ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

Author: ChaoZhang, Date: 2024-11-12 16:14:11Tags: ATRSMATP/SLOHLCMA

Overview

This strategy is a trend-following trading system based on the Average True Range (ATR) indicator, which identifies market trends through dynamic calculation of price volatility ranges and incorporates adaptive take-profit and stop-loss mechanisms for risk management. The strategy employs a multi-period analysis approach, using ATR multiplier to dynamically adjust trade signal triggers for precise market volatility tracking.

Strategy Principles

The core strategy is based on dynamic ATR calculations, using a period parameter (default 10) to compute market true range. An ATR multiplier (default 3.0) is used to construct upper and lower channels, triggering trading signals when price breaks through these channels. Specifically: 1. Uses SMA or standard ATR for volatility baseline calculation 2. Dynamically computes upper and lower channels as trend-following references 3. Determines trend direction through price and channel crossovers 4. Triggers trading signals at trend reversal points 5. Implements percentage-based dynamic take-profit and stop-loss system

Strategy Advantages

- High Adaptability: Dynamically adjusts to market volatility through ATR

- Controlled Risk: Built-in percentage-based take-profit and stop-loss mechanisms effectively control per-trade risk

- Parameter Flexibility: Key parameters like ATR period and multiplier can be adjusted based on market characteristics

- Visual Clarity: Provides comprehensive graphical interface including trend markers and signal alerts

- Time Management: Supports custom trading time windows, improving strategy applicability

Strategy Risks

- Trend Reversal Risk: May generate frequent false signals in ranging markets

- Parameter Sensitivity: Choice of ATR period and multiplier significantly impacts strategy performance

- Market Environment Dependency: May experience larger slippage during high volatility periods

- Stop Loss Settings: Fixed percentage stops may not suit all market conditions

Strategy Optimization Directions

- Introduce multiple timeframe analysis to improve trend identification accuracy

- Add volume indicator confirmation to enhance signal reliability

- Develop adaptive take-profit and stop-loss mechanisms that adjust dynamically with market volatility

- Include trend strength filters to reduce false signals

- Integrate volatility indicators to optimize entry timing

Summary

This is a well-designed trend-following strategy that achieves precise market volatility tracking through the ATR indicator, combined with take-profit and stop-loss mechanisms for risk management. The strategy’s strengths lie in its adaptability and controlled risk, though market environment impact on strategy performance should be noted. Through the suggested optimization directions, the strategy’s stability and profitability can be further enhanced.

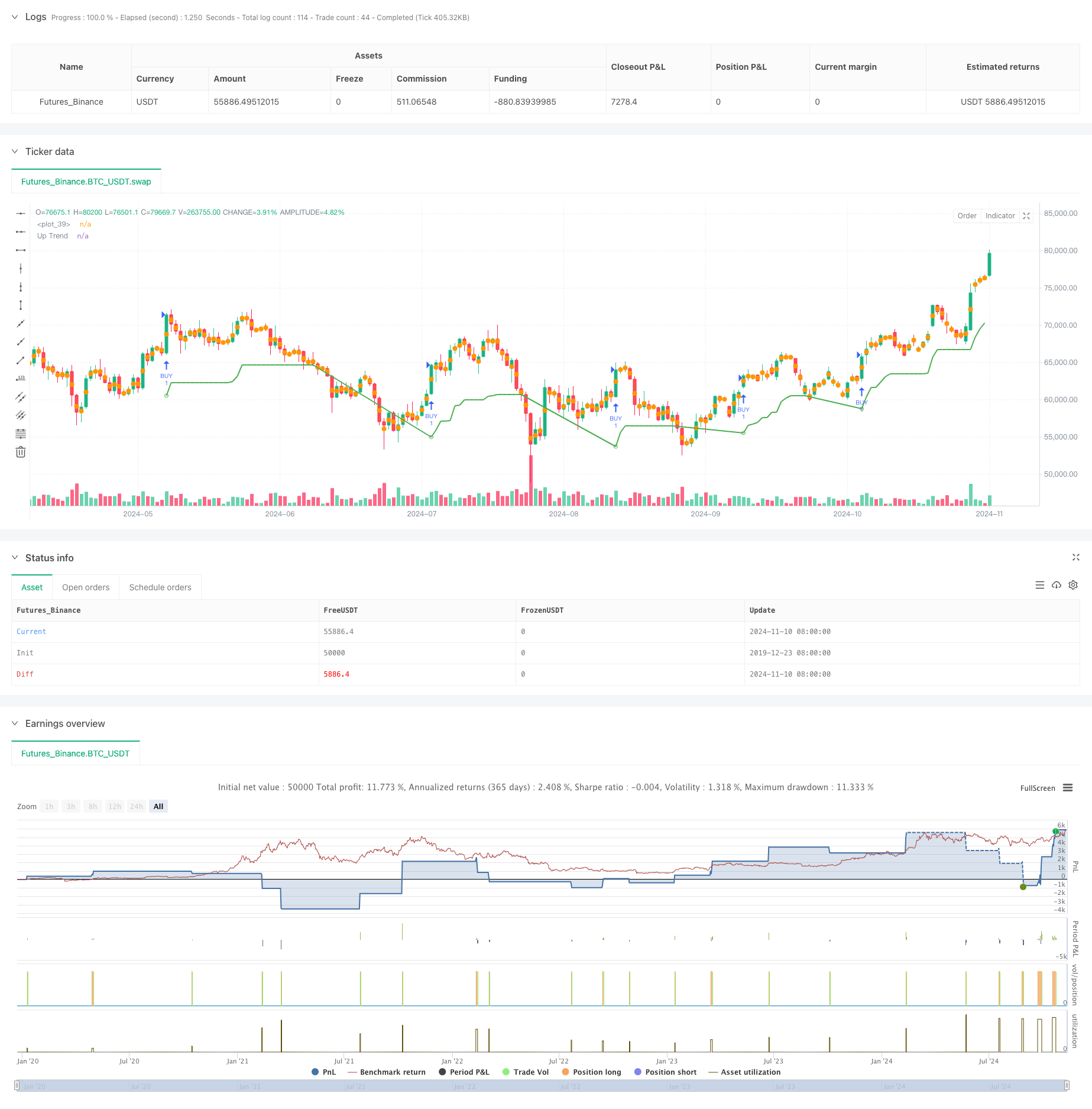

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Buy BID Strategy", overlay=true, shorttitle="Buy BID by MR.STOCKVN")

// Cài đặt chỉ báo

Periods = input.int(title="ATR Period", defval=10)

src = input.source(hl2, title="Source")

Multiplier = input.float(title="ATR Multiplier", step=0.1, defval=3.0)

changeATR = input.bool(title="Change ATR Calculation Method?", defval=true)

showsignals = input.bool(title="Show Buy Signals?", defval=false)

highlighting = input.bool(title="Highlighter On/Off?", defval=true)

barcoloring = input.bool(title="Bar Coloring On/Off?", defval=true)

// Tính toán ATR

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Tính toán mức giá mua bán dựa trên ATR

up = src - (Multiplier * atr)

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + (Multiplier * atr)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Vẽ xu hướng

upPlot = plot(trend == 1 ? up : na, title="Up Trend", style=plot.style_line, linewidth=2, color=color.green)

buySignal = trend == 1 and trend[1] == -1

// Hiển thị tín hiệu mua

plotshape(buySignal ? up : na, title="UpTrend Begins", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(buySignal and showsignals ? up : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

// Cài đặt màu cho thanh nến

mPlot = plot(ohlc4, title="", style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? (trend == 1 ? color.green : color.white) : color.white

fill(mPlot, upPlot, title="UpTrend Highlighter", color=longFillColor)

// Điều kiện thời gian giao dịch

FromMonth = input.int(defval=9, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=2018, title="From Year", minval=999)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=999)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

// Cửa sổ thời gian giao dịch

window() => (time >= start and time <= finish)

// Điều kiện vào lệnh Buy

longCondition = buySignal

if (longCondition)

strategy.entry("BUY", strategy.long, when=window())

// Điều kiện chốt lời và cắt lỗ có thể điều chỉnh

takeProfitPercent = input.float(5, title="Take Profit (%)") / 100

stopLossPercent = input.float(2, title="Stop Loss (%)") / 100

// Tính toán giá trị chốt lời và cắt lỗ dựa trên giá vào lệnh

if (strategy.position_size > 0)

strategy.exit("Take Profit", "BUY", limit=strategy.position_avg_price * (1 + takeProfitPercent), stop=strategy.position_avg_price * (1 - stopLossPercent))

// Màu nến theo xu hướng

buy1 = ta.barssince(buySignal)

color1 = buy1[1] < na ? color.green : na

barcolor(barcoloring ? color1 : na)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dynamic ATR Stop Loss and Take Profit Moving Average Crossover Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- Triple Bottom Rebound Momentum Breakthrough Strategy

- ATR Volatility and Moving Average Based Adaptive Trend Following Exit Strategy

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGY

- High/Low Breakout Strategy with Alpha Trend and Moving Average Filter

- Dynamic Dual-Indicator Momentum Trend Quantitative Strategy System

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- The two platforms hedge balancing strategy

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Advanced MACD Dynamic Trend Quantitative Trading Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern