Multi-Timeframe RSI Oversold Reversal Strategy

Author: ChaoZhang, Date: 2024-09-26 15:38:20Tags: RSIEMASLTP

Overview

This strategy is a multi-timeframe trading system based on the Relative Strength Index (RSI) and Exponential Moving Average (EMA). It primarily utilizes the RSI indicator to identify oversold conditions and combines it with a long-term EMA as a trend filter to initiate buy orders when the market shows oversold reversal signals. The strategy also incorporates stop-loss and take-profit mechanisms, as well as a feature to increase position size during price declines, aiming to capture market rebounds while controlling risk.

Strategy Principle

The core principle of this strategy is to use the RSI indicator to identify oversold conditions and trigger buy signals when the RSI value falls below a set threshold. Specifically:

- It uses an 11-period RSI indicator, considering oversold conditions when the RSI value is below 20.

- A 290-period EMA is used as a long-term trend indicator to help filter out unfavorable market environments.

- When buy conditions are met, the strategy opens a long position.

- A 1.4% stop-loss and 3.5% take-profit are set to control risk and lock in profits.

- The strategy closes positions when the RSI value exceeds 79.

- If the price drops by 2%, the strategy increases the position size by 3 times to average down costs and capture larger rebound opportunities.

This multi-layered trading logic aims to enhance the strategy’s stability and profitability.

Strategy Advantages

Multi-indicator combination: By combining RSI and EMA, the strategy can more accurately identify potential reversal opportunities while considering long-term trends.

Risk management: Built-in stop-loss and take-profit mechanisms help control the risk of each trade, protecting capital safety.

Dynamic position management: The mechanism to increase positions during price declines can lower average costs and improve potential returns.

Flexibility: Strategy parameters can be adjusted to adapt to different market environments and trading instruments.

Automation: The strategy can be executed automatically on trading platforms, reducing emotional interference.

Strategy Risks

False breakout risk: RSI may produce false breakouts, leading to incorrect trading signals.

Trend reversal: In strong trends, the strategy may trigger signals frequently, increasing trading costs.

Parameter sensitivity: Strategy performance may be highly sensitive to parameter settings, requiring careful optimization and backtesting.

Slippage and trading costs: Frequent trading may result in high transaction costs, affecting overall returns.

Market environment dependency: The strategy may perform poorly in certain market environments, requiring continuous monitoring and adjustment.

Strategy Optimization Directions

Multi-timeframe analysis: Consider introducing RSI analysis on multiple time frames to improve signal reliability.

Dynamic parameter adjustment: Dynamically adjust RSI thresholds and EMA periods based on market volatility to adapt to different market environments.

Incorporate volume indicators: Combining volume analysis can help confirm the validity of price movements.

Optimize position sizing logic: Consider using more complex position sizing algorithms, such as dynamic sizing based on ATR.

Introduce machine learning: Use machine learning algorithms to optimize parameter selection and signal generation processes.

Summary

The Multi-Timeframe RSI Oversold Reversal Strategy is a quantitative trading system that combines technical indicators with risk management. By leveraging RSI oversold signals and EMA trend filtering, the strategy aims to capture market rebound opportunities. Built-in stop-loss and take-profit mechanisms, along with dynamic position sizing logic, further enhance the strategy’s risk control capabilities. However, users need to be aware of potential risks such as false breakouts and parameter sensitivity. Through continuous optimization and adjustments, such as introducing multi-timeframe analysis and machine learning techniques, this strategy has the potential to maintain stability and profitability across various market environments.

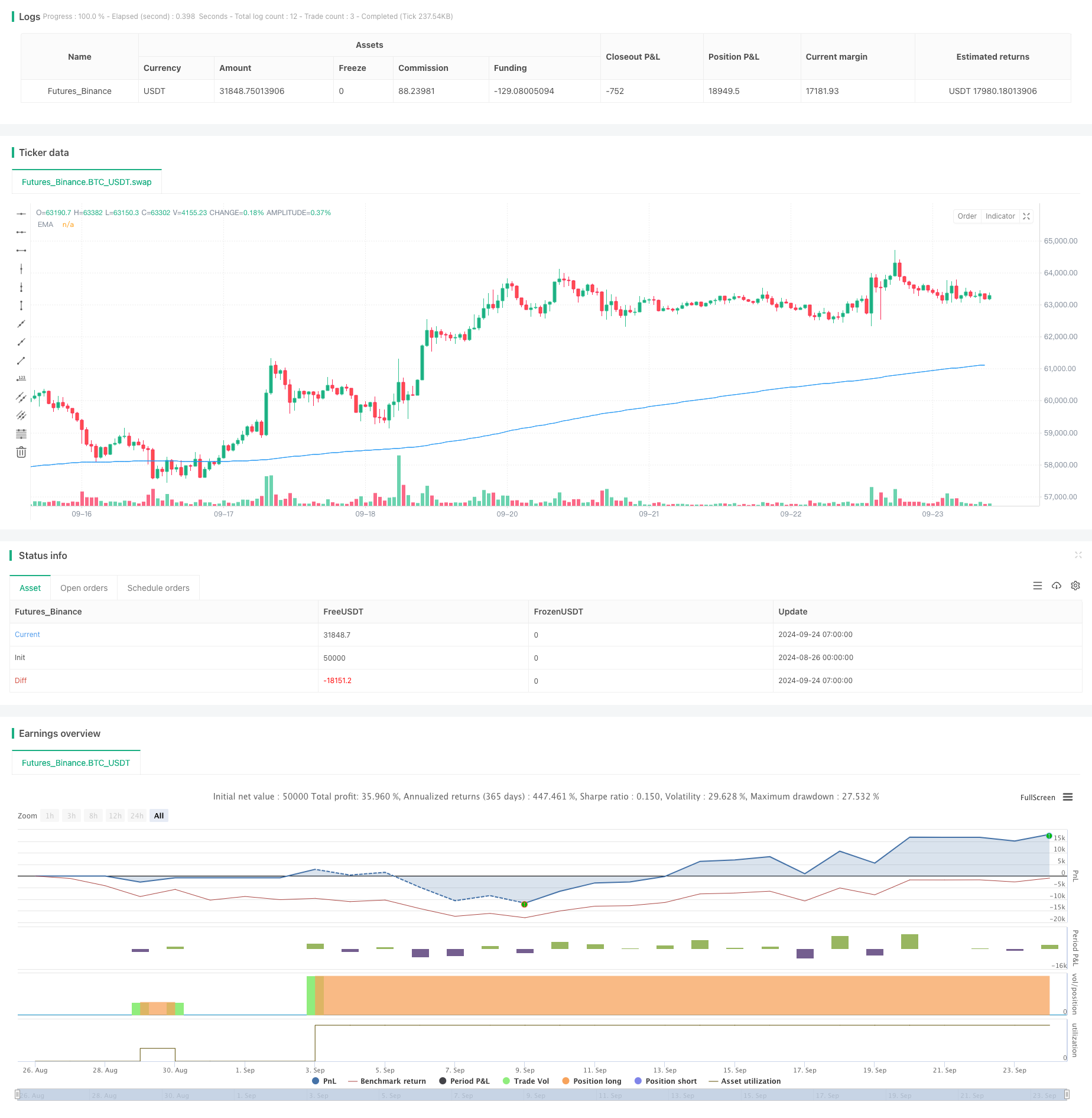

/*backtest

start: 2024-08-26 00:00:00

end: 2024-09-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(" 15min oversold gold", overlay=true)

// Parameters

rsiPeriod = input.int(11, title="RSI Period")

rsiSource = close

rsiEntryValue = input.float(20, title="RSI Value for Entry", step=0.1)

rsiExitValue = input.float(79, title="RSI Value for Exit", step=0.1)

emaPeriod = input.int(290, title="EMA Period")

stopLossPercent = input.float(1.4, title="Stop Loss (%)") / 100 // Convert percentage to a decimal.

takeProfitPercent = input.float(3.5, title="Take Profit (%)") / 100 // Convert percentage to a decimal.

// Calculate RSI and EMA

rsiValue = ta.rsi(rsiSource, rsiPeriod)

longEma = ta.ema(rsiSource, emaPeriod)

// Plot the EMA

plot(longEma, title="EMA", color=color.blue, linewidth=1)

// Entry conditions for long trades

longCondition = rsiValue < rsiEntryValue

// Exit conditions for long trades

rsiExitCondition = rsiValue > rsiExitValue

// Tracking the entry price, setting stop loss, and take profit

var float entryPrice = na

if (longCondition)

entryPrice := close

stopLossPrice = entryPrice * (1 - stopLossPercent)

takeProfitPrice = entryPrice * (1 + takeProfitPercent)

stopLossHit = close < stopLossPrice

takeProfitHit = close > takeProfitPrice

// Execute trades using the if statement

if (longCondition)

strategy.entry("Long", strategy.long)

// Distinct exit conditions

if (rsiExitCondition)

strategy.close("Long", comment="RSI Exit")

if (takeProfitHit)

strategy.close("Long", comment="Take Profit Hit")

///add a more limit buy

morebuy=entryPrice*(0.98)

buymore=close<morebuy

if buymore

strategy.entry('add more', strategy.long, qty = 3, comment = 'letgo bitch')

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Dynamic EMA System Combined with RSI Momentum Indicator for Optimized Intraday Trading Strategy

- Adaptive Trend Following Strategy with Dynamic Drawdown Control System

- Multi-Indicator Dynamic Trading Strategy

- Multi-Trend Following and Structure Breakout Strategy

- Multi-EMA Crossover with Momentum Indicators Trading Strategy

- Enhanced Multi-Indicator Trend Reversal Intelligence Strategy

- KRK ADA 1H Stochastic Slow Strategy with More Entries and AI

- Multi-Indicator Crossover Momentum Trading Strategy with Optimized Take Profit and Stop Loss System

- Adaptive Risk Management Strategy Based on Dual Moving Average Golden Cross

- Dual Indicator Trading Strategy Combining Trend Following and Momentum

- Adaptive Price-Crossing Moving Average Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Trend Following Strategy

- Dual Coral Trend Crossover Strategy

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategy with Trend Magic Indicator Auto-Trading System

- 52-Week High-Low/Average Volume/Volume Breakout Strategy

- Multi-EMA and CCI Crossover Trend Following Strategy

- Dynamic Trend-Following EMA Crossover Strategy

- Multi-Factor Dynamic Adaptive Trend Following Strategy

- Intelligent Institutional Trading Structure Momentum Strategy

- Gaussian Cross EMA Trend Retracement Strategy

- EMA MACD Momentum Tracking Strategy

- Dynamic Position Management RSI Overbought Reversal Strategy

- Multi-Zone RSI Trading Strategy

- Dynamic Trend Following Strategy with Machine Learning Enhanced Risk Management

- Crossover Moving Average with Smoothed Candlestick Momentum Strategy

- Dual Moving Average Crossover Strategy with Daily Profit Target

- Dynamic Stop-Loss Moving Average Crossover Strategy

- MACD-ATR-EMA Multi-Indicator Dynamic Trend Following Strategy