CDC Action Zone Trading Bot Strategy with ATR for Take Profit and Stop Loss

Author: ChaoZhang, Date: 2024-06-03 16:19:32Tags: TAEMAATR

Overview

This strategy is a trading bot strategy based on the CDC action zone. It uses the 12-period and 26-period Exponential Moving Averages (EMA) to determine market trends, going long when the short-term EMA is above the long-term EMA and going short when the opposite is true. The strategy employs Average True Range (ATR) to set dynamic take profit and stop loss levels. The take profit level is determined based on ATR and a multiplier, while the stop loss level is fixed at 5% of the current closing price.

Strategy Principles

- Calculate the 12-period and 26-period EMAs to determine market trends.

- Calculate ATR to set dynamic take profit and stop loss levels.

- When the short-term EMA is above the long-term EMA, a buy signal is generated, and a long position is opened.

- When the short-term EMA is below the long-term EMA, a sell signal is generated, and a short position is opened.

- The take profit level is determined based on ATR and a multiplier, and the position is closed when the price reaches the take profit level.

- The stop loss level is fixed at 5% of the current closing price, and the position is closed when the price reaches the stop loss level.

Strategy Advantages

- Using EMAs to capture market trends can effectively adapt to different market conditions.

- Employing ATR to set dynamic take profit levels can better protect profits.

- Fixed stop loss levels help control risk and limit losses to an acceptable range.

- The code structure is clear and easy to understand and modify, making it suitable for further optimization.

Strategy Risks

- EMAs are lagging indicators and may generate false signals when the market changes rapidly.

- ATR-based take profit levels may not protect profits in time during high market volatility.

- Fixed stop loss levels may lead to premature position closures in some cases, missing out on potential profits.

- The strategy does not consider trading costs and slippage, so actual trading results may differ from backtesting results.

Strategy Optimization Directions

- Experiment with other trend indicators, such as MACD or moving average crossovers, to improve signal accuracy.

- Optimize the ATR multiplier and take profit/stop loss percentages to better adapt to different market conditions.

- Introduce dynamic stop loss mechanisms, such as trailing stops or volatility-based stops, to better control risk.

- Consider trading costs and slippage, and choose appropriate trading instruments and trading sessions to improve the strategy’s actual performance.

Summary

This strategy is an ATR-based take profit and stop loss trading bot strategy based on the CDC action zone. It uses EMAs to capture market trends, ATR to set dynamic take profit levels, and fixed percentage stop losses to control risk. Although the strategy has certain advantages, it still has some risks and room for improvement. With further optimization and testing, the strategy may achieve good performance in actual trading.

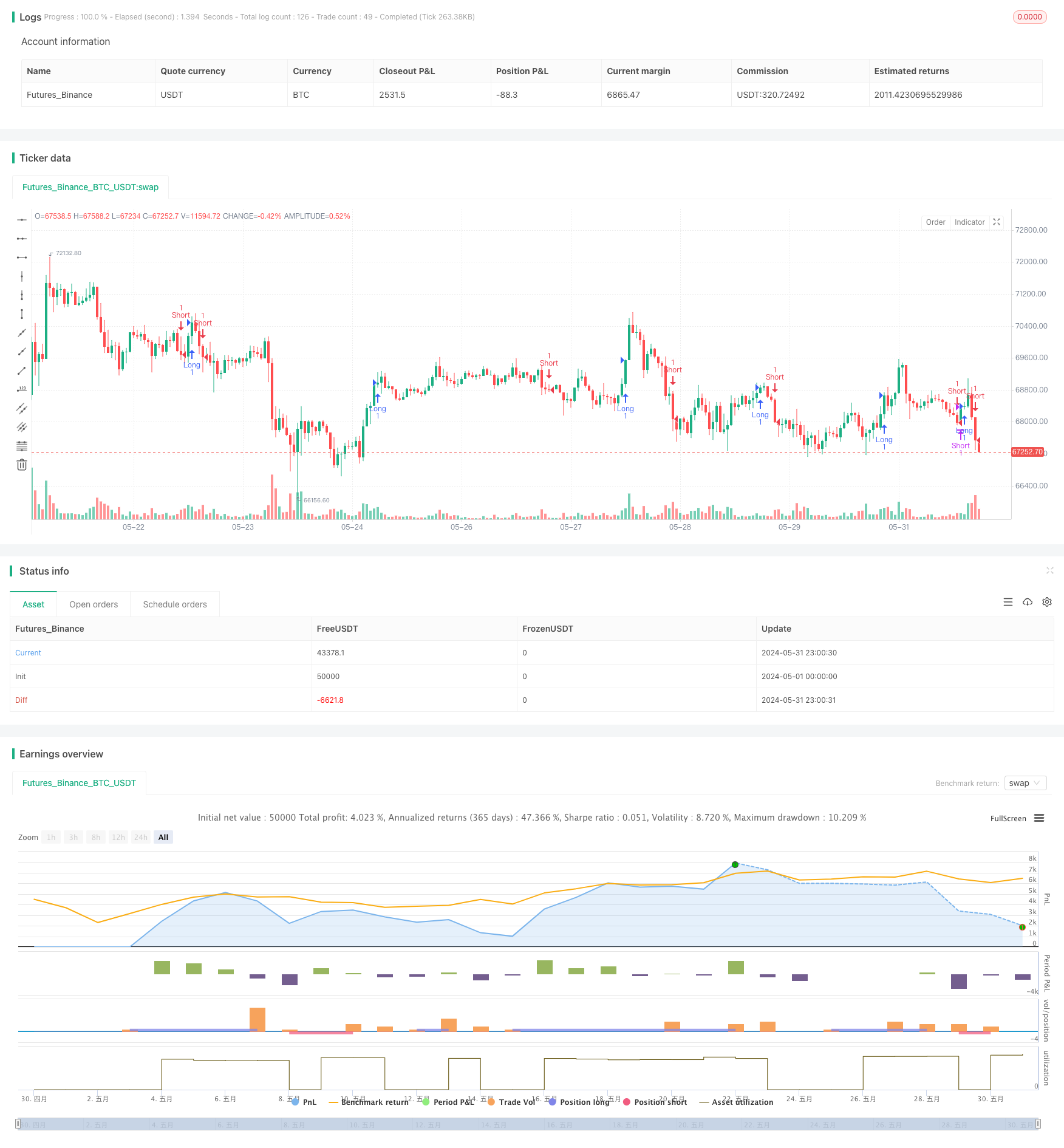

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CDC Action Zone Trading Bot with ATR for Take Profit and 5% Stop Loss", overlay=true)

// ดึงข้อมูลราคาปิด

close_price = close

// คำนวณเส้น EMA 12 และ EMA 26

ema12 = ta.ema(close_price, 12)

ema26 = ta.ema(close_price, 26)

// คำนวณ ATR

atr_length = input.int(14, title="ATR Length")

atr = ta.atr(atr_length)

// กำหนด Multiplier สำหรับ ATR Trailing Stoploss

mult_atr_stoploss = input.float(2.5, title="ATR Stoploss Multiplier")

// คำนวณ ATR Trailing Stoploss

prev_stoploss = close_price

for i = 1 to 10

prev_stoploss := math.max(prev_stoploss, high[i] - mult_atr_stoploss * atr)

// กำหนด Take Profit เป็น ATR Trailing Stoploss

takeProfitPercent = input.float(10, title="Take Profit (%)") / 100

takeProfit = close_price + (close_price - prev_stoploss) * takeProfitPercent

// กำหนด Stop Loss เป็น 5% ของราคาปิดปัจจุบัน

stopLossPercent = input.float(5, title="Stop Loss (%)") / 100

stopLoss = close_price * stopLossPercent

// กำหนดสีแท่งกราฟ

buyColor = input.color(color.green, title="Buy Color")

sellColor = input.color(color.red, title="Sell Color")

neutralColor = input.color(color.gray, title="Neutral Color")

color = if (ema12 > ema26)

buyColor

else if (ema12 < ema26)

sellColor

else

neutralColor

// สัญญาณ Buy

buySignal = (color == buyColor) and (color[1] != buyColor)

// สัญญาณ Sell

sellSignal = (color == sellColor) and (color[1] != sellColor)

// เปิด Position Long

if (buySignal)

strategy.entry("Long", strategy.long)

// เปิด Position Short

if (sellSignal)

strategy.entry("Short", strategy.short)

// ปิด Position เมื่อถึง Take profit

if (strategy.position_size > 0 and close_price > takeProfit)

strategy.exit("Long", profit=takeProfit)

// ปิด Position เมื่อถึง Stop loss

if (strategy.position_size > 0 and close_price < stopLoss)

strategy.exit("Long", loss=stopLoss)

// ปิด Position เมื่อถึง Take profit

if (strategy.position_size < 0 and close_price < takeProfit)

strategy.exit("Short", profit=takeProfit)

// ปิด Position เมื่อถึง Stop loss

if (strategy.position_size < 0 and close_price > stopLoss)

strategy.exit("Short", loss=stopLoss)

- Dynamic Keltner Channel Momentum Reversal Strategy

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- Multi-EMA Cross with Oscillator and Dynamic Support/Resistance Trading Strategy

- EMA Dynamic Trend Following Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Enhanced Multi-Indicator Momentum Trading Strategy

- K Consecutive Candles Bull Bear Strategy

- Triple EMA Crossover Strategy

- Keltner Channels EMA ATR Strategy

- ATR and EMA-based Dynamic Take Profit and Stop Loss Adaptive Strategy

- Dynamic Trend Following Strategy

- Smooth Moving Average Stop Loss & Take Profit Strategy with Trend Filter and Exception Exit

- MACD Convergence Strategy with R:R, Daily Limits, and Tighter Stop Loss

- Starlight Moving Average Crossover Strategy

- Percentage Threshold Quantitative Trading Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- MACD and Supertrend Combination Strategy

- Buy/Sell Strategy Based on Volume & Candlestick Patterns

- SMA Trend Following Strategy with Trailing Stop-Loss and Disciplined Re-Entry

- EMA and Bollinger Bands Breakout Strategy

- Continuous Candle Based Dynamic Grid Adaptive Moving Average with Dynamic Stop Loss Strategy

- MA Cross Strategy

- Trend-Following Trading Strategy with Momentum Filtering

- RSI and Linear Regression Channel Trading Strategy

- Double Vegas Channel Volatility-Adjusted SuperTrend Quantitative Trading Strategy

- EMA RSI Crossover Strategy

- Moving Average Convergence Momentum Cloud Strategy

- Dual Moving Average Crossover Stop Loss and Take Profit Strategy

- TEMA Dual Moving Average Crossover Strategy

- Multi-Timeframe SMA Trend Following Strategy with Dynamic Stop Loss