Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

Author: ChaoZhang, Date: 2024-11-12 15:14:13Tags: EMARSIADXMADMI

Overview

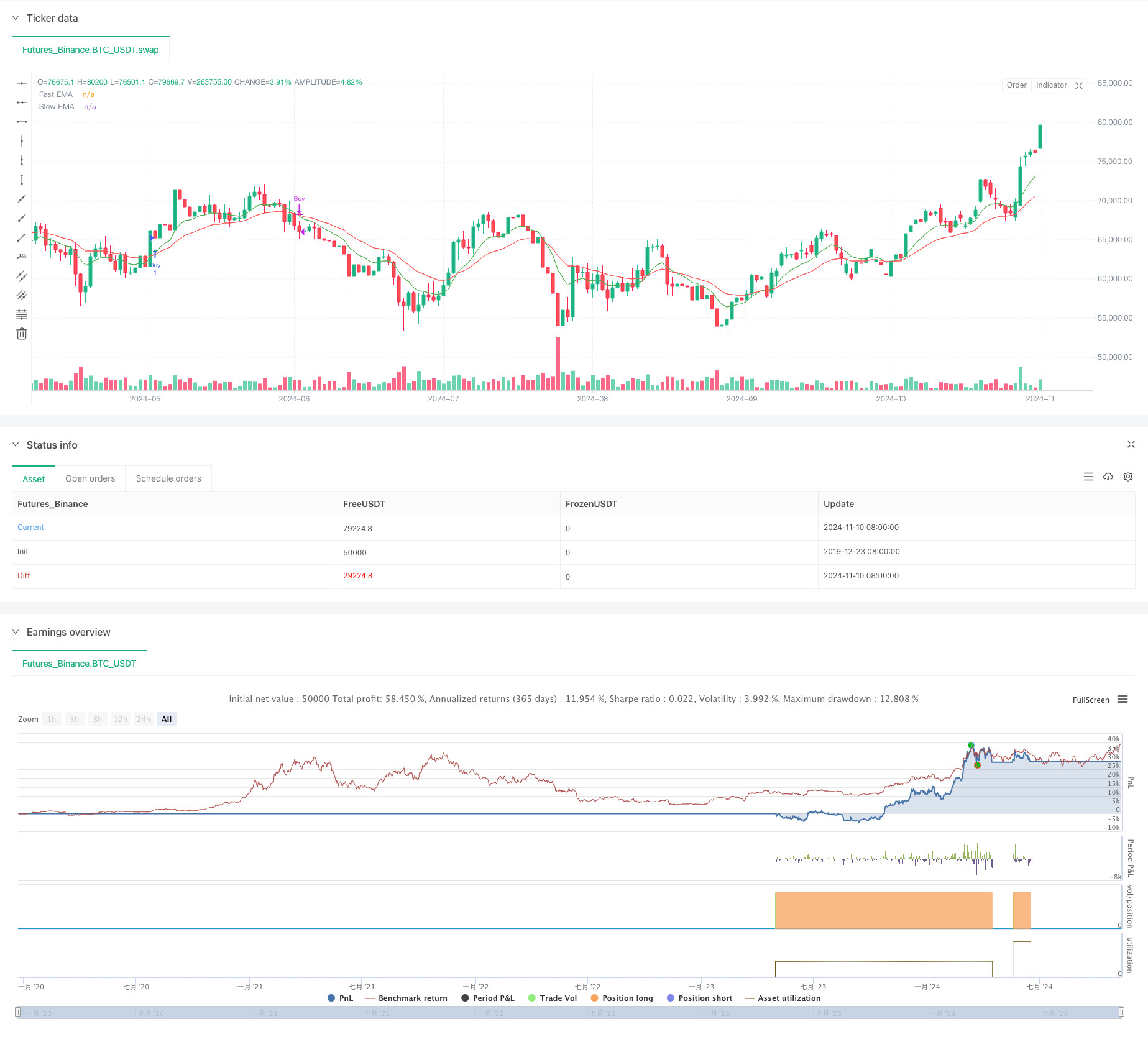

This strategy is a quantitative trading system based on multiple technical indicators, integrating Exponential Moving Average (EMA), Relative Strength Index (RSI), and Average Directional Index (ADX). The strategy uses EMA crossover signals as the primary entry criteria, combined with RSI for overbought/oversold confirmation and ADX for trend strength assessment, forming a complete trading decision system. The strategy also includes a risk management module that controls stop-loss and take-profit levels through a predefined risk-reward ratio.

Strategy Principles

The core logic of the strategy is based on the following key components: 1. Uses 9-period and 21-period EMAs as the main signal system, generating buy signals when the fast line crosses above the slow line and sell signals when it crosses below 2. Incorporates RSI as a filter, requiring RSI below 60 for buy signals to avoid entering in overbought areas, and above 40 for sell signals to avoid exiting in oversold areas 3. Utilizes ADX to confirm trend strength, executing trades only when ADX is above 20 to ensure entry in clear trends 4. In terms of money management, the strategy employs a 2.0 risk-reward ratio for setting profit targets and stop losses

Strategy Advantages

- Integration of multiple technical indicators improves signal reliability and reduces false signals

- EMA crossover system effectively captures trend reversal points

- RSI filter effectively prevents unfavorable entries in extreme zones

- ADX incorporation ensures trading only in clear trends, improving win rate

- Fixed risk-reward ratio settings support stable long-term capital growth

- Strategy features a clear graphical interface with trade signal markers and price labels

Strategy Risks

- Multiple indicators may lead to signal lag, affecting entry timing

- May generate frequent crossover signals in ranging markets, increasing trading costs

- Fixed RSI and ADX thresholds may not be suitable for all market conditions

- Preset risk-reward ratio may not be appropriate for all market phases

- Lack of volume consideration may affect signal reliability

Strategy Optimization Directions

- Introduce adaptive indicator parameters, dynamically adjusting EMA periods based on market volatility

- Add volume confirmation mechanism to improve signal reliability

- Develop dynamic RSI and ADX thresholds to adapt to different market environments

- Dynamically adjust risk-reward ratio based on market volatility

- Add time filters to avoid trading during unfavorable periods

- Incorporate market environment recognition module to use different parameter settings in different market states

Summary

This is a well-designed strategy with complete logic incorporating multiple technical indicators. Through the integration of EMA, RSI, and ADX, the strategy demonstrates good performance in trend following and risk control. While there are areas for optimization, the strategy has good practical value and room for expansion. Performance can be further improved through the suggested optimization directions.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced EMA + RSI + ADX Strategy", overlay=true)

// Input parameters

lenFast = input.int(9, title="Fast EMA Length", minval=1)

lenSlow = input.int(21, title="Slow EMA Length", minval=1)

rsiPeriod = input.int(14, title="RSI Period")

adxPeriod = input.int(14, title="ADX Period")

adxSmoothing = input.int(1, title="ADX Smoothing")

adxThreshold = input.int(20, title="ADX Threshold")

riskRewardRatio = input.float(2.0, title="Risk/Reward Ratio")

// EMA Calculations

fastEMA = ta.ema(close, lenFast)

slowEMA = ta.ema(close, lenSlow)

// RSI Calculation

rsiValue = ta.rsi(close, rsiPeriod)

// ADX Calculation

[plusDI, minusDI, adxValue] = ta.dmi(adxPeriod, adxSmoothing)

// Entry Conditions

buyCondition = ta.crossover(fastEMA, slowEMA) and rsiValue < 60 and adxValue > adxThreshold

sellCondition = ta.crossunder(fastEMA, slowEMA) and rsiValue > 40 and adxValue > adxThreshold

// Entry logic

if (buyCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", from_entry="Buy", limit=close + (close - strategy.position_avg_price) * riskRewardRatio, stop=close - (close - strategy.position_avg_price))

if (sellCondition)

strategy.close("Buy")

// Plotting EMAs (thinner lines)

plot(fastEMA, color=color.new(color.green, 0), title="Fast EMA", linewidth=1)

plot(slowEMA, color=color.new(color.red, 0), title="Slow EMA", linewidth=1)

// Entry and exit markers (larger shapes)

plotshape(series=buyCondition, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.normal, title="Buy Signal")

plotshape(series=sellCondition, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.normal, title="Sell Signal")

// Displaying price labels for buy/sell signals

if (buyCondition)

label.new(bar_index, low, text="Buy\n" + str.tostring(close), color=color.new(color.green, 0), style=label.style_label_down, textcolor=color.white)

if (sellCondition)

label.new(bar_index, high, text="Sell\n" + str.tostring(close), color=color.new(color.red, 0), style=label.style_label_up, textcolor=color.white)

// Optional: Add alerts for entry signals

alertcondition(buyCondition, title="Buy Alert", message="Buy signal triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell signal triggered")

- Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Moving Average and Relative Strength Index Strategy

- Dual Moving Average RSI Momentum Strategy Based on EMA and Trendline Breakouts

- ADX Trend Breakout Momentum Trading Strategy

- AlphaTradingBot Trading Strategy

- Multi-Moving Average Cross Trend Following RSI Oscillation Strategy

- Dual Dynamic Indicator Optimization Strategy

- Multi-Technical Indicator Trend Following Strategy with Ichimoku Cloud Breakout and Stop-Loss System

- Dynamic Multi-Period Exponential Moving Average Cross Strategy with Pullback Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern

- Parabolic SAR Divergence Trading Strategy

- Combined Momentum SMA Crossover Strategy with Market Sentiment and Resistance Level Optimization System

- Multi-Period RSI Momentum and Triple EMA Trend Following Composite Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- E9 Shark-32 Pattern Quantitative Price Breakout Strategy

- Open Market Exposure Dynamic Position Adjustment Quantitative Trading Strategy

- High Win Rate Trend Mean Reversion Trading Strategy

- Dual Moving Average RSI Trend Momentum Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management