else

strategy.exit("Exit Long", "Long", loss=atr * atr_multiplier_for_sl, profit=atr * atr_multiplier_for_tp)

if (short_condition)

strategy.entry("Short", strategy.short)

if use_trailing_stop

strategy.exit("Exit Short", "Short", trail_points=atr * trailing_stop_atr_multiplier, trail_offset=atr * 0.5)

else

strategy.exit("Exit Short", "Short", loss=atr * atr_multiplier_for_sl, profit=atr * atr_multiplier_for_tp)

- Trend-Following Trading Strategy with Momentum Filtering

- Dual EMA Trend Momentum Trading Strategy

- Multi-Indicator Dynamic Volatility Trading Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Multi-Level Dynamic Trend Following System

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Turnaround Tuesday Strategy (Weekend Filter)

- Low-Risk Stable Cryptocurrency High-Frequency Trading Strategy Based on RSI and MACD

- Ichimoku Leading Span B Breakout Strategy

- Long Entry on EMA Cross with Risk Management Strategy

- MACD and RSI Combined Long-term Trading Strategy

- DCA Dual Moving Average Turtle Trading Strategy

- VWAP Trading Strategy

- Multi-Indicator Combination Strategy (CCI, DMI, MACD, ADX)

- RSI2 Strategy Intraday Reversal Win Rate Backtest

- Hurst Future Lines of Demarcation Strategy

- Trend Following Strategy Based on OBV and MA Crossover Signals

- GBS TOP BOTTOM Confirmed Strategy

- Squeeze Backtest Transformer v2.0

- Fibonacci Trend Reversal Strategy

- HTF Zigzag Path Strategy

- WaveTrend Cross LazyBear Strategy

- CCI, DMI, and MACD Hybrid Long-Short Strategy

- AlphaTradingBot Trading Strategy

- Vegas SuperTrend Enhanced Strategy

- Quantitative Trading Strategy Based on Modified Hull Moving Average and Ichimoku Kinko Hyo

- RSI Trend Reversal Strategy

- Stochastic Crossover Indicator Momentum Trading Strategy