Trend Breakout Trading System with Moving Average (TBMA Strategy)

Author: ChaoZhang, Date: 2024-11-12 16:24:08Tags: MASMASLTP

Overview

This strategy is a trend breakout trading system that combines moving averages with price breakout concepts. The core mechanism is generating trading signals based on price closes breaking above the moving average, with stop-loss levels set at recent lows and a 2:1 profit-to-loss ratio for risk management. The strategy uses a Simple Moving Average as a trend indicator and identifies trend changes through price-line crossovers.

Strategy Principle

The strategy employs a 20-period Simple Moving Average (SMA) as a trend indicator. Long signals are generated when the closing price breaks above the moving average from below. Stop-loss levels are set at the lowest point of the past 7 candles to avoid placing them too close to entry points. Take-profit levels are set using a classic 2:1 reward-to-risk ratio, meaning the profit target is twice the distance of the stop-loss. The strategy includes visualization components that mark trend lines, trading signals, and stop-loss/take-profit levels on the chart.

Strategy Advantages

- Trend Following Nature: Effectively captures market trends using moving averages

- Robust Risk Management: Uses dynamic stop-loss based on market volatility

- Reasonable Risk-Reward Ratio: Implements 2:1 profit-to-loss ratio for better expected returns

- Clear Visualization: Detailed chart annotations for better market understanding

- Adjustable Parameters: Trend line length and stop-loss calculation period can be customized

Strategy Risks

- Choppy Market Risk: May generate frequent false signals in ranging markets

- Slippage Risk: Breakout signals may face significant slippage during execution

- Stop-Loss Positioning Risk: Lowest point stop-loss might be too wide, leading to large losses

- Quick Reversal Risk: Fast reversals after breakouts may trigger stop-losses

- Parameter Sensitivity: Different market conditions may require parameter adjustments

Strategy Optimization Directions

- Add Trend Confirmation Indicators: Consider adding RSI or MACD for trend confirmation

- Optimize Stop-Loss Mechanism: Consider using ATR for dynamic stop-loss adjustment

- Incorporate Volume Confirmation: Add volume verification for breakout signals

- Improve Signal Filtering: Add volatility filters to reduce false breakouts

- Enhanced Profit-Taking: Consider implementing trailing stops for better profit protection

Summary

This is a well-structured trend-following strategy with clear logic. It generates signals through moving average breakouts, combined with reasonable risk management mechanisms, making it practically applicable. While inherent risks exist, the suggested optimization directions can further enhance strategy stability and profitability. The strategy is suitable for trending market conditions, and traders can adjust parameters according to specific market characteristics.

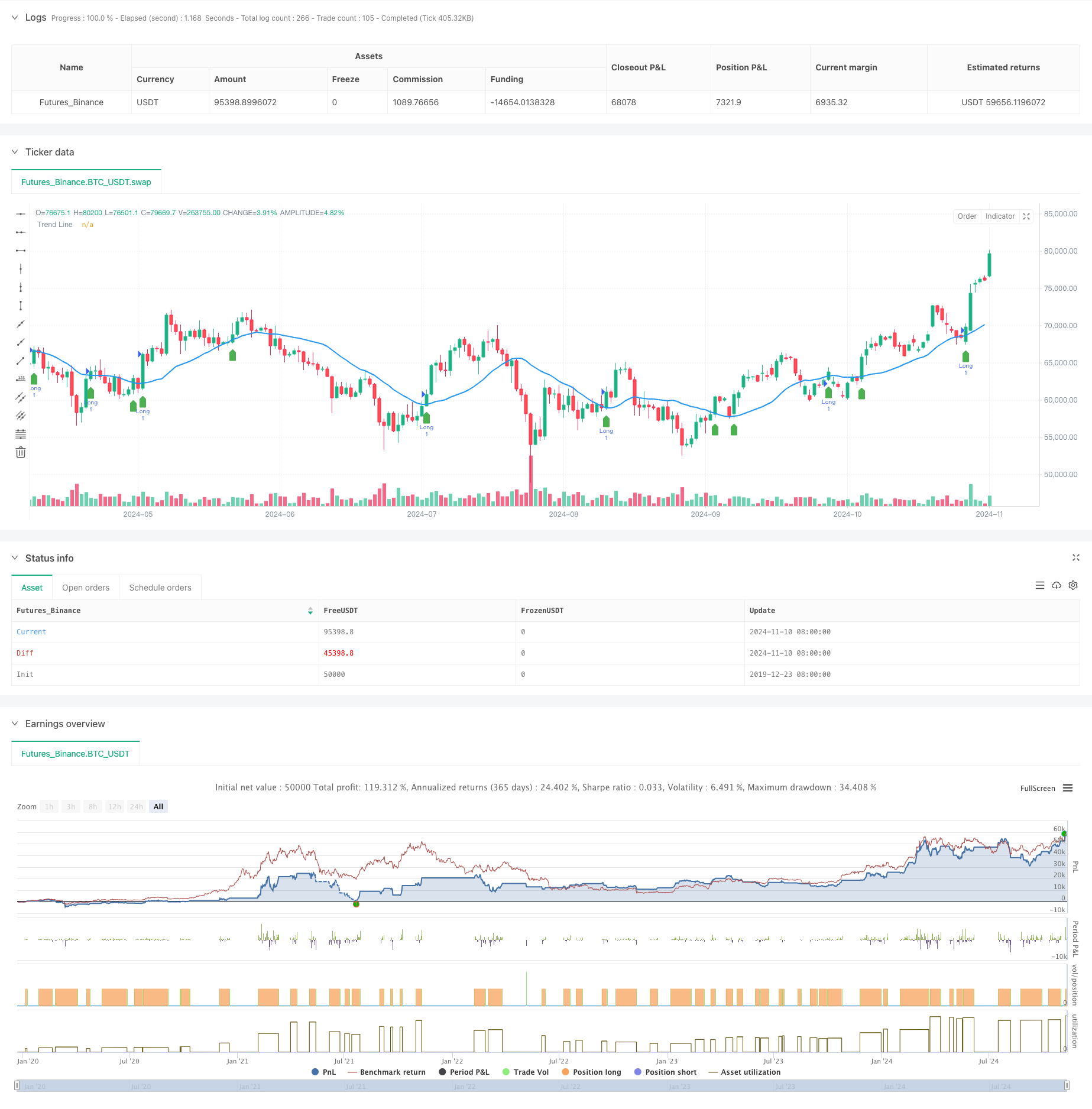

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Breakout with SL and TP", overlay=true)

// Parametrlar

length = input(25, title="Length for SL Calculation")

trendLength = input(20, title="Trend Line Length")

// Trend chizig'ini hisoblash

trendLine = ta.sma(close, trendLength)

// Yopilish narxi trend chizig'ini yorib o'tganda signal

longSignal = close > trendLine and close[1] <= trendLine

// Oxirgi 7 shamning minimumini hisoblash

lowestLow = ta.lowest(low, 7)

// Stop Loss darajasini belgilash

longSL = lowestLow // SL oxirgi 7 shamning minimumiga teng

// Take Profit darajasini SL ga nisbatan 2 baravar ko'p qilib belgilash

longTP = longSL + (close - longSL) * 2 // TP 2:1 nisbatida

// Savdo bajarish

if longSignal

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", "Long", limit=longTP)

strategy.exit("Stop Loss", "Long", stop=longSL)

// Grafikda trend chizig'ini chizish

plot(trendLine, title="Trend Line", color=color.blue, linewidth=2)

// Signal chizish

plotshape(longSignal, style=shape.labelup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

// SL va TP darajalarini ko'rsatish

// if longSignal

// // SL chizig'i

// line.new(bar_index, longSL, bar_index + 1, longSL, color=color.red, width=2, style=line.style_dashed)

// // TP chizig'i

// line.new(bar_index, longTP, bar_index + 1, longTP, color=color.green, width=2, style=line.style_dashed)

// // SL va TP label'larini ko'rsatish

// label.new(bar_index, longSL, "SL: " + str.tostring(longSL), color=color.red, style=label.style_label_down, textcolor=color.white, size=size.small)

// label.new(bar_index, longTP, "TP: " + str.tostring(longTP), color=color.green, style=label.style_label_up, textcolor=color.white, size=size.small)

- Dynamic Moving Average Crossover Trend Following Strategy with Adaptive Risk Management

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Intelligent Moving Average Crossover Strategy with Dynamic Profit/Loss Management System

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss

- Dynamic Trailing Stop Dual Target Moving Average Crossover Strategy

- Risk-Reward Ratio Optimized Strategy Based on Moving Average Crossover

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Trend Following RSI and Moving Average Combined Quantitative Trading Strategy

- Dual Moving Average-RSI Synergy Options Quantitative Trading Strategy

- Multi-EMA Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit Optimization

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- The two platforms hedge balancing strategy

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Advanced MACD Dynamic Trend Quantitative Trading Strategy

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy